How innovative financial solutions can build climate resilience

· 5 min read

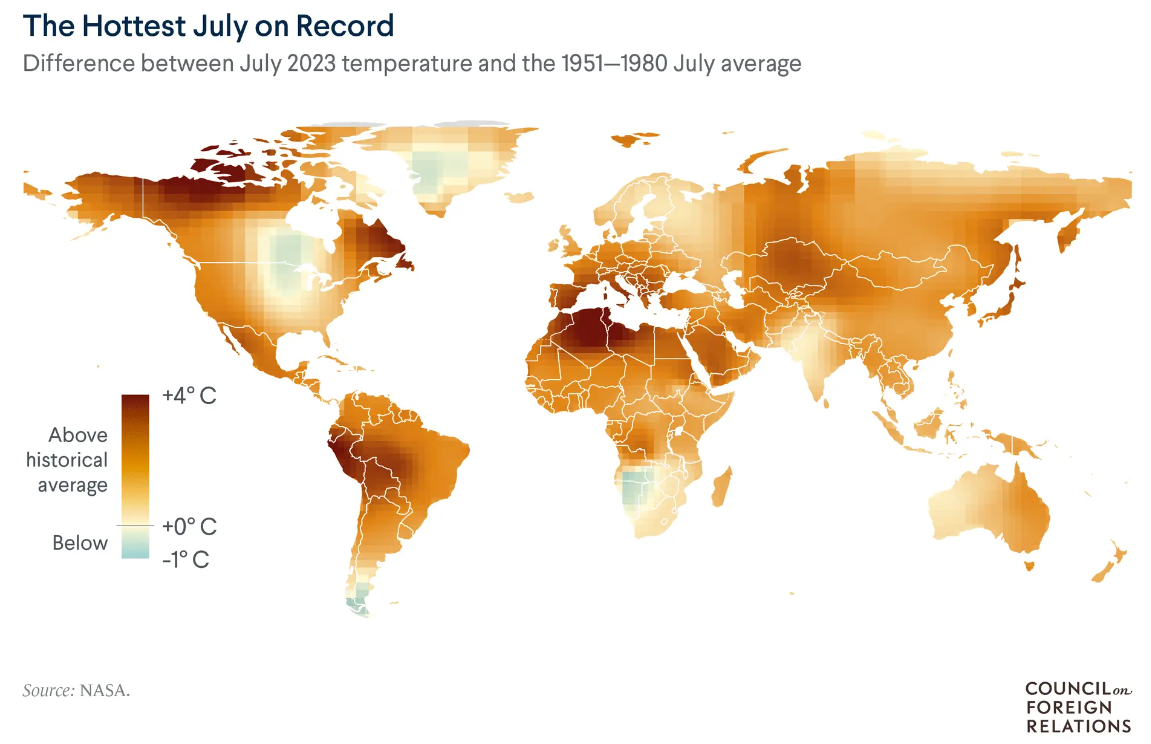

In 2023, the world entered into an era of global boiling – and the long term impacts of rising temperatures on the global financial system are likely to be profound. The insurance industry is struggling to adapt to a new normal. Prior to 2005, industry losses did not exceed $50 billion per year. Now, losses fuelled by climate change regularly exceed $100 billion a year. By 2050, extreme heat and related climate perils could reduce the world economy by $23 trillion, with significantly higher losses in the Global South where nations have fewer resources to adapt their infrastructure and economics.

As extreme weather events such as heatwaves and wildfires become more frequent and intense, companies and governments are leveraging innovative mechanisms for financing and transferring risk in non-traditional ways. While cascading climate risks are fuelling disruption and volatility, today’s risk landscape presents opportunities for business leaders to proactively build climate resilience into business models, products, workforces, and investments.

Innovative financing solutions play a critical role in reducing the risks for investors and insurance companies operating in climate risk-prone geographies. Reforestation bonds, coral reef resilience bonds, and parametric insurance for heat resilience have all been successful in steering private and institutional capital towards critical climate resilience interventions. The scale and scope of the climate challenge cannot be solved by governments alone – private industries must play a central role as de-riskers and investors in climate mitigation and adaptation.

To prevent climate-fuelled insurance deserts from forming, incentives are needed for companies, households, and individuals to take key adaptation measures into their own hands. The impacts of climate change can be mitigated by resilience interventions, thereby removing some of the weight of risk from insurers and incentivizing them to continue providing coverage.

For example, California’s Wildfire and Forest Resilience strategy made available up to $117 million for local projects that address the risk of wildfire. In a state where roughly 30% of the primary insurance market is either pulling out or not renewing policies due, in part, to untenable wildfire risk, this is exactly the type of community-led adaptation project that can de-risk climate perils and keep “insurance deserts” from expanding.

However, rapidly increasing costs of natural disasters are straining some of the innovative financing solutions that have provided respite to economies and societies in the past. Yields in the catastrophe bond market are soaring as investors are now demanding the highest premiums in years to cover issuers against disasters. Financing solutions for climate resilience must advance to keep pace with a rapidly intensifying risk landscape.

Prevention is better than cure, and moving societies and economies to a prevention mindset requires investment in adaptation and mitigation. Business leaders are increasingly leveraging artificial intelligence (AI) and machine learning to more effectively map exposures to climate risk and bolster preparedness. Identifying climate-driven vulnerabilities in investment portfolios, supply chains, and worker health/well-being strengthens the case for implementing forward-looking resilience strategies and mobilizing investment in key adaptation/mitigation interventions.

Currently, there is a massive adaptation financing gap to contend with – $194-366 billion per year is needed in developing countries alone to protect vulnerable communities and economies from the most dire fallouts from climate change. However, roughly 90% of weather-related disaster funding is spent on post-event response rather than prevention and mitigation, despite the fact that each $1 invested in prevention yields up to $13 in long-term risk reduction benefits.

In the world of insurance, there is a dual challenge. On the one hand, insurance companies face a looming crisis in profitability. On the other hand, affordability for policyholders and customers is becoming out of reach. Leaders from the public and private sectors must shift towards a preventative mindset to anticipate climate risk before disaster strikes and cultivate recovery coalitions to “build back better” when disaster inevitably does strike.

Where governments, businesses, and individuals are unable to scale adaptation and prevent the fallouts of climate change, investing in nature-based solutions can be the most effective path to resilience. Nature-based solutions, which refer to projects supported and motivated by natural processes, can reduce the risk of flood, fire, or drought, improve human health and well-being, strengthen infrastructure, and build overall societal and economic resilience.

Nature-based solutions (NBS) for climate resilience are 50% cheaper than grey alternatives and can deliver 28% greater added value in terms of productivity and positive externalities. NBS are an estimated trillion-dollar opportunity – accelerating buy-in from investors and asset managers will bolster climate resilience and present new opportunities in the years to come. For example, in Medellin, Colombia, a public-private partnership funded “Green Corridors Program” planted an interconnected network of greenery across the city that reduced average city temperatures by 2°C, sequestered significant amounts of carbon, improved air quality, and increased biodiversity due to more wildlife-friendly habitats.

As the business case for climate adaptation becomes increasingly clear, private sector leaders are becoming an increasingly important part of the climate resilience financing conversation. While only 3% of adaptation efforts are currently funded by private sources, the growing frequency and severity of climate peril are elevating the resilience imperative to the top of the agenda and driving critical change in vulnerable communities and economies around the world.

In today’s increasingly volatile climate risk landscape, shifting from a post-event recovery mindset towards a pre-event resilience strategy is essential for minimizing climate-fuelled economic impacts and consequences for human health and well-being. This transition requires buy-in from both industry giants and governments, and advancing the public and private sector’s core risk management capabilities will help vulnerable communities and economies address the consequences of extreme heat. But climate perils are inevitable, regardless of how diligently we work to protect them. And when a natural disaster does strike, it is this multistakeholder approach that will promote and insure a climate-resilient future.

This article was originally published by the World Economic Forum. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Gokul Shekar

Corporate Sustainability · Sustainable Business

Barnabé Colin

Biodiversity · Nature

Charlene Norman

Sustainable Business · Sustainable Finance

Trellis

Sustainable Finance · Corporate Governance

Sustainable Views

Sustainable Finance · Public Governance

Responsible Investor

AI · Sustainable Finance