Green hydrogen industrial value chains: geopolitical and market implications

· 6 min read

The global transition to a low-carbon economy and adopting the needed clean energy technologies at scale will significantly impact existing value chains[1] and transform production-to-consumption lifecycles. Regulatory and business models will need to rapidly evolve to manage the resulting substantial cost challenges and dramatic shifts in stakeholder interactions while continuing to create value.

Green hydrogen[2] is likely to play a pivotal role in a carbon-free future, as its adoption will enable the decarbonization of energy-intensive industrial processes whose emissions are hard to abate through simple electrification—such as steel and cement production. However, to take advantage of the economic opportunities created by its adoption at scale, countries will need to rethink the roles they could play in a new energy landscape and define strategic industrial policies accordingly.

Our research[3] shows how successful industrial policies must reflect a country’s potential value chain positioning in future green hydrogen markets and elucidates macro geopolitical trends that could reshape international relations as countries compete for industrial leadership, market shares, and opportunities for job creation.

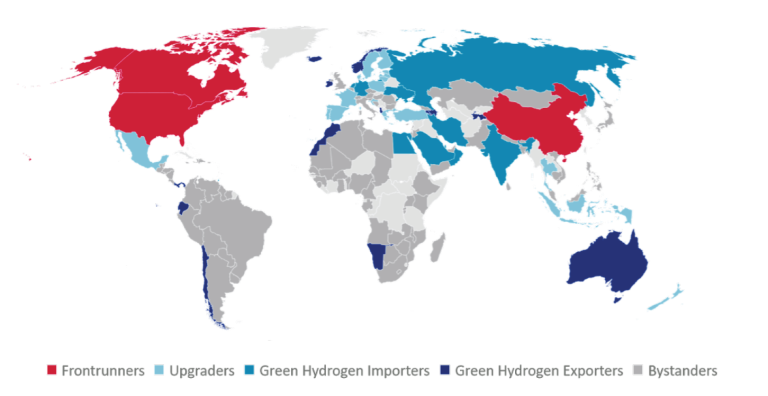

Focusing on three key industrial applications—ammonia, methanol, and steel production, which today account for about 41% of global hydrogen demand and which are expected to increase their shares due to global decarbonization efforts (IRENA, 2022)—we identify five country groups based on the three key variables of resource endowment, current positioning in hydrogen markets, and economic relatedness.[4]

While individual countries in each group face unique challenges and opportunities, nascent dynamics between these groups could spur a green race for industrial leadership impacting international relations.

Frontrunners. Countries with vast resource endowments and considerable market shares in today’s hydrogen industrial applications could evolve into frontrunners by integrating the green hydrogen value chain segments of production and industrial applications. Potential frontrunners should focus on industrial policies that foster upscaling along value chains.

Upgraders. Countries with adequate resources for green hydrogen production and highly related economic activities could upgrade their value chain position and attract green hydrogen-based industries. Potential upgraders could benefit from strategic partnerships with frontrunners to foster technological and knowledge transfer. Policies should focus on attracting foreign capital—for example, by lowering market risk, developing public-private partnerships, and forming joint ventures.

Green hydrogen exporters. Resource-rich countries without upgrading potential should prioritize green hydrogen exports and would benefit from partnerships with green hydrogen importers to deploy enabling infrastructure and reduce market risk. Furthermore, coordination on international standards for green hydrogen production and use could avoid conflict and facilitate trade at a global scale.

Green hydrogen importers. Resource-constrained countries with hydrogen-based industrial applications must develop strategic partnerships to ensure secure and stable green hydrogen supplies. Furthermore, stimulating innovation and knowledge creation through targeted policies will be critical to sustaining competitiveness during the transition to a low-carbon economy and avoiding industrial relocation to frontrunners or upgraders.

Bystanders. Countries with significant constraints along all mentioned three key variables of resource endowment, current positioning in hydrogen markets, and economic relatedness should assess the techno-economic feasibility of removing some of these limitations. Figure 1 depicts the overall geopolitical and market potential for green hydrogen industrial applications.

Our research highlights how only a few countries, like China, Canada, and the United States, could emerge as clear frontrunners. Locating industrial facilities close to low-cost green hydrogen production would allow these nations to create significant added value by increasing control over supply chains and minimizing hydrogen transportation costs. These countries could thus reap the most extensive benefits and become geopolitical and market winners in the global race for green industrialization, market shares, and opportunities for job creation.

Competition for green hydrogen-based industries could foster market tensions between green hydrogen importers and upgraders, resulting in trade barriers or conflicts. Resource-rich countries, like Thailand and Mexico, have the potential for green industrialization and would likely compete with import-dependent industrial powers for market shares and jobs, leading to new geopolitical tensions.

New dependencies could also emerge. Most countries with highly developed ammonia, methanol, or steel industries, such as Saudi Arabia, Japan, and Germany, are also resource-constrained and would depend on green hydrogen imports to meet their demand. From a geopolitical perspective, this means that today’s dependencies and supply disruption risks would likely shift, but not disappear, in a low-carbon energy world.

Finally, tensions between higher-income countries in the Global North and lower-income countries, often located in the Global South, could intensify. Although there are opportunities for economic gains in all world regions, most frontrunners are middle- to high-income countries. Many lower-income countries, especially in Africa, could not easily compete in value-added segments of future value chains and would thus be limited to green hydrogen exports. Hence the promise of ‘sustainable development’ and green industrialization, often associated with the energy transition, might not be replicable everywhere.

Going forward, addressing the opportunities and challenges of green industrialization will require countries and regions to:

This article is also published by the Harvard Kennedy School Belfer Center. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Hydrogen · Green Hydrogen

illuminem briefings

Green Hydrogen · Hydrogen

illuminem briefings

Green Hydrogen · Sustainable Business

Energies Media

Green Hydrogen · Hydrogen

Hydrogen Insight

Green Hydrogen · Hydrogen

Hydrogen Insight

Hydropower · Green Hydrogen