Hydrogen in Europe: considerations on early movers and future targets

· 14 min read

As of today (April 2023), more than two years have passed since the release of the first European Hydrogen Strategy1 (July 2020), corresponding to less than seven years left before the first hydrogen production milestone in 2030. The release of the strategic plan for the European Union was followed by country-specific strategies with specific targets (Table 1). Moreover, in response to Russia's invasion of Ukraine, the European Commission released the REPowerEU2 Plan, which increases the targets of scaling-up renewable energies and accelerating the quest for energy independence. REPowerEU involves an updated target in the production of 10 million tons per year of renewable hydrogen by 2030, almost a threefold increase compared to previous target capacity. Combined with an equivalent amount of hydrogen import, 20 million tons per year of renewable hydrogen supply is planned for 2030.

Table 1. Hydrogen demand in 2020 and renewable hydrogen production in 2030 according to declared strategies. Hydrogen demand of countries listed in the table covers 64% of total hydrogen demand within the European Union. Data for 2020 refers to the existing production of hydrogen from fossil sources3,4. The calculation of tons of hydrogen produced per year from the size of the electrolysers installed is based on 1 GW = 0.085 Mt/y.

|

demand 2020 |

planned production for 2030 |

|

| EU - 27 [1],[2],[3] | 7.9 |

3.4 - H2 Strategy 10 - REPowerEU - production 10 - REPowerEU - import |

| Germany [3],[5] | 1.7 | 0.4 |

| France [3],[6] | 0.5 | 0.5 |

| Italy [3],[7] | 0.5 | 0.4 |

| Spain [3],[8] | 0.6 | 0.3 |

| Netherlands [3],[9] | 1.3 | 0.2 |

| Belgium [3],[10] | 0.4 |

0 - production 0.6 - import |

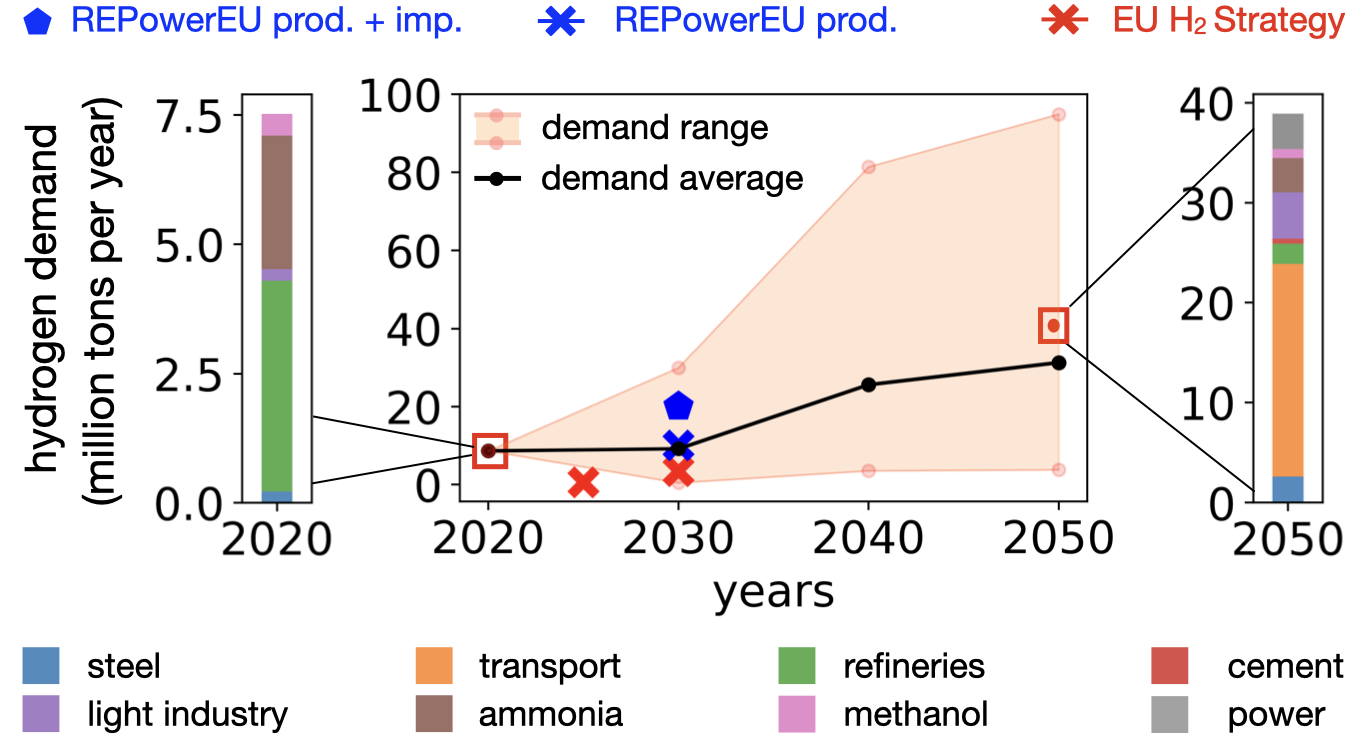

While the targets have a clear aim of scaling-up the hydrogen usage, the recognition of the global role of hydrogen as an energy carrier in the future energy system varies widely among different independent institutions (IPCC11: 90 Mt/y, IRENA12: 540 Mt/y, IEA13: 450 Mt/y). For Europe alone, predictions of hydrogen demand in 2050 vary14 from 4 Mt/y to 95 Mt/y (Figure 1).

Figure 1. Uncertainty regarding future hydrogen demand and European targets. Historical data on hydrogen demand in Europe14 and the uncertainty of the future demand14, according to predictions available in literature, are compared with targets of the European Hydrogen Strategy1 and the REPowerEU2 Plan. The breakdown of demand per sector is derived from historical data (2020)4 and reference scenarios15. The power sector demand in 2050 is assumed to be equal to 10% of the total demand from the other sectors.

Among the drivers of uncertainty stem the future location of production plants within energy-intensive sectors of steel, cement, ammonia, and methanol production. The war in Ukraine led natural gas prices to skyrocket in European countries and created the conditions for potential outsourcing of manufacturing plants to countries with lower energy costs. The use of hydrogen in the power sector involves an additional conversion step to electricity, which implies an increase in the final electricity price. Only those countries, where the combination of hydropower and batteries will not be sufficient for large-scale seasonal storage, might adopt hydrogen for power production. The transport sector alone is a significant source of uncertainty. Let aside if hydrogen cars will have any role in light mobility, the degree of hydrogen use in trucks, planes, and trains determines wide ranges of demand uncertainty.

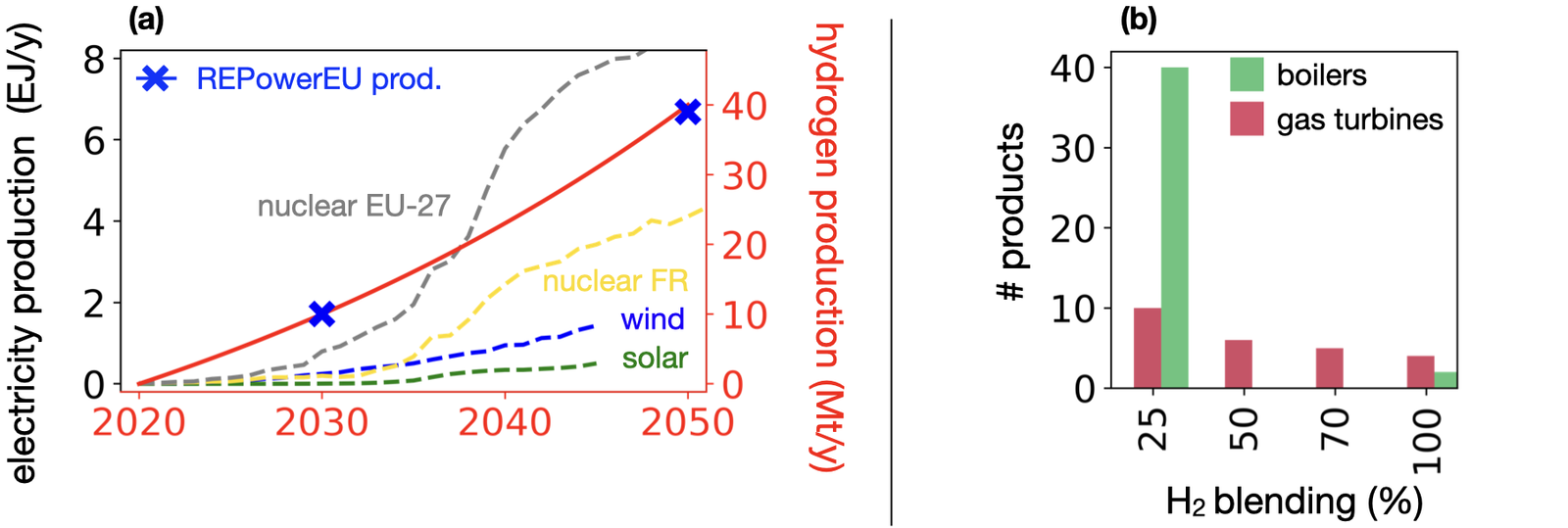

Skepticism can arise on the actual feasibility of installing 120 GW of renewable hydrogen capacity by 2030. As a point of comparison, the current renewable capacity in Europe16 amounts to 491 GW in 2020 (176 GW in 2005). Odenweller et al.17 quantified the likelihood of achieving this target. Even assuming steep growth rates of wind and solar technologies, the authors concluded that there is only a 25% likelihood that 120 GW of renewable hydrogen capacity will be installed by 2030. Increasing the chances would require "unconventional" growth rates in the production of renewable hydrogen capacity, which have been reached so far only for military technologies (WWII US aircraft production, US nuclear power weapons) or for civil technologies with massive public investments (France nuclear power). Under such growth rates, the likelihood of achieving 2030 targets would increase from 25% to 49%. According to the study, a breakthrough comparable to solar panel production may occur quickly but is unlikely before 2036.

Wind and solar technologies reached 29% of electricity generation globally18 and have experienced the fastest growth in the recent history of energy technologies, summing up to approx. 3 TW of production capacity19 in 2020. However, a simple comparison of the historical energy production from wind, solar and nuclear power in France (FR) and in Europe (EU-27) suggests that the 2030 targets might be very complex to achieve (Figure 2(a)). Nonetheless, a scale-up of hydrogen production faster and greater than wind and solar, comparable to the installation of nuclear power plants, could allow the achievement of the target for 2050.

Figure 2. Comparison of the historical technology deployment (a) and number of boilers and gas turbines available in the market as of today by European companies compatible with hydrogen use (b). (2a) Exponential rise of electricity demand for hydrogen production fitted to satisfy RePowerEU's target of 10 Mt/y production by 2030 and a net-zero target of 40 Mt/y by 205015. The production of electricity from wind and solar technologies is based on historical Energy Balances from the International Energy Agency20. Reference years as the start of the historical data are 1995 for wind and solar and 1965 for nuclear energy. (2b) The products are classified with respect to the fraction of hydrogen that they can accept as input fuel.

In recent years, the definition of "Swiss army knife" of the energy transition has been widely used to promote hydrogen technologies for their potential to satisfy various types of energy demand. Indeed, from a technical point of view, hydrogen could be used in applications ranging from space heating to steel production. Yet, technical feasibility doesn't necessarily imply optimal use.

For space heating, we have seen the protests of the public to the replacement of natural gas-fuelled boilers with hydrogen-fuelled boilers in the Whitby Hydrogen Village21. The concern was well-founded, since the use of hydrogen for heating buildings requires an amount of electricity from four to more than six times greater than heat pumps, with a direct impact on monthly utility costs. As pointed out in a recent review, no independent research institution indicated hydrogen as a solution for heating demand22. In its five principles, the Hydrogen Science Coalition23 underlines that focusing on the wrong demand sectors would be an expensive mistake leading to the promotion of a too-expensive technology and the limitation of other technologies which are already more cost- and energy-efficient. This doesn't mean that there will be no market for hydrogen-fuelled boilers. A niche market might exist, associated with buildings that might require heating temperatures higher than what commercial heat pumps could provide. The current products offered in the market seem to reflect the suboptimal use of hydrogen for home heating (Figure 2(b)), with only two products capable of reaching 100% hydrogen blend (i.e., fraction of hydrogen in the total input fuel).

According to the Hydrogen Science Coalition23, the use of hydrogen in transport should also be avoided. However, demand in the mobility sector follows more complex drivers than for space heating. Hydrogen-fuelled cars could have their own demand for niche customers as luxury goods, for which cost and energy efficiency are not limiting factors. An additional driver for hydrogen demand in mobility is geopolitical concerns about Europe’s dependency on other countries for the resources required in the production of batteries. The high uncertainty in hydrogen technologies diffusion (Figure 1) suggests the possibility that a large market for hydrogen cars might arise. The manufacturing processes of hydrogen-fuelled cars have synergies with those of battery electric vehicles but with the fuel cells and hydrogen storage tanks replacing the batteries. The strategy of selling both an electric and a hydrogen-fuelled version of a car should hence not be a surprise. However, while this strategy might pay off in the short term, the medium- and long-term concretization of the energy transition could completely exclude those technologies from the market.

According to a demand repartition among sectors from IEA's reference scenario15 in EU-27, out of the 40 Mt/y of demand, 64% is highly subject to uncertainty and might never materialize. This demand corresponds to the transport and the power sector. Differently, the achievement of the net-zero target by 2050 requires that the remaining 36% of demand, i.e. 14 Mt, is covered with low-carbon hydrogen production, driven by the existence of a limited number of alternatives. This "risk-free" demand corresponds to the chemical sectors of methanol and ammonia production, refineries, steel, and light industry (producing aluminum, paper, glass, and other goods). With this consideration, the target of 20 Mt/y supply in 2030 at EU-27 is already 30% larger than the "risk-free" hydrogen demand in 2050. This supply might result in an overshoot of what might be the real demand for hydrogen in the European energy transition.

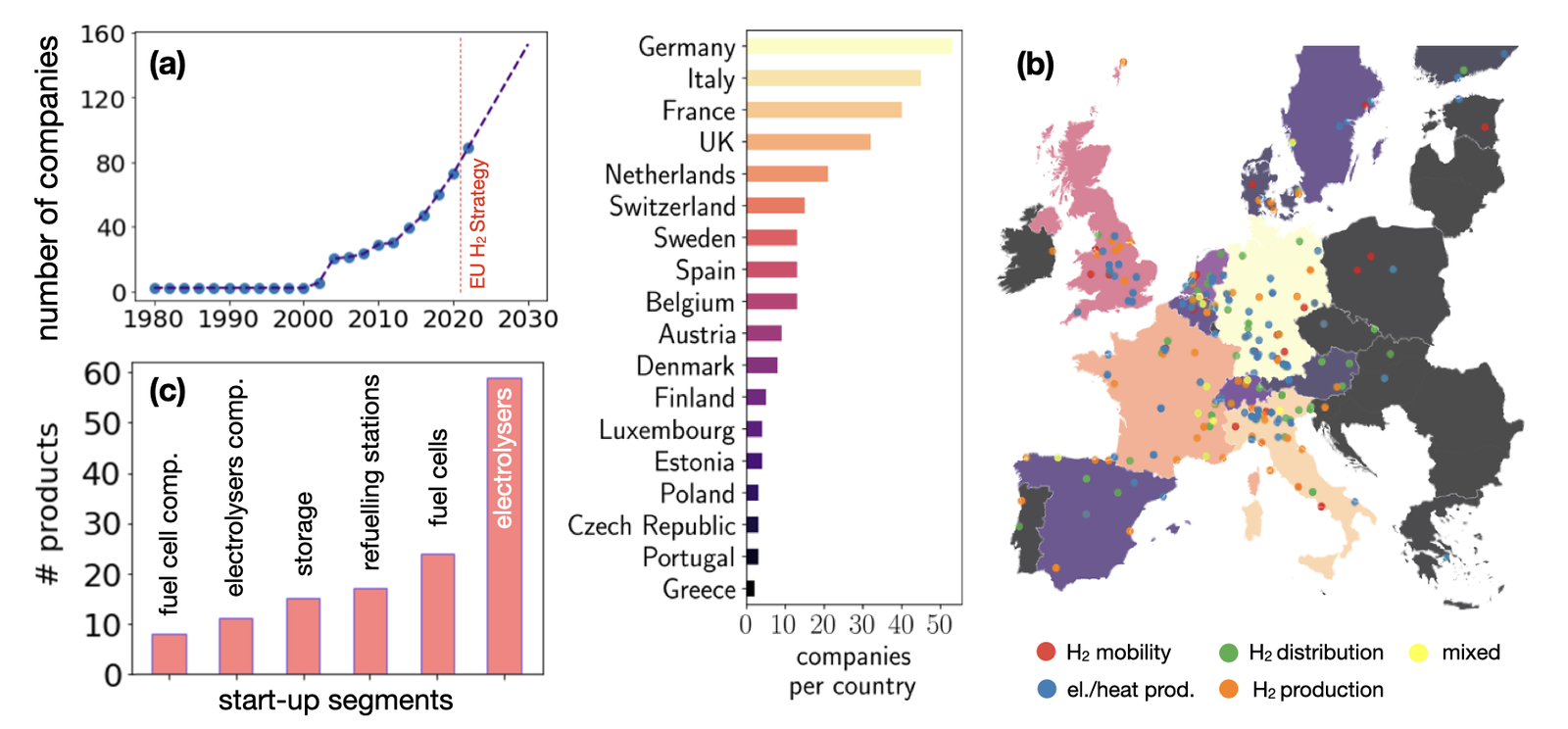

Looking at the existing companies in the arena, the European hydrogen industry seems to have already kick-started its growth path. Based on a snapshot of all the existing companies in Europe which offer products along the hydrogen value chain, Figure 3 shows evidence of the increase in the number of recently funded companies. While there is a clear rise in the number of companies (Figure 3 (a)), it is too early to identify the tipping point in the growth rate. While sectoral industrial growth is only in its infancy, the European industrial landscape could be substantially developed by the investment plans of REPowerEU. A substantial number of start-ups were born, which concentrate on the production of fuel cells and electrolysers, the respective components (i.e., catalysts and membranes), refueling stations, and storage technologies (Figure 3 (c)).

Figure 3. Cumulative number of European companies with a focus on hydrogen (a), a snapshot of the European companies with at least one product in the hydrogen supply chain (b), and a number of products offered by companies identified as start-ups (c). The creation of a substantial number of new companies from 2004 suggests a possible emergence of the hydrogen industry in the considered countries. Start-ups were identified by filtering the companies on the number of employees (< 200) and year of foundation (> 2015).

As the saying goes, "when in doubt, take the next step", the high uncertainty that characterizes the future hydrogen demand should encourage the prioritization of low-carbon hydrogen for "risk-free" demand sectors. The production of chemicals, steel, refineries, and light industries represent key sectors whose decarbonization can hardly be achieved without the use of low-carbon hydrogen. Giving equal priority to hydrogen use in other sectors, like mobility or home heating, could catalyze investments in hydrogen technologies that might not have a future. The number of hydrogen-fuelled boilers for low-temperature heating seems to reflect this awareness, in contrast with the high number of products in the segment of refueling stations from start-up companies. While different demand sectors may experience varying levels of hydrogen penetration, the supply of hydrogen is a bottleneck. The proliferation of start-up companies in this segment seems to target its overtake.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Hydrogen · Energy

illuminem briefings

Hydrogen · Green Hydrogen

illuminem briefings

Sustainable Finance · Biomass

Eurasia Review

Hydrogen · Energy

H2-View

Hydrogen · Energy

Forbes

Green Hydrogen · Ethical Governance