Gone with the win-win?

· 13 min read

ESG investing promised the chance to address the world’s most pressing problems while earning strong returns. But progress on both fronts has been disappointing.

ESG investing began with a two-pronged promise: the opportunity to solve the world’s most pressing challenges; and market-beating returns for its backers.

But progress on tackling the challenges has been painfully slow, and returns are being questioned. Meanwhile, environmental tipping points are approaching alarmingly fast. A massive change in perceptions is needed to take into account the true environmental and social costs of businesses’ operations. Perhaps sustainability is less a market opportunity and much more a moral challenge.

ESG is suddenly everywhere, though becoming more confusing and contentious by the day.

Environmental, social and governance factors were amalgamated into a single acronym in 2004 as part of a UN-sponsored initiative to persuade us that such issues were not merely of discretionary interest to socially responsible investors but increasingly central to proficient asset management. ESG factors should no longer be thought of as costly distractions but rather as drivers of performance.

Hence, ESG was a crystallisation of the notion that sustainability can be a win-win for investors – simultaneously good for profit and planet. The hope was that sustainability-aware markets would direct capital towards solution technologies and business models for which demand and profitability would increase, triggering a virtuous circle in which ESG investors would benefit by resolving social and ecological problems.

The idea has certainly gained traction. The Global Sustainable Investment Alliance estimates that global ESG assets now account for one third of total assets under management, while ESG-themed ETFs – a newer development – have grown tenfold since 2017.

Inevitably, with this growth have come challenges. Some financial institutions have exaggerated their sustainability claims – so-called greenwashing – leading regulators to levy fines and formulate an official taxonomy of environmentally sustainable actions.

From another direction, anti-ESG or anti-woke actors question the premise that businesses should care about such factors and have persuaded several US states to sell or avoid ESG investments.

Yet much mainstream commentary ignores the key issue that motivated ESG pioneers: is ESG investing making the world more sustainable?

On this critical matter, doubts are rising, for two major reasons. First, the scientific community is warning that global ecological challenges may be greater and more imminent than first understood. Second, after 20 years, the win-win narrative has less to show for its efforts than hoped.

This article reviews each dynamic in turn.

Ecological challenges are fundamentally physical not economic problems, and while scientists caution against reducing interconnected ecological challenges to climate change alone, climate change remains the overarching ecological risk and exemplifies the physical aspect of such threats.

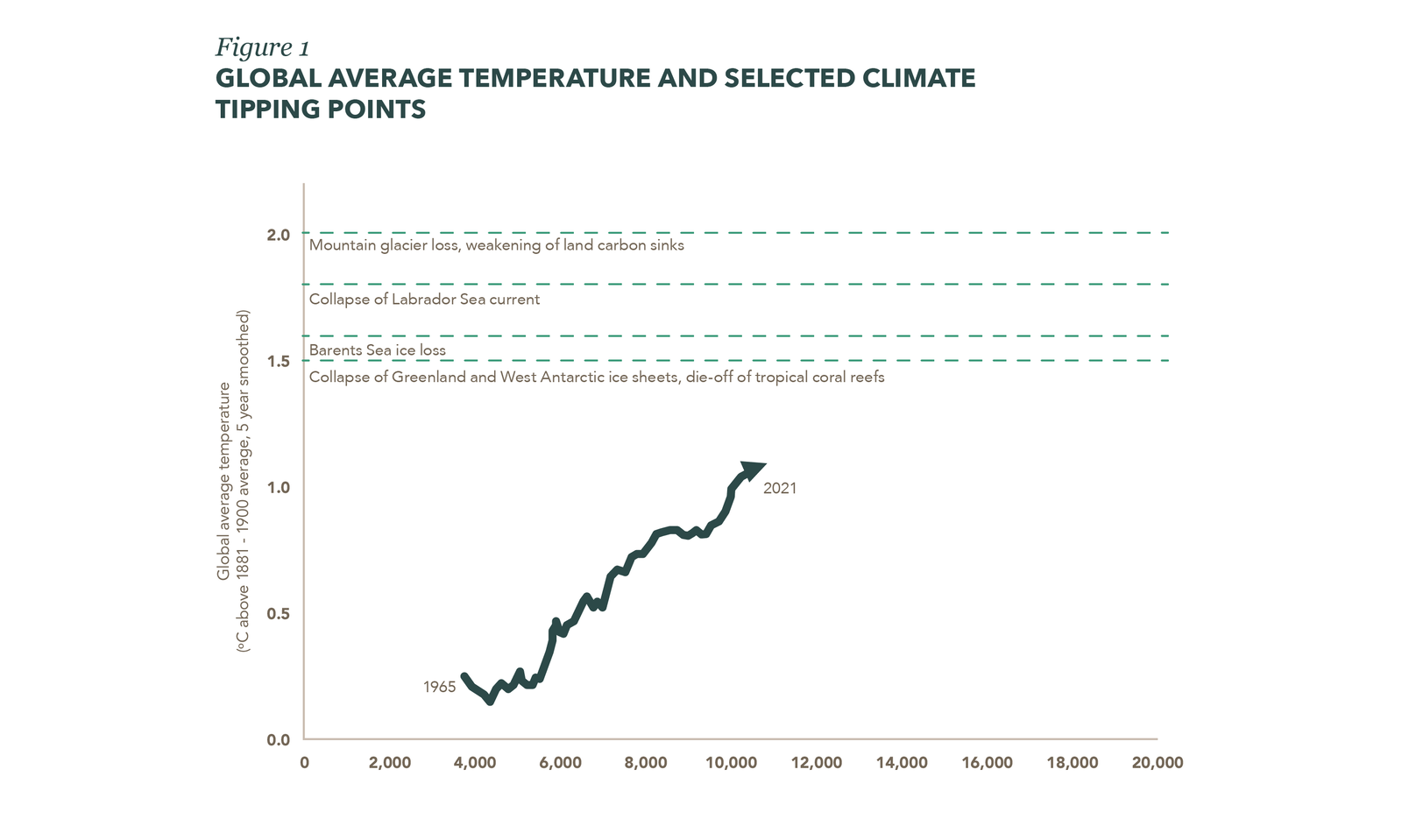

The global average temperature is now 1.1°C above pre-industrial levels and continues to rise towards irreversible tipping points, such as the loss of the Greenland and West Antarctic ice sheets, which scientists now believe may be reached at 1.5°C of warming (Figure 1).

The recognition that critical tipping points are so close is a major, if underappreciated, development of climate research. In the early 2000s – when win-win thinking took hold – the Intergovernmental Panel on Climate Change believed tipping points lay at about 5°C of warming, suggesting considerable time and ecological headroom to make a transition. That view has decisively changed. A September 2022 review described 16 major climate tipping points, six of which are likely to be triggered within the Paris Agreement range of 1.5°C to 2°C of warming.

The risk tipping points present is not only that they are irreversible on human timescales but also that breaching first thresholds will accelerate warming and so raise the probability of crossing subsequent thresholds to initiate a self-reinforcing tipping cascade.

Figure 1

The trajectory plotted in Figure 1 corresponds to the first part of what economists call an environmental Kuznets curve (EKC), for which the left of Figure 2 is the textbook form. EKCs outline the relationship between economic growth (per capita income) and environmental damage (eg global temperature as a proxy for climate change). The curve is named after its resemblance to the Kuznets curve originally proposed by economist Simon Kuznets, who hypothesised that market forces might initially increase economic inequality before decreasing it, in an inverted U shape.

The key question is what shape will the EKC for climate change take after its rise to date? Here we arrive at a profound difference in worldview that divides individuals, professions and cultures and is in many respects the crux of the sustainability debate.

The economic perspective is that the EKC will mimic the original Kuznets curve for inequality and will amenably turn back down with economic growth as wealth and innovation remedy initial environmental harms. For example, London used to be smog-ridden in the 1950s but now is not. Hence, the EKC is a graphical depiction of economics’ faith that growth can eventually remedy all ills. In contrast, those working in the natural world tend to have an ecological worldview. While this accepts the EKC may sometimes bend down, it also recognises that complex systems – from the smallest of organisms up to large civilisations and ecosystems – are susceptible to failure and collapse, often in tipping cascade fashion.

For the ecologist, growth is not unambiguously positive but depends on its complexion. Growth of certain forms or in certain directions can lead complex systems over critical thresholds. In contrast to the economist’s confidence that the EKC will always turn down in time, the ecologist perceives the EKC may also sometimes be backward-bending. Beyond a threshold, environmental damage may accelerate and eventually undermine economic activity.

As Figure 2 highlights, the fundamental difference is between those who perceive limits to economic growth and those who do not. The addition of the dotted horizontal line changes everything. It transforms an open-ended situation in which it is acceptable just to keep making forward progress into an adaptive challenge with deadlines. Readers might reflect not just on which view best fits their intuition, but also on why they may have greater inclination towards one or the other. Based on what formal or informal influences?

Figure 2

To settle such a consequential divergence of views, we would ideally conduct experiments and collect evidence. Unfortunately, for climate change and other global challenges, we are the experiment.

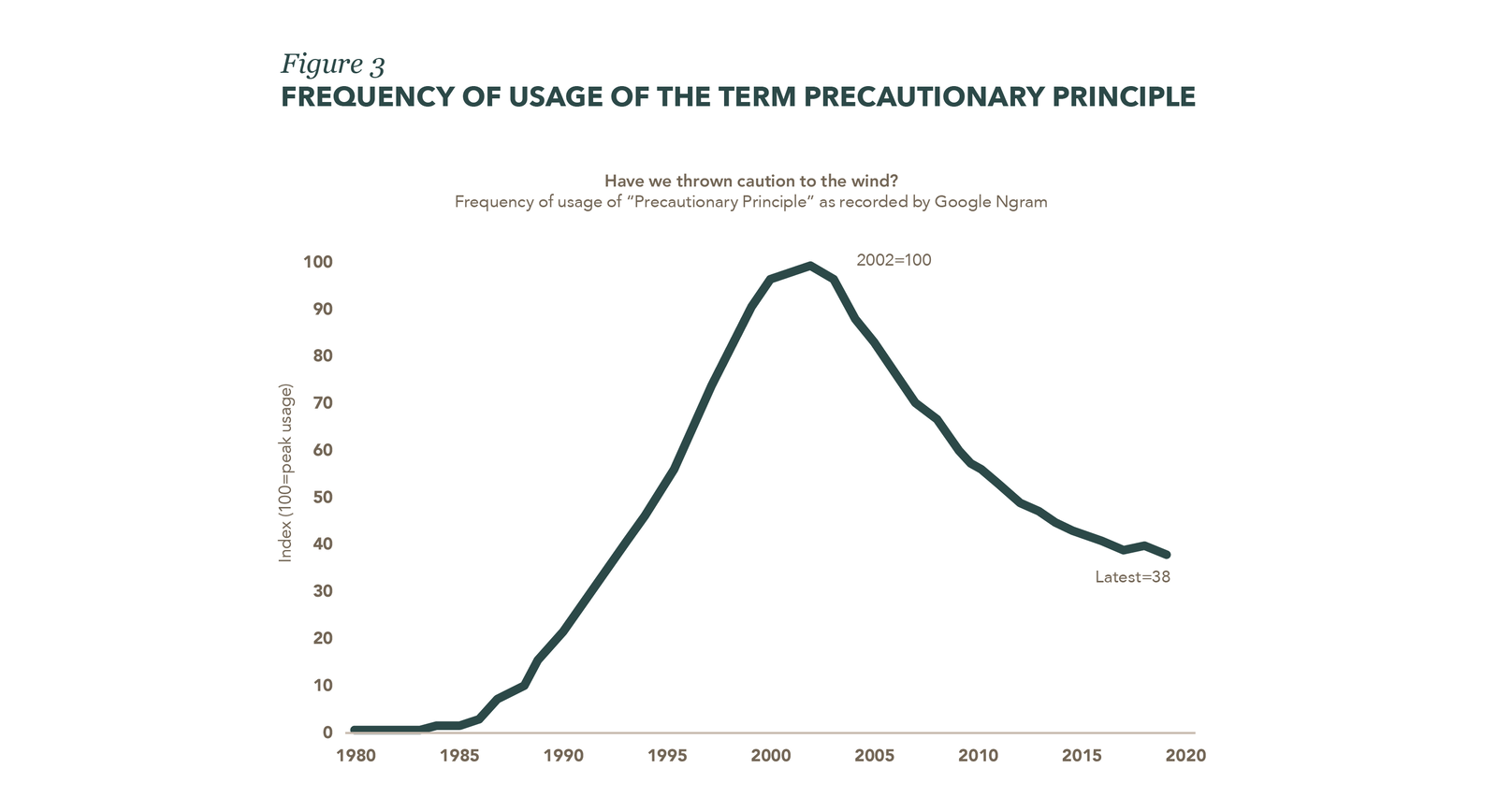

When you cannot step out of an experimental frame and there is some risk the experiment will fail, it is best to proceed very cautiously. This is why sustainability researchers formulated a precautionary principle in the 1980s. Despite rising ecological challenges, usage of the term precautionary principle peaked in 2002 and has declined markedly since – quite possibly a casualty of the appealing and reassuring win-win narrative that emerged at the time (Figure 3).

Figure 3

Scientists’ growing concerns about the proximity of thresholds have surfaced in the boardroom in the shock of Net Zero, with its demand that global greenhouse gas (GHG) emissions reduce sharply in very short order. The notion has been a rude awakening for many businesses conditioned by ESG practices to view sustainability as being a bit more sustainable than the last fiscal period rather than being, as ecologists have always interpreted it, sustainable enough before it is too late. Possibly, there have been some uncomfortable silences in boardrooms as the coin has dropped. ‘Oh, they mean that much sustainability…’

Unfortunately, that much sustainability raises difficult questions about the sufficiency of win-win strategies – because the sustainability win now looks much more demanding than first thought.

The second major development is a growing recognition of the insufficiency of voluntary win-win dynamics.

Today, GHG emissions are nearly 50% higher than they were in 2000 – and still rising. In February 2022, scientists warned we have likely exceeded the safe use of plastics and chemicals, meaning we have now transgressed six out of nine planetary boundaries.

Certainly, these trajectories might be worse still without ESG-prompted market efforts. It is also probable that some benefits of ESG investing will accrue with a lag. But the inescapable conclusion is that the strategies humanity is currently deploying to become sustainable do not appear to be driving enough change fast enough.

One key reason market societies are struggling to solve ecological problems is that financial statements do not yet reflect the physical reality of which we are newly aware. Market societies overwhelmingly deploy their human and physical resources as financial statements direct. This is Adam Smith’s invisible hand working efficiently in practice. Yet, in following those signals, we currently miss the physics for the finance, because financial statements are not fully costed.

For example, less than 4% of global carbon emissions are priced at levels consistent with the Paris Agreement’s temperature goals. Hence, hardly any of today’s market transactions reflect their full contribution to climate change. The same neglect is repeated to varying degrees for other environmental and social problems.

The sustainability challenge in a nutshell: our generally accepted financial statements are not fully costed, yet a comprehensive thicket of incentives, duties and market practices assumes they are. ESG-style efforts to steer markets to be more sustainable are being overpowered by the systemic neglect of costs. For all the sincere aspirations to make capitalism sustainable, fair, inclusive and more, the system much of the world currently lives under is externality-denying capitalism.

Markets’ ascendancy to their current primacy of social coordination, boosted by neoliberalism from the 1970s, owes much to economics’ claims of the superiority of market outcomes. Yet these claims rest on mid-twentieth century economic theories that, largely due to the mathematical limitations of the era, both modelled markets as complete (in the sense that market values exist for all human preferences) and assumed growth was independent of natural resources.

While economists understood their models were abstractions, their conclusions were so agreeable that the temptation inevitably took hold to play up the autonomous benefits of markets. This required playing down the externalities that confounded such amenable findings. Hence, externalities, flagged as important by economist Arthur Pigou as early as 1910, were marginalised as negligible residuals to the centrepiece of an efficient economy.

The shock for economics today is that externalities can no longer be dismissed as marginal when they are fast becoming the main event. In what increasingly appears a fateful accident of timing, markets were elevated to the primacy of human decision-making, based on their appealing properties when complete, just as major ecological externalities heaved into view to scotch that assumption.

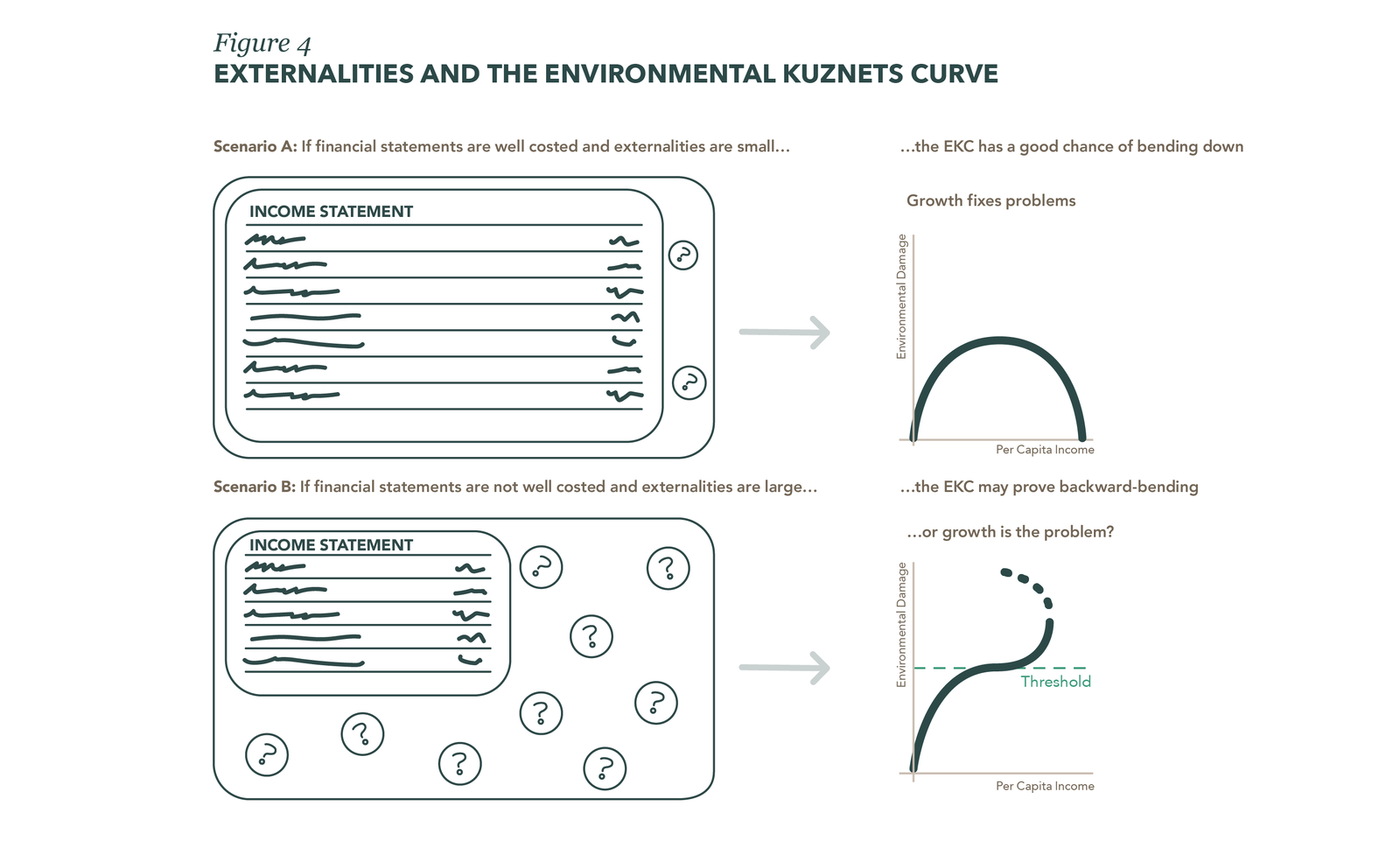

Consequently, we can tell two contrasting stories about markets’ ability to tackle limits-constituted problems based on the degree to which external costs are reflected in financial statements (Figure 4).

Figure 4

In scenario A, where financial statements are assumed to be well costed and externalities small, market-led solutions have a high chance of solving environmental problems, because economic growth is externality- and threshold-aware. Market signals should therefore be able to drive the requisite technological substitution and behaviour change in timely fashion.

In contrast, in scenario B, where income statements are not well costed and externalities are large, market-led solutions are likely to fail because economic growth is constituted in a way that is blind to its consequences and so may generate damage faster than solutions can be implemented, with a risk of transgressing irreversible thresholds.

This is the essence of the reservation many natural scientists intuitively harbour about economic growth being a solution for climate change – the wealth generation that will supposedly solve problems may create more damage along the way than we can subsequently remedy. How wealthy we were all going to be becomes a moot point.

A metaphor may help fix the intuition. Essentially, we are discovering that Adam Smith’s invisible hand is connected to an unmentionable foot. The hand represents the market’s autonomous allocative and innovative dynamics, which are real and remarkable and have been much celebrated. But the foot represents the real costs generated by market activity which are not recognised and land on other people and other places, sometimes with a lag.

Unfortunately, the hand and the foot are engaged in a dynamic struggle. A market system’s overall benefit for human wellbeing depends on the relative strength of the hand’s (internal and recorded) value creation and the foot’s (external, largely unrecorded) cost-shifting. To believe that economic growth can solve all social and environmental problems is to trust that the invisible hand can always repair what the unmentionable foot damages – and do so before irreversible or intolerable harms occur.

One key reason market societies are struggling to solve ecological problems is that financial statements do not yet reflect the physical reality of which we are newly aware.

For all the ESG headlines, the foremost question is whether the win-win dynamic, which is ESG’s founding ethos, is working as quickly as we need. And, if not, what is humanity’s plan B for tackling still-mounting environmental challenges?

The sustainability crisis presents investors not simply with difficult investment decisions but with the transcendent question of what they might do to help tackle problems, given that private sector actors wield considerable influence in a market society.

Above all, investors might ask how well we are stewarding our market system.

There are many reasons to like markets, given their allocative and innovative possibilities. But, for real-world markets to live up to their textbook properties, market signals must be continuously trued up to our ever-evolving understanding of reality. Hence, a fundamental stewarding duty of a market-favouring society must be to continually internalise externalities. It is the fate of current generations to have identified large and growing externalities on our watch.

Truing up markets can be achieved in various ways – pricing, permitting or other regulatory means – which make real scarcities known to markets. With less than 4% of global carbon adequately priced, Mr. Market has no real inkling of the climate crisis because it has not been communicated to him in the language he understands. The hand doesn’t know what the foot is doing. It might help to inform Mr. Market by pricing carbon so he comes to know of the problem. At which point he may prove to be a formidable ally. In this effort, private sector actors, as key market stewards, could exert considerable influence.

We might rue our misfortune that such challenges have arisen and wish inconvenient consequences were not so. Or we might reflect, as the longest-lived and most prosperous generations ever to have lived, that we face a challenge commensurate with our good fortune and inherited capacities.

A stewarding duty to true up market signals to a new sense of consequences is simply one manifestation of the broader challenge modern culture faces in learning to accept both welcome and unwelcome revelations of scientific advances. Science both giveth in the form of benign discoveries and new technologies and taketh away in the surfacing of inconvenient truths. Unfortunately, it is a package deal. Part of the maturing of a scientific culture involves developing the individual and collective capacity to treat welcome and unwelcome news just the same.

Twenty years after ESG’s crystallisation of the hope there might be an agreeable win-win, sustainability now looks much more like a moral obligation than an appealing market opportunity – less win-win, more must do. Yet, if we can rise to the moral challenge of internalising externalities today, authentically sustainable market opportunities will surely be abundant in the future.

This article was also published on Ruffer. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

References:

Alex Hong

Energy Transition · Energy

Steven W. Pearce

Adaptation · Mitigation

John Leo Algo

Ethical Governance · Environmental Sustainability

Financial Times

Sustainable Finance · ESG

Sustainability Magazine

Net Zero · ESG

Responsible Investor

AI · Sustainable Finance