· 8 min read

"Naive risk management at best and fatally foolish at worst"

These are not my words but surely resonate aloud. Let me share some compelling reasons.

Pandemic pipeline

The strain of highly pathogenic avian influenza virus H5N1, currently spreading in U.S. dairy cows, only needs a single mutation to readily latch on to human cells found in the upper airway. This could have major implications for a new pandemic, reveals Science, if such a mutation were to become widespread in nature.

In close proximity to the above comes Lloyd’s of London release - the pre-eminent insurance and reinsurance market in the world - that the global economy could be exposed to potential losses of $13.6 trillion USD over a five-year period from the threat of a hypothetical future human pandemic.

These losses could result from widespread disruption across global industries due to local lockdowns and global travel restrictions. With the transportation sector worth over 10% of global GDP, sustained international travel restrictions could potentially result in significant economic costs.

Whilst on the subject, I never stop from mentioning how organizers of Wimbledon 2020 mitigated potential financial loss, due to the event cancellation, by means of an infectious diseases cover. Likewise, how smart risk management saved the University of Illinois (Urbana-Champaign) despite loss of revenue from Mainland Chinese students - one of their biggest sources of income - not turning up in the year of COVID.

Ever since the insurance industry has developed a range of specialist solutions to help manage the risks associated with pandemics. It includes affirmative cover for new outbreaks of known and unnamed infectious diseases, insurance for the development, transit and storage of vaccines, and protection against interruption or cancellation of events during a pandemic. The insurance industry has discovered a segment ripe to be monetized. What was once conveniently labelled as a black swan event is now a market development opportunity!

Btw the particular group of H5N1 responsible for the current outbreak was first detected in North America in 2021. According to Scientific American it has affected a wide range of animal populations, including wild birds, bears, foxes, a variety of marine mammals and, most recently, dairy cows. Surprisingly nowhere does Lloyd’s report allude to a zoonotic trigger emanating from biodiversity loss.

“Lloyd’s has a unique position and opportunity to bring together communities, businesses, insurers and governments to find solutions to the systemic risks that threaten our shared future” - says CEO John Neal. Will that be achievable notwithstanding climate breakdown - is conspicuous by its absence from the narrative and blind spots such as these:

Climate models falling short

“Climate models are falling behind reality. New research reveals that real-world data shows more extreme and unexpected climate changes than models predict.” Writes Kasper Benjamin Reimer Bjørkskov. His findings come from “Global emergence of regional heatwave hotspots outpaces climate model simulations” - a study by Kai Kornhuber, Samuel Bartusek, Richard Seager, Mingfang Ting in the Proceedings of the National Academy of Sciences (PNAS).

Most models, he explains, cannot simulate the small-scale processes that run Earth’s climate systems, like: Jet streams; Cloud formation; Soil moisture interactions; Ocean currents. These tiny, daily processes combine in complex ways that models can’t fully capture. Thereby:

• Extreme events (like heat, storms, and marine heatwaves) are happening faster and more intensely than models predict

• The interconnected systems of land, atmosphere, and oceans are reacting in non-linear and amplifying ways we didn’t expect

• Climate models underestimate extreme trends by up to 4x in some areas

• Our understanding of the climate crisis must, therefore, evolve - models need to account for these overlooked processes

• Moreover, the gap between models and reality is growing. Science is clear - the climate is changing faster than we are prepared for

A key message coming out loud and clear from the climate scientists: “the best way to reduce both uncertainty in and exposure to climate impacts is a rapid transition of relevant societal sectors away from fossil fuels to stabilize global temperature rise.”

Imagine the implications of the highlighted deficiencies in the models used by reinsurers and insurers in their risk evaluations. Again the compelling reasons for the money pipelines (not just insurers) to hasten moving away from fossil fuel.

Climate endgame: exploring catastrophic climate change scenarios

This paper contributed by Luke Kemp, Chi Xu, Joanna Depledge and Timothy M. Lenton to the PNAS makes a strong case for why the planetary wellbeing should not be ignored. Allow me to highlight some of the crucial messages coming out:

• Climate risks are becoming more complex and difficult to manage, and are cascading across regions and sectors

• There is ample evidence that climate change could become catastrophic

• Understanding extreme risks is important for robust decision-making, from preparation to consideration of emergency responses

• We could enter such “endgames” at even modest levels of warming. This requires exploring not just higher temperature scenarios but also the potential for climate change impacts to contribute to systemic risk and other cascades

• A thorough risk assessment would need to consider how risks spread, interact, amplify, and are aggravated by human responses

• Even simpler “compound hazard” analyses of interacting climate hazards and drivers are underused. Yet this is how risk unfolds in the real world. For example, a cyclone destroys electrical infrastructure, leaving a population vulnerable to an ensuing deadly heat wave

• Too much is at stake to refrain from examining high-impact low-likelihood scenarios. The COVID-19 pandemic has underlined the need to consider and prepare for infrequent, high-impact global risks, and the systemic dangers they can spark

• It is time to seriously scrutinize the best way to expand our research horizons to cover this field, suggest the authors

• The proposed “Climate Endgame” research agenda provides one way to navigate this under-studied area. Facing a future of accelerating climate change while blind to worst-case scenarios is naive risk management at best and fatally foolish at worst

• The Intergovernmental Panel on Climate Change (IPCC) has yet to give focused attention to catastrophic climate change. This appears warranted, following the IPCC’s decision framework

• Such a report could investigate how Earth system feedbacks could alter temperature trajectories, and whether these are irreversible

A slowing Earth system

The Atlantic Meridional Overturning Circulation (AMOC) is part of a single "conveyor belt" of continuous water exchange that transports water throughout the world’s oceans. It is the main ocean current in the Atlantic including at the surface and at great depths that are driven by changes in weather, temperature and salinity.

Human driven actions - unhindered fossil fuel burning and relentless deforestation (Amazon in particular) thereby skyrocketing Green House Gas (GHG) emission, Arctic and Greenland are melting - transforming water chemistry and the dynamics. Thereby leading to a slow down and eventually a tipping point as per renowned scientists like Stefan Rahmstorf.

A weaker AMOC would decrease the mixing and bring less warm water northwards, leaving warmth to the tropics and cold to the polar areas - likely making hot areas hotter and cold areas colder. This AMOC decline could also affect precipitation patterns, strengthen storms, and raise sea level along the North American Atlantic coast.

Research is scant on how a possible movement of rain bands moving south could impact India, East Asia and West Africa. However, these geographies could lose much or all of their monsoon seasons. Two-thirds of Earth’s population depends on monsoon rain, in large part to grow their crops. These changes would happen within only a few growing seasons rather than over generations, giving little time to adapt.

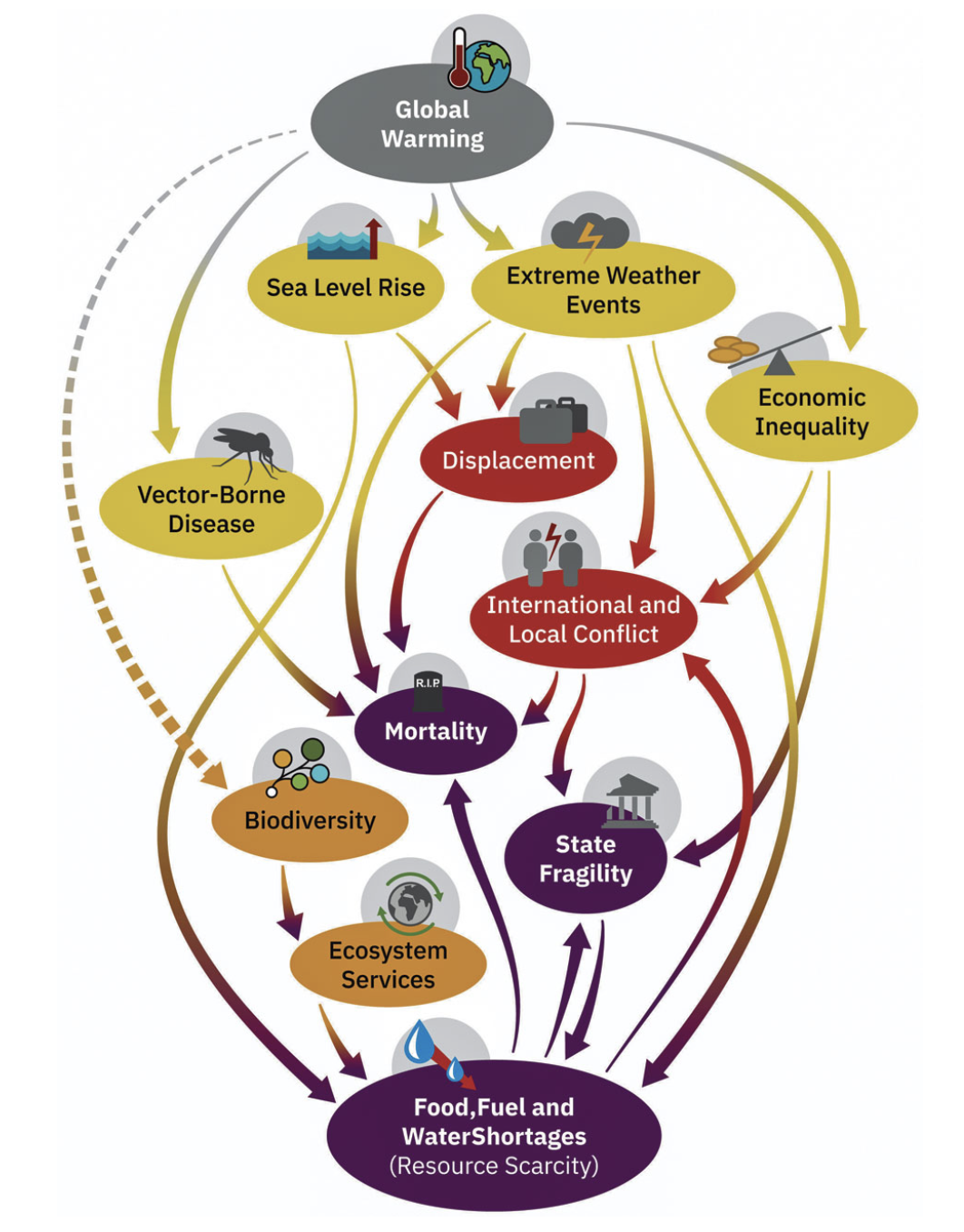

Cascading global climate failure. This is a causal loop diagram, in which a complete line represents a positive polarity (e.g., amplifying feedback; not necessarily positive in a normative sense) and a dotted line denotes a negative polarity (meaning a dampening feedback). Source: https://www.pnas.org/doi/full/10.1073/pnas.2108146119 Photo: Climate Endgame: Exploring catastrophic climate change scenarios/CC BY 4.0.

While the full impact of the system settling into a much weaker flow, or collapse is not fully known but the effect would be catastrophic. Not only is the scientific community beginning to raise frequent alarms but also alerting how the turn of events could bring forward the likely date of such a possibility.

The financial services have not even woken up to what might be coming, how to mitigate, adapt and be more resilient to the challenges a slowing AMOC poses. Can insurers afford to procrastinate? Yet it is not on their radar.

In conclusion

If any one were to assume, particularly the insurers, that the lessons from the last Pandemic have equipped them to effectively handle the next one. Or the climate models in current usage are effective enough to address climate risk/s. Likewise, IPCC’s wishy-washy attention to catastrophic climate change without investigating how Earth system feedbacks could alter temperature trajectories, and whether these are irreversible - we have a serious existential problem on hand.

Actuary Sandy Trust charts the path: “Increasingly severe climate and nature driven impacts are highly likely, including fires, floods, heat and droughts. This is a national security issue as food, water and heat stresses will impact populations. If unchecked then mass mortality, involuntary mass migration events and/or severe GDP contraction are likely.”

“Climate change is taking the gloves off.” Warns Munich Re’s Chief Climate Scientist. One thing that we can be sure of - LA like ‘Pralaya’ (Sanskrit: "dissolution" or "melting away") will keep manifesting with greater frequency and intensity if we cling on to “Naive risk management at best and fatally foolish at worst.”

This article is also published on Sanctuary Nature Foundation. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.