Investment metrics for climate change (I/IV): it will cost us dearly

· 16 min read

This is part one of a four-part series on new investment metrics adapted to the realities of climate change. You can find part two here and part three here.

Climate change is visible everywhere you look.

Glaciers are melting at an unprecedented rate, as those pictures from the 1930s and the 2020s show.

Farmers all over the world need to cope with more frequent and more severe drought, even in moderate climates such as Switzerland.

Even the U.S. Navy is contemplating abandoning some of its major bases, as sea levels rise faster than ever.

On top of that, economic troubles start appearing everywhere you look.

Capital is becoming scarcer. Not just for fancy startups, but for business in general. Part of the reason is that investment in business continuity is on the rise. Part of it is because governments dole out huge stimulus packages in the wake of COVID-19. And part of it is because markets tend to become smaller due to the rising geopolitical tensions between the West, Russia, and China.

And don’t forget the costs of restoring our defense capabilities, modernizing our social security systems, and preventing future pandemics.

Oh, and we forgot the costs of climate change and the energy transition.

It’s obvious: we’re in both economic and ecological trouble, in a global context.

Shall we be scared, just because our house (or planet) is burning?

Not at all. Nothing cleans like a fire.

But to clean up our house, we will need to change some of our 20th-century habits for good. And with habits, I don’t mean micro-habits of individuals, but macro-habits of entire societies.

In this series of articles, I propose new investment metrics adapted to the realities of climate change.

Let’s dive right into confirming that climate change will cost us dearly.

In general, there are two ways to tackle climate change: mitigation and adaptation.

Mitigation is the proactive part of tackling climate change. For example, it means shifting from fossil to renewable energy long before the last drop of oil is burned. Or it means reducing waste by repairing things instead of throwing them away long before raw materials become scarce.

The best time for climate change mitigation was 30–50 years ago. Unfortunately, the wider public wasn’t susceptible to effectively mitigate the then-remote threat of climate change at that time.

The world kept turning, and climate change unfolded — first slowly, and then faster and faster. It became visible by melting glaciers, frequent droughts, and rising sea levels. It started to hurt ordinary people more and more — not just in some faraway places, but also in rich countries, right at your doorstep.

And suddenly governments and people were busy fighting fires instead of preventing fires. Putting out that forest fire in your own country, and sending aid to other countries fighting ever bigger forest fires. Saving your people from floods, and supporting your farmers in droughts.

Whenever a crisis hits, people tend to focus on the crisis only and forget everything else, especially the root causes of the crisis. Whilst this is certainly understandable and might also lead to a quick resolution of a crisis, this behavior is fatal in the case of climate change: we need to fundamentally change our 20th-century habits for good to effectively curb climate change — no matter if we’re fighting a crisis or not.

So whilst it is too late to focus on climate change mitigation alone, it would also be fatal to focus only on climate change adaptation, omitting to change our 20th-century habits. If we don’t invest in climate change mitigation, we would fuel the vicious cycle even more, and through it raising the costs for climate change adaptation beyond imaginable.

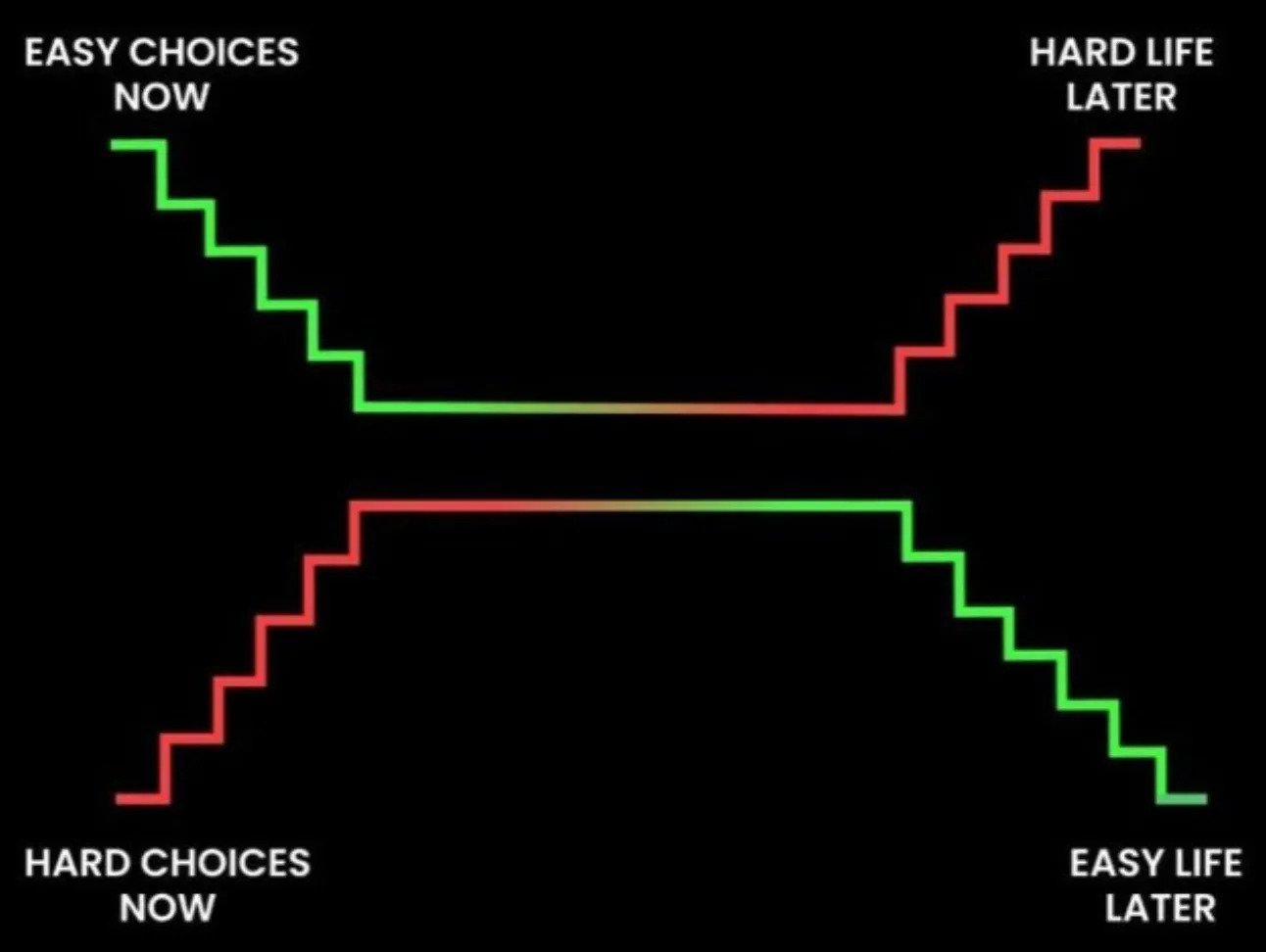

There's an old saying: easy choices now, hard life later. Hard choices now, easy life later.

For all my readers who are older than 60 years, this should resonate with you. Your generation chose the easy life 30–50 years ago, and now we are experiencing the hard life. No blame though, the deed is done, and we have to live with the decisions you took 1–2 generations ago.

Life is hard now because the costs of climate change adaptation are enormous. Consider the infrastructure costs of abandoning U.S. Naval Station Norfolk, the largest naval base in the world, due to rising sea levels. Consider the economic costs of melted glaciers, preventing the agricultural sector of entire countries from being irrigated with natural water. Consider the social costs of entire populations leaving their home countries, simply because it gets too hot to survive at home.

It’s pointless to list all the cost items related to climate change adaptation. And it’s equally pointless to mention that many other pressing issues are very costly: rebuilding our defense capabilities, modernizing social security, and preventing future pandemics, to name just a few.

Now for the hard part. It’s a fact that not even the richest countries will have enough funds to adapt to all the climate change problems, even if we wouldn’t have any other problems such as rebuilding our defense capabilities, modernizing social security, or preventing future pandemics.

Because funds are scarce, we will need to place “bets” on how climate change will progress, and decide what we will do and what we will not do based on those bets.

That will involve some hard choices: abandoning a naval base because we bet on disproportionate sea level rises in the North Atlantic. Abandoning your hometown because we bet on extreme droughts in your area as opposed to other regions. This will not be easy, but remember the old saying from above: easy choices now, hard life later. Hard choices now, easy life later.

When choosing our battles, we cannot just choose what is best now, we need to anticipate the best solution for the future. Here, I would advocate taking the learnings from the military into consideration — it takes decades to build bases or develop ships and airplanes, so you need to plan carefully to meet operational demands 20–30 years into the future.

The military is a good example for another reason. It cannot afford the luxury of ideology. It has to operate and fight in the world as it exists, with the resources it has. Furthermore, it has to plan to operate and fight in the world we are creating. The same is true for the fight against climate change.

Militaries have intelligence services, climate change needs scientists. To maximize the probability of our bets being correct, we need to base our decisions on facts and science, not on politics and emotions.

With the fact that funding will be notoriously short, and challenges widespread, at least we have the luxury to choose our investments wisely.

On a very high level, I would advocate three core criteria to evaluate investments: bang-for-the-buck, a long-term perspective, and a win-win mindset.

We cannot afford the luxury of ideology. The times of investing in 10% fuel efficiency improvement projects or disposable tableware made of bamboo are over. We need to measure every investment against avoided tons of CO2 per dollar invested. And we need to make sure that those investments with the best scores are made first — no matter if they are your pet projects or not, and no matter if you like the technology or not.

As an example, don’t just reduce the bang-for-the-buck metric on the efficiency of different CO2 avoidance or removal technologies. Maybe it’s a better idea to avoid huge amounts of CO2 emissions in a less-developed country with less efficient technology, than going from clean to super-clean in a highly developed country. In this respect, Asia is regarded as highly crucial to win the battle against climate change.

It’s no longer enough to score a quick win and postpone rather than avoid emissions. We need to think long-term when making decisions for our investments. Rather than having a business case for 3–5 years, I would suggest a business case where the payoffs will be reaped by your children and grandchildren.

We will need to change our mindset to get this right, as our societies are so focused on instant gratification, same-day delivery, and self-actualization that we have forgotten what it means to put rewards off or work for a greater common good instead of individual benefit.

Our systems from the 19th and 20th centuries were designed to produce winners and losers. In those times, “winning” meant becoming rich faster than others. The “others” were colonies, the communists, and… our planet.

That will have to change very quickly, otherwise, there won’t be any winners anymore. We have to realize that the common good is one single planet where all of us live. We all have to work towards the same goal, even if we might have different opinions and live in different cultures.

If we screw it up in some place, the effects will be noticed in the global climate. If someone loses, we will all lose.

Now it’s time to fill the three core criteria with life. We need to analyze and segment different investment types to effectively mitigate and adapt to climate change.

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Corporate Governance · Adaptation

illuminem briefings

Sustainable Finance · ESG

illuminem

Adaptation · Biodiversity

Politico

Climate Change · Agriculture

CBC News

Climate Change · Biodiversity

Human Rights Watch

Adaptation · Environmental Rights