Cutting through the noise: don’t miss structural shifts

· 5 min read

When it comes to change, we are often distracted by “white noise”: trends that are not long-lasting but are loud or politically polarized. The problem is that this noise often stops us from seeing the underlying structural shifts.

How should banks adjust to changing energy forecasts? Some recent climate scenarios have thrown a curveball – a forecast resurgence of some hydrocarbon use. According to the IEA, for example, we should expect a 32% surge in coal demand by 2030, compared to 2021 levels, in part due to heavy continued Chinese usage.

Such reassessment has multiple implications, not least for banks. If the global economy now accepts that hydrocarbon use will not peak for several years, should they continue to eschew investments in high carbon-emitting sectors (like oil and coal) on the basis of earlier different forecasts and net-zero commitments? My view is that any reassessment, if justified, needs to be done transparently, so to keep bank decarbonisation strategies credible and retain investor trust.

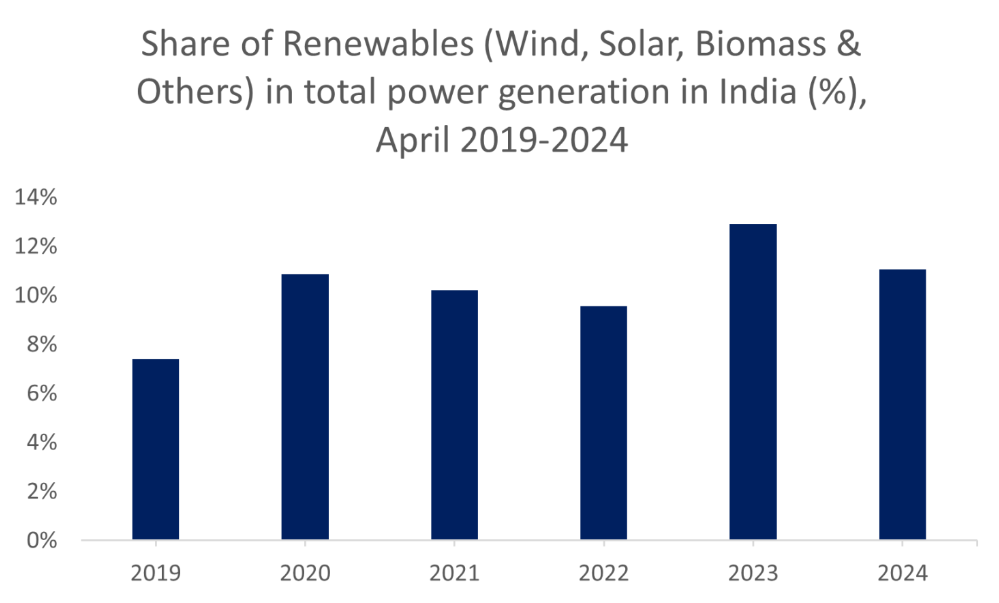

India’s hydropower output down sharply. India experienced a 16.3% drop in hydroelectricity generation during the last 12 months as of March 31, the steepest decline in at least 38 years. Erratic rainfall led to increased reliance on coal-fired power. Currently, renewables account for around 11% of India’s power output, down from 13% the previous year, but this is likely a blip, not a trend: India remains a key country for global renewables implementation.

Source: Grid-India. Data as of April 3, 2024.

The lesson is that environmental projects, not just in India, will always be vulnerable to external pressures. Unpredictable weather patterns are only one source of disruption. Continuous adaptation and achieving resilience must stay a focus of energy production.

Don’t expect perfect sustainability rating standardisation. Sustainability ratings play an increasingly important role in the valuation of companies. However, comparing the sustainability metrics of corporations is still difficult, due to the number of rating agencies as well as a lack of methodological standardisation. We are working closely with rating agencies as they increasingly incorporate nature and biodiversity metrics in the assessment process, but it remains important to remember that ratings are a signalling tool and cannot always be a one-size-fits-all solution for sustainability assessments. Like a traffic light, they provide an essential tool for managing traffic, but individuals still need to be capable of driving.

What does this imply for the investor? Choosing appropriate ratings doesn’t just need regulation but also a critical evaluation of the underlying rating methodologies and where the data is coming from. As the rating landscape evolves, investors will need to think carefully about how best to focus on companies that demonstrably address environmental and social issues, especially around nature and biodiversity, and properly disclose this information.

ESG indices: the importance of macro expectations. The performance picture for the major ESG indices is currently mixed but with the positive generally outweighing the negative. However, the main negative outlier is in the clean energy sector, with low double digit negative YTD performances from some related ESG indices. This should remind us of the continuing importance of overall, rather than ESG-specific, macro expectations as well as the company-specific issues affecting the sector. One problem for clean energy is that the extent of interest rate cuts in 2024 priced in by market participants has fallen from -168 basis points at the beginning of the year to less than -75 basis points now (Fed Funds Futures). Alternative energy companies are particularly sensitive to such changes in interest rate expectations due to high debt levels in general and because their earnings tend to be far in the future, they must be discounted more heavily if interest rate expectations rise relative to previously expected levels.

The importance of macro expectations is demonstrated at the other end of the performance scale too. Japan-focused ESG indices have benefited from strong gains in the overall Japanese equity market, fuelled by Japanese economic hopes as well as corporate governance improvements.

Recent developments highlight that there remain major obstacles on the way towards achieving a sustainable world. We need to make sure these aren’t self-inflicted. My worry is that focusing on words only can trap us in semantic debates, obscuring the urgency of finding solutions.

“Purpose” is the keyword here. Consider the key areas of regulation, metrics, and litigation. At a time of regulatory ambiguity, we need an adaptive regulatory framework focused on purpose, not perfection. Similarly, we shouldn’t chase ever-increasing volumes of metrics: what really matters is how we use them, and how we communicate why they matter. Litigation can have a sometimes underappreciated purpose in fostering a risk management system related to nature-related and other risks. Words are important here, as is information, but actions always speak loudest of all. Ultimately, it's not about labelling the problem; it's about solving it.

Match the number to the issue: USD4.5 trillion.

Answer: annual clean energy investment to limit global warming to 1.5°C, according to the IEA.

Further reading: Some interesting ideas about how businesses can gain from becoming more sustainable: “The Responsibility Revolution: How the Next Generation of Businesses Will Win” - by Jeffrey Hollender and Bill Breen.

This article is also published on the author's LinkedIn. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change