Cooling the planet with coal? We need to count the carbon cost of propping up the status quo

· 5 min read

Sweating through my third shirt of the day during my most recent trip to India, I saw first-hand how the limitations of lithium-ion storage are scuppering efforts to transition to clean energy alternatives.

Part of the problem is the current focus of our industry, which revolves around ancillary service markets and a myopic approach to trading. This is something I’ve experienced as a trader in gas markets, fixated on those hour-by-hour buy-and-sell prices.

We know that renewables can help to push prices down in a more sustainable way long-term and that less reliance on the whims of volatile oil and gas markets can only be a good thing. But we’re currently nowhere near the amount of storage capacity that we need to properly address energy demand at peak times and shift our consumption towards using a majority of renewable sources.

As temperatures in places like Jaipur rise to levels that are unbearable (even unliveable) and certainly unsuitable for lithium-ion storage, a grimly ironic cycle kicks in: we end up cooling down a rapidly heating planet with coal- and gas-powered air con units.

Not only is the monetary cost of this huge, but the carbon expenditure — the kilograms of equivalent CO2 produced for each megawatt hour of energy — is enormous.

The social costs are even greater: the World Health Organisation calls climate change “the biggest health threat facing humanity.” To my ears, the estimate that climate change will cause 250,000 additional deaths a year between 2030 and 2050 sounds conservative.

It’s my belief that innovation in energy storage not only provides an answer to the existing duck curve demand problem but does so with clear monetary and social cost benefits too. Achieving the transition will require more effective hardware storage solutions — including ones that will work in baking-hot countries like India. We are actively solving this hardware challenge.

Yet it’s difficult not to be drawn into thinking of carbon expenditure in the abstract.

As an industry, we need to broaden our thinking and be interested in the carbon arbitrage of what we’re doing as well as the price arbitrage.

We’ve spent some time working on a case study assessing energy mixes in India, and measuring how better storage of energy generated from renewable sources could help to reduce the carbon impact associated with meeting periods of peak demand.

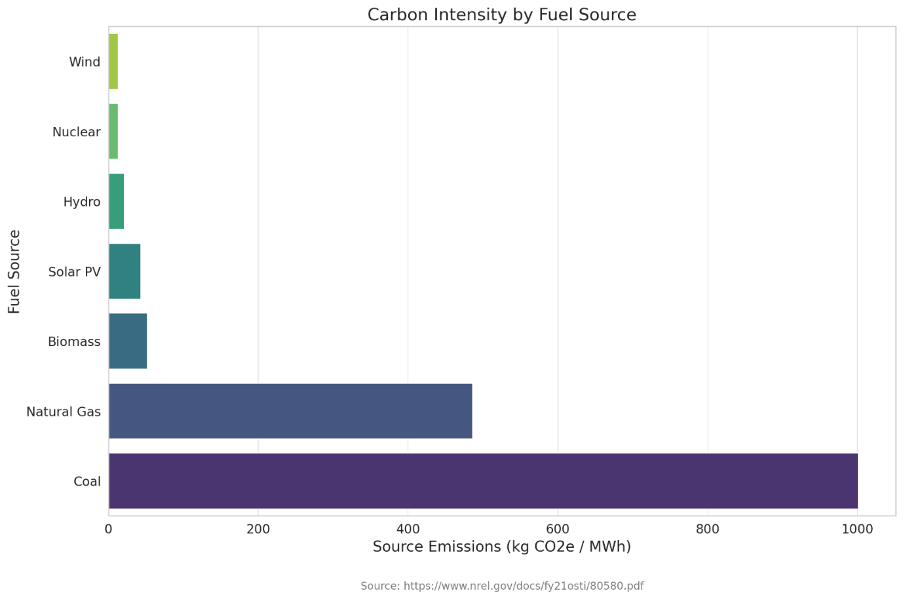

Our study used ‘cradle to grave’ figures of various energy sources provided by the USA’s National Renewable Energy Laboratory (NREL). These account for the amount of CO2 emissions produced across the entire life cycle of, for instance, a solar panel or lump of coal and the plant using it to generate energy.

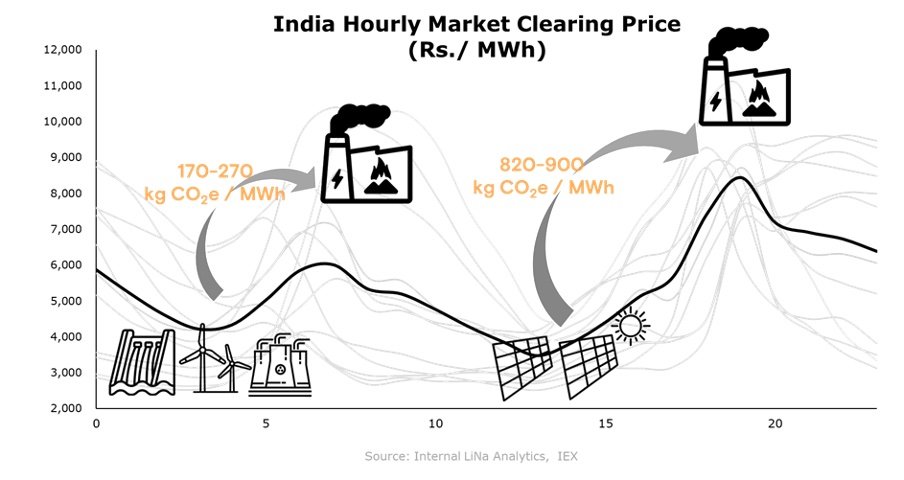

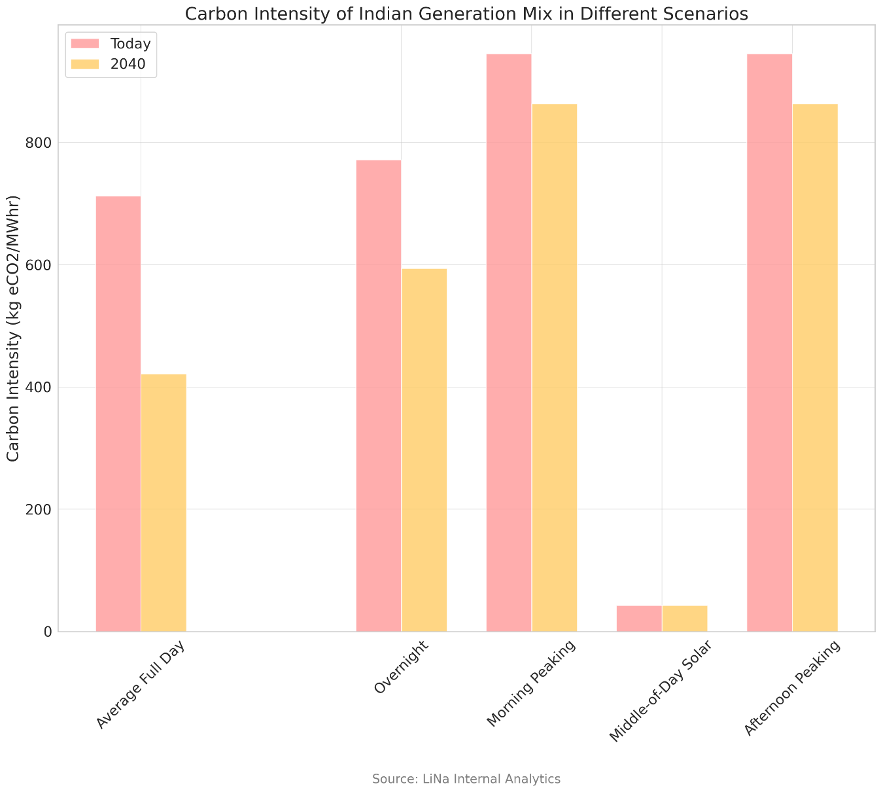

Currently, an 89% coal and 11% gas mix is used to meet peak demand when people in India start waking up, at a carbon cost of 946 kilograms of CO2 per megawatt hour. Improving that even slightly to the overnight fuel mix of 5% wind, 72% coal, 9% gas, 3% nuke, and 11% hydro, and storing that overnight energy ready for morning use instead of relying on peaking capacity, results in a drop in carbon impact to around 770 kilograms of CO2 per megawatt hour.

That’s a significant daily saving. If we were talking in dollars here, traders would be salivating at the prospect.

The reduction is even more drastic — to a mere 43 kilograms of CO2 per megawatt hour — if greenfield solar energy could be stored throughout the day and used to meet the evening energy demand in its entirety. This scenario is clearly a target we should be aiming for, and an effective energy storage technology to make the investment economic is key.

Our predictions take into account that the energy mix will continue to lean towards renewables — a belief backed up by pledges to decarbonise from governments worldwide.

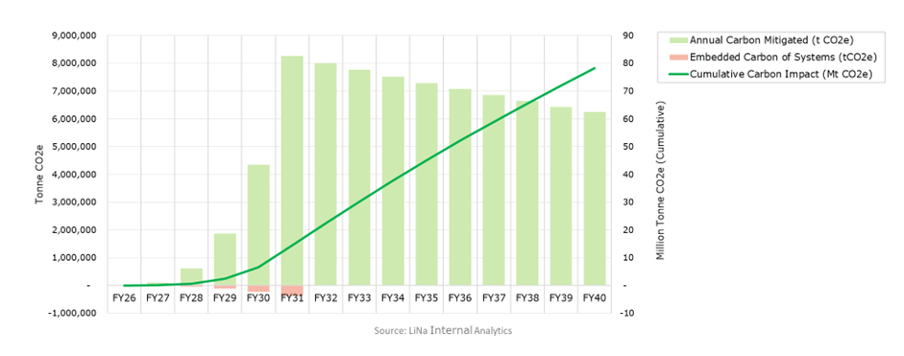

If we’re able to deliver on our mission of providing effective storage solutions to hot emerging markets like India, then with our planned deployments over the next decade we’ve calculated total net impact savings of 80 million tonnes of CO2 equivalent over their lifetimes. That’s the equivalent of taking 5.5 million internal combustion engine vehicles off the road (Ford Fiestas to be precise).

These are dizzying figures (I could spend much longer talking about them than is perhaps healthy).

In effect, we’re applying the trader’s arbitrage logic, but seeing how many kilograms of carbon we can save and not just how many dollars.

And of course, without the need to expend money burning coal— the difference in cost between maintaining solar panels versus digging up and burning coal is frankly monumental — we’ll be saving money while preserving the future of the planet too.

This will only be possible with deep tech. Without safe, resilient, and low-cost energy storage this is all just hypothetical.

The potential gains unlocked by getting this right are huge. For those whose lives are already being destroyed by accelerating extreme weather events, it’s extremely urgent too.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Yury Erofeev

Battery Tech · Mobility Tech

illuminem briefings

Energy Transition · Energy Storage

illuminem briefings

Green Tech · Carbon

Oil Price

Circularity · Battery

Electrek

Battery · Energy Sources

CNBC

Battery Tech · AI