The carbon impact of your bank: the biggest secret the banks don’t want you to know about

· 4 min read

Did you know your company’s choice of bank is likely to be contributing more carbon emissions than all other actions combined?

That’s because of how your bank is investing.

This means that, for values-led businesses, the choice of bank could be eroding all the great work they are doing from an operational perspective.

Where your money goes matters.

The UK’s traditional big 5 banks - Barclays, HSBC, Santander, NatWest and Lloyds - put £27 billion into oil & gas companies last year. [1]

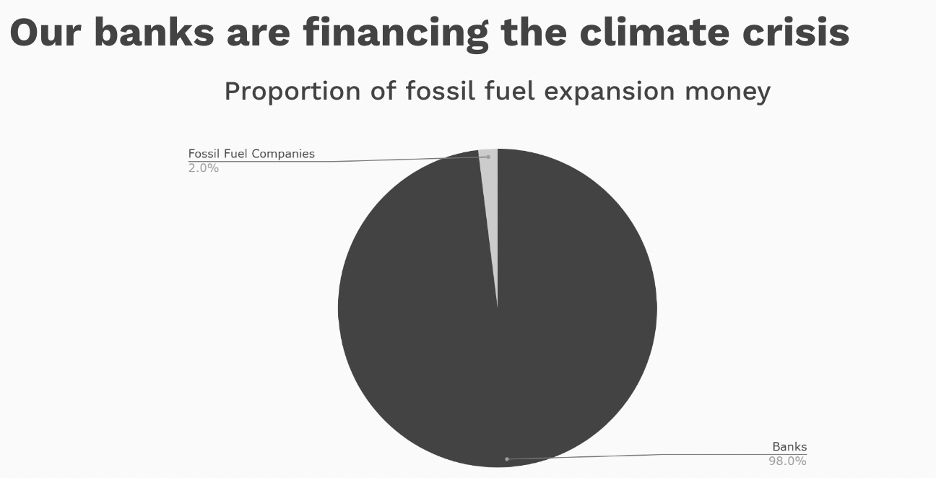

The world’s 60 biggest banks, including the UK’s big 5, invest 50 times more into fossil fuel expansion than the fossil fuel companies. [2] To put that another way, for every £1 that BP invests into fossil fuel expansion, the world’s biggest banks are putting in £50.

In short, without the banks’ money, oil & gas would be a thing of the past.

Where a bank invests has huge implications on the level of carbon emissions.

MotherTree’s research has uncovered that most of the major banks are investing billions into fossil fuels, while a tiny proportion goes into renewable energy.

And these kinds of investments can be reflected as a carbon footprint.

Looking at the bank’s own operations, plus where the bank invests, a view of the bank’s overall carbon footprint can be built up.

The choice of bank has a huge impact on your carbon footprint.

For the majority of businesses, the biggest source of carbon emissions is from their bank.

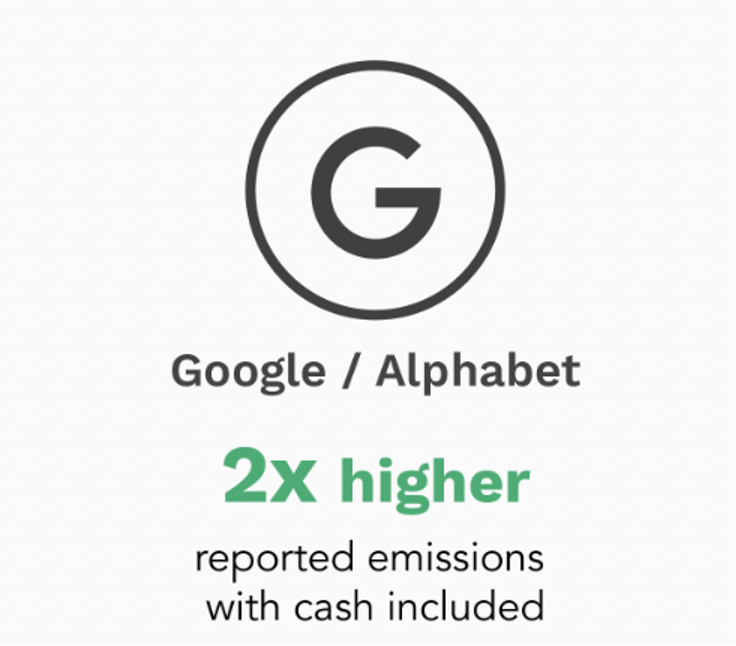

Take Google and its parent company Alphabet; Google has over $130 billion in cash for paying employees, acquiring other companies and tax purposes. This cash is invested with just a few banks and based on how those banks are investing, the cash has a carbon footprint. That footprint is bigger than Google’s carbon footprint for its entire supply chain.

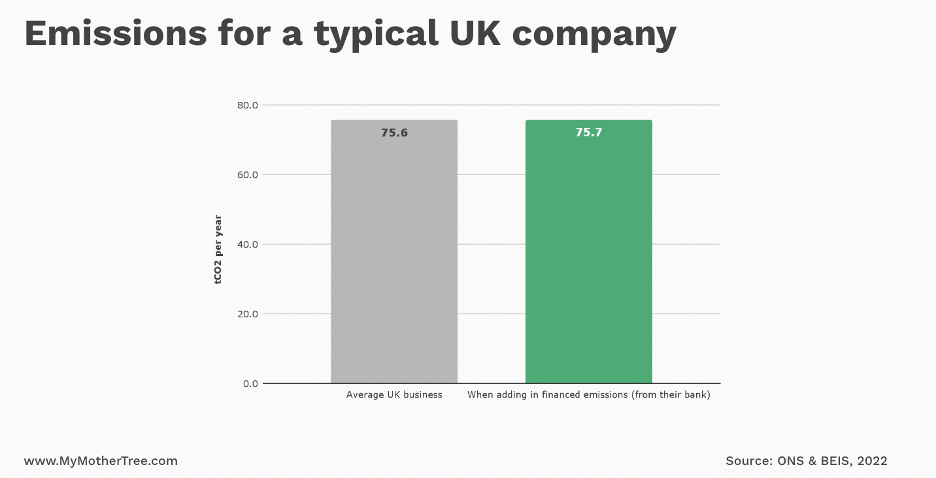

And it’s a similar trend for the average UK company. [3]

The average footprint for a company with 10 employees is around 75 tonnes of CO2 per year, while the choice of bank adds another 75 tonnes to the total.

When the cash is taken into account, the footprint doubles.

For many values-led businesses, the focus is, understandably, on their mission.

For example, my team and I recently started working with a company with two female founders, who recruited employees from pensions and foster care. Their values were deeply rooted in equality.

And yet, when we looked at where their banks were investing, it produced some hard-to-see results: Investments in companies with all white male boards and no policies on reducing the gender pay gap.

So all the great work of driving equality was being undone by the bank.

Switching banks can actually lead to higher interest rates.

Often, the greenest options outperform traditional banks on interest rates.

Isn’t that crazy? You put out more carbon and get a lower interest rate.

Switching bank accounts is easier than ever before.

And with a range of services available from branches to apps, there’s never been more choice.

So make sure your choice of bank aligns with your values, reduces CO2 and gets you a better interest rate.

You never know, it might be the most impactful decision you make for your business.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[1] Banking on Climate Chaos, 2023

[2] Bill McKibben, Wall Street Journal, 17th September 2019

[3] Based on ONS data, the average UK company has 10 employees and £300k in the bank

John Leo Algo

Ethical Governance · Environmental Sustainability

illuminem

Consumers Green Tech · Corporate Social Responsibility

Charlene Norman

Sustainable Business · Sustainable Finance

The Verge

Diversity & Inclusion · Corporate Social Responsibility

The Wall Street Journal

Sustainable Lifestyle · Corporate Social Responsibility

illuminem Voices

Ethical Governance · Climate Change