Navigating the future: introduction to double materiality for businesses

· 8 min read

In an era where sustainability has become the guiding beacon for business decisions, a new concept is emerging on the horizon, poised to revolutionize how companies navigate through the increasingly turbulent waters of social and regulatory expectations: double materiality.

This innovative compass, pointing towards both economic prosperity and environmental and social responsibility, offers businesses the opportunity to explore uncharted territory, where every decision and action reflects on a dual mirror, financial and impact. I'll take you on a journey through the principles and practices that are shaping the future of corporate sustainability, unveiling how companies can turn challenges into opportunities, successfully navigating towards a more responsible and prosperous future.

Get ready to discover how double materiality is not just a passing trend but a true strategic revolution, capable of charting a clear course towards a horizon of sustainable success.

Double materiality is a fundamental principle that guides companies in identifying and communicating information relevant to sustainability. This concept was formally introduced by the European Commission in 2019, within the guidelines on the disclosure of non-financial information, with a specific focus on climate-related information.

"Materiality" is a term rooted in the English financial context, where it has been widely used to describe issues of significant relevance. In Italy, this terminology initially did not have a specifically attributed meaning in the same context. However, the term "materiality" is used to identify and categorize issues considered important or significant, highlighting its extended application beyond linguistic boundaries. The essence of double materiality lies in the assessment of two main aspects: financial materiality and impact materiality.

Double materiality compels companies to consider both their impact on the external environment and society, and how environmental, social, and governance (ESG) issues affect the company's financial performance and stability. This two-pronged approach underscores the importance of not overlooking the interactions between these aspects, fostering greater awareness and responsible action toward sustainability-related risks and opportunities.

Financial materiality (Outside-in) pertains to information relevant for generating economic value at the company level, which is disclosed for the benefit of investors and shareholders. This information aids in understanding how sustainability issues can directly impact the company's financial performance.

Impact materiality (Inside-out), conversely, focuses on the company's influence on the environment, economy, and people, aiming to communicate these impacts to a wider range of stakeholders. The Global Reporting Initiative (GRI) also underscores the adoption of this approach, requiring a focus on impact materiality for comprehensive and balanced sustainability reporting.

The European Standards for Sustainability Reporting (ESRS) further stress the importance of embracing double materiality in sustainability reports, positioning it as a fundamental requirement for companies operating within the European Union. This emphasis on integrating double materiality into corporate sustainability reporting reflects a growing trend toward holding companies accountable for their operational impacts, not only in financial terms but also in broader societal and environmental terms.

In an increasingly interconnected world aware of climate change, social inequalities, and economic challenges, companies are faced with the need to redefine their impact on society and the environment. Double materiality emerges as a beacon in the night, guiding companies through the stormy sea of stakeholder expectations and regulatory pressures.

Double materiality acts as a bridge, connecting a company's financial performance to its socio-environmental impact. For companies, this means looking beyond balance sheets to understand how their operations influence the external world and, in turn, how global issues such as climate change can affect their stability and economic growth.

The European Union has marked a milestone in corporate sustainability with the introduction of the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS), guiding companies towards a deeper integration of double materiality into their sustainability reporting. This regulatory evolution not only raises the level of detail and breadth of information available but also invites companies to critically reflect on their environmental and social impacts, as well as future strategies.

Embracing Double Materiality within your business might feel like an expedition through uncharted terrain, but armed with an accurate map and a trustworthy compass, you can steer towards a destination of sustainability and accountability.

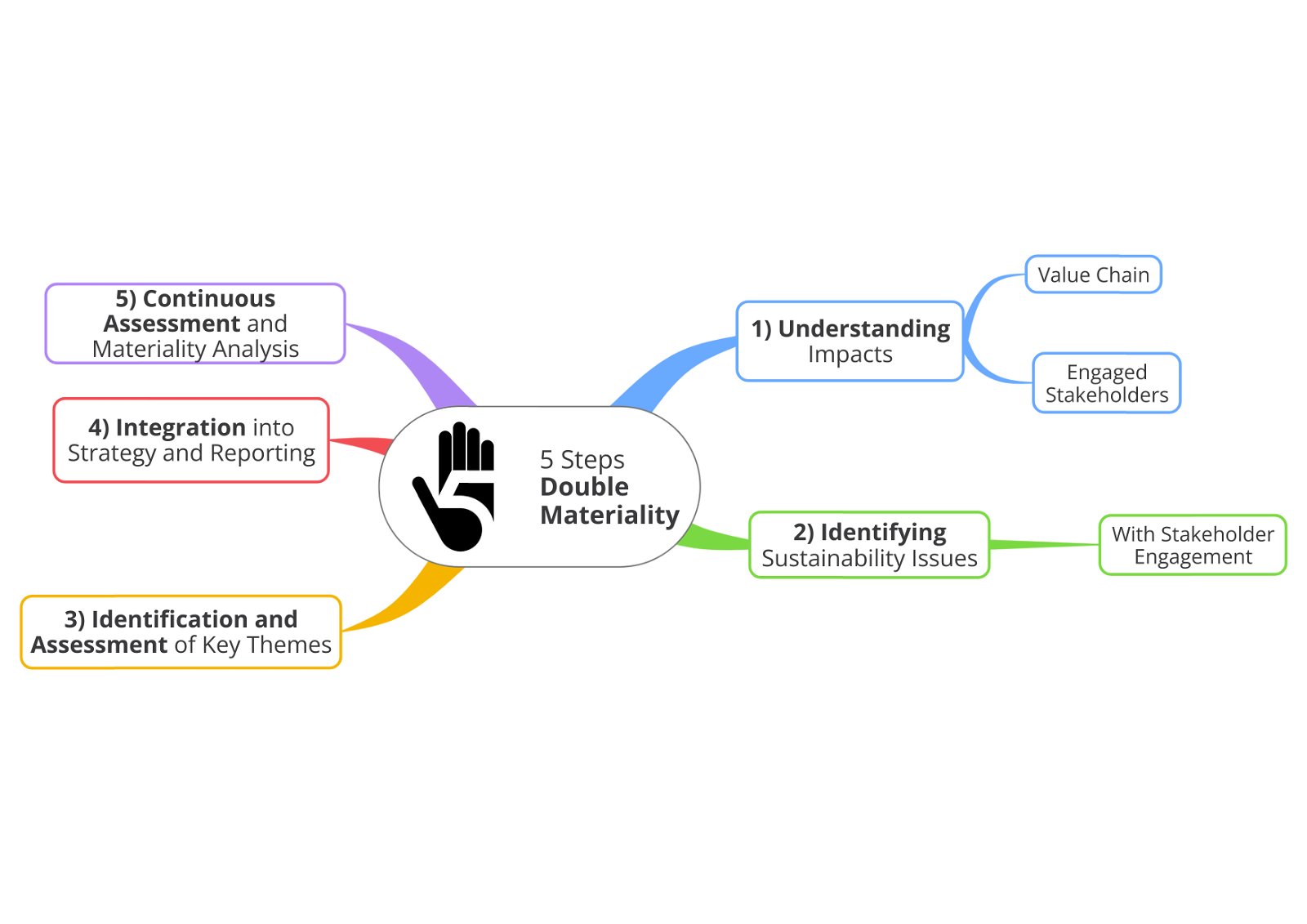

Here are the essential steps to incorporate this groundbreaking approach into your business strategy:

The first step in this exploratory journey requires mapping the territory, identifying the impacts that your value chain has on the environment, society, and economy. Here, it is essential to engage stakeholders, both internal and external, to gain a holistic view. This not only helps recognize where and how your company impacts the world but also guides you in selecting relevant stakeholders to engage with. Remember, targeted engagement is key to effective assessment.

After establishing a clear understanding of impacts, the next step invites dialogue. Interacting with stakeholders allows you to discover sustainability issues that closely affect your company and your operational context. This process is essential to balance the granularity of issues, ensuring they are neither too broad nor overly specific. Effective assessment methodology through questionnaires and consultation with external experts can help reduce subjectivity and focus on truly significant themes.

At this point, it's time to assess the identified issues, considering both impact materiality and financial materiality. This three-dimensional process helps you understand not only how your company's activities influence the external world but also how these influences can, in turn, reflect on financial performance. An analysis that considers the temporal horizon and geographical perspective provides you with a comprehensive framework of risks and opportunities.

Once key materiality themes have been identified, the next step is to strategically integrate them into business operations and communication. This requires active involvement from company leadership, setting clear objectives, and ensuring that roles and responsibilities are well defined. Integrating Double Materiality means bringing sustainability to the forefront of business decisions, guiding towards more responsible and transparent practices.

Last but not least is continuous assessment. The world changes, and so do materiality issues. Regular review ensures that your company remains aligned with the evolving social, environmental, and economic context, keeping your sustainability strategy relevant and up-to-date.

Incorporating Double Materiality is no small feat, but the benefits in terms of transparency, compliance, risk understanding, and opportunity realization, and above all, contributing to a more sustainable future, are immeasurable. By following these steps, your company can not only navigate but thrive in a world demanding increasing accountability and concrete action towards sustainability. Adopting double materiality into the strategic and operational fabric of companies is not just a move towards regulatory compliance, but it opens the door to a multitude of benefits that can radically transform business perspectives and performance. Let's take a closer look at the treasures hidden in this valuable practice.

While the concept of double materiality offers a valuable compass to guide companies towards more sustainable and responsible business practices, its implementation journey is not without challenges. Understanding and overcoming these challenges is crucial to unlocking the true potential of double materiality and ensuring it becomes a driving force for positive change within organizations.

Process complexity: Effectively applying double materiality requires careful identification and evaluation of relevant themes, involving a broad spectrum of stakeholders and considering both financial and non-financial impacts. This process can be complex and require significant time and resource commitment, especially for companies approaching complex sustainability concepts for the first time.

Need for cultural change: Integrating double materiality into business strategy is not just a technical matter but requires a profound cultural change within the organization. This includes developing greater awareness and sensitivity towards sustainability issues among employees at all levels, from executive leadership to operational roles. Addressing resistance to change and building consensus around the importance of sustainability represents a significant challenge.

Regulatory compliance: With the evolution of sustainability regulations, as highlighted by the CSRD in the European Union, companies must navigate a constantly changing legislative landscape. Ensuring compliance with the latest provisions requires continuous vigilance and the ability to quickly adapt reporting practices and business strategies.

Stakeholder engagement: Double materiality places particular emphasis on the importance of engaging stakeholders in assessing sustainability issues. However, identifying, engaging, and managing relationships with a wide range of stakeholders, each with their own expectations and priorities, can be a daunting task. Creating effective communication channels and inclusive engagement processes requires meticulous planning and ongoing commitment.

Measurement and evaluation: One of the most challenging aspects of implementing double materiality is developing reliable metrics and indicators that can accurately capture both the financial and non-financial impacts of business activities. This requires not only access to high-quality data but also the ability to interpret this data meaningfully to guide informed strategic decisions.

In conclusion, while the hurdles linked with adopting dual materiality are substantial, its potential to revolutionize business practices toward increased sustainability and accountability is immense. By tackling these obstacles with resolve and strategic foresight, companies can not only fulfill regulatory requirements but also establish themselves as pioneers in sustainability, significantly contributing to shaping a more sustainable and equitable future.

Despite the obstacles inherent in adopting dual materiality, future prospects are promising for companies ready to embark on this path. The evolution of regulations and stakeholder expectations will continue to mold the business landscape, making the embrace of dual materiality not only attractive but imperative. Companies that can adeptly navigate this landscape, adjusting and innovating, will be optimally positioned to thrive in a sustainable future. The journey toward sustainability is lengthy and intricate, yet armed with the compass of dual materiality, companies possess all the tools necessary to navigate toward a brighter and more responsible future.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Alex Hong

Energy Transition · Energy

Steven W. Pearce

Adaptation · Mitigation

John Leo Algo

Ethical Governance · Environmental Sustainability

Financial Times

Sustainable Finance · ESG

Sustainability Magazine

Net Zero · ESG

Responsible Investor

AI · Sustainable Finance