Decentralized ammonia production in Europe: challenges and opportunities for current players

· 10 min read

If there is one industry tightly interconnected with our daily life, that's agriculture. Although not evident, the production of many vegetables in our grocery basket relies on synthetic fertilizers. Accordingly, crop prices depend, among other factors, on the price of synthetic fertilizers. Ammonia, in particular, covers a dominant role in carrying nitrogen as a nutrient for crop production. Currently, the majority of synthetic fertilizers rely on natural gas use, with the release of carbon emissions. To achieve the net-zero emissions target, synthetic ammonia fertilizers face two contemporary challenges: (i) maintaining cost-competitiveness to guarantee low fertilizer prices, and (ii) achieving carbon emissions reduction.

In recent years, cost-competitiveness has been critical for European ammonia manufacturers due to the increase in natural gas prices, which followed the conflict in Ukraine. Adding to high labor costs, companies with production based in Europe, like Yara International, have struggled to maintain competitive margins [1]. To remain cost-competitive, BASF Chemicals, a major European chemical manufacturer, announced the closure of its ammonia production plants in Germany by the end of this year for relocation abroad [2].

Carbon emissions reduction from European regulation further challenges industrial cost-competitiveness. The Renewable Energy Directive III (RED III) [3] requires the replacement of hydrogen produced from natural gas with hydrogen from water electrolysis fed with renewable electricity: 42% of European hydrogen use by 2030 and 60% by 2035. In addition, starting from 2025 the Fit for 55 package [4] is reducing the free emissions credits for synthetic ammonia fertilizers production to zero by 2034. By becoming fully part of the European Emissions Trading System (EU-ETS), fertilizer producers have to comply with carbon credits [5] whose price has recently peaked at 100 EUR/tCO2. To avoid unfair competition from producers subject to relaxed carbon regulation, the Carbon Border Adjustment Mechanism (CBAM) [6] levelizes emissions costs of importers with European producers subject to the EU-ETS. Nonetheless, European ammonia producers may still face disadvantages when supplying demand outside Europe compared to producers operating under more relaxed carbon regulations.

In this context, Yara International recently inaugurated an ammonia plant of 21 thousand tons per year capacity fed with renewable hydrogen in Norway [7], while Iberdrola has committed to the construction of a plant of 100 thousand tons per year capacity for renewable ammonia production in Spain [8] from 2026. However, maintaining industrial cost-competitiveness while complying with the defossilization target raises questions at the core of ammonia production supply chain design, plant operation strategy, and geographical positioning, thus requiring a choice among possible different approaches.

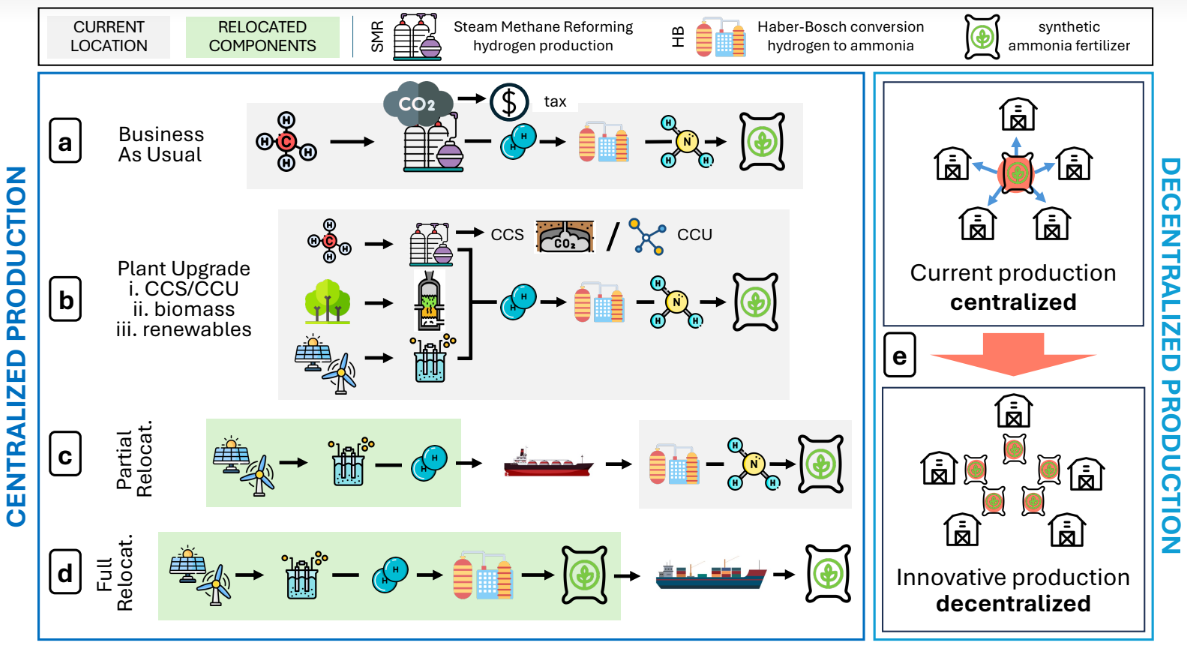

A total of five approaches can be chosen when managing fossil-based energy-intensive plants for ammonia production (Figure 1).

The first approach, business-as-usual in Figure 1(a), corresponds to no change of production equipment or site location, leading to additional expenses related to carbon tax payments and dependence from fossil sources volatility.

The second approach, plant upgrade in Figure 1(b), corresponds to investments to curb plant's emissions. This can be achieved based on different technological routes [9] which involve (i) the introduction of carbon capture technologies avoiding the release of carbon dioxide emissions in the atmosphere, or switching to (ii) biomass or (iii) renewable electricity as defossilized feedstocks. Carbon capture requires the availability of CO2 sites for underground storage (carbon capture and storage, CCS), or investments in the usage of CO2 for the production of other carbon-based molecules, like synthetic methane, methanol or high-value chemicals (carbon capture and usage, CCU). Renewable feedstocks require a sufficient availability of biogas for the intermediate biogenic hydrogen production, and solar or wind power for the intermediate electrolytic hydrogen production.

The third approach, partial relocation in Figure 1(c), consists in switching the input feedstocks to a carrier derived from renewable electricity, but produced abroad in locations where the renewable potential and production cost is lower than Europe [10]. This approach implies a choice of chemicals to minimize the transport cost, in the form of hydrogen, ammonia, or synthetic natural gas (with CO2 captured from air, or biogenic sources).

The fourth approach, full relocation in Figure 1(d), consists in pursuing defossilization and cost-competitiveness by directly moving the industrial production to the locations where renewable power is most available and cheap10. While no changes might occur on the demand side, plant relocation implies a complete change in the design of the supply chain of final fertilizer products. Additionally, this approach can have dramatic economic and social impacts on the original manufacturing country, while exposing the company to a new industrial regulatory framework.

Finally, the fifth approach, industrial restructuring in Figure 1(e), consists in the shift from the historically centralized configuration of the ammonia fertilizer production industry towards a decentralized production based on small-scale ammonia production plants located at the demand point [11]. For companies managing existing ammonia fertilizers production facilities, this option can be a threat to their current business model. Nonetheless, it represents an opportunity for both new players that could enter in the fertilizer industry, and for consolidated players to invest in innovative small-scale technologies which can build on the know-how of large-scale Haber-Bosch plants operation.

Figure 1. Approaches for defossilized production while pursuing cost-competitiveness. Approaches a-b represent the case with no change in the location of the plants, and no impact on the current supply chain. Approaches c-d represent the cases of partial or complete relocation, requiring a new supply chain. Approach e corresponds to a restructuring of the current centralized plants towards decentralized production. The figure is a simplified schematic not representing all the possible variations to the five approaches which are discussed in the text. Tax refers to the carbon tax, CCS/CCU to Carbon Capture and Storage or Usage.

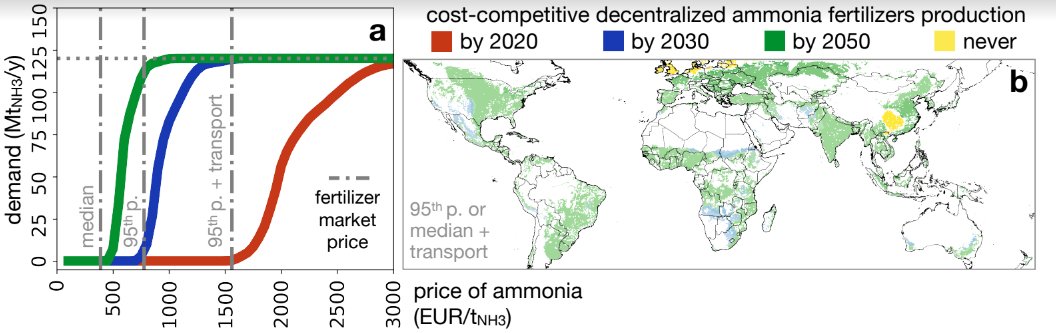

Recently, a study from Tonelli et al. [12] benchmarked the cost of low-carbon decentralized small-scale ammonia fertilizers production at the demand site with the historical ammonia fertilizer market price. Cost of production varies widely in the world, depending on the local availability and cost of renewable electricity production. The study assumes two possible configurations for ammonia production: a system with electricity fed from agrivoltaic solar panels and one with electricity fed from the grid. Additionally, two technologies with different maturity (Technology Readiness Level - TRL) are analyzed: electrocatalysis (low TRL) and electric Haber-Bosch (high TRL). Electrocatalysis allows the direct conversion of water and nitrogen into ammonia (direct nitrogen reduction), while the electric Haber-Bosch system involves the intermediate production of hydrogen. While the former can follow an intermittent supply of electricity, the latter requires an intermediate hydrogen buffer for a continuous operation of the reactor for ammonia synthesis.

Being dependent on the supply of natural gas (Figure 1(a)), ammonia fertilizer production prices have increased by three times following the Russian invasion of Ukraine, from an average 350 €/t up to 1050 €/t. This increase in prices underscores the exposition of the current ammonia fertilizer production industry to the volatility of the natural gas market. In addition, the fertilizer price at the demand site depends on downstream expenses, such as long-distance transportation and tariffs, which can double the final ammonia fertilizer price. The technologies for decentralized production have the largest deployment potential in the locations that experience the largest impact of downstream logistics. These locations include Central and South Africa, North America and Australia.

Among the findings of the study, today's limited technological maturity makes the cost of ammonia fertilizer too high for cost-competitiveness with current centralized production based on natural gas. However, the technological learning predicted for the next decades allows the majority of the ammonia fertilizer demand to be potentially cost-competitively supplied with decentralized production by 2050 (Figure 2(a)). Exceptions include locations with the lowest solar irradiation, like North Europe, and inland China (Figure 2(b)).

Figure 2. Distribution of ammonia fertilizer demand and price: (a) cumulative, and (b) spatially-explicit. The figure refers to a grid-connected system based on electric Haber-Bosch technology. Source: (Tonelli et al., 2024) [12]

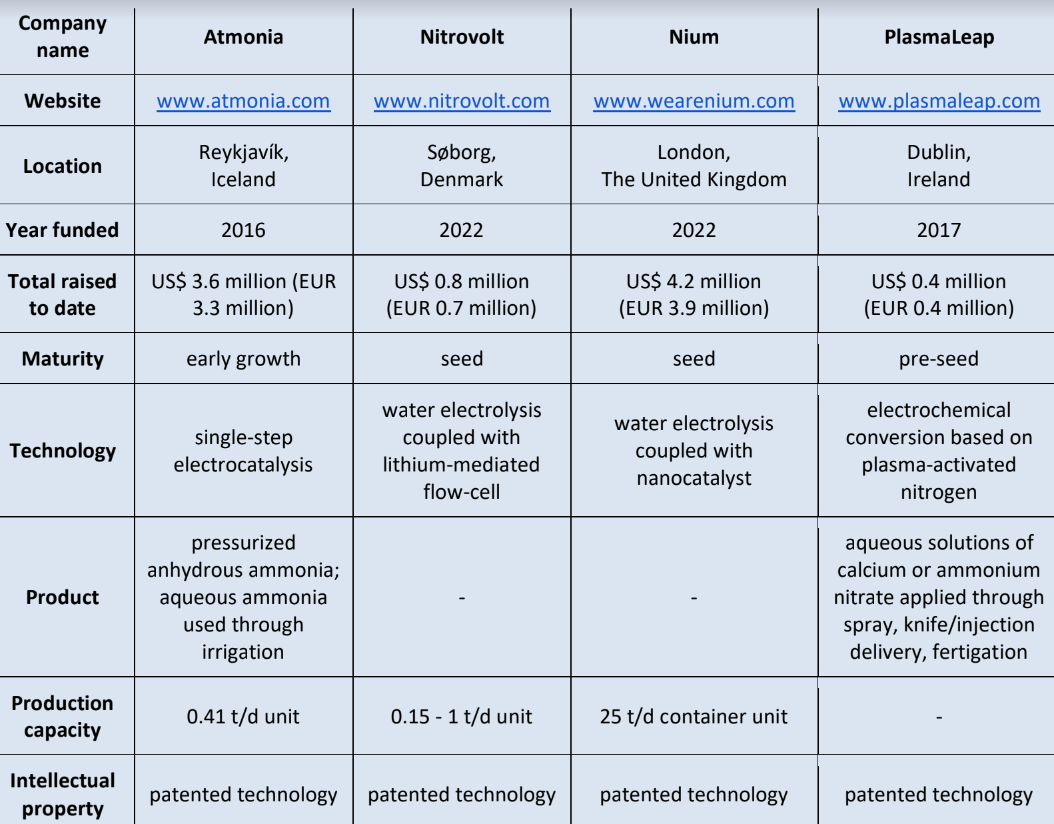

Looking at the European industrial landscape, a few start-ups have embraced the challenge of developing a system for small-scale decentralized ammonia fertilizer production (Table 1). These actors are supported by aggregated investments of approximately US$ 9 million (EUR 8.3 million). Nitrovolt and Nium, respectively located in Denmark and the UK, have both chosen a two-stage technology with the intermediate production of hydrogen from water electrolysis, used as a feedstock for the synthesis of ammonia through different typologies of reactor. Despite being founded in the same year (2022), Nium has received the largest funding, amounting to more than US$ 4.2 million (EUR 3.9 million). Atmonia (founded in 2016, US$ 3.6 million raised) opted for the direct production of ammonia based on electrocatalysis, or direct nitrogen reduction reaction. PlasmaLeap (founded in 2017, US$ 0.4 million raised) has developed a plasma-based technology with the intermediate production of calcium or ammonium nitrate, converted to ammonia through electrochemical conversion. Based on the information available, aqueous ammonia represents the favorite target final product, allowing the distribution of fertilizers on croplands through the irrigation system.

The recently born start-ups are the forerunners in the European climate tech ecosystem technologies for decentralized fertilizer production. However, despite a similar average year of foundation, the start-ups in the United States within this market segment present substantially larger funds, with six start-ups supported by US$ 67.8 million (EUR 62.7 million) aggregated funds. Canadian players in this market segment have even larger funding per single company, with aggregated funds of US$ 42.3 million (EUR 39.1 million) of two start-ups. Overall, the competitive gap between European and North American players can lead to different interpretations. European investors might be less convinced of the competitiveness of decentralized fertilizer production technologies. Reasons behind can include the average size of European farms as potential final customers, or the lower average distance between centralized fertilizer production plants and croplands in Europe. Additionally, European established players could still be more keen in upgrading ammonia production plants based on indirect electrification than considering a substantial restructuring from centralized to decentralized production (see Figure 1). Nonetheless, the lower funds raised by the identified European start-ups compared to the North Americans in this market segment might be representative of a less reactive European climate tech ecosystem, calling for a boost in investments in European start-ups.

TABLE 1: Start-ups in Europe focusing on decentralized ammonia production technologies. Analysis based on EU-27, the UK and CH [13], [14]. Currency conversion: US$ 1 = EUR 0.924 (2023).

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

1. A'Hearn, B. Yara curtails 2023 European ammonia production by 19pc. Argus (2024). 2. Young, I. No recovery in sight in 2024 for Europe's crisis-ridden chemical industry. S&P Global (2023).

3. Council of the European Union. Renewable energy: Council adopts new rules. Press release. https://europa.eu/!tmtB6W (2023).

4. Council of the European Union. Fit for 55. https://europa.eu/!3WBHmX (Last review: 12/04/2024).

5. ICAP Allowance Price Explorer. https://icapcarbonaction.com/en/ets-prices (2022). 6. European Commission. Carbon Border Adjustment Mechanism. https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en#cbam (2024). 7. Yara International. https://www.yara.com/news-and-media/media-library/press-kits/renewable-hydrogen-plant-heroy a-norway/ (2024).

8. Iberdrola.

https://www.iberdrola.com/press-room/news/detail/iberdrola-trammo-sign-EU-s-largest-agreemen t-for-the-export-green-ammonia (2023).

9. Rosa, L. and Gabrielli, P. Energy and food security implications of transitioning synthetic nitrogen fertilizers to net-zero emissions. Environmental Research Letters 18(1), 014008 (2022). 10. Verpoort, P.C., Gast, L., Hofmann, A. and Ueckerdt, F. Impact of global heterogeneity of renewable energy supply on heavy industrial production and green value chains. Nature Energy, 1-13 (2024).

11. Comer, B.M., Fuentes, P., Dimkpa, C.O., Liu, Y.H., Fernandez, C.A., Arora, P., Realff, M., Singh, U., Hatzell, M.C. and Medford, A.J. Prospects and challenges for solar fertilizers. Joule 3(7), 1578-1605 (2019).

12. Tonelli, D., Rosa, L., Gabrielli, P. et al. Cost-competitive decentralized ammonia fertilizer production can increase food security. Nat Food 5, 469–479. https://doi.org/10.1038/s43016-024-00979-y (2024).

13. Pitchbook. https://pitchbook.com/ (accessed on 16/06/2024).

14. Dealroom. https://dealroom.co/ (accessed on 16/06/2024).

Olaoluwa John Adeleke

Power Grid · Power & Utilities

Alex Hong

Energy Transition · Energy

illuminem briefings

Hydrogen · Energy

Financial Times

LNG · Oil & Gas

Oil Price

Renewables · Energy

Forbes

Energy Transition · Energy Management & Efficiency