ESG & impact investing: death march in the wrong direction, but slower

· 6 min read

When I started working 25 years ago to change the financial system so it worked for multiple stakeholders, there was tremendous pushback from Asset owners, managers, service providers, rating agencies, etc. Many think it was smooth sailing in Europe. The opposite is true. I remember being asked to speak to the Dutch insurance industry about climate risk. I said “The Netherlands is below sea level. Sea Level are going to rise, I would be concerned.” The answer I got from the audience showed how low a level of awareness existed. “It is not a problem for us if sea level rises. We don’t cover salt water damage.” I told that insurance executive “that is true but you give mortgages. If 200.000 homes are underwater, you have a big financial disaster”. We have come a long way. Unfortunately the money flows and definition has given a false sense of success. I think we have failed miserably.

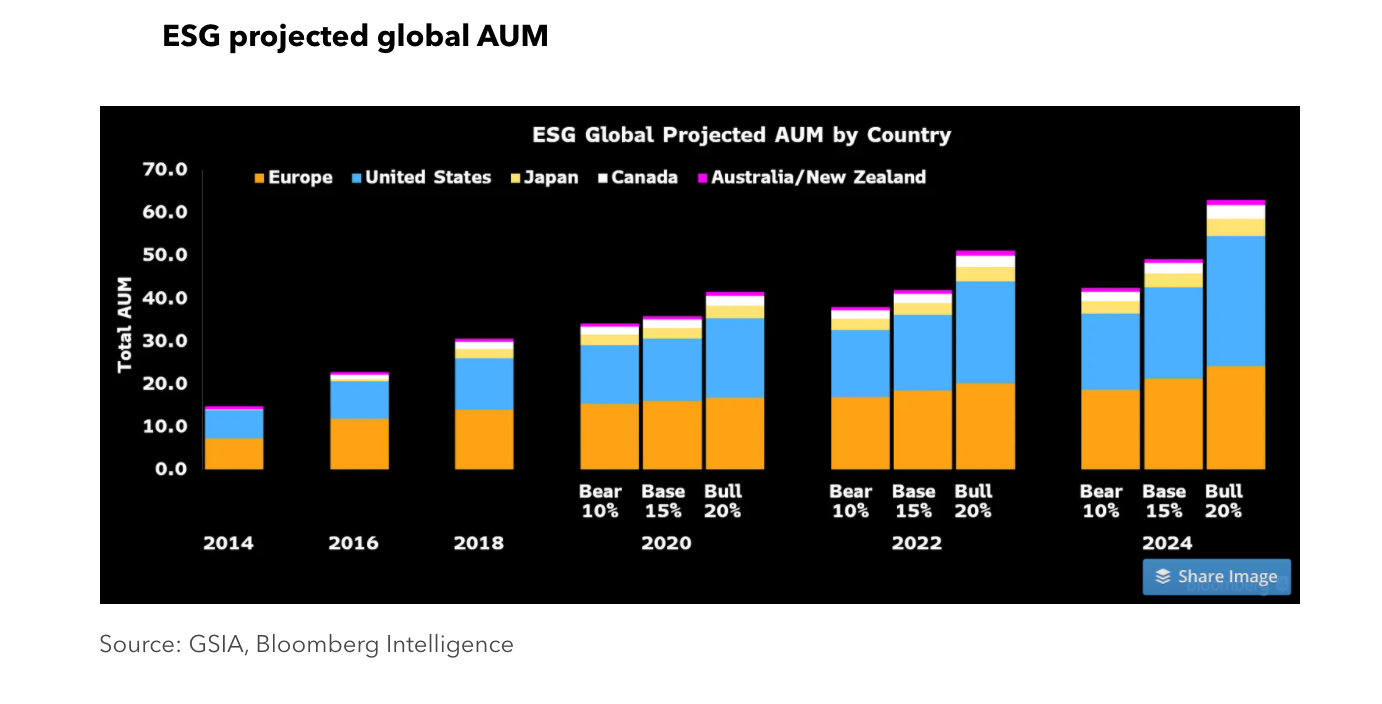

Based upon the money flows, one would say it has been a resounding success. “ESG assets may hit $53 trillion by 2025, a third of global AUM” according to Bloomberg Intelligence February 23, 2021 In addition, there never has been so much attention via media, business schools, policy makers, impact network associations, conferences, press releases talking about ESG and Impact. We won! Or did we.

The assorted Social Investment Forums claim 40 Trillion dollars committed to ESG, already, in one shape or form. Are these figures accurate?

Is so much money really going into ESG and Impact, or is the definition incorrect? Has ESG and Impact become synonymous with a membership card to a fitness club but never going. Has any of this money really addressed the challenges that they were intended to help, fix or address?

The environmental and societal challenges the world faces, after all the trillions going into ESG, are staggering. ESG and Impact Investing seem to be a failure.

All of the above have grown significantly despite the money flows that were intended to reverse the trend.

A family office in Singapore asked me to stop by to discuss ESG and Impact Investing, as this family was transitioning from intensive fossil fuels to sustainability. The head of the Family Office said “Robert. We don’t understand how can the most toxic companies score so well on ESG Sustainability Indexes:

I had to explain that the methodology used for ESG assessment is not what the company does but how it reports.

If one looks at institutional investors like pension funds, they began claiming ESG alignment because they were engaging with the companies through intermediaries. Engagement was very popular as nothing had to change, the pension funds maintained their positions and an intermediary spoke to the companies that the asset owner wanted to see behavioural change. Were they really changing the behaviour of the companies to address climate risk? Not really.

Impact and ESG Network organisations were building up their members who all were claiming commitment to ESG and Impact. If you “pull up the kimono”, nothing substantial is there. Often empty gestures, but all want to be seen as part of the club, because that is where the money flows were going. Don’t want to miss the party.

The ones who have benefitted from ESG and Impact Investing are:

Society and the environment has not benefitted.

The reason for ESG’s rapid’s growth is because it has multiple beneficiaries, and not only for the investor. It looks at all risk factors; social, environmental (climate change), governance as well as financial.

If a company has extraordinary social performance, they often spend less on hiring the best and the brightest and they retain them longer, as most employees are looking for some purpose. Additionally, companies that have excellent environmental performance often waste less, pay fewer fines, use fewer raw materials and energy. All of this leads to higher returns and lower risk.

But the really big drivers of ESG and Impact investing is at the macro level of resource depletion, being driven by emerging market economic growth. At 8 percent annual growth, China would reach US consumption levels in 2030. This would translate into an oil consumption of 60 million barrels per day for China (present consumption is about 84 million worldwide).

This massive commodity requirement is even worse if we look at grain, iron ore, paper, coal, steel, and meat. If we then add India to the mix, and then the other 3 billion in emerging markets and the developed world, one can see that linear growth is not possible at this level of inefficient use of resources or present business model. We won’t have enough.

The real opportunity for the financial sector is a massive drive for resource effectiveness or efficiency, which is what sustainability is about. Doing more with less. This also translates into more profitability.

When a wealth manager engages their clients on ESG investments, that conversation can be much more engaging than traditional investing. Impact Investing instills passion and excitement. If one looks at the anticipated transfer of wealth – some US$30 trillion- in the coming 20-30 years to Gen Z and Millenials, this is a massive opportunity.

Gen Z values are not only financial. They are more willing to align their values with their investments. As information, education and infrastructure for ESG Investments increases, the market will grow even faster.

The market is clearly there but the way ESG is done now is just a death march in the wrong direction but slower. Fortunately, many asset owners are realizing this and demanding investment that is regenerative in nature or far less harmful. This message was clearly made with the announcement of the launch of Net Zero Asset Managers The Net Zero Asset Managers initiative is an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050. I hope this is not another empty promise wrapped in a shiny press release. We have had enough of that. Let’s stop the ribbon cutting and grab the shovel and do the work.

"There is no more neutrality in the world, you either have to be part of the solution or you’re going to be part of the problem — there ain’t no middle ground." - Eldridge Cleaver

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Gokul Shekar

Corporate Sustainability · Sustainable Business

illuminem

Consumers Green Tech · Corporate Social Responsibility

illuminem briefings

Ethical Governance · Human Rights

Politico

Corporate Sustainability · Public Governance

Responsible Investor

Carbon · Corporate Sustainability

SOMO

Corporate Sustainability · Human Rights