Pathways for the future energy organisations – Persistence and Consistency

· 3 min read

While 2050 seems far off, companies need to align strategically to operationalise their tactics for tomorrow. Given the current landscape, we have been working on a simplified framework approach to achieving the net carbon future objectives of any energy company.

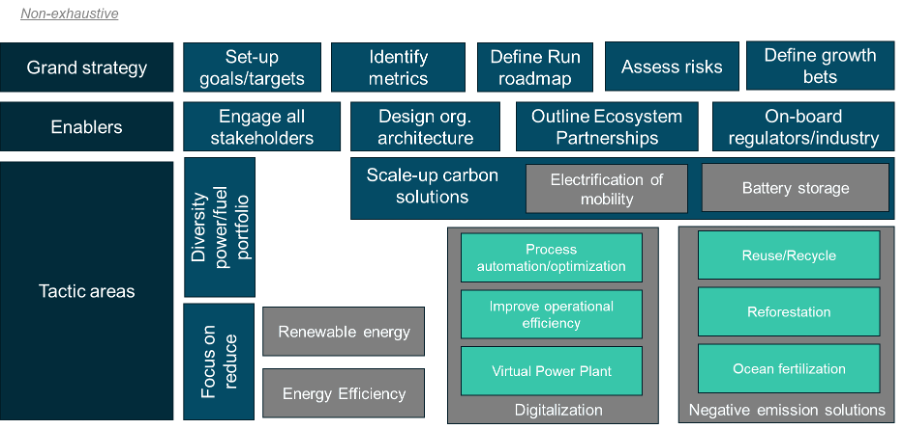

The simplified net-carbon zero framework is focused on three main pillars:

In any important definition of a strategy, it’s paramount for an organisation to define the goals, metrics and a roadmap. It must assess risks and the feasibility of the achieving the goals and define the growth bets on which to focus in the long-term, while the short-term is supported by the core business. To enable the strategy, all the stakeholders will need to be involved, from shareholders, customers and suppliers to employees.

With the Greenhouse Gas Protocol in place, energy companies are looking to reduce carbon emissions not only across their operations (Scope 1 emissions) but also in their supply-chain (Scopes 2 and 3). Two other factors will be critical to enable the strategy as not all organisations have the capabilities to implement its strategy. It is important, therefore, to define partnerships and work closely with policy makers, regulators, competition and adjacent industries. In this context, we will be entering a time of cooperation vs competition, that is highly required in order to accelerate the path to carbon neutrality.

Finally, energy companies have seven tactical options to drive energy transition. These are investments in renewable energy, focus on energy efficiency, alternative fuels, digitalisation, negative emission solutions, electrification of mobility and battery storage. There are a further three drivers of the transition, namely shareholder and consumer pull, and policy design push that represent the stimulus that will speed the urgency of responding to the tactical drivers.

While sentiment among the energy companies is changing, investments remain low when compared to the size of their overall CapEx budgets. The International Energy Agency has stated that investment to date by oil and gas companies outside their core business areas is less than 1% of total capital spend. According to analysts a much more significant change in overall capital allocation would be required to accelerate energy transitions.

There has been a regional strategy, particularly in oil and gas American based companies versus European companies.

American oil and gas companies continue to focus on traditional activities, including:

European players have been developing new business models and risk-reducing low-carbon technologies extending beyond their core traditional activities. In the future, we believe companies will need to take steps to MEASURE, QUANTIFY, STRATEGISE, RESPOND and IMPLEMENT net-zero initiatives.

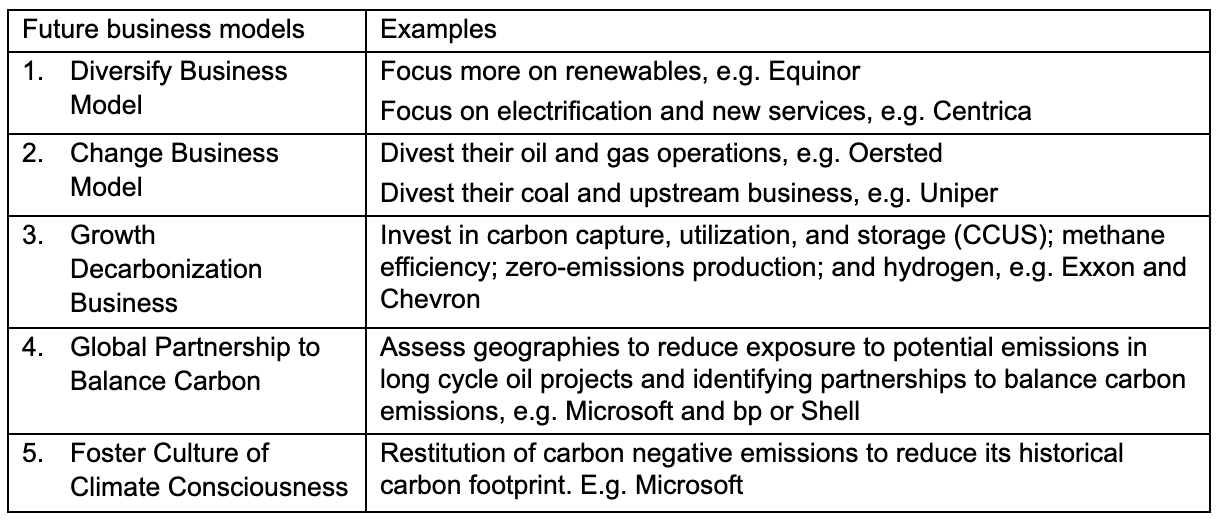

The future business models will be quite different from the ones we see today:

While the shape of business models will differ, one thing is certain, all the oil and gas companies we know today will be more sustainable and carbon conscious in 2050. The roadmap seems to be taking shape in most organizations, but two factors will determine the highest value players: persistence in defining the new bets and consistency in embracing a climate focused culture and governance.

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Aaron Bruckbauer

Pollution · Greenwashing

Jesse Scott

Carbon Market · Carbon Regulations

Glen Jordan

Sustainable Lifestyle · Sustainable Living

Inside Climate News

Pollution · Nature

The Jerusalem Post

Biodiversity · Climate Change

earth.com

Climate Change · Effects