Green, greener, greenwashing – how new methodologies can assess fund greenwashing risk exposure

· 9 min read

How many posts, articles, and sponsored content did you come across where companies talked about their positive sustainable behaviour?

At least on my LinkedIn feed, there seem to be quite a lot.

Now, imagine searching for one of these companies on Google News and the first article you find highlights their pollution, government bribes, or mistreatment of employees in their supply chain. While this is just a hypothetical example, it wouldn't be difficult to find a real-life case. The implication is clear: you've just identified a strong indicator that this company is at risk of greenwashing.

Greenwashing is defined by its communication and action dimensions. When a company communicates positively about its future while being primarily driven by controversies today, it clearly misleads its image. In short, it's greenwashing.

ESG data providers have long been collecting news articles about companies to derive their ESG-related risk ratings and assess their exposure to controversies. This methodology is widely used to identify corporate controversies.

With advancing technology, these news articles can now not only explain controversies but also assess the sentiment expressed in the articles. This means determining whether an article portrays a company in a positive or negative light.

Covalence, a Swiss-based ESG data provider founded in 2001, utilizes this sentiment data to assess a company's greenwashing risk. Their methodology aligns with the logic we presented earlier.

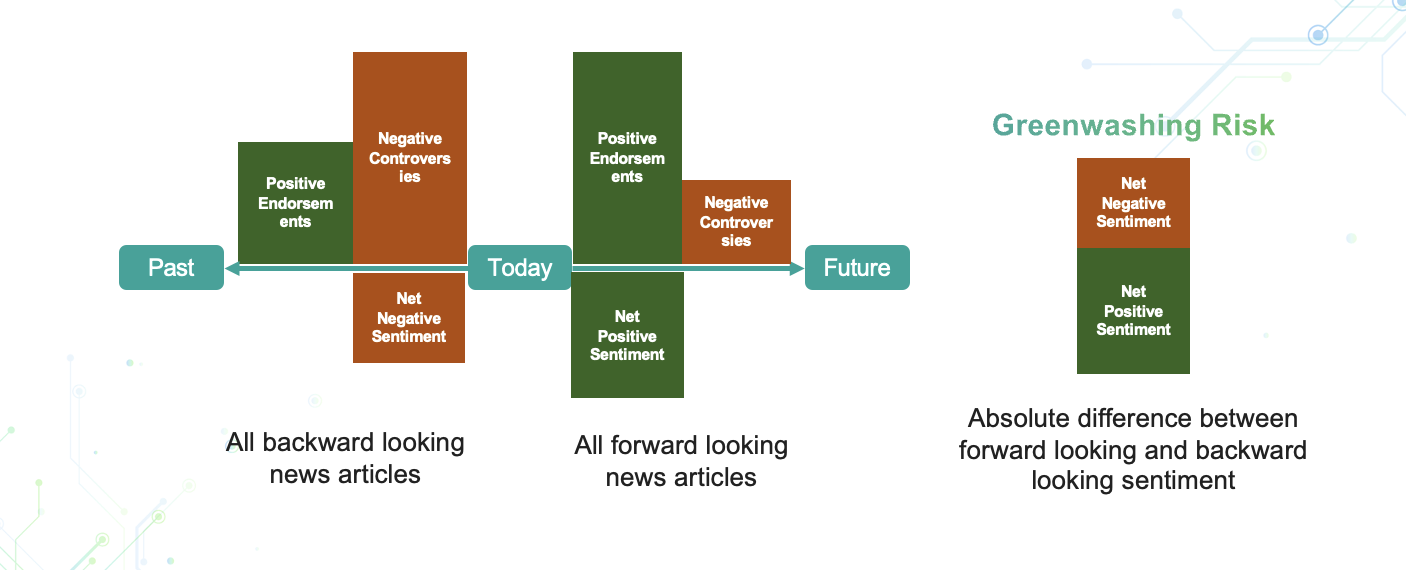

Figure 1: Sentiment analysis assessment of methodology

For each news article published about a company, Covalence determines whether it is forward-looking or backward-looking and whether it carries positive or negative sentiment. For instance, an article titled "Company X Announces Net Zero Plan for 2040" would generate a positive forward-looking sentiment, while an article about an oil spill causing an environmental catastrophe would generate a negative backward-looking sentiment. The methodology further breaks down news into the three pillars of ESG: Environmental, Social, and Governance. By aggregating the net sentiment of each article, both forward-looking and backward-looking, the Greenwashing Risk is derived (Figure 1).

The Greenwashing Risk is calculated as the absolute difference between the forward-looking and backward-looking sentiment. In other words, if a company makes numerous positive claims about its future but has negative headlines in reflecting its past, there is a significant disparity between its presentation and performance. The greater this difference, the higher the risk of greenwashing.

It is important to note that the Greenwashing Risk Indicator doesn't measure greenwashing itself, but rather the likelihood that a company is exposed to greenwashing.

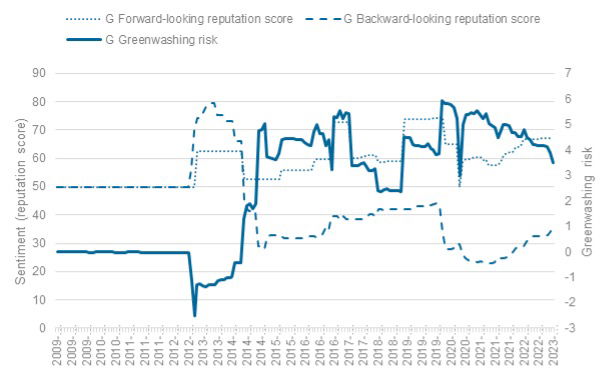

Since the data is sentiment-driven, it can change rapidly. Taking the earlier example of an oil spill, the negative sentiment surrounding it can significantly affect the risk indicator. Therefore, Covalence's methodology also considers depreciation over time. The longer ago the negative event occurred, the less it impacts the current score.

While examining individual companies is interesting, understanding how the data looks for a fund is even more valuable. So, what is the fund's exposure to greenwashing risks?

To aggregate the data at the fund level, the portfolio weight of each position with its corresponding exposure is summed (Figure 2). Positions with insufficient data and lacking a risk score are ignored and excluded from the analysis

Figure 2: Example analysis of a corporate with its Governance Pillar Greenwashing Risk Indicator

Let's consider a well-known European index for this analysis—the ETFs tracking the MSCI Europe.

By combining Covalence's data with the holdings of selected ETFs, I conducted an analysis on their methodology.

Table 1: Overall greenwashing risk exposure of ETF tracking the MSCI Europe

|

|

Overall Risk |

E Risk |

S Risk |

G Risk |

|

Low Exposure |

48.68% |

67.01% |

60.48% |

39.01% |

|

Medium Exposure |

18.34% |

6.025 |

15.33% |

12.36% |

|

High Exposure |

10.68% |

1.15% |

5.35% |

6.95% |

|

Major Exposure |

6.00% |

1.42% |

0.86% |

4.32% |

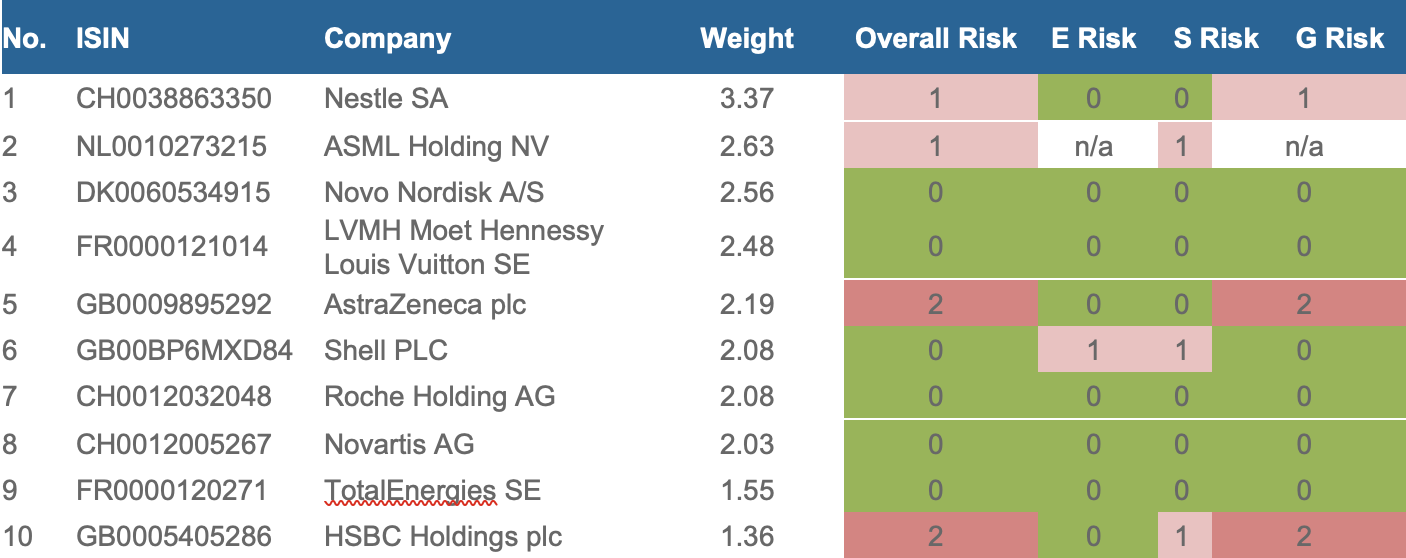

On the positive side, the analysis reveals that only 6% of the holdings are exposed to major ESG greenwashing risks. However, there are still several companies in the calculated portfolio that show exposure. Looking at the top ten holdings, they account for more than 22%, with only two positions carrying a high risk, both related to the Governance pillar. There are no significant risk exposures among the top holdings which is a positive sign.

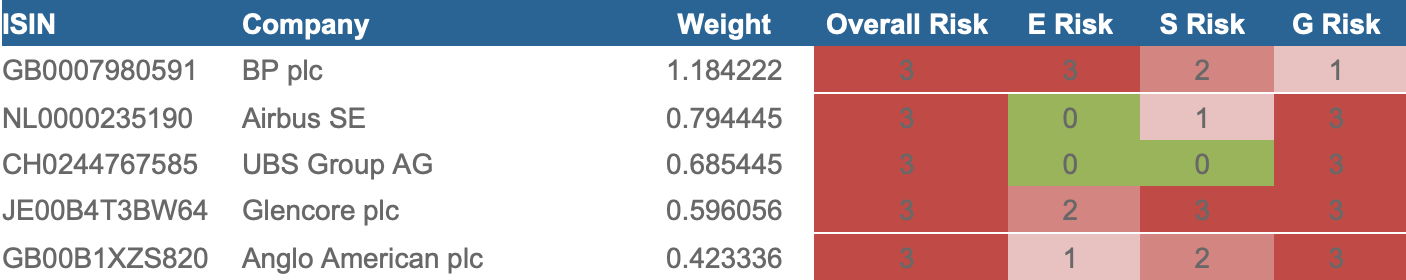

In total, the aggregated index comprised 431 portfolio positions, of which 20 positions were flagged with a major greenwashing risk. Here are the five largest companies with major exposure to greenwashing risks:

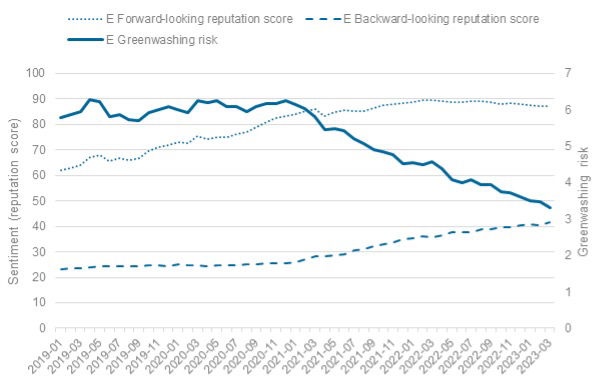

BP plc is the largest company in the market with a major environmental greenwashing risk. It's worth noting that BP plc is on a positive trend. While its forward-looking sentiment remains consistently elevated, the backward-looking sentiment has significantly increased since 2021, resulting in a clear decrease in overall greenwashing risk. However, it still poses a significant risk.

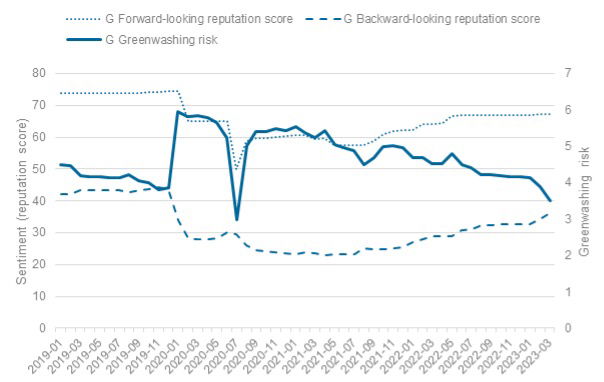

Airbus SE is the second-largest company in the aggregated index, exposed to major greenwashing risk in the governance pillar. Airbus SE is known for manufacturing the Eurofighter, which has been associated with negative publicity due to government bribery. A positive aspect is that Airbus is also trending towards decreasing its greenwashing risk.

With increasing regulations regarding fund sustainability criteria, exposure to greenwashing is a critical issue for fund providers. While the level of risk can vary, one way to be exposed to greenwashing is through the companies in which a fund invests.

Fund managers often engage with companies in their portfolios to assess whether they are involved in greenwashing. Innovative solutions like these provide asset managers with new ways to identify potential issues and determine where further engagement is needed.

As regulations evolve, there will be a heightened awareness of greenwashing risks. Companies will face mounting pressure to reduce greenwashing practices and ensure clients are well informed about their investment decisions. This will ultimately have direct and costly effects on fund managers, as seen in recent developments surrounding DWS.

Distributors need a comprehensive understanding of the funds they offer in their universe. They must possess in-depth knowledge of underlying fund data to effectively report on potential greenwashing allegations. This includes understanding whether a fund is invested in companies exposed to greenwashing. Fund managers often struggle to maintain full control and understanding of their investments, particularly in funds of funds. This risk should not be overlooked.

For fund managers, the DWS case serves as a clear indication of the potential consequences associated with greenwashing. The availability of more and better analysis methodologies is advantageous. Greenwashing assessment at the corporate level must become an integral part of every research process, requiring robust indicators and processes to uncover potential issues.

Data providers must develop new methodologies and enhance existing ones to identify greenwashing issues. With access to extensive underlying data and the necessary technology, improved capabilities in NLP (Natural Language Processing) and AI for data analysis can help better understand the intricacies of greenwashing and flag specific issues. Managing funds with a large number of holdings necessitates quantitative approaches to assess exposure, such as the one presented here.

Service providers should respond to greenwashing by offering improved comparison methodologies and software. The increasing awareness surrounding qualitative data through greenwashing issues will drive differentiation, opening new opportunities for researchers to explore. Understanding the various levels of greenwashing and how they manifest is of utmost importance.

Finally, regulators play a crucial role. As research demonstrates the limited impact investors can have in creating change, regulators must ensure that their regulations effectively fulfil clear objectives. These objectives should make relevant data available and foster transparency to protect consumers.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

AI · Labor Rights

illuminem briefings

Greenwashing · Public Governance

illuminem briefings

Agriculture · Corporate Sustainability

The Guardian

Natural Gas · Greenwashing

Financial Times

Greenwashing · Fashion

Sustainable Views

Greenwashing · Net Zero