Sodium: An alternative to the "white gold" of the energy transition

· 9 min read

As the world transitions towards low-carbon energy systems, scaling up clean energy technologies will drive demand for critical minerals and metals, such as lithium, nickel, cobalt, graphite, and rare earth elements. Stakeholders in the private and public sectors must work together to implement effective and efficient strategies, policies, and regulations to ensure that supplies are secure, reliable, sustainable, and equitable.

Over the past years, the price volatility of minerals and metals has increased due to rising demand, supply chain disruptions, and concerns about tightening supplies. In addition, today’s markets are highly concentrated in a small number of countries. Although supply diversification investments are increasing, most near-term growth is expected from existing major producers, resulting in an even higher geopolitical risk. [1]

The transportation sector offers a stark example of these dynamics. Every year, the world increasingly relies on batteries. In 2022, electric vehicles (EVs) accounted for about 10 percent of global vehicle sales and are expected to reach 35 percent by the decade’s end. [2] Announced policiesaround the world are accelerating these trends. For example, recent climate legislation in the United States is deploying billions into battery manufacturing and incentives for EV purchases. [3]

Lithium-ion batteries, a technology also used in computers and cell phones, power most EVs today. Typical of innovation cycles, years of development and deployment have resulted in significant cost reductions and improved performances. Today’s EVs are becoming increasingly competitive with internal combustion vehicles and can be driven for hundreds of kilometers between charges. Lithium is used in EVs because it is lightweight, has high energy densities, is relatively low maintenance, and can be repeatedly charged.

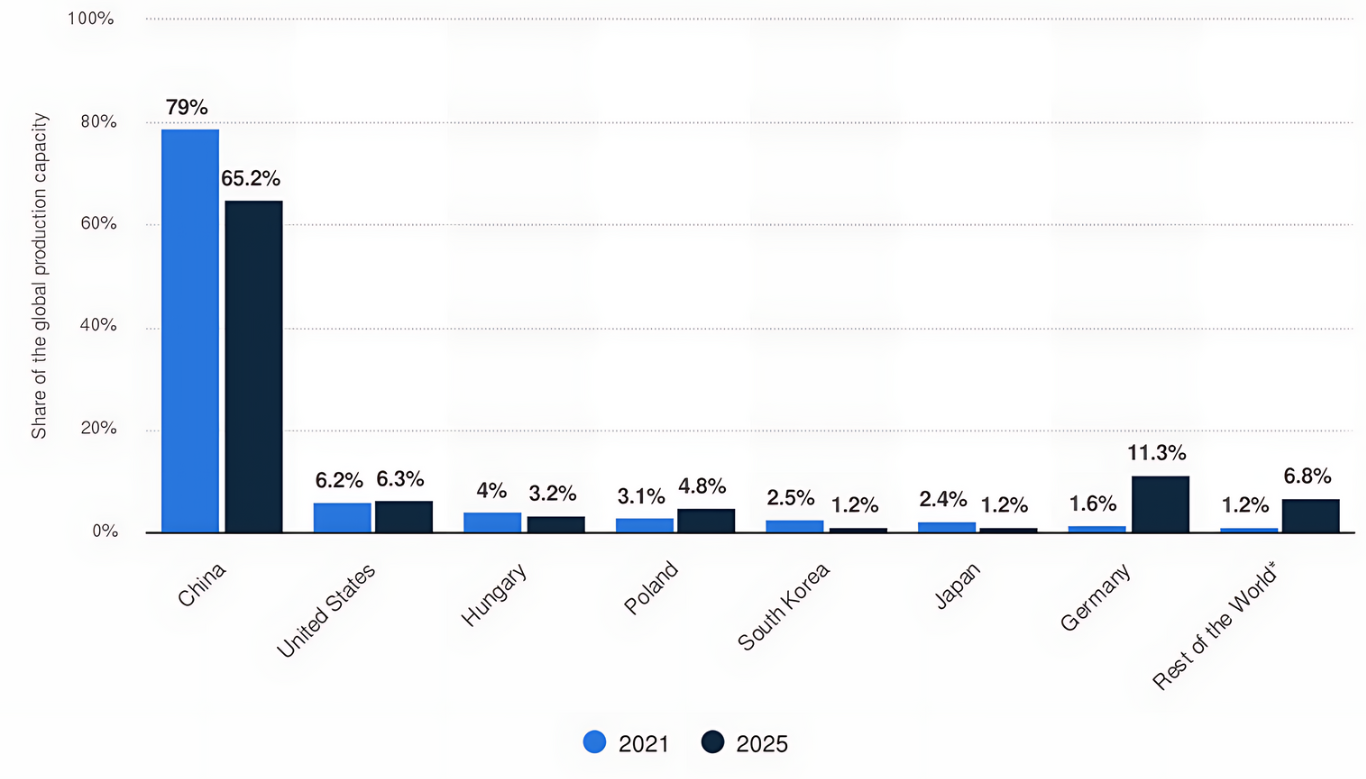

From a market and geopolitical perspective, analysts estimate that lithium demand will increase tenfold before the end of this decade.[4][5] In 2021, China dominated lithium global markets with 79 percent of all lithium-ion battery manufacturing capacity; this figure is expected to decrease slightly to around 65 percent by 2025 (see Figure 1).

Figure 1. Share of the global electric vehicle lithium-ion battery manufacturing capacity in 2021 with a forecast for 2025, by country. Source: Statista (2024)

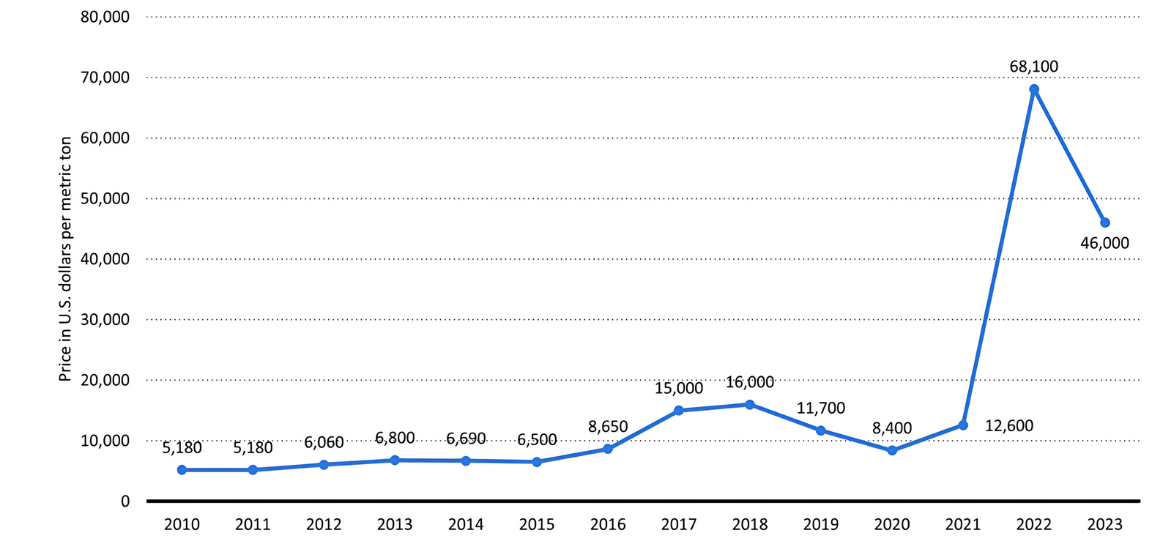

Furthermore, lithium price volatility has also increased due to rising demand for batteries and supply disruptions [6] (see Figure 2). Hence, manufacturers and investors increasingly seek cheaper and more distributed alternatives to lithium.

Figure 2. Lithium prices, 2010-2023. Source: US Geological Survey; Benchmark Minerals (2024)

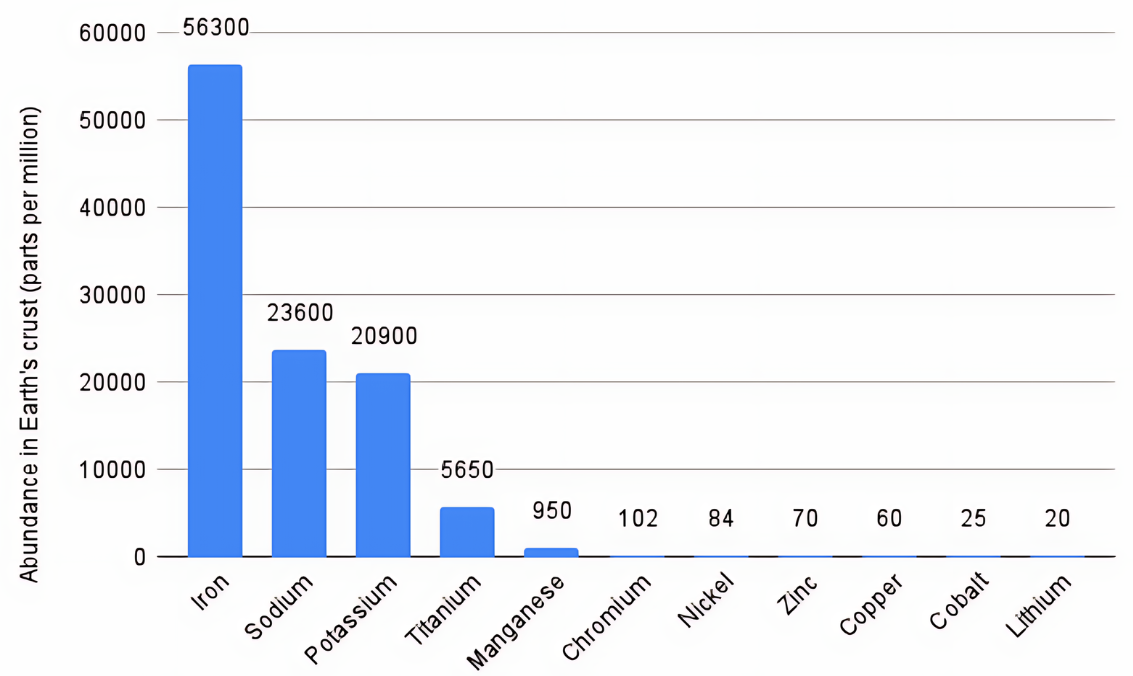

While lithium is relatively scarce (compared to other metals, see Figure 3) and primarily refined in China, sodium is neither. Sodium’s chemical properties are very similar to those of lithium, making it effective in batteries. Furthermore, sodium, found in salt, is about 1,200 times more abundant and significantly more economical to produce. [7] Lithium batteries also use cobalt and nickel in their electrodes. These metals are also in short supply and have concentrated production. In contrast, sodium batteries can use electrodes made with iron and manganese, which are plentiful. Since these components are less expensive and more geographically distributed, scaling up production could yield batteries that cost significantly less than their lithium counterparts (up to one-third) [8] and reduce geopolitical risks. Furthermore, sodium-based batteries retain their charge longer, especially at low temperatures. [9]

Figure 3. Abundance of elements in Earth's crust. Source: CRC Handbook of Chemistry and Physics, 97th edition (2016–2017), p. 14-17.

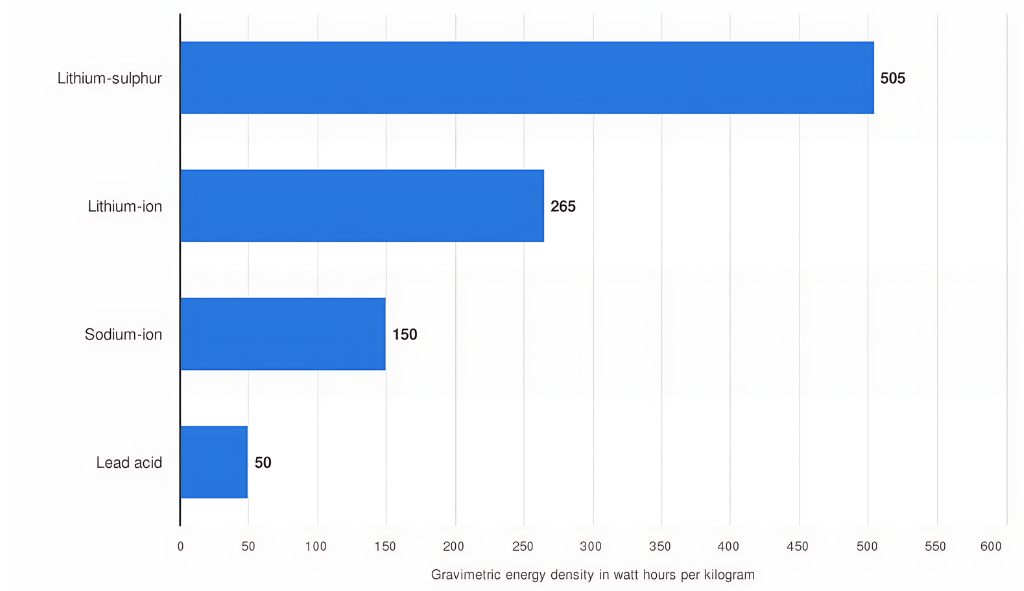

However, sodium is not a perfect replacement for lithium. The energy density of sodium-ion batteries is lower than that of lithium ones (see Figure 4), meaning sodium-ion batteries can store less energy than lithium-ion batteries of the same size. [10] Furthermore, sodium is more than three times heavier than lithium, considerably increasing the battery weight and resulting in shorter driving ranges.11 Finally, the associated industrial value chains are immature and, as in the case of lithium, concentrated in China.[6] [7]

Figure 4. Gravimetric energy density of different types of batteries in 2020. Source: Statista (2024)

Given the geographical concentration of critical metals and the associated geopolitical and market implications, stakeholders are striving to enhance cleantech value chain resilience to avoid falling into the traps and inefficiencies of the past.

Western players could see key advantages beyond affordability. China’s control of critical battery metals allows it to dominate the entire EV value chain. Replacing lithium with sodium offers a chance to reduce geopolitical risk. This is especially true for the United States, which holds over 90 percent of the world’s known soda ash reserves, the most cost-efficient source of sodium. [12]

The Five-Point Plan for Critical Minerals Security presented during the 2023 G7 Ministers of Energy Meeting in Japan emphasized “the growing importance of critical minerals for the clean energy transition and the need to prevent economic and security risks caused by vulnerable supply” and “that strong environmental, social and governance standards are vital for creating responsible and resilient critical minerals supply chains.” [13] Similarly, the European Critical Raw Materials Act highlights the importance of strengthening the adoption and deployment of breakthrough technologies in critical raw materials. [14]

In the transportation sector, technological innovation efforts have focused on sodium batteries. In Europe, Swedish Northvolt announced an innovative sodium-ion battery design containing no lithium, cobalt, or nickel, which it intends to rapidly deploy to markets to compete with Chinese, Korean, and Japanese players. [15] In January 2024, the French-Italian automaker Stellantis announced a strategic investment in Timat, a sodium-ion battery startup, including the construction of a battery factory in Northern France with an initial capacity of 0.7 GWh by 2026, which could be increased to 5 GWh by 2029. [16]

In Asia, the South Korean Ministry for Science announced investments of up to USD 3.8 billion to promote 12 strategic technologies as part of its long-term growth plan to achieve global innovation leadership and support national champions like LG, SK, and Samsung. Specifically, the plan highlights the need to develop next-generation high-performance batteries like sodium-ion batteries. [17]

In Japan, Toyota disclosed that it plans to scale up manufacturing of innovative next-generation solid-state sodium batteries. Tokyo University of Science announced the development of sodiumion batteries with performances equivalent to conventional lithium-ion batteries. [18]

As for China, Beijing has become a key player also in sodium battery innovation and manufacturing. The 14th Five-Year Plan for Scientific and Technological Innovation in the Energy Sector highlights the need to develop and deploy innovative battery systems, including sodium-ion batteries. [19] Local companies have announced plans to scale up production of new sodium battery cells that are so much like lithium ones [20] that the same manufacturing equipment could be used. [21] Of the 20 planned sodium battery factories worldwide, 16 are in China, and by 2025, the country could control 95 percent of the world’s manufacturing capacity. [22] For example, the world’s largest battery maker, CATL, will start commercialization by the end of 2024,22 while automaker BYD has begun the construction of its first sodium-ion battery plant in Xuzhou, with a planned annual capacity of 30 GWh and an investment of USD 1.4 billion. [23]

In the United States, Tesla has announced plans to produce sodium batteries but has yet to build production facilities. [23]

Increasing market penetration of electric vehicles is driving demand for batteries and related critical minerals and metals. While alternatives to conventional lithium-ion batteries are rising and supply chains are expanding, manufacturing remains highly concentrated, with China leading the battery and components trade. Western countries, particularly those in Europe that have spent the past two years trying to reduce their dependence on Russian natural gas, do not want to leave their future energy security similarly compromised.

Therefore, private, and public sector stakeholders must work together to implement effective and efficient strategies, policies, and regulations to ensure that supplies are secure, reliable, sustainable, and equitable to reduce geopolitical risks.

This will require a concentrated effort to:

• Ensure reliability and resiliency against supply disruptions through diversification. This will require promoting exploration and production diversification of raw material supplies.

• Support research and development efforts to accelerate innovation cycles for alternatives to conventional lithium-ion batteries. Looking beyond sodium-ion batteries, aluminum sulfur batteries [24] – aluminum being the most abundant metal in the Earth’s crust – could also provide low-cost backup storage for renewable energy sources.

• Deploy the needed enabling infrastructure, including evaluating the feasibility of large-scale production using existing lithium-ion batteries infrastructure.

• Encourage sustainable and responsible practices across value chains.

This article is also published on the Belfer Center's website. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[1] IEA. “Ensuring supply reliability and resiliency.” Critical Minerals Policy Tracker. Accessed February 2024.

[2] IEA. “Global EV Outlook 2023 - Catching up with climate ambitions.” (2023).

[3] DOE. “The U.S. National Blueprint for Transportation Decarbonization.” (2023).

[4] New York Times. “The Lithium Gold Rush: Inside the Race to Power Electric Vehicles.” (2021) accessed February 2024.

[5] USGS. “Lithium.” Mineral Commodity Summary. (2023).

[6] Blois, M. “Lithium earning dazzle.” Chemical Engineering News (2023). Accessed February 2024.

[7] Fast Markets. “Do solid-state and sodium-ion batteries have the power to overcome the lithium supply crunch?” (2023). Accessed February 2024.

[8] Argonne National Laboratory. “Cathode innovation makes sodium-ion battery an attractive option for electric vehicles.” (2024). Accessed February 2024.

[9] Financial Times. “Sodium batteries: worth their salt.” (2023). accessed February 2024.

[10] Dou, X. et al. “Hard carbons for sodium-ion batteries: structure, analysis, sustainability, and electrochemistry.” Mater. Today 23, 87–104 (2019).

[11] Ma, L. A., et al. “Strategies of mitigating dissolution of solid electrolyte interphases in sodium-ion batteries.” Angew. Chem. 133, 4905–4913 (2021).

[12] Hamlin K., A pinch of salt could unsettle electric-car order, Reuters (2024).

[13] G7. “Five-Point Plan for Critical Minerals Security” Annex to the Climate, Energy and Environment Ministers’ Communiqué, Sapporo, Japan (2023).

[14] European Commission “Critical Raw Materials: ensuring secure and sustainable supply chains for EU’s green and digital future“ (2023).

[15] Milne R. Northvolt in new sodium-ion battery breakthrough, The Financial Times (2023). Accessed February 2024.

[16] Guillaume, G., and Hummel, T. “Stellantis to invest in French sodium-ion battery maker for EV output.” (2024). Accessed February 2024.

[17] Boram, K. “S. Korea to invest 5 tln won in R&D for 12 strategic technologies in 2024.“ Yonhap News Agency (2023). Accessed February 2024.

[18] Cuthbertson, A. “Battery breakthrough brings ‘unprecedented performance’ to next-gen cells.” Independent (2023). Accessed February 2024.

[19] Nikkei. “China leads global battery patent race for post-lithium-ion era.” (2023). Accessed February 2024.

[20] Bela, V. “Sodium batteries: is China sparking a new revolution in the electric vehicle industry?” South China Morning Post (2023). Accessed February 2024.

[21] Bradsher K., Why China Could Dominate the Next Big Advance in Batteries, The New York Times (2023). Accessed February 2024.

[22] Deal Street Asia. “BYD setting up $1.4 sodium-ion battery plant in China.” Nikkei Group (2024). Accessed February 2024.

[23] Spence, E., and Lee, A. “Tesla rival BYD and other battery giants are betting on sodium for EVs and energy storage—and challenging the dominance of lithium-ion.” Fortune (2023). Accessed February 2024.

[24] Pang, Q., et al. “Fast-charging aluminium–chalcogen batteries resistant to dendritic shorting” Nature 608, 704–711 (2022).

Alex Hong

Energy Transition · Energy

illuminem briefings

Hydrogen · Energy

illuminem briefings

Energy Transition · Energy Management & Efficiency

Inside Climate News

Oil & Gas · Ethical Governance

International Energy Agency

Energy Management & Efficiency · Energy Transition

Financial Times

Corporate Governance · Oil & Gas