Democratizing investment: The tokenization of tropical hardwood as an alternative asset

· 10 min read

In the dynamic landscape of asset tokenization, a compelling and transformative avenue has surfaced, challenging the conventional norms of wealth ownership: the tokenization of tropical hardwood. This innovative approach opens doors to exciting financial opportunities and serves as a beacon of democratization within an asset class historically monopolized by billionaires and institutional investors.

With its allure and durability, tropical hardwood has long been an exclusive domain of the affluent, prized for luxury furniture, exquisite flooring, and prestigious construction projects. However, the investment potential inherent in these lush, biodiverse forests has largely remained out of reach for the broader populace due to substantial capital requirements and logistical complexities.

The advent of asset tokenization disrupts this paradigm. By fractionalizing ownership of tropical hardwood forests into digital tokens on blockchain platforms, a new era of accessibility and inclusivity emerges. Now, investors from all corners of the globe can participate in the stewardship of these valuable resources, transcending geographical and financial barriers.

This shift represents more than a financial evolution—it embodies a fundamental rebalancing of wealth ownership. As tropical hardwood tokenization gains traction, it promises to democratize access to tangible assets, empowering individuals and communities to engage in sustainable investments previously confined to the privileged few. This convergence of technology and forestry exemplifies the potential of asset tokenization to drive meaningful change in how we perceive and interact with wealth.

Tropical hardwood, celebrated for its exceptional durability, exquisite grain patterns, and rich color variations, has established itself as a premier material in the realms of high-end furniture, luxurious flooring, and prestigious construction projects. Its innate beauty and resilience have rendered it a symbol of sophistication and quality.

However, the allure of tropical hardwood has been accompanied by exclusivity in ownership and investment. Historically, engaging in tropical hardwood forestry or timber trade has been the domain of the affluent elite and large corporate entities. This exclusivity stems from several factors:

Acquiring and managing tropical hardwood forests demands substantial capital investment. The costs associated with land acquisition, sustainable forestry practices, and compliance with environmental regulations have posed significant barriers to entry for individual investors.

The complexities of managing tropical hardwood resources extend beyond financial considerations. Sustainable forest management requires specialized knowledge, skilled labor, and ongoing maintenance efforts, presenting operational challenges that deter smaller investors from participating.

Accessing global markets for tropical hardwood products involves navigating intricate supply chains and meeting stringent quality standards. Established players with extensive networks and resources have historically dominated these markets, limiting opportunities for smaller investors to capitalize on this valuable asset class.

The promise of tokenization in the context of tropical hardwood forests represents a paradigm shift in investment accessibility and sustainability. Through the process of tokenization, the traditional barriers to entry into this asset class are dismantled, opening doors to a more inclusive and globally accessible investment landscape.

Tokenization facilitates fractional ownership, allowing investors to purchase and hold fractions of tropical hardwood forests represented by digital tokens. This feature eliminates the need for substantial capital outlay, enabling individuals to participate in asset ownership with smaller investment amounts.

By leveraging blockchain technology, tokenized ownership of tropical hardwood forests transcends geographical boundaries. Investors from around the world can acquire tokens representing ownership stakes in these assets, promoting geographical diversification of investment portfolios.

Tokenized assets offer enhanced liquidity compared to direct ownership of physical assets like tropical hardwood forests. Investors can easily buy, sell, and trade tokens on digital platforms, unlocking liquidity and flexibility in investment strategies. The ability to convert fractional ownership into tradable tokens enhances market efficiency and reduces the liquidity constraints associated with traditional asset ownership.

Perhaps most importantly, the tokenization of tropical hardwood encourages sustainable forestry practices and responsible investment in natural resources. As investors gain fractional ownership in forests, there is an inherent incentive to promote long-term sustainability. Token holders are aligned with the interests of maintaining healthy forests, fostering biodiversity, and mitigating deforestation risks. This symbiotic relationship between investors and environmental stewardship contributes to the preservation of valuable ecosystems while generating financial returns.

By adding an alternative asset like tropical hardwood, investors can mitigate risks associated with stock or bond market fluctuations. Tropical hardwood, known for its resilience and enduring demand in luxury markets, presents a potential avenue for long-term value appreciation. The inclusion of tropical hardwood tokens can enhance portfolio resilience and provide a hedge against inflation, currency devaluation, or economic downturns.

Tokenized ownership of tropical hardwood forests promotes sustainable forest management practices. As investors gain fractional ownership through tokens, they become stakeholders in the preservation and responsible utilization of forest resources. This ownership model encourages forest stewardship, biodiversity conservation, local community engagement, and reforestation efforts. This environmental impact aligns with investors' growing interest in socially responsible and environmentally sustainable investments.

Historically, investment opportunities in tropical hardwood forests have been limited to ultra-wealthy individuals and large institutional investors due to high entry costs. However, tokenization democratizes access to this asset class, enabling small investors to participate in an asset traditionally reserved for the privileged few. Through fractional ownership represented by tokens, individuals with varying financial capacities can engage in tropical hardwood investments, fostering greater financial inclusivity and democratization of wealth ownership.

A specialized platform is developed leveraging blockchain technology to tokenize ownership of tropical hardwood forests. This platform facilitates the issuance, trading, and management of digital tokens representing fractional ownership in designated forest areas.

Forest management entities or investment groups tokenize hectares of sustainably managed tropical hardwood forests into digital tokens. Each token represents a specific fraction of ownership in the underlying forest asset. These tokens are then made available for investors to purchase on the tokenization platform.

The fractional ownership model enables investors to acquire stakes in tropical hardwood forests with lower financial thresholds compared to direct ownership. Token holders are entitled to a share of the profits generated from sustainable timber harvesting and eco-tourism activities within the forest areas.

The tokenization platform ensures transparency through blockchain-enabled smart contracts that record ownership rights and revenue distributions in a secure and immutable manner. Governance mechanisms, such as voting rights tied to token ownership, enable token holders to participate in decision-making processes related to forest management practices.

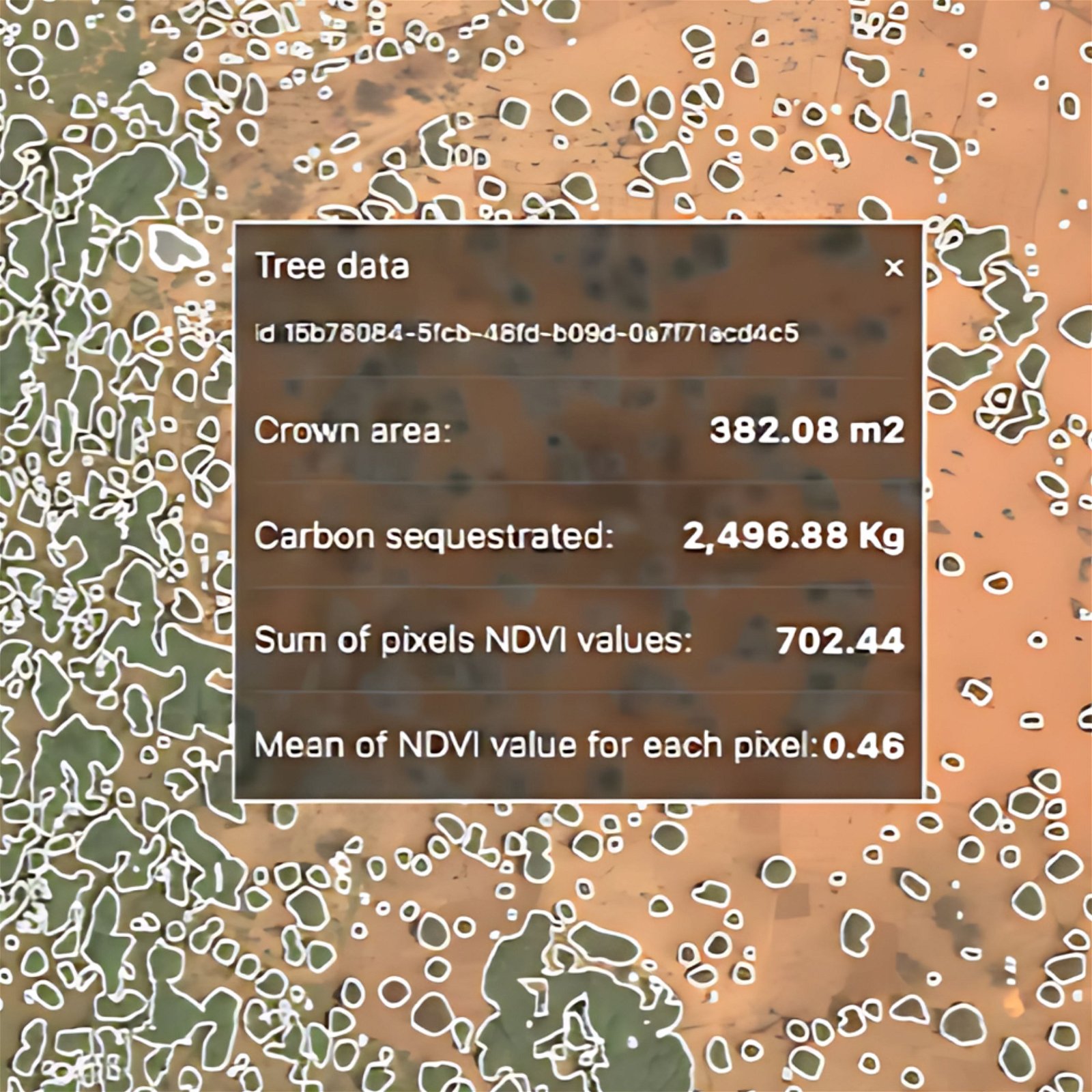

The platform integrates environmental monitoring tools to track forest health, biodiversity metrics, and carbon sequestration levels. This data not only informs sustainable forest management practices but also provides investors with insights into the environmental impact of their investments.

Tokenization of tropical hardwood forests can extend benefits to local communities through job creation, education programs, and community development initiatives supported by revenue generated from forest activities.

A holistic business model for tropical hardwood tokenization encompasses a broader spectrum of environmental, social, and economic considerations. Here's an elaboration on how such a model can be structured:

Instead of focusing solely on carbon sequestration and trading within carbon markets, a holistic approach emphasizes the multifaceted benefits derived from sustainably managed tropical hardwood forests. This includes recognizing and valuing ecosystem services such as biodiversity conservation, watershed protection, soil fertility maintenance, and recreational amenities.

In addition to revenue generated from timber harvesting, a holistic model incorporates diversified income streams from eco-tourism, agroforestry, non-timber forest products (e.g., fruits, nuts, medicinal plants), and carbon offset sales. By leveraging multiple revenue sources, the business model becomes more resilient to market fluctuations and contributes to the long-term viability of forest management.

A key component of a holistic approach is fostering positive relationships with local communities dependent on forest resources. This involves integrating community-based enterprises into the value chain, providing employment opportunities, supporting education and healthcare initiatives, and sharing benefits from forest-related activities. Empowering local communities as stakeholders strengthens social cohesion and ensures equitable distribution of benefits.

Beyond sustainable forestry, a holistic business model promotes regenerative practices that enhance forest resilience and ecological integrity. This includes selective logging techniques, natural regeneration methods, and investments in reforestation and restoration projects. By prioritizing forest health and biodiversity conservation, the model aligns with broader conservation goals.

Implementing rigorous certification standards (e.g., Forest Stewardship Council - FSC) and adhering to internationally recognized sustainability criteria demonstrate commitment to responsible forest management. Compliance with these standards enhances market access, boosts investor confidence, and fosters credibility within the sustainable investment landscape.

A holistic business model emphasizes the importance of long-term investment horizons aligned with ecological processes. Investors are encouraged to adopt patient capital approaches that prioritize ecosystem resilience and social well-being alongside financial returns. This shift from short-term profit maximization to sustainable value creation contributes to the longevity and success of forest-based enterprises.

Leveraging advancements in technology, such as remote sensing, satellite imagery, blockchain-enabled traceability, and data analytics, enhances operational efficiency and transparency within the business model. Technology-driven solutions facilitate real-time monitoring of forest conditions, supply chain management, and impact assessment, enabling adaptive management practices and informed decision-making.

The path towards democratizing access to assets like tropical hardwood through tokenization represents a transformative journey that aligns with evolving technology and investment practices. Here's an elaboration on this journey:

Tokenization harnesses the power of blockchain technology to break down traditional barriers to asset ownership. By fractionalizing ownership and enabling tradeability of digital tokens, individuals of varying financial means can participate in previously exclusive investment opportunities. This democratization of access promotes financial inclusivity and empowers a broader spectrum of investors to engage in sustainable investments aligned with environmental and social objectives.

The democratization of tropical hardwood ownership signifies a shift towards sustainable investment practices. Tokenization incentivizes responsible forest management and conservation efforts as investors become stakeholders in the long-term health and viability of forest ecosystems. This alignment of financial interests with environmental and social goals contributes to a more conscientious approach to wealth creation.

Despite its potential, the tokenization of tropical hardwood forests presents challenges that must be addressed for widespread adoption. Regulatory compliance, including legal frameworks for token issuance and trading, forest management standards, and ensuring equitable distribution of benefits to local communities, requires collaborative efforts among stakeholders. Investors, forestry experts, government entities, and community representatives must work together to establish transparent and accountable practices that uphold sustainability principles.

Overcoming hurdles in tropical hardwood tokenization necessitates robust governance structures that prioritize stakeholder engagement and consensus-building. Collaborative governance frameworks ensure that decision-making processes consider diverse perspectives, promote transparency, and address socio-economic concerns related to forest management and investment outcomes.

Democratizing asset ownership through tokenization requires education and awareness initiatives to inform stakeholders about the benefits, risks, and responsibilities associated with sustainable investments. By fostering a culture of informed decision-making and shared responsibility, tokenization can catalyze positive change in how natural resources are valued and managed.

The road to democratization is characterized by ongoing innovation and adaptation. As technology evolves and investment practices mature, continuous innovation in blockchain applications, forest monitoring technologies, and impact assessment methodologies enhances the effectiveness and scalability of tokenized asset models.

The tokenization of tropical hardwood represents a profound departure from traditional paradigms of wealth ownership, transcending mere financial opportunity to embody principles of inclusivity and sustainability. By harnessing the transformative potential of web3 technology, investors now have unprecedented access to responsible investments that were once the exclusive purview of the elite, paving the way for a more equitable and environmentally conscious global economy.

As this transformative trend gains traction, the future of asset tokenization holds immense promise for reshaping the investment landscape. By fostering transparency, inclusivity, and accountability, tokenization not only unlocks economic opportunities but also promotes responsible resource management and environmental stewardship. This evolution towards a more accessible and equitable investment ecosystem signifies a fundamental redefinition of wealth ownership—one that prioritizes collective prosperity, sustainability, and the preservation of our natural heritage for generations to come.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Alex Hong

Energy Transition · Energy

Steven W. Pearce

Adaptation · Mitigation

John Leo Algo

Ethical Governance · Environmental Sustainability

Responsible Investor

Sustainable Finance · ESG

Responsible Investor

ESG · Sustainable Finance

Responsible Investor

Sustainable Finance · ESG