An interview with Gillian Marcelle: “Facts will not stop those who cannot drag their hearts and minds away from nomenclature wars..."

· 11 min read

Dr. Gillian Marcelle leads Resilience Capital Ventures LLC, (RCV), a boutique capital advisory practice specializing in blended finance. She has a proven track record in attracting investment and focuses on telecoms, fintech, renewable energy and regenerative agriculture. Her clients and partners include the government of The Bahamas, MPC Energy Solutions, PolicyLink, Marin Agricultural Land Trust (MALT), AfricaBio and the Clinton Foundation. She currently serves on the Advisory Board of New Majority Capital and has guided numerous ventures in the role of Senior Advisor. Her specialty is the design and implementation of blended finance strategies that often involve partnerships, ecosystem strengthening and designing architectures for transformational change.

Gillian’s educational background includes earning degrees in Economics from the University of the West Indies, St Augustine, Trinidad & Tobago, and the Kiel Institute of World Economics, Germany; an MBA with a specialization in high technology management from the George Washington University and a doctorate in innovation policy from the Science and Technology Policy Research Unit, SPRU, University of Sussex. Her international public service includes appointments with the Global Building Network; several agencies in the United Nations system; the World Economic Forum, the Global Future Council on SynBio; and an appointment as a Commissioner on the Value Commission, a project of the Capitals Coalition.

PG: It is time for yet another COP. Do you see its ongoing relevance despite an oil-rich nation playing the host?

GM: The fact that the host of COP28 is the United Arab Emirates, a Gulf state country, has generated a lot of attention in the US and Europe and even calls for a boycott.

My country of origin is Trinidad and Tobago, an energy-led economy, and so simply from the point of view of hypocrisy, it would be silly for me to take a negative attitude towards the UAE.

Then there is this – the UAE is pursuing ambitious decarbonization and energy transition strategies as outlined in its National Determined Contribution (NDC) and the UAE Energy Strategy 2050.

UAE more than triple the share of renewable energy by 2030 to stay on track with its climate change mitigation goals, as well as help increase the share of installed clean energy capacity in the total energy mix to 30 percent by 2030.

The plans include:

…a broad range of measures including renewable and nuclear power, reverse osmosis desalination, improved efficiency, district cooling and demand-side management, carbon capture and storage (CCS), hydrogen use in industry, fugitive methane cutting, public transport and electric vehicles, innovative agricultural technologies, and others.

Source: Commitments and Contradictions: Gulf and Middle East Decarbonization Strategies Ahead of COP28. These efforts to make accelerated progress to reach net zero emissions by 2050 will be achieved by the commitment to size-able investment with reported investments reaching USD 53 billion.

UAE has also strengthened its institutional apparatus in the following ways:

The UAE was the first Gulf state to announce a national climate strategy in 2017 and was also the first to link its climate strategy with its economic development plans, for which the UAE Green Agenda 2015-2030 was established as an overarching implementation framework. The UAE Council on Climate Change and Environment, established in 2016, is the committee responsible for overseeing the implementation of the Green Agenda. Source: The GCC and the road to net zero.

Moreover, the UAE has orientated itself in support of the concerns and negotiating demands of the developing world.

The relevance of COP28 UAE, in my view, is that these conferences continue to move the world forward by providing an albeit imperfect process of figuring out how to solve problems that extend beyond national boundaries.

The UAE supports green infrastructure and clean energy projects worldwide and has invested in renewable energy ventures worth around 16.8 billion USD in 70 countries with a focus on developing nations. It has also provided more than 400 million USD in aid and soft loans for clean energy projects.

Source: The UAE’s response to climate change.

As part of its leadership role, the UAE through the COP Presidency has been active in offering support for the L&D Fund and led the way for standing up coalitions for accelerating renewable energy. Working with sixty countries including US, EU, South Africa and Vietnam among them, to make a high-ambition pledge to scale down coal and triple investments in clean and renewable energy by 2030.

Notwithstanding all of these measures, commitments and policy advances, the UAE and other Gulf States face heavy criticism for maintaining and even expanding oil and gas production. It will be important going forward to monitor and hold accountable all fossil fuel providers with robust tax regimes, local supplier development initiatives and initiatives to invest oil and gas windfall profits in energy efficiency and accelerated rollout of renewable energy.

This media and Western NGOs display a very different posture from the UK, where the Glasgow hosted COP26 was presented as the venue where the private sector would swoop in and take over climate finance.

We all know how that turned out.

As far as the relevance of the UNFCCC Conference of Parties negotiations go, many commentators, particularly those from the Global South, know that there is value to multilateral venues where the voices and votes of small and less powerful countries count.

Therefore, the relevance of COP28 UAE, in my view, is that these conferences continue to move the world forward by providing an albeit imperfect process of figuring out how to solve problems that extend beyond national boundaries.

I echo the views of Amb. Selwin Hart and the UN Secretary General in calling upon member states and non-state actors to use these opportunities well, to display more ambition and increase the proportion of adaptation finance.

For those very strongly concerned about the host of this year’s COP, they can wait until COP29 in Brazil to engage.

PG: Any thoughts on developed countries trying to push the L&D Fund out of the UNFCC? How and when does it become fully functional?

GM: My support for the L&D Fund is a matter of record. I saw the recent pieces regarding the recommendations of moving the secretariat out of the UNFCC.

Those of us concerned about establishing a mechanism to mobilize and deploy funds that compensate countries for cumulative and historical loss and damages arising from climate change regard any kerfuffle about bureaucratic arrangements as unnecessary delays.

When countries in the Global North wish to mount collaborative or national responses to natural disasters, wars, or pandemics, they find ways to proceed. Therefore, the agreement reached in early November was very welcome and set the stage for the Loss and Damages Fund to be on the official agenda.

There are models of effective execution of large-scale financing that can be used as examples. It is also likely that the origin of the L&D Fund will have to be recognized if it is to have legitimacy. The scale of the financing required is certainly daunting.

As Avinash Persaud, advisor to Prime Minister Mia Mottley of Barbados, said when quoted in a recent Financial Times piece, progress on the L&D Fund should be regarded as a shared and important objective of the entire international community.

Western media has, by and large, failed to cover this issue with balance and nuance. The road bumps are celebrated and presented as news without the corresponding long form investigative pieces to build commitment.

There are very few journalists providing a sense of progress. As I have said before, “facts will not stop those who cannot drag their hearts and minds away from nomenclature wars and/or endless debates as to whether carbon taxes and voluntary initiatives work.”

The roll-your-sleeves-up-and-get-it-done community that is designing, deploying and evaluating solutions for the polycrisis should be amplified more. We are going to be using COP28 UAE as a focusing device for our efforts; A meeting place and venue for dialogue and knowledge sharing outside of the formal negotiations.

PG: The burgeoning Climate Crisis is defying all timelines and deserves urgent action. Aren’t there too many distractions getting in the way?

GM: I do not foresee any time soon where there will be no noise and distractions. In my view, what is required is: narrative change in finance and economics to place responding to the polycrisis at the center of economic and investment strategies; movement building to tap into the knowledge of climate and social justice advocates and activists around the world; and activating all forms of capital at scale with ecosystem strengthening efforts done in parallel.

What is required is: narrative change in finance and economics to place responding to the polycrisis at the center of economic and investment strategies…

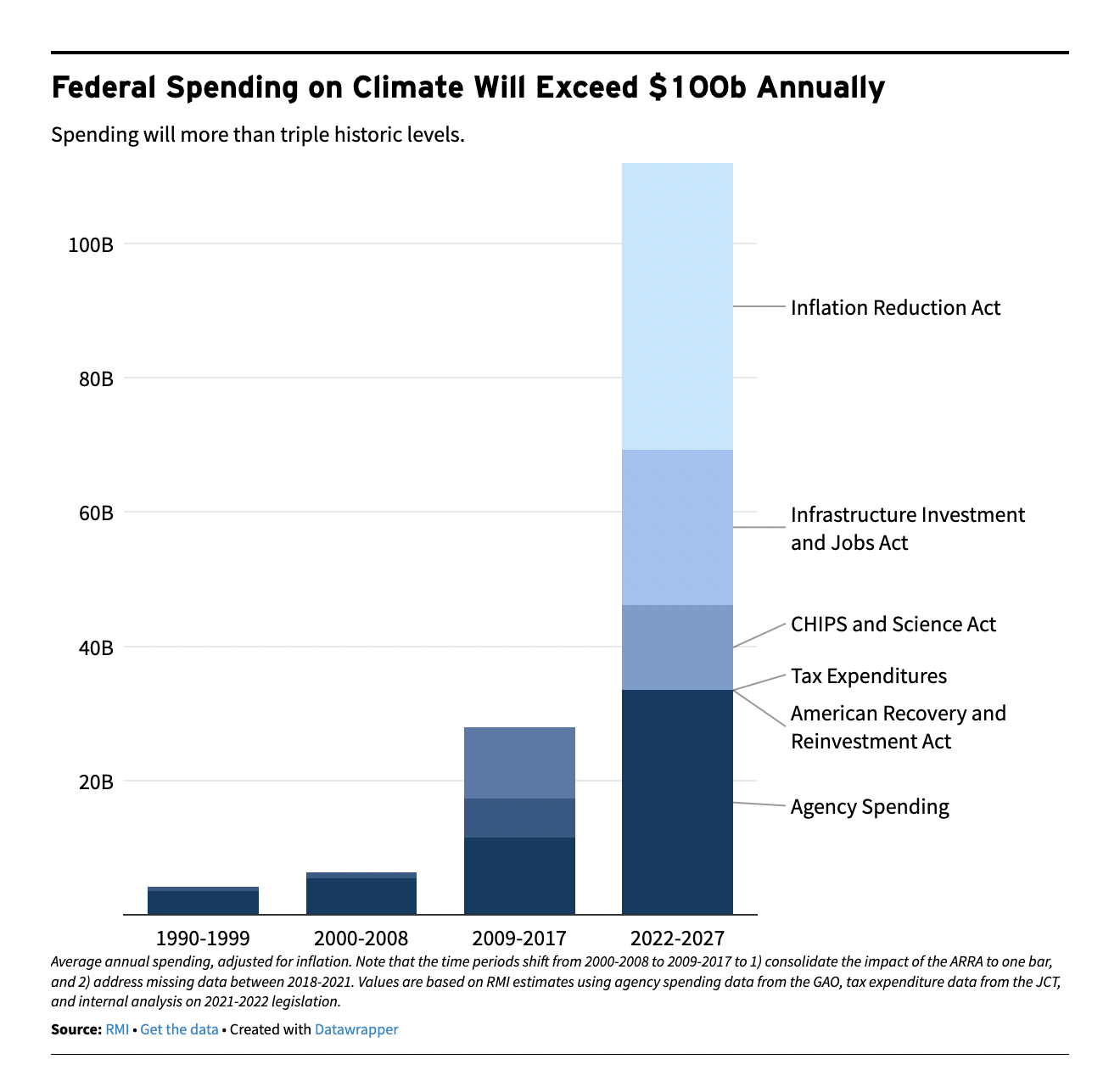

I am encouraged to see efforts along these lines in countries as diverse as Uruguay, where 98% of all energy is derived from renewable sources, and the United States, with billions in annual federal spending on climate under the Biden-Harris Administration.

Figure 1. U.S. Annual Federal Spending on Climate (1990-2027)

Source: RMI

PG: Would you please share what ‘The Bahamas Sustainable Investment Program (BSIP)’ is about?

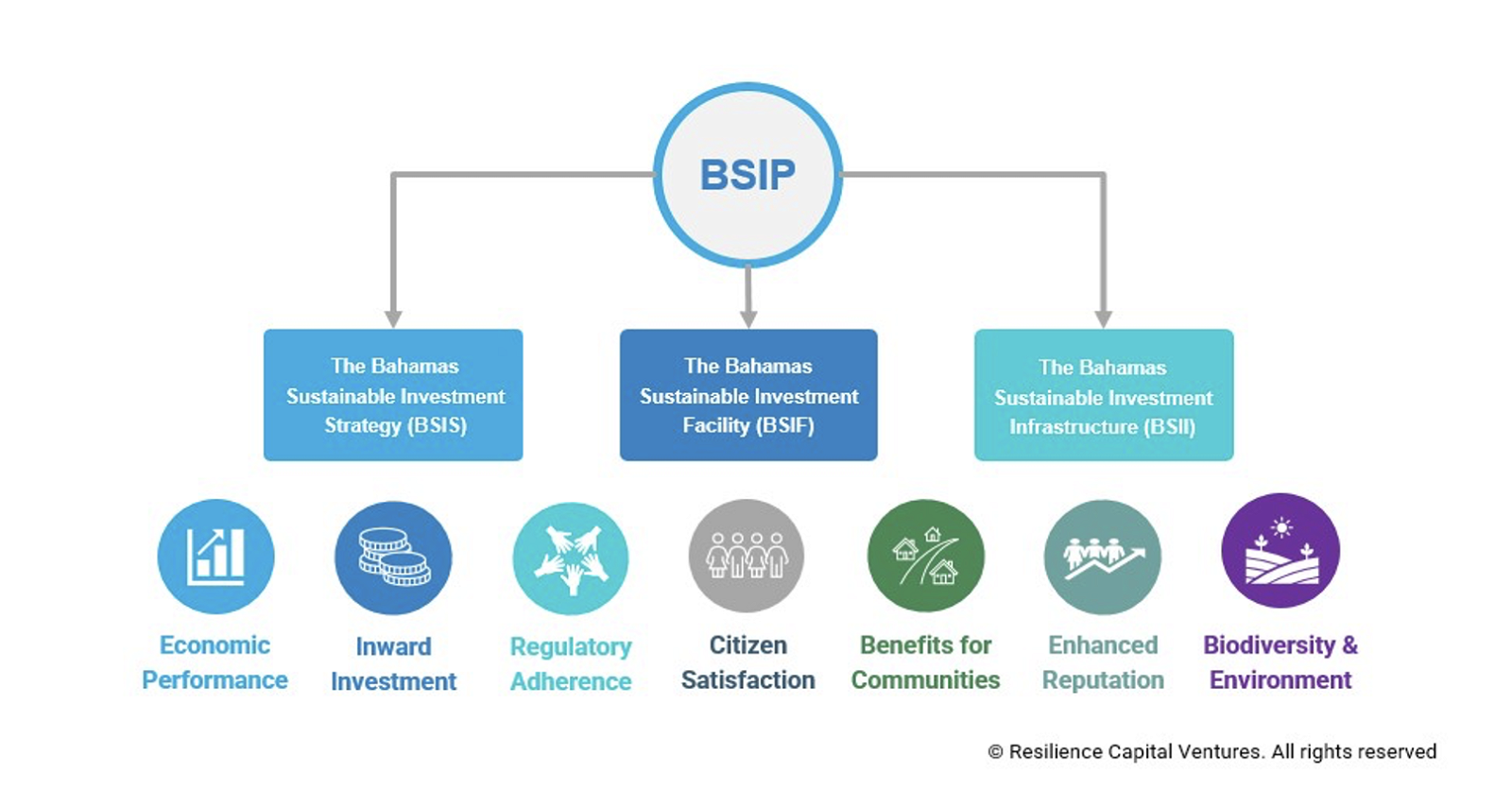

GM: The Bahamas Sustainable Investment Program (BSIP) is an ambitious multi-year investment and economic development program. BSIP seeks to position The Bahamas at the forefront of sustainable investment trends and deliver socio-economic benefits to the people of the country in line with national development goals and existing commitments on climate change and environmental response. This initiative is important for delivering on the government’s vision of a transformed economy and society.

Figure 2. The BSIP overview

Source: The Bahamas Sustainable Investment Program

Once implemented, the BSIP will mobilize high-quality investments that produce risk-adjusted returns and positive social impact while adhering to global ESG standards and sustainability philosophies. This initiative will position The Bahamas as an even more attractive investment destination to global investors and align the domestic investment policy framework with global trends. Powered by the BSIP, The Bahamas will become a demonstration site showcasing what is possible when astute government leadership directs institutional development and facilitates private sector investment.

PG: What would be the role of Resilience Capital Ventures and how do you propose to address sluggishness in capital growth and reduction of misallocation decisions?

GM: The BSIP is designed by Resilience Capital Ventures (RCV) and we lead its execution on behalf of our client – the government of The Bahamas. This program serves to accelerate investment in mitigation, adaptation, and disaster management. By bringing together professionals skilled in capital markets, risk management, issuing securities, underwriting and placement, the program focuses attention of global capital markets on an underserved market. This is critical for success. Our focus draws on the dynamism of private sector firms in light of the many challenges that Development Finance institutions, quasi-public funds, and Multilateral Development Banks have with sluggishness and long lead times for deployment. Even the new President of the World Bank Group has taken aim at unnecessary bureaucratic processes as part of his plan for improvement.

Misallocation decisions arise out of gaps between actual and perceived risks and low levels of contextual knowledge and experience.

In my view, misallocation decisions arise out of gaps between actual and perceived risks and low levels of contextual knowledge and experience. Financiers take the easier and more familiar investment opportunities first. This means they rarely get to small islands in the Caribbean. This is not because of the inherent value, attractiveness, or necessity but simply because these jurisdictions are not top of mind.

Our approach draws on my pioneering experience in taking African telecom companies to global capital markets and more recent experience in helping private equity clients raise capital for renewable energy projects. My own experience is complemented and enhanced by a senior team with decades of experience and a track record of accomplishment. RCV is fortunate to have retained an entire bench of finance and development professionals, including members of the Diaspora, who are frankly fed up with the mediocrity that gets presented to governments in our countries of origin. We know that this is not the best in class and now have an opportunity to demonstrate what is possible and are putting accountability for our outputs up for scrutiny.

PG: Is there a synergy with the Bridgetown Initiative?

GM: It is possible for small island nations in the Caribbean to innovate in multiple directions at the same time. Our work on The BSIP is focused on the design and execution of capital market solutions and therefore, in alignment with and additional to the recommendations of the Bridgetown Initiative.

The articulate advocacy of Prime Ministers Philip Davis of The Bahamas and Mia Mottley of Barbados has raised the profile of the Caribbean at a time when this is sorely needed. However, it is important that no initiatives are pitted against each other because of intellectual laziness or lack of familiarity.

We at Resilience Capital Ventures are supportive of all efforts to restructure international financial systems in ways that benefit the developing world. We also join others in commending the leadership of Barbados in spearheading those efforts.

Praveen, thank you for the opportunity to share these views as the international community gets ready for COP28 in Dubai. With the conflict and war in the world, it is very important to focus on ways that we can move forward towards desired future states where humans and other species thrive and we do a better job of stewarding planet Earth.

PG: It is a real pleasure, Gillian. Many thanks for your unique insights and perspective. My best wishes in all your endeavours.

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Michael Wright

Agriculture · Environmental Sustainability

Vincent Ruinet

Power Grid · Power & Utilities

illuminem

Climate Change · Environmental Sustainability

World Economic Forum

Carbon Removal · Sustainable Investment

UNEP FI

Circularity · Sustainable Investment

Financial Times

Oil & Gas · Sustainable Investment