· 14 min read

Clean hydrogen is emerging as a key energy carrier in the transition to a low-carbon economy. However, its large-scale distribution presents significant logistical challenges. Multiple transportation methods are available, ranging from pipelines and liquefaction to conversion into carriers such as ammonia, each with distinct advantages and trade-offs.

The optimal distribution approach will depend on factors such as distance, existing infrastructure and specific end-use applications. While pipelines offer an efficient solution for regional distribution, liquefied hydrogen enables long-distance transport, but at much higher energy costs. Alternatively, hydrogen can be converted into ammonia, facilitating storage and global shipping due to its higher volumetric energy density and mature global infrastructure. Given the diverse needs of a global hydrogen economy, a hybrid approach that leverages a combination of these methods will likely be necessary to enable cost-effective, scalable and sustainable hydrogen distribution. This chapter outlines the strategic priorities for scaling hydrogen supply chains, emphasising innovation, coordinated investment and effective policy frameworks.

The remainder of this chapter is structured as follows: Section 2 reviews the technology landscape and evolving market dynamics. Section 3 analyses hydrogen logistics options, focusing on pipelines, liquefied hydrogen and ammonia. Section 4 outlines key strategies related to innovation, policy and market development.

Technology and market dynamics

As the world advances toward a cleaner energy future, clean hydrogen is emerging as a promising energy carrier. However, its role in the transition to a low-carbon economy will depend not only on efficient and sustainable production but also on developing and deploying effective logistics for its distribution – often across long distances – from production sites to consumption hubs.

A rainbow of colours dominates almost every conversation on the transition to a low-carbon economy: green, grey, blue, turquoise, pink, yellow, orange – an ever-increasing palette to describe the same colourless, odourless and highly combustible molecule, hydrogen. The only difference is the chemical process used to produce it.

Hydrogen is the most abundant element in the solar system, but it naturally occurs only in its compound form on Earth. Therefore, it must be produced from molecules that contain it, such as water or hydrocarbons, through specific processes, including thermo-chemical conversion, biochemical conversion or water electrolysis.

The colours of hydrogen are crucial for the energy transition because each production pathway generates different amounts of greenhouse gas emissions and results in different production costs. Today, renewable (or green) hydrogen is two to three times more expensive than hydrogen produced from fossil fuels.

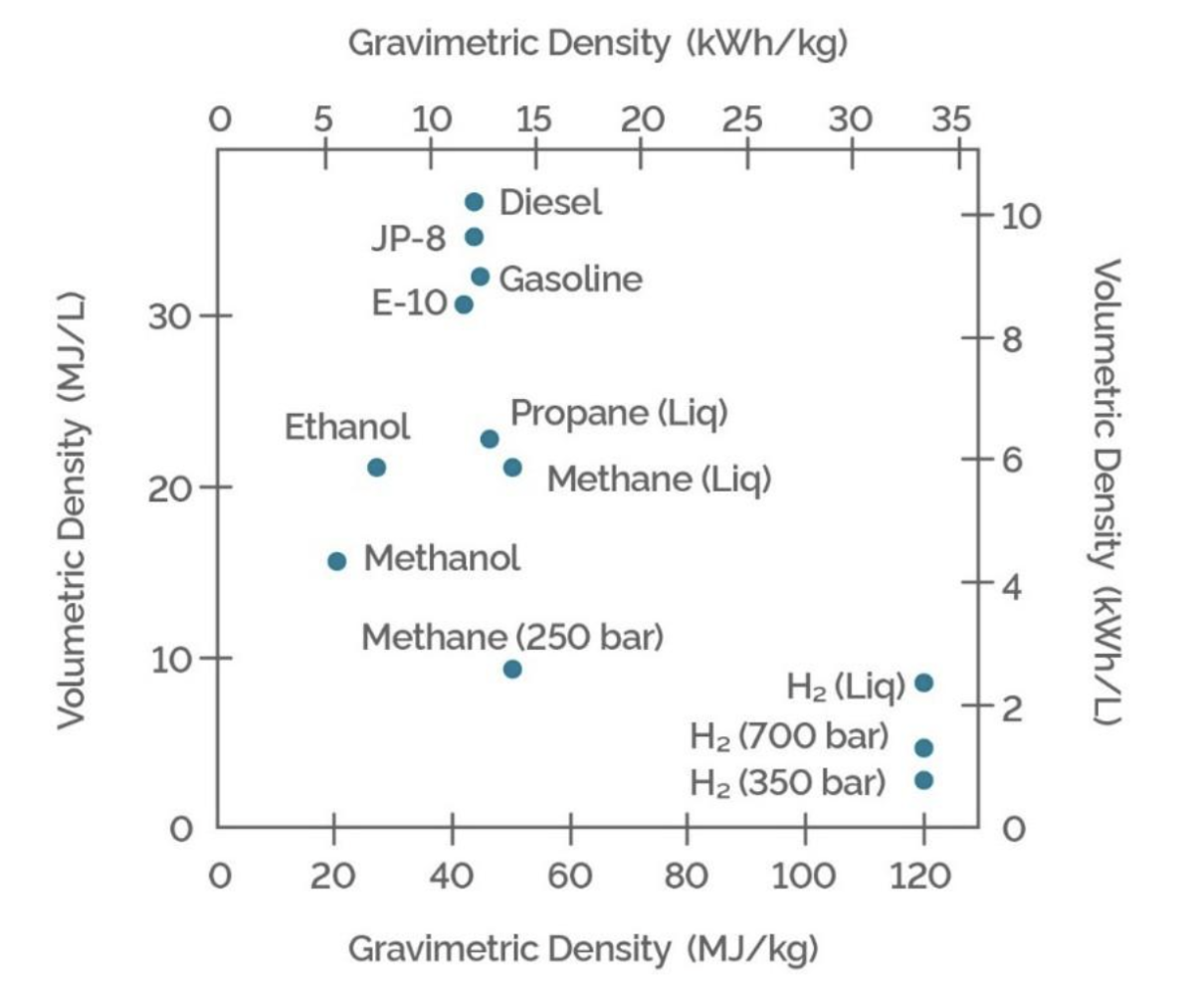

On a mass basis, hydrogen has three times the energy density of gasoline (120 MJ/kg compared to 44 MJ/kg). However, the situation is reversed on a volume basis: liquid hydrogen has an energy density of about 8 MJ/L, while gasoline has aificantly higher density of 32 MJ/L (see Figure 1). Thus, larger hydrogen volumes must be transported to achieve energy equivalence, a significant cost barrier to large-scale distribution.

Hydrogen can be compressed to increase energy density, but achieving substantial gains requires high pressures. While liquefaction more than doubles hydrogen’s density compared to compression, it needs extremely low temperatures, and consumes nearly a third of the total energy content.

Figure 1: Gravimetric vs. Volumetric Energy Densities

Therefore, transporting hydrogen via carriers such as ammonia (NH₃) or methanol (CH₃OH), which contain multiple hydrogen atoms, can enable the distribution of significantly larger volumes relative to the tank size. Unlike pure hydrogen, which requires cryogenic storage at -253°C, ammonia can be stored as a liquid at -33°C or at ambient temperature under moderate pressure, making it easier to distribute.

From a greenhouse gas (GHG) emissions perspective, hydrogen carrier systems entail incremental energy demands at each value chain stage, including carrier synthesis, transportation and reconversion to hydrogen. These processes can generate substantial life-cycle emissions, depending on both the carbon intensity of the energy sources and the design and efficiency of the overall supply chain.

For instance, hydrogen liquefaction requires approximately 6 kWh per kilogram of hydrogen (primarily for compression), which translates into 0.6 kg CO₂-equivalent per kilogram of hydrogen for every 100 g CO₂/kWh increase in the carbon intensity of the electricity grid. While renewable electricity could significantly reduce these emissions, liquefaction facilities necessitate a continuous power supply, and stable operation under intermittent renewable inputs has yet to be demonstrated. Similarly, in the case of liquid organic hydrogen carriers (LOHCs), emissions on the importing side – arising from dehydrogenation and compression – are estimated at 0.2 kg CO₂-equivalent per kilogram of hydrogen per 100 g CO₂/kWh increase in grid carbon intensity.

These values underscore the critical importance of electricity sourcing: the lower the carbon intensity of the grid, the lower the indirect emissions associated with hydrogen transport and storage. Ultimately, the environmental impact of each hydrogen carrier – be it ammonia, methanol, LOHCs or liquefied hydrogen – is influenced not only by energy consumption but also by factors such as infrastructure compatibility, safety considerations, storage conditions and overall lifecycle efficiency. Therefore, selecting the most appropriate carrier involves a nuanced trade-off between environmental, technical and economic priorities.

From a market perspective, global hydrogen demand reached 97 million metric tons (Mt) in 2023, a 2.5% increase from 2022. However, this growth was driven mainly by broader economic trends rather than the impact of targeted policy measures. Hydrogen consumption remains concentrated in refining and industrial applications, where it has been a staple for decades. Its adoption in emerging key sectors of the energy transition, such as energy storage, heavy industry and long- distance transport, remains limited, accounting for less than 1% of global demand, despite a 40% increase compared to 2022.

Ammonia, by contrast, is already a strategically important carbon-free global commodity. In addition to its role in sectors such as chemicals, refrigeration, mining and pharmaceuticals, its primary application in fertiliser production makes it critical to global food security.

Ammonia accounts for approximately 30% of hydrogen demand. In 2023, global production reached 152 Mt,17 with approximately 10% traded internationally. This established global trade network provides a strong foundation for ammonia’s emerging role as a hydrogen carrier, leveraging well- established transport infrastructure such as ports, vessels and storage facilities.

While hydrogen and ammonia have been used safely in various industrial applications for decades, their deployment in new energy systems requires thorough safety evaluations. Both compounds pose specific risks that must be carefully managed. Hydrogen, for instance, is highly flammable due to its low flashpoint. However, it requires a higher concentration in air to ignite – 4% compared to 1.6% for gasoline. At the same time, its low density and high diffusivity help reduce some of the risk, as hydrogen tends to disperse quickly in open environments. As a result, effective ventilation and leak detection systems are critical components in the safe design of hydrogen infrastructure.

Ammonia, by contrast, is toxic and corrosive, requiring strict handling and storage procedures to prevent leaks and environmental damage. Fortunately, its pungent odour allows for early detection at concentrations well below those that pose lasting health risks. These considerations underscore the critical need for real-time monitoring systems and regularly updated safety protocols in all future applications. Equally important is the promotion of public awareness campaigns to build trust, address safety concerns and secure long-term political and societal support.

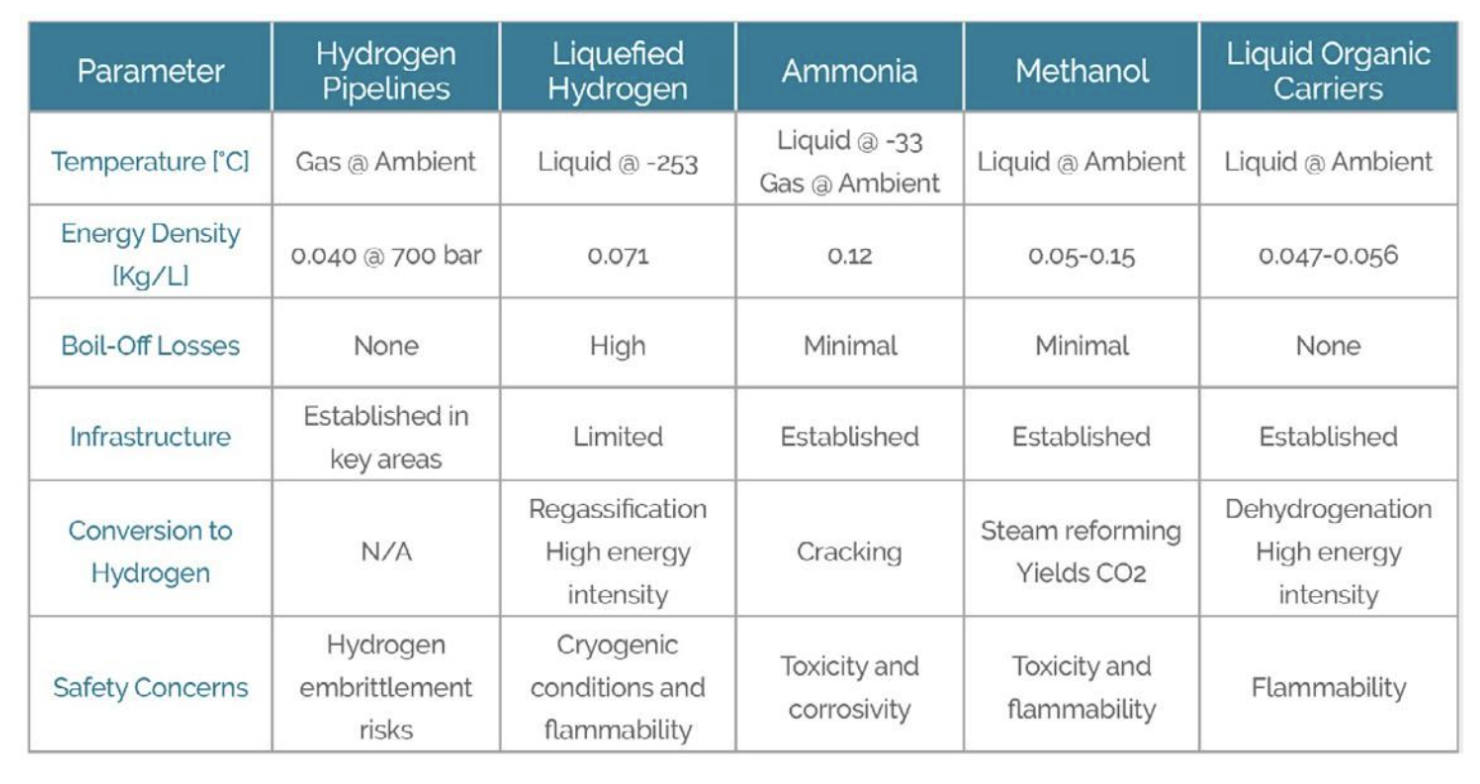

In summary, multiple transportation methods are available for hydrogen, including pipelines, liquefaction and conversion into carriers such as ammonia, each offering unique advantages and trade-offs associated with energy density, cost, infrastructure maturity and safety (see Figure 2). Given the diverse demands of a global hydrogen economy, a hybrid approach that combines these methods will likely be essential to achieve cost-effective, scalable and sustainable hydrogen distribution.

Hydrogen transportation

Pipelines

Hydrogen can be distributed as a gas through dedicated pipelines or blended with natural gas in existing infrastructure. While hydrogen pipelines operate similarly to natural gas pipelines, they require specialised materials and designs due to hydrogen’s unique properties.

In the early stages, hydrogen can be blended with natural gas in existing networks at low concentrations, often without significant upgrades. However, blending faces regional limitations: while some networks and end-use applications can tolerate higher hydrogen levels, others are limited to only small percentages due to concerns such as hydrogen embrittlement.

Furthermore, differing national blending limits present a significant barrier to cross-border hydrogen trade. This underscores the need for internationally harmonised standards, certification schemes and tracking frameworks, all of which are essential but complex steps toward developing integrated and efficient hydrogen markets.

In later stages, transitioning to new infrastructure or converting existing gas networks to pure hydrogen will be necessary. However, the ultimate challenge lies in managing the final step of this transition. A critical yet often overlooked issue is that converting a distribution zone to pure hydrogen requires all end consumers, including residential users, to switch simultaneously – a complex logistical hurdle. Strong policy guidance and public- private coordination will be crucial to managing this transition from planning and financing to deployment.

Pipelines are well-suited for short- to medium-distance transport, particularly within industrial clusters. However, large-scale deployment requires substantial capital investment and long-term infrastructure commitments, underscoring the need for strategic planning. Furthermore, their fixed routes make them inflexible, limiting adaptability to shifting supply and demand. Unlike shipping or trucking, which offer dynamic routing, pipelines require extensive planning and investment, making them less viable for regions with evolving supply chains. This rigidity also complicates scaling, as rerouting or expanding networks incur high costs and regulatory challenges.

Planned hydrogen projects - notable examples

A growing number of international projects underscore the global momentum behind hydrogen. Countries are collaborating across borders to scale up production, establish trade routes and develop integrated value chains.

• European Hydrogen Backbone (EHB). A consortium of European gas network operators is developing a dedicated hydrogen pipeline infrastructure by repurposing existing natural gas pipelines and constructing new dedicated ones as needed. The initiative, including the SouthH2 Corridor project26, aims to connect hydrogen production hubs in Spain, North Africa and the North Sea with industrial consumers in Germany, France and the Netherlands

• Hydrogen Pipeline Network (US). Several initiatives are under way to expand pipeline infrastructure, including clean hydrogen hubs in Texas, the Midwest and California, however, these face uncertainty due to proposed policy changes by the Trump administration

• China’s Hydrogen Infrastructure Expansion. China is building one of the world’s largest hydrogen pipeline networks, backed by both state and private sector investments. This includes the world’s longest hydrogen pipeline, aimed at enhancing hydrogen production, distribution and industrial integration

Liquefied hydrogen

Shipping hydrogen as liquefied hydrogen (LH₂) presents a promising pathway for international trade, thanks to its higher volumetric energy density compared to compressed hydrogen, which enables more efficient long-distance distribution and supports market expansion.

However, several challenges must be overcome for widespread adoption to occur. As discussed, LH₂ requires cryogenic temperatures (around -253°C), resulting in high energy consumption during liquefaction. Boil-off losses30 during storage and transport further reduce overall efficiency. Moreover, the supporting infrastructure – such as specialised tankers, terminals and cryogenic handling systems – is still in its early stages of deployment and requires significant investment to become commercially viable.

Safety is another critical consideration. Hydrogen’s flammability and the complexity of ultra-cold handling require robust safety protocols and clear regulatory frameworks. In parallel, LH₂ faces growing competition from alternative hydrogen carriers, such as ammonia and liquid organic hydrogen carriers, which may offer more scalable or cost-effective options depending on the specific use case.

Addressing these technical, economic, and logistical challenges is essential for LH₂ to become a mainstream hydrogen transport solution. Nonetheless, ongoing advancements in cryogenic technology are steadily improving storage and transportation efficiency, thus reinforcing LH₂’s long-term value chain potential.

Planned liquefied hydrogen projects -notable examples

• Hydrogen Energy Supply Chain (HESC). Japan and Australia are partnering to produce hydrogen from coal in Australia and transport it to Japan using specialised LH₂ carriers. The pilot phase has successfully demonstrated the feasibility of liquefaction and transport, with full-scale commercialisation planned for the 2030s.

• European NAVHYS Project37. Co-funded by the European Union, Ariane Group is leveraging its expertise from space rockets to lead a project advancing LH₂ as a viable maritime energy carrier. By integrating know-how from shipbuilding, space technology, energy and safety, the initiative aims to accelerate maritime decarbonisation. Furthermore, it will address critical challenges, including adapting ship design, port infrastructure and operational frameworks for seamless LH₂ integration.

Ammonia

Thanks to its higher volumetric energy density compared to liquefied hydrogen (see Table 9.1), ammonia is emerging as a strategic, carbon-free hydrogen carrier, particularly for long-distance and international transportation. Synthesised from hydrogen and nitrogen (N₂) via the established Haber- Bosch process,38,39 ammonia benefits from existing global infrastructure, providing a practical pathway for scaling hydrogen adoption. Unlike LH₂, which suffers from boil-off losses, ammonia can be stored with minimal energy loss.

Its dual functionality – as a direct fuel and carrier that can be converted back to hydrogen at the point of use – enhances its market appeal and versatility across sectors. As our research shows,40,41 these advantages position ammonia as a key enabler in the development of a global hydrogen economy, prompting a strategic shift in production toward locations near hydrogen generation hubs.

However, its deployment faces critical challenges. The conversion processes to and from ammonia are energy- intensive, affecting overall efficiency. Additionally, reconversion technologies – like catalytic cracking – require further advancement to become commercially viable.

Countries such as Japan and Australia are already investing in ammonia-based supply chains to facilitate the transport and trade of hydrogen. As of February 2025, the Ammonia Energy Association (AEA) had listed 485 projects worldwide, with a combined annual capacity exceeding 451 million tons.

Planned ammonia projects – notable examples

• NEOM Green Hydrogen Project (Saudi Arabia). The NEOM Green Hydrogen Project, one of the world’s most prominent initiatives of its kind, aims to produce green hydrogen-derived ammonia for export to global markets. Developed in partnership with ACWA Power and Air Products, the project aims to achieve an annual output of up to 1.2 million tons of green ammonia by 2026.

• Baytown Project (Texas, US). Mitsubishi and commodity trader Trammo signed agreements to off- take up to 1 million tons of low-carbon ammonia annually from ExxonMobil’s hydrogen facility, which is expected to begin operations in 2029.

• Yara International’s Green Ammonia Initiatives (Norway). Yara International opened Europe’s largest green hydrogen and ammonia plant in Norway in 2024. It also partnered with PepsiCo to supply European farmers with decarbonised fertiliser and signed purchase agreements with renewable fertiliser producers in India, Egypt and Oman.

• Japanese Consortium’s Investment in Indian Green Ammonia Project. A consortium of six Japanese companies, including IHI Corporation and MOL, is exploring investment opportunities in a green ammonia production facility in India. The plant aims to produce approximately 400,000 tons of green ammonia annually by 2030, to export it to Japan.

Conclusions and recommendations

The choice between hydrogen pipelines, liquefied hydrogen and ammonia depends on factors such as distance, cost, safety and existing infrastructure. Our research shows how pipelines are best suited for regional, continuous supply along fixed routes, while ammonia and liquefied hydrogen facilitate long-distance and international trade.

Among these, ammonia currently holds a strategic advantage due to its higher energy density, well-established global infrastructure and lower energy-intensive handling requirements compared to liquefied hydrogen. Therefore, ammonia presents a compelling option for establishing an international, carbon- free hydrogen supply chain, facilitating efficient and flexible connections between production hubs and demand centres.

Looking ahead, hydrogen logistics are likely to follow a hybrid model – leveraging pipelines in regions with mature infrastructure and liquefied hydrogen and ammonia for cross- border and intercontinental transport. Innovation in storage technologies, ammonia cracking and the optimisation of liquefied hydrogen transport will be critical in determining the most cost-effective and scalable solutions.

Unlocking hydrogen’s full potential will require coordinated action from industry leaders, policymakers and researchers. A supportive policy and regulatory environment, driven by government incentives and international cooperation, will be key to deploying hydrogen distribution networks at scale. Nations and companies investing early in enabling infrastructure will gain a competitive edge in the energy transition.

From this perspective, we would recommend an approach that includes the following elements:

• Infrastructure Investment & Integration. Prioritise coordinated public and private investment in hydrogen pipelines, ammonia shipping and terminal infrastructure, ensuring integration with renewable energy sources to support carbon-neutral and efficient hydrogen value chains. Synchronise demand growth, production scale-up and infrastructure deployment to enable balanced and resilient logistics.

• Technology Innovation & Cost Reductions. Support innovation and industrial-scale deployment to reduce costs across the value chain. Focus on key technologies such as ammonia-to-hydrogen conversion, liquefaction efficiency and advanced pipeline materials to mitigate hydrogen embrittlement.

• Regulatory Frameworks & Safety Standards. Develop harmonised, transparent regulations and streamlined permitting processes. Define ownership and sharing of enabling infrastructure. Implement real-time monitoring and continuously updated safety protocols.

• International Collaboration & Market Development. Coordinate with global partners on standardisation, certification and tracking frameworks. Ensure uninterrupted energy supply to end-users by facilitating cross-border trade and reducing market friction through multilateral agreements.

• Public Engagement. Promote awareness campaigns to foster public trust and secure long-term political and societal support.

Hydrogen logistics will be a cornerstone of the clean energy transition. Coordinated action across infrastructure development, regulatory alignment, technological innovation and international cooperation will be essential to realising its full potential.

Early investment in infrastructure, cost-reduction strategies and integration with renewable energy systems will position hydrogen as a globally viable and sustainable energy carrier, driving decarbonisation and enhancing energy security in the decades ahead.

Figure 2: Summary of main variables

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.