· 9 min read

The European Emissions Trading System 2 (EU ETS 2) will complement EU ETS 1, which has been active since 2005, and it is an important instrument to reduce emissions within the EU by 55% by 2030. Emissions from the use of fuels in buildings, road transport, energy, manufacturing, construction and in small industrial plants are covered by EU ETS 2 since 2024 - totalling around 35% of all EU emissions. For the approximately 12,000 companies affected in the EU, the EU ETS 2 means new obligations that are accompanied by economic challenges.

From 2027, the responsible companies will have to purchase emission allowances in the amount of the emissions in the fuels they sell. The market-based pricing of emission allowances means that they will be exposed to greater uncertainty and volatility. In Germany, the EU ETS 2 is implemented by the comprehensively amended Greenhouse Gas Emissions Trading Act (TEHG) and replaces the national emissions trading system (nEHS).

The transition from the nEHS to the EU ETS 2 in Germany

While the nEHS mechanism worked with an annually increasing, staggered fixed price corridor for emission allowances without a quantity limit since 2021, the emission allowances for 2026 are to be auctioned within a price corridor (source: BMUKN). The EU ETS 2, on the other hand, will introduce an EU-wide and annually decreasing emissions cap right from the start in 2027. The cap will start with a quantity of just over 1 billion allowances and will decrease by 5.38% annually from 2028 onwards.

Due to the quantity of available emission allowances for obligated companies decreasing annually and their auctioning, the price in the EU ETS 2 is determined by supply and demand. Like the nEHS, the EU ETS 2 is an 'upstream' system, which defines responsible entities in line with their liability for payment of energy tax. The obligation to report verified emissions and submit emission allowances therefore lies with companies bringing fuels into consumption such as fuel distributors. This means that most entities responsible for the nEHS will also be obliged to do so under the EU ETS 2.

Companies will therefore have a dual reporting obligation for emissions between 2024 and 2026, for both the nEHS and the EU ETS 2, with the nEHS fully transferring to the EU ETS 2 from 2027.

Design and special features of the EU ETS 2

From 2027, the auctioning of emission allowances in the EU ETS 2 will take place via an EU-wide platform, which is yet to be determined. The price will be determined by the balance between the supply of allowances and companies' demand for them. While this market mechanism is efficient, it also carries the risk of high prices and volatility. Several price damping mechanisms have been integrated to prevent unchecked price increases and facilitate the market launch.

• Frontloading will temporarily increase the auction volume by 30% in 2027 to facilitate the market launch, and this volume will be withdrawn again between 2029 and 2031.

• The volume-based Market Stability Reserve (MSR) will withdraw emission allowances from the market in the event of an oversupply or release them again in the event of a shortage.

• Price triggers also exist: if the price exceeds EUR 45/tCO₂ or doubles/triples in the short term, limited quantities of allowances are released from the MSR. However, this is not a hard price cap.

• As a final safety net, the start of the system can be postponed to 2028 if energy prices are high; a decision on this will be made by 15 July 2026.

The price question: Do high abatement costs lead to high certificate prices?

Despite the damping mechanisms that have been implemented, analyses indicate that the price level in the EU ETS 2 is likely to remain high and volatile. This is due to the structurally high marginal abatement costs in sectors where the fuels are used. While e-mobility makes decarbonising the transport sector comparatively cheap, the building sector is sluggish due to long investment cycles and renovation rates of often less than 1% per year. This sectoral inertia, particularly in the building sector, means that even high emission certificate prices only lead to necessary emission reductions slowly.

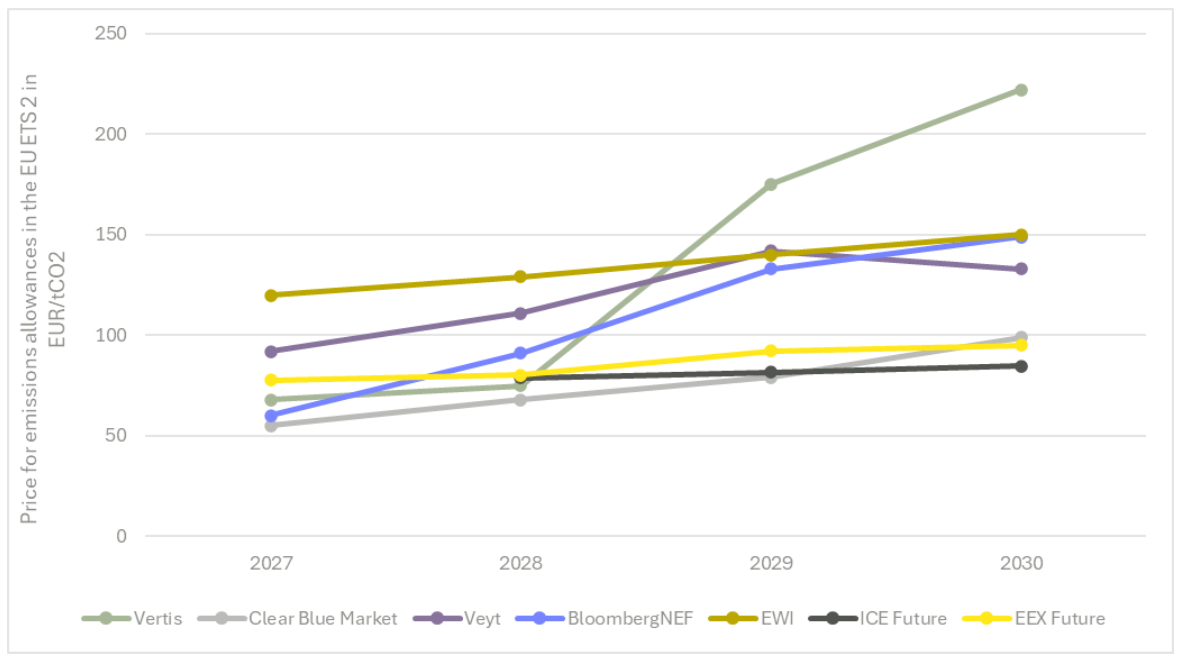

Modelling by the EWI forecasts an equilibrium price starting at around 120 EUR/tCO₂ in 2027, rising to over 200 EUR/tCO₂ by 2035 (Quelle: EWI). However, even at these high prices, the European climate target for the buildings and transport sectors in 2030 would not be met. The target would only be achievable with a price for emission allowances of at least 250 EUR. For end customers of fuels, this would result in significant cost increases, potentially reaching 50% for heating oil and 32% for natural gas by 2035. To cushion the social and economic hardships, the European Climate Social Fund will be set up in 2026 with funding of up to EUR 86.7 billion until 2032. This fund is intended to support vulnerable households and (micro)enterprises.

Figure 1 shows the price scenarios of various organisations, as well as the prices of traded futures market products for emission allowances in the EU ETS 2. Despite the different assumptions underlying these scenarios, the trend is clear: even in the most optimistic scenario, prices for emission allowances will remain relatively high, with the futures market products already traded on the Intercontinental Exchange (ICE) and the European Energy Exchange (EEX) showing prices of about 80 EUR/tCO₂.

Figure 1: Price forecasts and scenarios for the EU ETS 2 (Vertis, Clear Blue Market, Veyt und BloombergNEF) and prices of traded futures market products (ICE and EEX Future, prices from 08.07.2025)

Futures as a strategic hedging instrument

Forecast prices of up to 120 EUR/tCO₂ from 2027 represent a significant cost risk for obligated companies. As emission allowances in the EU ETS 2 can only be purchased at auctions from 2027 onwards, futures contracts on established exchanges such as the ICE or EEX are the central instrument for managing this risk. Futures are standardised contracts that allow the future purchase of certificates to be hedged at a fixed price today, thereby converting an unpredictable risk into a predictable expense. Trading in EU ETS 2 futures on the ICE began in May 2025 (source: ICE) and on the EEX in July 2025 (source: EEX). The current price of around 80 EUR/tCO₂ for futures contracts provides an initial indication of how prices could behave in the first years of auctions.

Price hedging requires a clear business strategy. Companies must define their risk profile and decide which of their expected obligations to hedge and when, in order to protect themselves from price fluctuations. At the same time, it is important not to miss out on the opportunity of falling markets altogether. Overall, this is a complex process in which several risk factors must be considered and weighed up, depending on the company's profile.

A practical roadmap for the implementation of EU ETS 2 in Germany

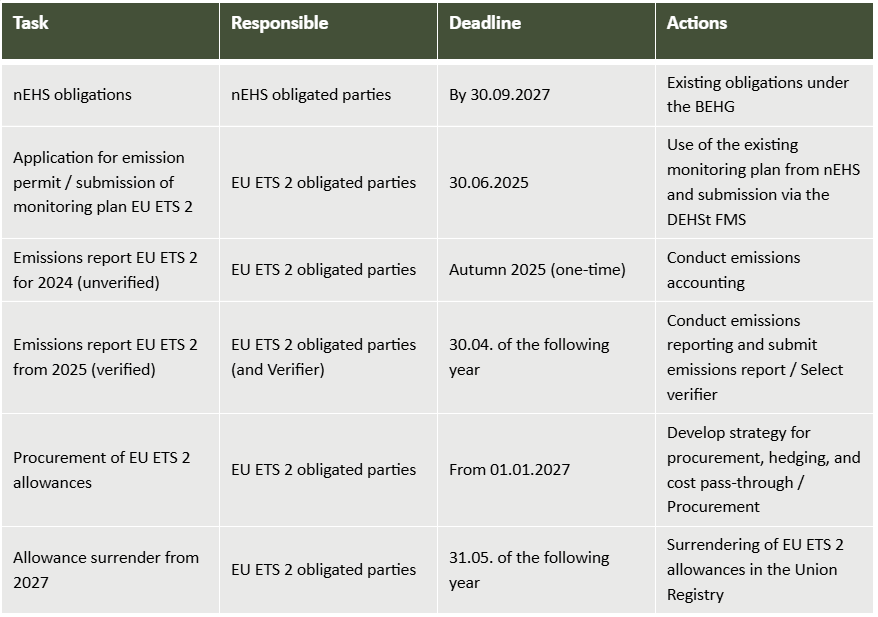

The implementation of EU ETS 2 for companies in Germany is governed by the amended TEHG and the detailed requirements of the German Emissions Trading Authority (DEHSt). The 'EU ETS 2 responsible parties', i.e. distributors of fossil fuels, are primarily affected. Their core obligations are clearly defined: First, they must apply for an emissions permit and submit a monitoring plan and have them approved by the DEHSt. Based on this, they must then measure, calculate and report emissions annually (source: DEHSt). From the reporting year of 2025 onwards, the emissions report must be verified by an accredited verification body. This is followed by the annual surrender of emission allowances. For the first time, this will take place on 31 May 2028 for emissions in the fuels sold during 2027 (see Table 1).

The first relevant deadline for obligated entites was 30 June 2025. By this date, applications for emissions permits and monitoring plans for EU ETS 2 had to be submitted to DEHSt. A crucial aspect of achieving legal certainty during the transition period until 2027 is the 'notional authorisation'. An existing, approved monitoring plan in the nEHS is provisionally valid as an emissions permit for EU ETS 2. However, it does not exempt fuel distributors from the formal obligation to submit an application by the aforementioned deadline. DEHSt's central tool for fulfilling these obligations is the ‘Form Management System’ (FMS), which features the new ‘3-in-1 monitoring plan’ (nEHS, EU ETS 1/waste, and EU ETS 2). Companies can use this system to import their nEHS data and add specific information for EU ETS 2. The permitted use of national standard factors for calculating emissions will make time-consuming in-house analyses unnecessary in the transition phase up to 2027 in many cases.

Table 1: Tasks and timetable in the nEHS and EU ETS 2

EU ETS 2 between high prices and political uncertainty

Analyses show that high marginal abatement costs can potentially lead to high, market-driven certificate prices. In addition to these economic realities, there is significant political uncertainty that is crucial for companies’ strategic planning. Calls from some Central and Eastern European EU member states to postpone the EU ETS 2, operational issues with implementation in various EU countries, and the still unclear design of national compensation measures create an unstable environment. As a result, the system faces the challenge of achieving ambitious climate goals without jeopardizing social acceptance or economic competitiveness (source: EU Parlament).

Success therefore depends heavily on political decisions and instruments that ensure trust in the implementation of EU ETS 2. This includes preventing a weakening of the strict cap through premature interventions, as well as designing effective social cushioning mechanisms. Examples include the EU-level Social Climate Fund or Germany’s Climate and Transformation Fund.

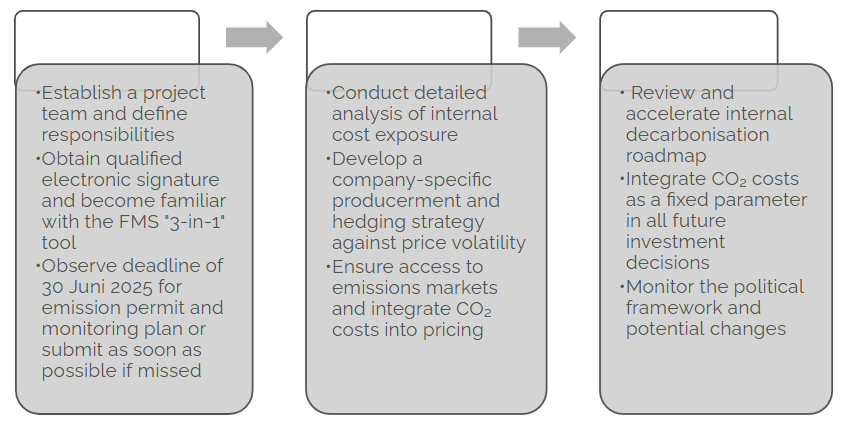

For companies, this creates the need for strategic “de-risking”: existing uncertainties can be minimized through proactive measures (see Figure 2). This means assessing financial risks, adjusting supply contracts, and thinking early about procurement strategies and hedging for emission certificates. It also involves viewing emission reduction and decarbonization efforts—both internally and for customers—as strategic safeguards against future, unavoidable CO₂ costs.

Figure 2: Calls for action regarding the EU ETS 2

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Sources

BMUKN, 2025, Referentenentwurf einer zweiten Verordnung zur Änderung der Brennstoffemissionshandelsverordnung, URL: https://www.bundesumweltministerium.de/gesetz/referentenentwurf-einer-zweiten-verordnung-zur-aenderung-der-brennstoffemissionshandelsver-ordnung

EWI, 2025, Auswirkungen und Preispfade des EU-ETS 2, URL: https://www.ewi.uni-koeln.de/de/publikationen/auswirkungen-und-preispfade-des-eu-ets2/

DEHSt, 2025, Leitfaden Überwachungsplan EU-ETS 2, URL: https://www.dehst.de/SharedDocs/downloads/DE/eu-ets-2/leitfaden-ueberwachungsplan.pdf?__blob=publicationFile&v=2

ICE, 2025, EUA 2 Futures, URL: https://www.ice.com/products/83048353/EUA-2-Futures/expiry

EEX, 2025, Environmentals, Futures, URL: https://www.eex.com/en/market-data/market-data-hub/environmentals/futures

Europäisches Parlament, 2025, ETS2 – Status and concerns, URL: https://www.europarl.europa.eu/RegData/etudes/BRIE/2025/772878/EPRS_BRI(2025)772878_EN.pdf