· 4 min read

Derisking prepurchases to build capacity.

How do CDR suppliers get access to the money they need to remove carbon?Funds are needed today to build facilities, buy land and equipment, pay contractors and sometimes build renewable energy. Venture capital helps, but is typically not used for project financing. As Shashank Samala from Heirloom recently said on the Carbon Curve podcast they need “1000 dollars in project infrastructure finance for every one VC dollar”. Of course, CDR suppliers need to sell their product, but the way it is done today is arguably not accelerating development fast enough.

Carbon removal is sold in mainly three ways:

1) Through the sale of “ex-post” carbon credits, where the carbon has already been removed and verified before sold. The supplier is selling the right to claim the removal. There are very few such credits available from durable CDR methods, those that do exist are mainly from biochar. Ex-post credits put all the upfront costs on the supplier and also leave them with the risk that the credits will be unsold.

2) Another way is offtake agreements where a price is agreed today but paid upon the CO2 being removed and verified. Offtake agreements mean suppliers need to finance their facilities using funds other than income from sales. They can take these offtakes to the bank, but typically the agreements must be very long, sometimes decades, for banks to give credit on reasonable terms.

3) The third way is pre-purchases, where the tons to be removed are paid for today. This provides the seller with cash on hand to build or operate their facility and work on research and development. The fastest way for a CDR company to grow would likely be to presell all its credits from a facility. However, all the risk of non-delivery is then put on the buyer, decreasing their appetite for these deals, apart from the most altruistic buyers.

Since ex-post credits and offtake agreements leave suppliers without enough cash to build their actual facilities, it would mean a lot for the sector if prepurchases could be scaled up. Here is where insurance comes in.

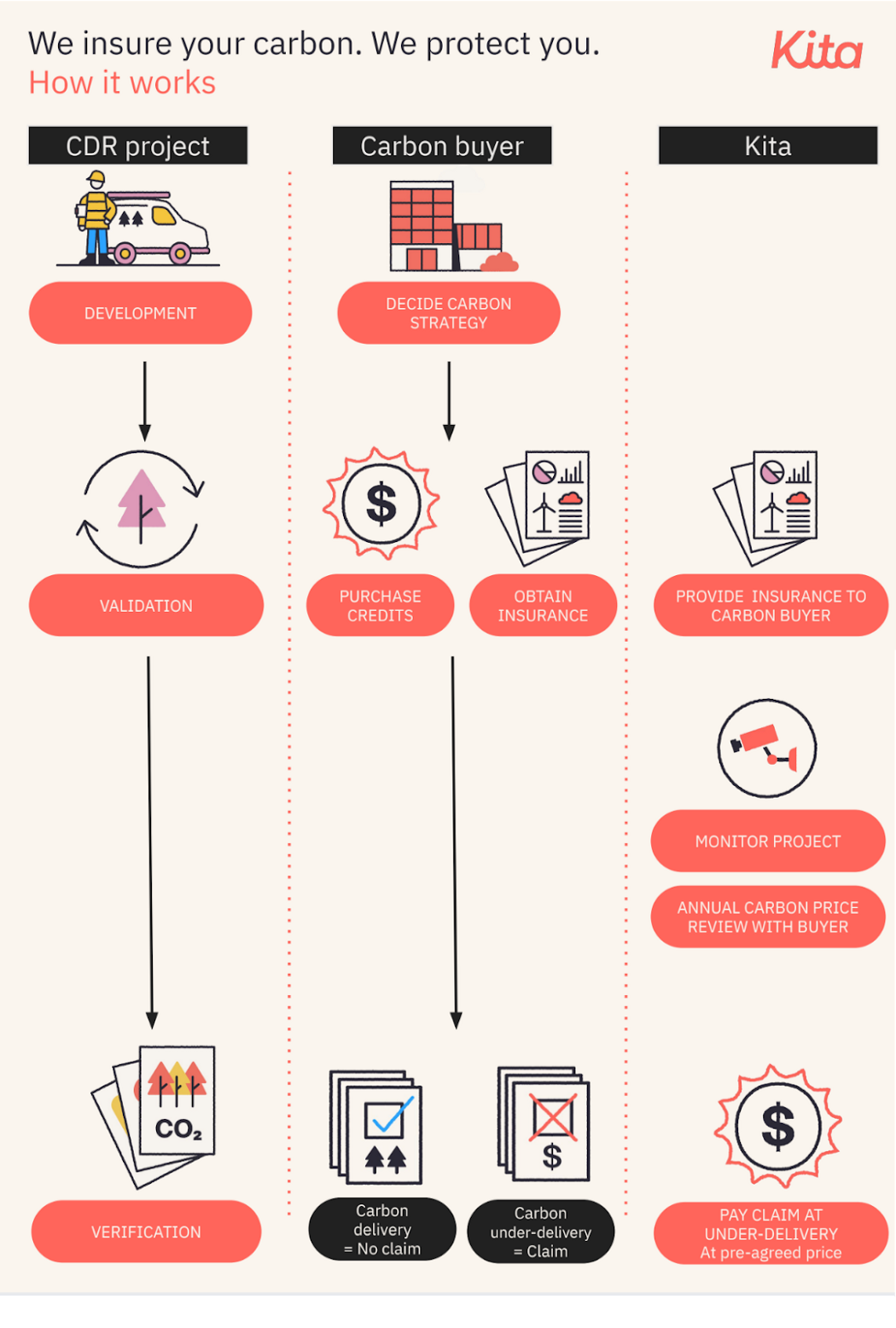

If a third party can insure the delivery of pre-purchased tons, the buyer is relieved of risk. If the carbon is not removed, the buyer gets their money back. Having a mechanism like this in place means pre-purchases goes from being the least attractive to the most attractive way of buying removals. Without taking any risk, buyers can claim they are helping to scale CDR by paying for new capacity to be put into place. And suppliers can scale faster, on better financial terms.

Thankfully this product now exists. Kita is a CDR insurance company that just launched. They are offering precisely what is described above, providing insurance to buyers for purchases from screened and approved CDR suppliers.

(Just as I published this article, another insurance for the voluntary carbon market was launched by Howden and Respira to “provide cover for third-party negligence and fraud”. The press release is a bit short on information on how it will work or if it covers prepurchases.)

New ways to scale CDR faster and give access to project finance for CDR suppliers are really needed. The supply of ex-post durable carbon credits is minimal. My assessment is that in 2021 probably less than 50 000 tons of CO2 were durably removed and sold as such, most of it biochar. The new direct air capture facilities being built will not be operational until 2–3 years from now, and most of them are also quite small, just removing a few thousand tons per year. (Although there are very notable exceptions.) The same applies for ocean capture facilities that are at an even earlier scale. Mineralization is starting to be deployed through, for example, spreading basalt on farmland, but it is starting from scratch. Biochar is also scaling up but from a small base.

I hope Kita gets of to a flying start and that other actors also get involved in insuring carbon removal. We need all the levers we can get to scale this sector from almost nothing to a multi-gigaton solution that helps to reverse the climate crisis.

This article is also published on the author's blog. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.