ESGT: Exponential technology requires exponential responsibility (Part 1: The new ESGT framework)

· 8 min read

This is Part 1 of a two-part series on exponential technologies and their implications for ESGT leadership. You can find Part 2 here.

In an era of exponential technological change and disruption, leaders everywhere must up their game and engage in exponential responsibility. How do they do that? By embracing a holistic environmental, social, governance and technological (ESGT) approach to intangible risk and opportunity management, by incorporating such considerations into strategic planning and product and service R&D and by exponentially turning up the volume on technology governance in all its nuances and incarnations.

The digital transformation agenda preoccupying corporate boards and senior executives has become an all-consuming pillar of leading large, global enterprises. This is as true in the private sector as it is in the government domain and, although less so, also in civil society. The pressure to keep up with the proverbial technological Jones' has led companies to digitize (and digitalize) all facets of their business models. Partly motivated by a quest for efficiency, partly (albeit insufficiently) motivated by an unyielding quest to improve cyber resilience, all, in the private sector at least, are motivated by a drive to improve the bottom line.

Additionally, digital natives are entering the workplace in force, populating large tech companies or creating exciting new business models and innovations that outpace and defy many of the old business ways. This new workforce is also demanding, among other things, that far greater attention be paid to all things environmental, social and governance (ESG).

Add to all this the recent explosion of large language artificial intelligence/generative AI onto the scene, first via Open AI’s release of the ChatGPT series in late 2022, swiftly followed by a host of competitors – large and small, private and public, known and unknown. We have ourselves a true demarcation line between yesterday and tomorrow – between what will become the obsolete ways of doing business and organizing society and governance and the new, yet undiscovered, ones.

All bets are off on holding on to the old, traditional and, frankly, tired ways of organizing and integrating strategy, risk management, product development and the like.

The challenge, however, as revealed by many lessons on the perils of making digital transformation an outcome rather than a journey, is that responsibly harnessing technology requires, more than ever before, an evolved governance framework akin to the ESG frameworks that have become de rigueur in corporate management circles. In short, the T of technology is missing in today’s ESG frameworks, however fleeting they may be in enterprise governance and management practice.

This 2-part article addresses how the “T” in ESGT needs to be folded into the overall ESG governance conversation and implementation at all kinds of businesses - from the most established, traditional multinationals and small to medium size enterprises (SMEs) to the newest startups including pure tech plays. T is not a separate, siloed endeavor that is narrowly related to risk management or digital transformation as it often is in bigger, more established businesses.

Nor should T be the be-all, end-all of a newer, pure tech company or start-up. Indeed, the T is an essential and intricate part of the management and governance of all things intangible or ESGT, whether in the context of an established multinational, an SME, or a startup. In fact, T is part of every organization's reality regardless of purpose - for profit, nonprofit, educational, governmental, or intergovernmental, among others.

Akin to established companies’ 'discovery' of all things digital and the sudden need for tech governance within their virtual walls, many of the purely digital or technology-focused new businesses popping up everywhere must also open their lens to incorporate relevant ESG considerations into their tech-heavy focus.

In Part 1 of this series, we discuss the unique context of our times that makes this ESGT discussion not only possible but necessary as well as what ESGT actually is and how to embed it into strategy. In Part 2 of this Article, we share examples of ESGT use cases and provide our thoughts on how leaders can future-proof ESGT governance.

The COVID-19 pandemic exacerbated the tension to responsibly harness technology as a cornerstone of the digital transformation agenda while at the same time accelerating the world’s technological adoption and dependency by more than a decade in a single year, raising the stakes. From ensuring household, business and government continuity, the reliance on technology during the pandemic has been one of the few global differentiators as few global systems did not strain under the weight of a global “work-from-home experiment”.

The inherently distributed nature of professional nomadic knowledge workers who were once told that working outside of corporate firewalls would produce cyber vulnerabilities, were the most adaptive people when COVID-19 shifted the world to an unending virtual reality. This virtual reality has not only blown apart the physical construct of center city offices, but it has also emboldened an itinerant knowledge worker class to never return to a 9 to 5 office job again.

A more foundational vulnerability has also been exposed, which is that the provision of even basic services, whether in the public or private sphere, was also revealed to be nearly impossible without technology at their core. How this is governed, including many points of tension such as privacy versus security, censorship resistance, and digital copyright protections, among so many others, is a critical governance frontier.

As technology and software clash with all facets of society and the global economy, the need for enduring approaches to governance anchored in first principles is crucial. The creative destruction cycle that drives the global economy forward has little respect for incumbency - especially not for too long. In the same way as the internet dethroned the traditional print media stalwarts, other industries are now under wholesale reinvention and assault from emerging technologies - including the very form of the corporation. Think about what ChatGPT and its siblings and rapidly multiplying successors are doing to our economy, society, politics, regulatory regimes and beyond.

When the world was tangled in web 1.0 the democratization of information and the reduction of friction in communication and knowledge sharing trumped the risk of misinformation and disinformation emerging as threats to truth and democracy.

The next generation of the internet tangled the world into a web 2.0 of online commerce, which over the course of several decades posed challenges to traditional industries, from retail to global supply chains.

The emergence of web 3.0, an internet where the exchange of value undergoes the same reduction in friction and instantaneity in banking, is first consuming financial services, but the art of what is now possible is much bigger - and scarier to its opponents. The building blocks of this internet of value are no longer an abstraction, because of the maiden decade of public blockchains, which are proving to be a foundational layer of technology, rivalled only by the internet itself.

Add to this massive equation is the rise of Generative AI and its already myriad incarnations, opportunities, and risks. We can no longer just talk about an integrated ESG strategy. We must talk about (and walk) ESG plus T. Omitting tech from this equation is like separating or omitting the connective tissue, the neural system from the body.

We believe that business leaders who identify and integrate their specific technology issues, risks, and opportunities into a larger ESG/ESGT strategy framework need to approach this process both deliberately and systematically.

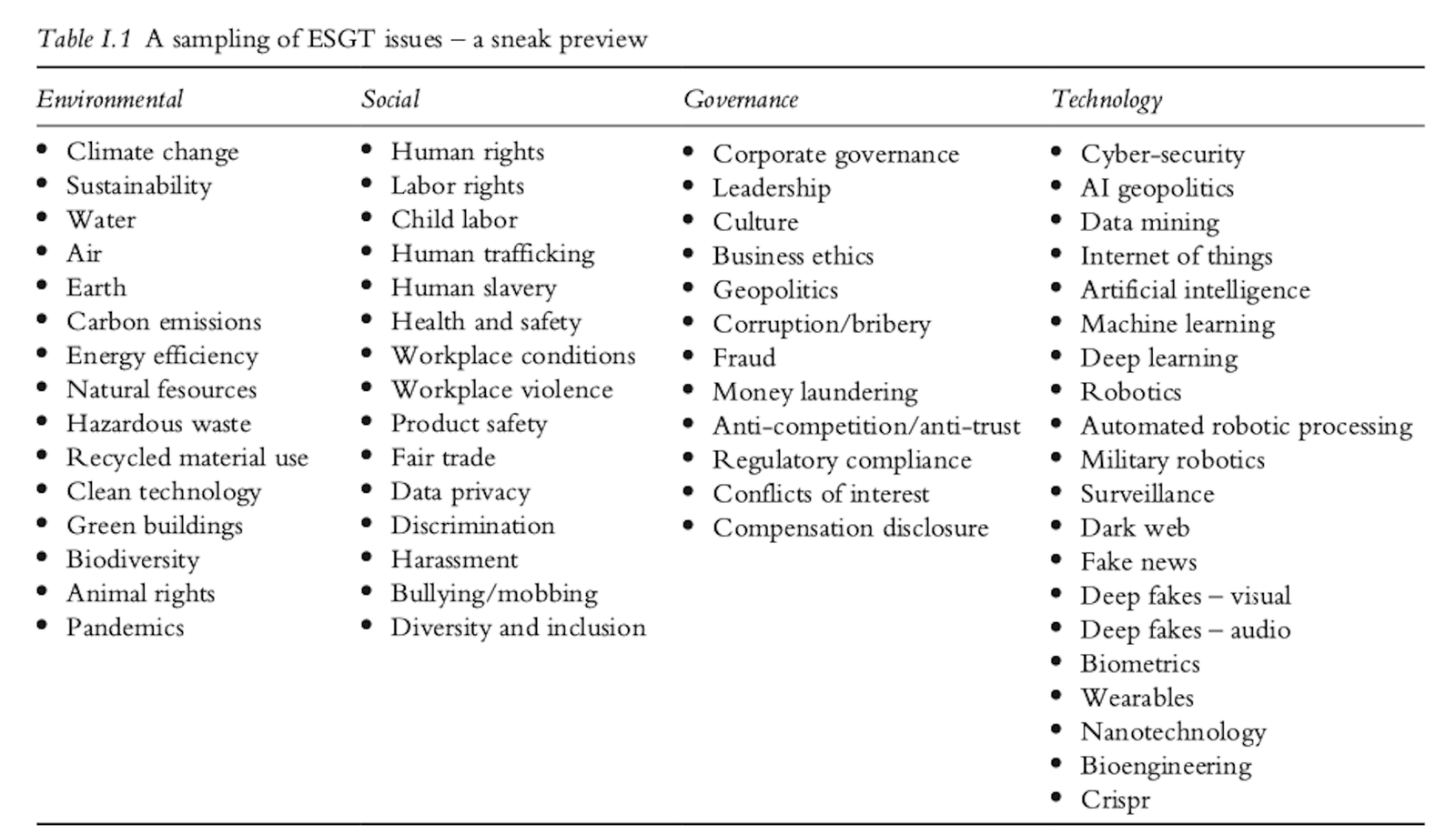

To begin with, it is critically important to do a deliberate and systematic audit of the key ESGT issues, risks and opportunities that relate to your specific business, footprint, employee/third-party population, assets, business plan and strategic objectives, to achieve your own typology or taxonomy of relevant issues. While it is always advisable to use existing frameworks to help with such a review process, none of the existing frameworks does justice to the identification of technology issues, risks, and opportunities that we think should be integrated into such an exercise. Hence our advocacy of an ESG+T approach.

You should create your own typology or taxonomy of relevant E, S, G and T issues, risks and opportunities that become part of the planning, risk management, crisis scenarios, research and development and value creation or protection of your organization. The Table below shows a sampling of ESGT issues, risks and opportunities that can serve as a jumping-off point for the creation of a customized taxonomy or typology for a company.

Source: A. Bonime-Blanc. Gloom to Boom: How Leaders Transform Risk into Resilience and Value. Routledge 2020.

In Part 2 of this series, we will provide several use cases and an approach to future-proofing ESGT governance to take into account both the massive risks and astronomical opportunities of the unprecedented tech disruption we are living through.

This article was adapted and updated from Chapter 15 of "Sustainability, Technology, and Finance". illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Aaron Bruckbauer

Pollution · Greenwashing

Glen Jordan

Sustainable Lifestyle · Sustainable Living

Gokul Shekar

Corporate Sustainability · Sustainable Business

Mirage News

Corporate Sustainability · Biodiversity

Politico

Corporate Sustainability · Public Governance

Responsible Investor

Carbon · Corporate Sustainability