COP29 Special: Leveraging the financial toolbox

· 4 min read

With COP29 now concluded, we examine the outcomes, and note the distinctly sobering biodiversity COP16. In both conferences, finance was at the center of the debate.

It was clear from the outset that the question of who would bear the bulk of these financing costs would be a key topic at COP29, as it was at COP16 in Cali, where no agreement could be reached on closing the estimated annual biodiversity financing gap of USD700bn.[1]

In this issue we look at:

How much money will we need?

What amounts were agreed at COP29?

How can we create the right incentives?

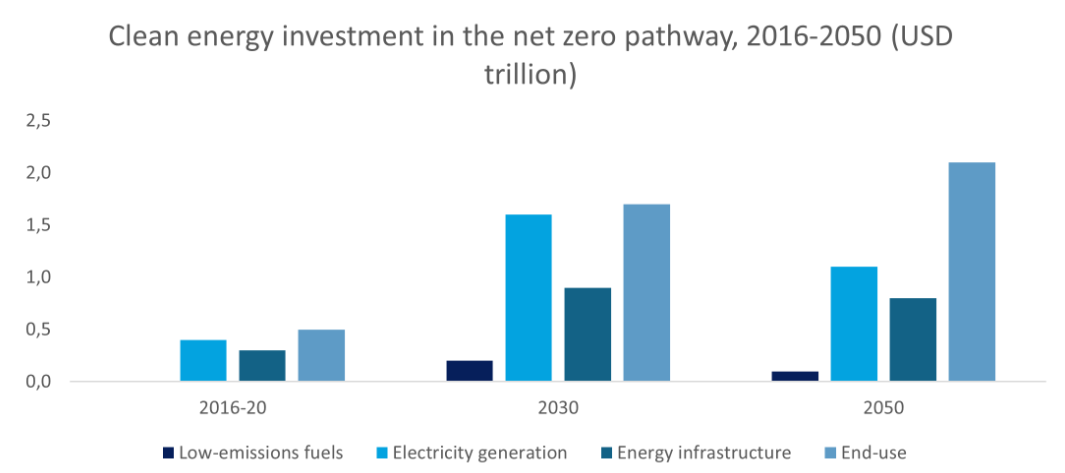

A lot - however you estimate it. Globally, it’s estimated that USD6.2tn of annual climate finance is required over the next five years to 2030, and USD7.3tn by 2050 – a total of almost USD200tn.[2] Another forecast estimates four times of what is currently invested; for emerging markets and developing countries, excluding China, to close to USD2.4tn a year by 2030 to meet climate goals. According to this forecast, about USD1tn per year will need to come from international sources of finance, both public and private.[3] Clean energy investments alone will have to increase sharply, as shown in the chart below based on IEA forecasts.

Equitable distribution of the financial burden is also important, and definitions matter. Many countries generating significant emissions are not classified as “developed”, thus aren’t obligated to contribute to climate finance payments. These include China, responsible for ~30% of global CO2 emissions from fossil fuels.[4]

‘Developed’ countries pledged to contribute at least USD300bn annually to support developing and emerging countries – a marked step up from the current goal of USD100bn, but significantly less than the USD1tn per year demanded from these countries.[5] Allocating USD700bn to the Loss and Damage Fund has been criticised as insufficient as well.[6],[7]

I too would like greater financial commitments to developed and emerging countries. But I also suggest looking beyond the headline commitment numbers and consider the crucial role of international capital markets in the net-zero transformation – in particular, whether they are using existing tools effectively. Private sector commitments may end up being more important than public commitments in many areas: the International Energy Agency, for example, estimates that to achieve net zero by 2050, over 70% of clean energy investment in emerging markets and developing economies must be financed by private sources, with nearly 60% of this financed by debt.[8]

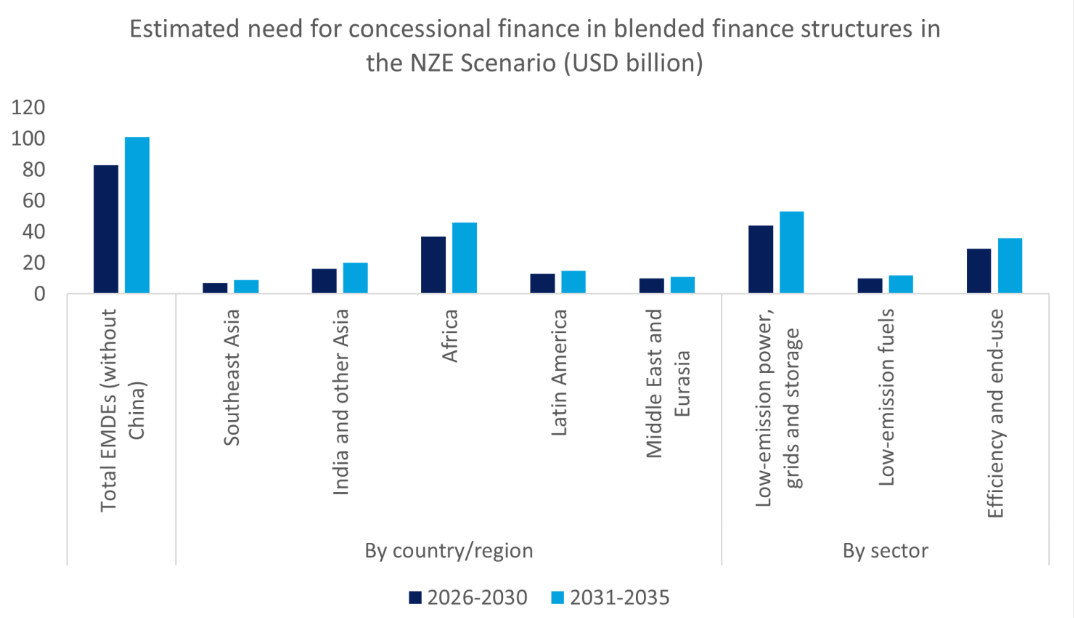

We have many financial tools already in place. Blended finance (public plus private), for example, can be appropriate for situations where private market-based investors wouldn’t invest in projects due to risks or scalability. We have seen significant progress here[9], although gaps are remaining, e.g., in adaptation finance (finance to help communities to adapt to likely future problems from climate change). As the second chart (again on energy) reminds us, blended finance will also likely still involve a substantial concessional finance component.

But different instruments serve different purposes and different goals will require different tools. While carbon pricing, for example, is an established tool against climate change, designing tools to facilitate biodiversity credits may be a much more difficult undertaking.

Convincing investors that the chosen financial tools will make a sustainable investment economically viable is the key point. Where gaps exist in the financial toolbox, we need to think about how to fill them.

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[1] A New Deal for the Nature Finance Gap | The Nature Conservancy

[2] How-big-is-the-Net-Zero-financing-gap-2023.pdf (climatepolicyinitiative.org)

[3] Finance & Justice | United Nations

[4] China - Countries & Regions - IEA

[6] Fund for responding to Loss and Damage ready to accept contributions (cop29.az)

[8] Unlocking climate solutions at scale through blended finance | World Economic Forum (weforum.org)

[9] State of Blended Finance 2024: Climate Edition - Convergence Resources | Convergence

illuminem briefings

Oil & Gas · Ethical Governance

illuminem briefings

Climate Change · Insurance

illuminem briefings

Labor Rights · Climate Change

The Guardian

Power Grid · Climate Change

NPR

Climate Change · Public Governance

BBC

Biodiversity · Climate Change