Oil Companies and the Windfalls of War

· 10 min read

Putin’s war on Ukraine is approaching its one-year anniversary, with little to suggest it will be stopping any time soon. Looking at the nightly news footage of the savagery of Putin’s scorched earth policy, it’s impossible not to think that war is hell.

However, war offers a highly profitable opportunity for some industries, e.g., arms makers. Unsurprisingly, oil companies are among the Ukraine war’s biggest — if not the biggest — beneficiaries. The reason? Too much demand in the face of too little supply.

ExxonMobil recently announced record annual earnings for 2022. The company’s annual revenue was $95.43 billion, with net income of $55.7 billion. The record exceeded its 2008 high watermark of $45.22 billion.

Exxon is hardly alone in making a hefty profit off the Ukraine war. Chevron, too, recorded record annual earnings — breaking its 2011 record by $10 billion. It did so despite missing its fourth-quarter earnings estimates by 6.6 percent. The shortfall was partly due to the company paying a windfall profit tax that it managed to avoid in the third quarter — more about such taxes in a moment.

Shell has also attained a new earnings record. It reported just under $40 billion for 2022. It bested its previous best by over $11 billion. The company’s 2022 profit was double that of 2021 and the highest in its 115 years of existence.

Shell paid out more than £5 billion to shareholders in the fourth quarter of 2022, as much as five times more than what it labels investments in renewables and energy solutions.

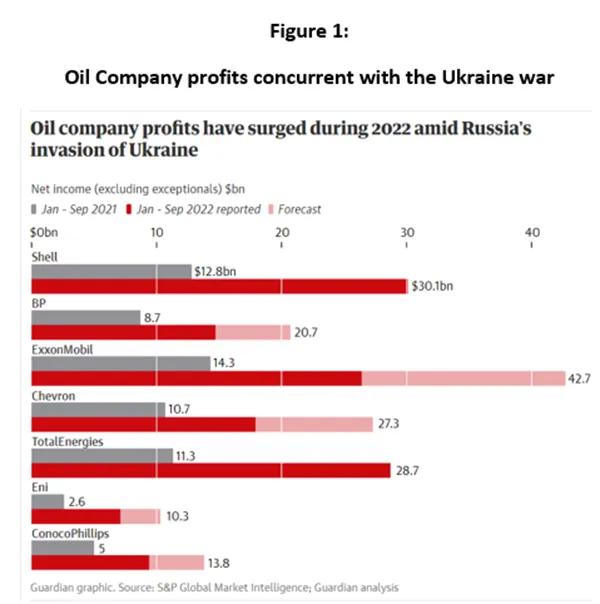

The announcements came with little wonder to Wall Street. The war and tight supplies have conspired to make major oil companies windfall pro-fiteers. The Guardian has reported on the impact of Putin’s war on oil company earnings.ow oil profits have surged and a relative ranking of which companies are taking in the most. Shell, ExxonMobile, and Chevron occupy the first, third, and fourth positions, respectively.

Although not responsible for starting the largest European conflict since WWII, Exxon, and other oil majors have done little to increase oil supplies, much to the concerns and consternation of President Biden. According to the president, oil companies are not profiting from doing something new or innovative. Their profits are a windfall of war, a windfall for the brutal conflict [that’s] ravaging Ukraine. (Emphasis added)

“Exxon made more money than God this year[i].”

Biden is hardly alone in his charge that oil companies are profiteering from the brutality of war. Jamie Henn speaking on behalf of the STOP — Stop The Oil Profiteering — campaign, believes “what Big Oil has done over the last year is the definition of war profiteering.”

As far as Merriam-Webster is concerned, Henn is right. Profiteering, according to the dictionary, is “the act or activity of making an unreasonable profit on the sale of essential goods, especially during times of emergency.” (Emphasis added)

Profiteering is an emotionally charged word that implies illegal or unethical practices. Mylan pharmaceutical was accused of illicit and immoral practices when it raised the price of its epinephrine injector pen from $57 to over $500 in just a few years[ii]. Why did the company do it? Having 85 percent of the market meant it could, and because they wanted to.

Are the oil companies guilty of the same ethical breach as Mylan? President Biden thinks the answer is yes because the companies and OPEC nations like Saudi Arabia have rebuffed his efforts to increase oil and gas supplies for duration of the war. Although having no known hand in the illegal incursion of Putin’s army into Ukraine, the president is accusing them of actively choosing not to ease the burden on consumers brought about by $5 a gallon gasoline and the inflationary pressures on the U.S. economy.

Shell, Chevron, and ExxonMobil are sharing their bounties with stockholders. Chevron has announced a $75 billion buyback of its stock and raised its dividend to 3.44 percent. In 2022, ExxonMobil paid out $30 billion in dividends and buybacks. Shell has announced a $4 billion share buyback and a 15 percent rise in its dividend.

As reported by OilPrice.com:

In 2022, U.S. oil company share buybacks increased 1,043%, dwarfing the 64% increase for S&P 500, while dividends were up 33%, more than three times the rise for all the companies in the index.

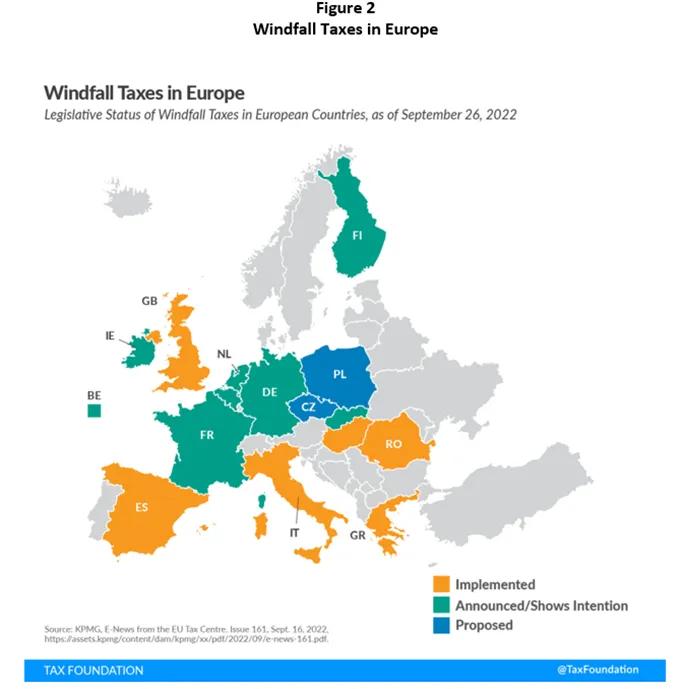

Unlike the U.S., other nations have enacted or are considering enacting a windfall profit tax. The European Union, the U.K., and India have already begun to levy taxes on oil and gas companies, as have Spain, Italy, and Romania. Other nations, including Poland and the Czech Republic, are proposing such measures, while France, the Netherlands, Germany, Belgium, Finland, and Ireland have indicated their intentions to follow suit. (See Figure 2)

Tax rates and the threshold at which the taxes are triggered are not the same among the nations. According to Tax Foundation, the Council of the European Union agreed to impose a “temporary solidarity contribution” on energy companies that realize “above a 20% increase of the average yearly taxable profits since 2018”.

Dubbed the Solidarity Contribution, the E.U. tax is calculated on eligible earnings above a 20 percent increase of the average yearly taxable profits since 2018. It will be levied on top of the taxes these companies already owe in their countries. The E.U. anticipates the policy will raise about €140 billion.

Some E.U. members and the U.K. have their own windfall profit schemes.

Germany introduced a 33 percent windfall profit tax starting on December 1, 2022. The new levy will affect oil, gas, and coal companies whose profits for 2022 and 2023 exceed by 20 percent or more than their 2018–2021 average.

In December, Finland proposed a temporary windfall tax on profits from the country’s electricity companies as part of a European Union response to soaring power costs. The proposed 30% tax would apply to any profits exceeding a 10 percent return on capital in 2023, with the government estimating it could bring in between 500 million and 1.3 billion euros ($533 million-$1.9 billion).

The U.K. announced plans in November to levy a windfall tax on oil and gas producers’ profits to 35 percent between January 1, 2023, and March 2028.

India has also raised its windfall tax on crude oil, petroleum, and aviation turbine fuel. The levy on crude is an increase of 24 percent.

The closest the U.S. has come to a windfall tax is found in the Inflation Reduction Act’s one percent tax on corporate share buybacks. Oil and gas companies will primarily bear the burden of the provision.

The revenues generated by the recent windfall taxes will be used for various purposes. Subsidization of utility ratepayers is the primary use of the levies. The U.K. tax will help to offset the cost-of-living crisis and shore up the U.K.’s finances.

Windfall taxes are also being levied on electric power producers. Finland is proposing a temporary tax on profits earned by electric utilities as part of a European Union response to soaring power costs. As proposed, the 30 percent tax would apply to any profits exceeding a ten percent return on capital in 2023.

Finland’s proposed tax is estimated to bring in between $533 million-$1.9 billion. If Finland passes the proposed levy, it will join the UK, Germany, and other E.U. members that have already taken such steps.

Electricity generator levies apply even to utilities using solar, wind, or other climate-conscious power sources. The levy appears to be at cross-purposes with the transition to a low-carbon economy. Writing about the U.K.’s levy, Gus Wood states that:

“The quantum of the Levy (45%), as well as the term of 63 months, will be met with surprise and disappointment by the renewables investment community.”

Are windfall taxes a good thing? It depends on who you ask. Wood Mackenzie analysts believe that the villainization of Big Oil through windfall measures are not the way to go. Their analysis suggests the levies will distort the market and risk prolonging the transition to low-carbon economies because lower prices for oil and gas will increase demand.

Julieta Biegner at Global Witness and many in the climate community are offended by the oil companies “using the [Ukraine] crisis as a proxy to expand U.S. energy exports.” Beigner, Henn, and others in the climate community — including progressive members in Congress — take offense at the oil companies making off with such wartime profits. It doesn’t help any when Chevron’s CEO calls the $40 billion the company earned in 2022 “a modest return,” when so many families are faced with agonizing decisions like — food or fuel.

Moreover, many in Washington and the clean energy and climate communities rare offended by oil and gas producers claiming the need for new lands to explore and from which more fossil fuels can be extracted. Senator Ed Markey (D-MA), a leading proponent of renewable energy, is quick to point out that oil and gas companies “already have an area the size of Indiana that they have leased from the American people that they are not drilling upon. If they really do have a concern about the need to drill for more oil and [natural] gas, there has been nothing stopping them over the last decade.”

“The reality is they profit from having a shortage of supply.”

Where is the U.S. in the matter of windfall taxes? Biden has indicated that he’s at least thought about it. Although to what avail is unclear.

Democrats in the House and Senate introduced windfall profit legislation in the 117th Congress. The proposal was a per-barrel tax equal to 50 per-cent of the difference between the current price of oil and the average price per barrel between 2015 and 2019.

Even in this topsy-turvey political era, it’s inconceivable that Congress would enact anything approximating the windfall profit taxes of other nations within term of the 118th Congress. In truth, it’s unlikely that any new tax on fossil fuels has a snowball’s chance of passage in this warming world.

There are issues at work here that shouldn’t go unnoticed by either our elected representatives or ourselves. There are societal questions that need to be addressed.

Companies and investors are entitled to compensation for their actions and the risks they take. But how much of a profit is just? Where is the a line to be drawn between profit and profiteering?

Does it make a difference how the gains were gotten and from where? Take, for example, conflict or blood diamonds.

The U.N. defines a blood diamond as originating from “areas controlled by forces or factions opposed to legitimateand internationally recognized governments, and are used to fund military action in opposition to those governments, or in contravention of the decisions of the Security Council.” (Emphasis added) It sounds familiar, doesn’t it?

Is there such a thing as conflict oil and gas? Was it right for President Biden to grant a license to Chevron to resume oil production in Venezuela — easing sanctions imposed on the country in 2019 over corruption and human rights concerns?

What of the president’s overture to Saudi Arabia — a nation led by a prince who likely ordered the death of the journalist Jamal Khashoggi? When does necessity override morality?

Exxon has known climate change is real for decades but hid it from the public[i].

Do oil companies and their investors have a paramount right to profits earned through no sweat of their brows over families who, through no fault of their own, are forced to make decisions between food and fuel, between keeping the lights on and life-saving medicines?

What are the obligations to society of oil and gas companies who have long known the climate-related consequences of burning their fuels and yet fight tooth and nail against solutions to the problems they’ve caused? These and other questions concerning the conduct of oil companies and their influence over governments and their impacts on Earth’s environment have gone unanswered for too long.

If not now, when?

[i] President Joe Biden

[ii] Claims vary. Some reports use the figure of $100 when Mylan obtained the EpiPen in 2008 and the spawning of public outrage in 2016 when the price jumped to $600.

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Purva Jain

Energy Transition · Energy Management & Efficiency

illuminem briefings

Carbon Capture & Storage · Oil & Gas

Jordi Roca Jusmet

Climate Change · Oil & Gas

The Guardian

Natural Gas · Greenwashing

Inside Climate News

Oil & Gas · Ethical Governance

Financial Times

Corporate Governance · Oil & Gas