Greening the black gold? How private carbon finance can tackle oil & gas

· 9 min read

A set of entrepreneurs in the U.S. are considering how carbon finance and the Voluntary Carbon Markets (VCM) can be harnessed in new ways to lower greenhouse gas (GHG) emissions. Their target: oil and natural gas wells.

These entrepreneurs are looking across the “lifecycle” of a well or a whole oilfield and, in the process, targeting different GHGs. Plugging older and idled wells primarily aims to avoid methane and other fugitive emissions and leaks. The primary purpose of plugging currently producing wells and stopping the development of an oilfield is to avoid emitting CO2 — potentially at a large scale.

It isn’t hard to anticipate the objections that will arise. First, for orphaned wells in the U.S., government monies are set aside for decommissioning. Second, much of this proposed carbon finance “pays the polluter,” i.e. the oil company or well owner, to not emit. Third, it might seem complicated to anticipate how much CO2 or methane emissions will be avoided by the various schemes.

Yet plugging wells (across all lifecycle stages) is a powerful and credible tool to lower GHG emissions. It can make a near-term impact, is technologically viable, and is quantifiable/measurable. Like any climate mitigation activity, safeguards must be taken to ensure that the volumes avoided are not emitted in the future and that their quantity is appropriately estimated. But such standards can be set and there is a sizeable existing industry of third parties, with decades of expertise in petroleum engineering and reservoir characterization, to verify adherence to best practices.

To consider climate mitigation activities and offset crediting, oil and gas wells/operations can be subdivided into five categories. These range from the end to the beginning of a well’s “life” and include conditions in which the operator is known and not known.

Orphaned Wells. Oil and gas wells that are inactive (not producing), are not (adequately) plugged, and have no “responsible operator.” The owner has relinquished the wells and they are the property of the government. Plugging these wells' primary benefit is avoiding methane emissions and other environmental impacts.

Idle/Non-Producing wells. Similar to orphans but the operator is known and solvent.

Marginal wells. Producing wells with a known operator. The distinction between these wells and Flowing wells (see below) is that marginal wells produce small quantities of hydrocarbons (i.e., oil and/or natural gas). To illustrate their scope, there are an estimated 335,000 wells in the United States (out of nearly 900,000 producing wells) that produce less than 1 barrel of oil equivalent per day. These marginal wells collectively produce 0.2% and 0.4% of the country’s oil and natural gas output, respectively, but comprise 11% of the country’s estimated methane emissions from oil and gas production.

Flowing wells. Producing wells that are more productive than marginal wells. The primary benefit of decommissioning these wells is primarily to avoid the CO2 emissions from use of the produced oil and gas (although it also avoids fugitive methane and other leaks).

Undeveloped resources. Recoverable oil and gas in the sub-surface requires capital (drilling wells and installing other infrastructure) and operating investments to exploit. The primary benefit of not developing these resources is to avoid CO2 emissions.

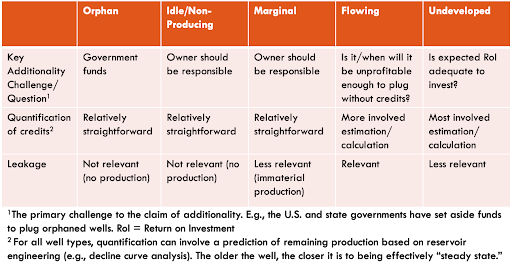

The VCM has undergone considerable evaluation of what constitutes a “high integrity” offset credit (for any climate mitigation activity). A set of “core principles” has emerged to ensure quality: namely that offset credits reflect a tangible climate mitigation activity. What follows is a summary of relevant principles and their relationship with oil & gas well decommissioning (also see the Exhibit at the end of this section).

Carbon offset crediting volumes should be based on calculations/measurements following best practices for estimating emissions in both the baseline/business-as-usual scenario and the climate mitigating activity scenario. For oil & gas wells, the quantity of avoided current and future emissions can be accurately estimated and measured. The process is anchored in the science, developed through decades of experience, that underpins globally accepted accounting practices for estimating recoverable hydrocarbon resources and then how a given well will produce over time. These estimates are relied on globally by financial institutions, government agencies like the U.S. Securities and Exchange Commission and investors for assessing the value of those reserves in this multi-trillion dollar industry, and the calculations made by and verified by independent third parties can be made transparent to credit markets.

The carbon avoided (removed) should remain so for a minimum of 40 years; a reserve (usually a buffer pool of credits) should be established to compensate/offset for reversals during that time frame. Plugging an oil & gas well using accepted standards creates a barrier that prevents hydrocarbon and other emissions/leaks for periods exceeding recommended permanence thresholds.

Carbon eligible for offset crediting should be net of any anticipatable leakage, i.e., of any emissions that result in response to the activity. If one area of forest is preserved but logging shifts to another area, the relocated logging results in leakage of carbon emissions. For oil, economics-based research into the price elasticity of demand has determined that it is reasonable to expect that roughly ½ of the curtailed oil supply would be replaced by other sources (demand for the other ½ would be expected to dissipate with the ensuing higher price) [1].

The activity should not harm and should provide other benefits (e.g., economic, health, gender equality) to impacted communities. Unplugged or inadequately plugged wells, which emit/leak methane, benzene (a known carcinogen), and brine, represent health risks to surrounding communities in addition to contributing to degraded ecosystems and global warming.

A climate-mitigating activity should receive funding from carbon offsets only if that activity is not economically viable, not legally mandated, and would not occur without such funding. For oil & gas wells, additionality considerations are the most complicated principle. Most rest on the idea that oil and gas development is legal and profitable, and thus, private funds are needed to provide incentives to change the status quo. However, the logic varies based on the well lifecycle stage; hence, more discussion follows, organized by well type.

Orphaned wells. As property of the government, plugging orphan wells is its responsibility. The additionality argument is premised on the fact that it is unrealistic that the government will (can) dedicate sufficient resources or has adequate funds to address them all.

Costs to plug wells vary widely, from as little as $20,000 to plausibly over $1 Million for deeper, harder-to-access and/or horizontal wells. Meanwhile, the pool of orphaned wells is vast, a function of a long history of oil & gas development, inadequate regulations regarding well decommissioning for much of that history, and oil firms falling into insolvency. There are 120+ Thousand documented orphaned wells in the U.S., but the actual number is thought to be many times that. Thus, with tens of $Billions needed to cover the costs of plugging, government funds are understood to be insufficient to meet the task [2] and therefore additional funds (from carbon offsets) can be considered necessary.

Idle/Non-Producing and marginal wells. The vast majority of idled wells are plugged by their owners. The argument for additionality with unplugged idle/non-producing wells is that regulatory enforcement is effectively too limited (or too slow) and that the well owner has considerable economic incentive to put off decommissioning for as long as possible. As such, if climate action demands moving more quickly, then carbon finance will be necessary to offset that economic incentive and regulatory system.

It is worth expanding on this point because conditions really aren’t as simple as “government must stop the deadbeat operators.” There is a calculus for operators — and regulators charged with looking after a State’s various interests, including economic ones — around maximizing the value of older wells. Operators historically have re-entered wells with different techniques and technologies to boost oil and gas production. There is also an evolving consideration of repurposing such wells for other uses instead of plugging them; some of these other uses support the energy transition, such as for CO2 injection, geothermal, or lithium extraction. Thus, in some cases, which would have to be supported, it can be established that carbon-based funding is required to drive faster plugging of the well vs. pursuing other options.

Flowing wells. For flowing wells, establishing additionality for funding plugging is more straightforward. The costs of hydrocarbon development are relatively front-end weighted. As such, once the capital investment is made, a well owner can expect production to be profitable for many years, even during periods of low commodity prices and long past the well’s productive prime (production naturally declines over time). A well owner thus needs to be given an economic incentive to decommission its wells.

Undeveloped resources. Establishing additionality for a crediting program that pays an owner not to develop an oil and gas field is more complicated than it is for flowing wells, but it has the same underpinnings. An owner can be expected to develop an oilfield if it meets expected Return on Investment (RoI) criteria and the owner can get access to adequate amounts of capital; thus, a crediting program that pays the owner not to develop an oilfield meeting those conditions can be considered additional.

Exhibit: Crediting Principles Challenges by Oil & Gas Well Type. Source: Payne Institute for Public Policy

As a general rule, adhering to core principles for oil and gas well crediting will require establishing a conservative set of assumptions for volumes over time (and, as appropriate, revenues). These assumptions must be benchmarked against wells/fields of a similar nature to establish their credibility and must be made available and transparent for independent verification. For the sector to strive even further to address integrity challenges, additional measures to ensure conservatism can also be considered, for example, subjecting crediting periods or baseline estimation to rising standards over time.

It may prove difficult for some would-be sources of carbon finance to overcome the “philosophical issue” of paying the polluter to stop producing. It will simply rub some offset credit buyers wrong, regardless of the assumptions used to generate such credits. But the reality, also being recognized in other industries as acceptance grows of the need for Transition Finance, is that oil & gas owners will need financial incentives to change their behavior. With integrity safeguards in place, carbon finance should be encouraged to support these powerful mitigation activities.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[1] It should be noted that different oil and gas reservoirs have different carbon intensities of extraction. Thus carbon finance, which in underpinned by GHG emissions, is well placed to encourage the decommissioning of relatively more carbon intensive oil & gas production. Leakage calculations can include if “leaked” production has a lower carbon footprint than the production being retired, although this practice requires further refinement.

[2] This issue also reflects the fact that financial assurances provided for decommissioning that are required by U.S. states are considered to be inadequate.

illuminem briefings

Hydrogen · Energy

illuminem briefings

Energy Transition · Energy Management & Efficiency

Vincent Ruinet

Power Grid · Power & Utilities

The Guardian

Rare Earths · Energy Sources

World Economic Forum

Renewables · Energy

Financial Times

Energy Sources · Energy Management & Efficiency