Enhanced rock weathering – the tech, ecosystem and economics

· 6 min read

Forget diamonds – basalt may now be an investor’s best friend.

Distributing volcanic rocks to farmers may sound like an unconventional way to combat climate change, however, under the umbrella of enhanced rock weathering (ERW), forward-thinking entrepreneurs are already rolling out this solution across agricultural land and further afield.

ERW is a nascent technology in the voluntary carbon market (VCM). Following puro.earth’s publication of the world’s first ERW methodology in October 2022, however, a viable route for ERW developers to bring verified credits to the market has emerged. Since the methodology became available impact investors and carbon credit buyers have begun evaluating this emerging option to assess its feasibility, quality, and desirability for inclusion in their portfolios.

Can spreading volcanic stone on fields and beaches really make a dent in global atmospheric CO2 levels? Will the quality of these projects stack up against existing offerings in the VCM? What economics are at play in this innovative climate solution? Here we unpack the process, developers and financing involved in ERW and assess its potential as an effective climate solution.

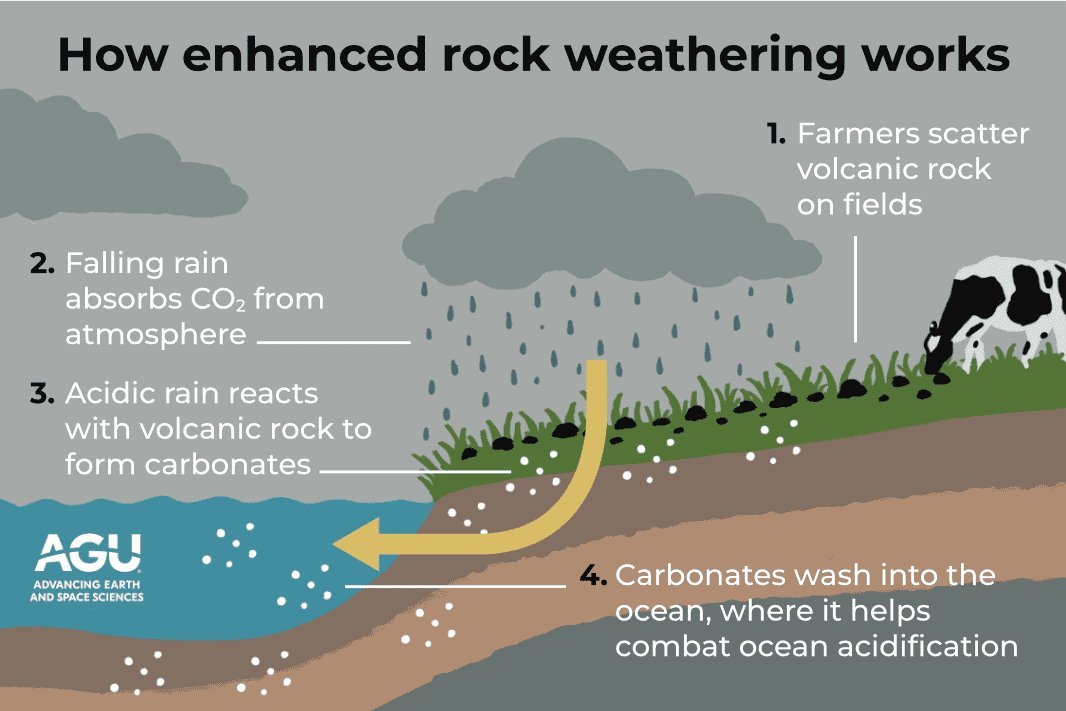

A simple definition: Enhanced rock weathering involves grinding volcanic rock into a fine powder and then spreading it on various landscapes such as farmlands, forests, and coastlines. The powder then reacts over time, removing CO2 from the atmosphere and locking it away in an inorganic form that will wash into lakes, rivers, and oceans.

ERW acts to supercharge existing geological processes to remove atmospheric CO2. Rock weathering naturally removes around 1.1 Gt of CO2 from the atmosphere each year. ERW may be able to match or even exceed this number, with the potential to remove 1 to 2 Gt of CO2 each year by 2100.

To provide some context, that would account for around 3% to 5% of global CO2 emissions – a meaningful contribution from ERW!

There are compelling additional benefits when embracing ERW, particularly for agricultural applications. The primary draw is the potential to increase crop yields over time through improved soil health, water retention and nutrient availability. In addition to these 'on-farm' benefits, farmers can gain revenue from carbon credit sales and savings on fertiliser usage. Also, ERW complements – rather than competes – with productive land, negating concerns about trade-offs with land used for food production.

Beyond agriculture, enhanced rock weathering can help replenish depleted soils, elevate soil quality on degraded soils, and counteract ocean acidification by increasing seawater alkalinity as inorganic compounds migrate to oceans over time. These ecosystem benefits expand the appeal and impact of ERW.

From a permanence perspective, inorganic carbon has a far higher potential than organic carbon, though it may lack permanence in more temperate conditions. Analysing the supply chain, the feedstocks (e.g. basalt rock) and equipment needed are globally abundant and commercially available, mitigating sourcing risks and limiting technological barriers to achieving scale. The location of readily available feedstocks may however dictate the boundary for projects that can deliver the most meaningful carbon benefits when factoring in transport emissions.

ERW is not without its limitations. One key concern is the uncertainty around how large-scale application of silicate rocks may impact surrounding environments and ecosystems. Careful site-specific assessments are necessary to minimise the risk of unintended changes to soil chemistry, biology and hydrology.

Another limiting factor is the prevailing market price for ERW carbon removals, presenting a barrier for companies looking to incorporate the technology into their procurement strategies. Businesses with robust operating profits and lower total annual emissions (e.g. technology companies) can afford to invest at prices well above the social cost of carbon1. These companies can have a catalytic impact on the industry. However, companies with thinner margins may find ERW’s current prices restrictive.

Other constraints include the current lack of standardised measurement and verification protocols, though methodologies are emerging. The logistics and costs of quarrying, grinding, transporting, and applying massive quantities of volcanic rock at scale are further challenges to achieving cost-competitive deployment.

Finally, while some natural rock dusts are waste products of mining, extraction solely for the purpose of ERW should be sustainably managed if actioned.

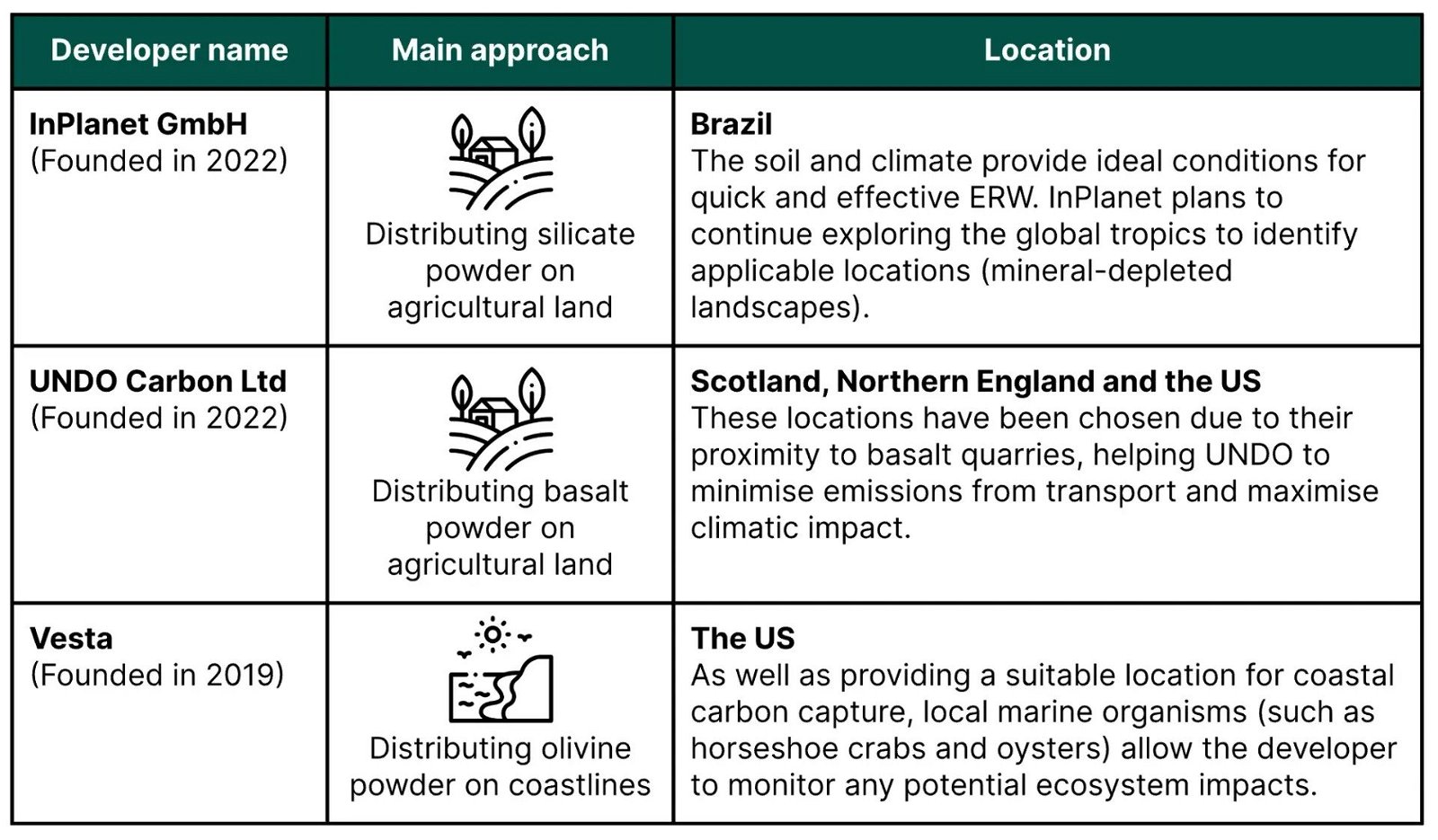

Prominent players in the enhanced rock weathering ecosystem include InPlanet, UNDO and Vesta, as outlined in the table below.

Other developers include Lithos, Mati Carbon, NextGen CDR, Green Sequest, Vaulterra, Zumwalt Acres, ClimeRock, Climitigation and Eion.

The existing developer ecosystem illustrates that:

While techniques vary, these pioneering companies are collectively demonstrating ERW's potential to scale as an impactful carbon removal solution.

The current prices for ERW carbon credits deviate from around $265 to $500 per tonne of CO2 equivalent. Several factors drive this high price, including:

While prices are steep compared to other carbon credits at present, expenses should diminish over time as logistics streamline, scale increases and measurement and verification costs decline with more established protocols.

Strategic partnerships and siting near rock quarries can also improve ERW economics. Overall, prices must decrease to expand adoption. However, higher initial pricing may well be justified, given ERW's permanence advantage versus other nature-based solutions.

The VCM will play a pivotal role in enabling ERW to scale as an impactful solution. By providing a mechanism for ERW projects to generate verified removal credits, the VCM can unlock essential carbon financing to support deployment. Carbon credit revenue makes operations financially viable where they otherwise may not be feasible.

The VCM also spurs innovation by bringing together experts, scientists and developers from different market segments to improve the measurement, reporting and verification (MRV) of ERW, supporting project-specific progress.

Developers, investors and carbon credit buyers all have important roles to play in responsibly scaling up ERW:

While still an early-stage climate innovation, ERW shows genuine potential to scale up in a meaningful way this decade. The permanent mineralisation of carbon, the multifaceted co-benefits and the global abundance of source materials make it a promising approach.

Pioneering developers are demonstrating ERW's versatility across contexts from agriculture to oceans, and the recent emergence of a methodology has unlocked access to carbon financing. Prices remain high but should lower with scale and supply chain maturation. Some uncertainties and risks exist, warranting judicious piloting and monitoring. However, the field is rapidly advancing.

This article is also published on Abatable. Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Carbon Regulations · Carbon Market

illuminem briefings

Carbon Market · Public Governance

illuminem briefings

Carbon Regulations · Public Governance

Euractiv

Carbon Market · Public Governance

CBC News

Carbon Market · Public Governance

Financial Times

Carbon Market · Public Governance