Congress’s climate triple whammy: innovation, investment, and industrial policy

· 12 min read

Between a bipartisan infrastructure bill (Infrastructure Investment and Jobs Act [IIJA]), potentially the largest investment in American research and science in decades (the CHIPS and Science Act),* and the historic climate spending contained in the IRA, the United States is on the path to a range of technology transitions that could transform our economy to a clean energy future.

While there is still an extraordinary amount of work to do, American households and businesses finally have the tools to choose an energy future that delivers cleaner air, better jobs, faster innovation, and technological solutions we can barely imagine yet. In practice, Congress has passed legislation that strategically encourages innovation throughout the technology adoption curve; catalyzes private investment by addressing the “valleys of death” that inhibit technology transitions; and revives an industrial policy framework that encourages domestic production in critical clean energy supply chains.

Even without accounting for the unpredictable effects of faster technological innovation and political feedback, these efforts are projected to reduce US emissions by around 40 percent, compared with 2005 levels, and add $3.5 trillion in new cumulative capital investments over the next decade.

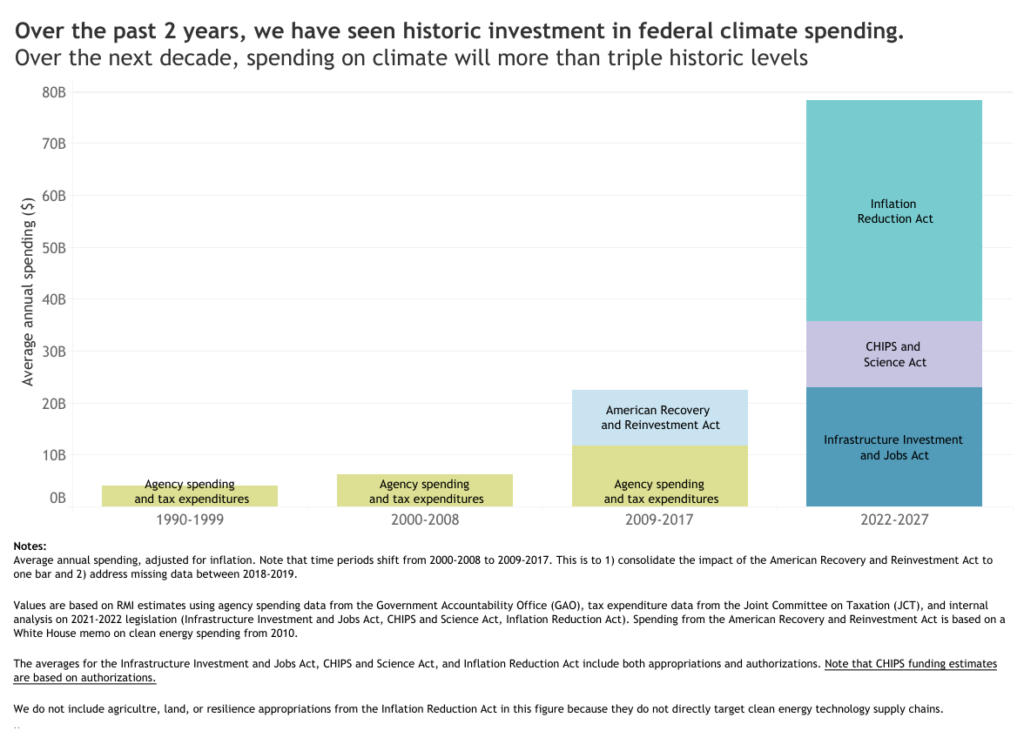

The next decade will be transformative for the technologies needed to confront the climate challenge and capitalize on the opportunities inherent in the clean energy transition. And for once, Congress is leading the way. Annual real federal spending on climate and clean energy over the next decade will likely be at least 3.5 times its level in the period from 2009 to 2017, and 15 times its levels in the 90s and early 00s, as the figure below illustrates.

While funding for the CHIPS and Science Act still needs to be appropriated as part of the budget process, this estimate of nearly $80 billion in annual spending doesn’t account for ongoing spending by federal agencies as part of President Biden’s “whole-of-government approach to the climate crisis.” In FY2021, federal agencies spent about $28.2 billion on climate change initiatives, and assuming this grows at the same rate as during the Obama administration, average annual federal spending – including agency spending and new Congressional legislation – could be as high as $114 billion, or around 5 times its levels from 2009-2017.

However, it is not just the sheer volume of spending, but its strategic application that could be transformative. In a sense, the CHIPS and Science Act is the “brains” of the operation, dedicating billions toward the cutting edge research and development needed to accelerate innovation in emerging clean energy technologies. The Infrastructure Investment and Jobs Act is the “backbone,” providing much of the infrastructure these technologies need to scale at speed. Finally, the IRA is the “engine,” driving investment growth through demand-pull measures that provide the security for these technologies to reach market maturity. Significantly, each bill is suffused with an industrial policy perspective that strategically prioritizes key industries while maintaining a technology-neutral approach.

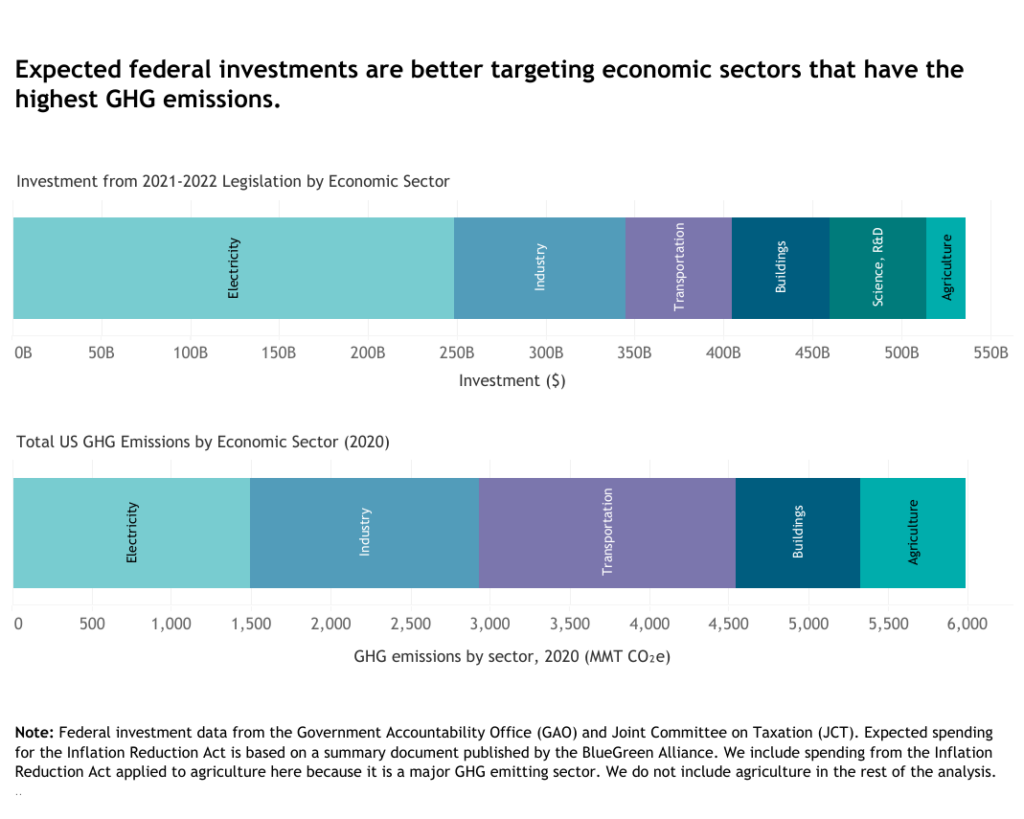

Most climate reporting has focused on how the climate spending in these bills is allocated between the economic sectors that contribute to climate change, like electricity or buildings. This is important, of course, since we need to eliminate emissions in every sector if we’re to reach net zero. Historically, there has been a disconnect between federal funding and emissions, but the policies of the 117th Congress show this is changing. For example, 30 percent of cumulative US emissions between 1990 and 2020 were from the transportation sector, yet only around 5 percent of federal climate dollars over the same period went to reducing these emissions. While we’re still a long way off parity, as the figure below shows, expected spending over the next ten years is getting closer, with 12 percent of spending going to transportation, which produced 27 percent of annual GHG emissions in 2020.

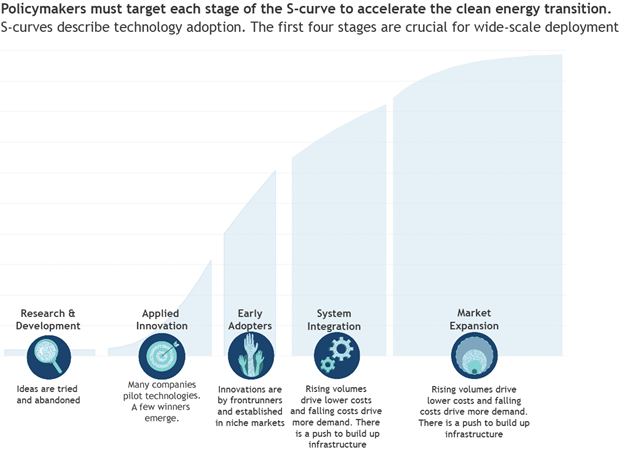

Even more important than where funding is allocated by sector, is when it is allocated in the technology adoption curve. The effects of climate change are a function of which technologies we use and how much we use them. We use technologies to meet an end and we decide which technologies to use based on what is cheap, abundant, and sustainable. This means that cleaner and greener alternatives must hit the market, at scale, and fast.

To be a little more precise, the transition to any new technology, including clean energy alternatives, typically occurs in phases, which are commonly represented in an S-Curve of technological adoption over time. The figure below briefly explains these phases and RMI’s Wayfinder website has more detail. The critical takeaway here is that if policymakers are to accelerate this process of technological transition, they need to create solutions targeted to each of those phases.

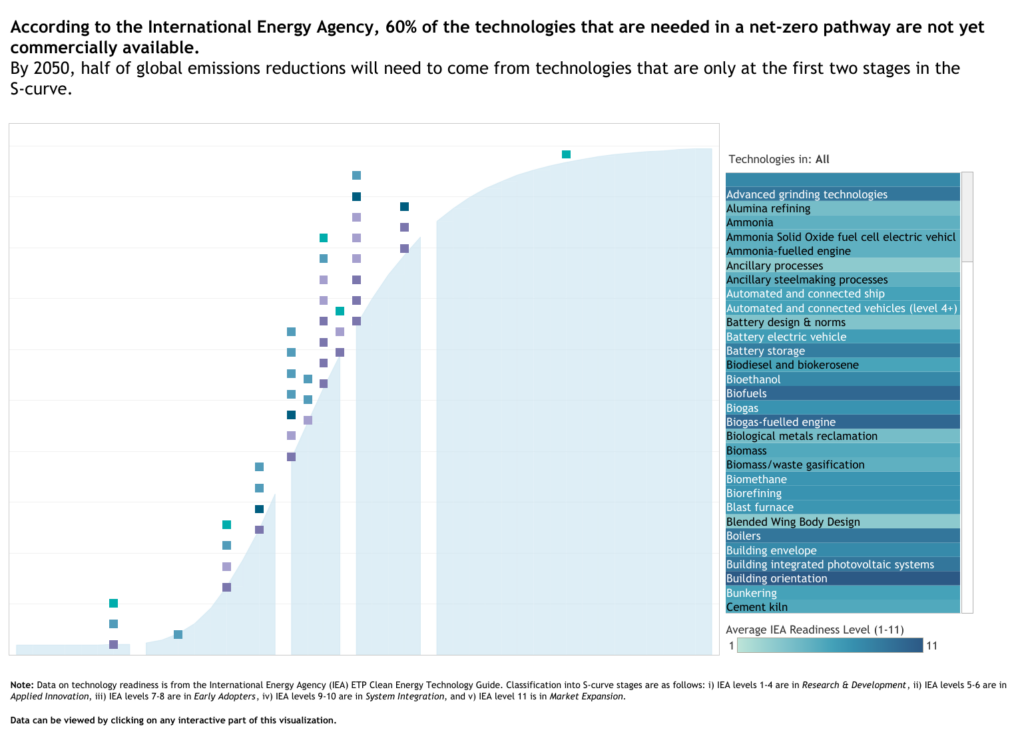

The International Energy Agency lists over 400 technologies that need to be dominant market leaders for the world to align with its net-zero pathway. However, 60 percent of these are not yet commercially available. By 2050, half of our emissions reductions are likely to come from technologies that are only prototypes or demonstration projects today. The interactive figure below provides an estimate for where clean energy sectors are today along this S-Curve, using the average “technology readiness level” of all technologies within each sector – clicking on a sector box will show the Readiness Level for individual technologies.

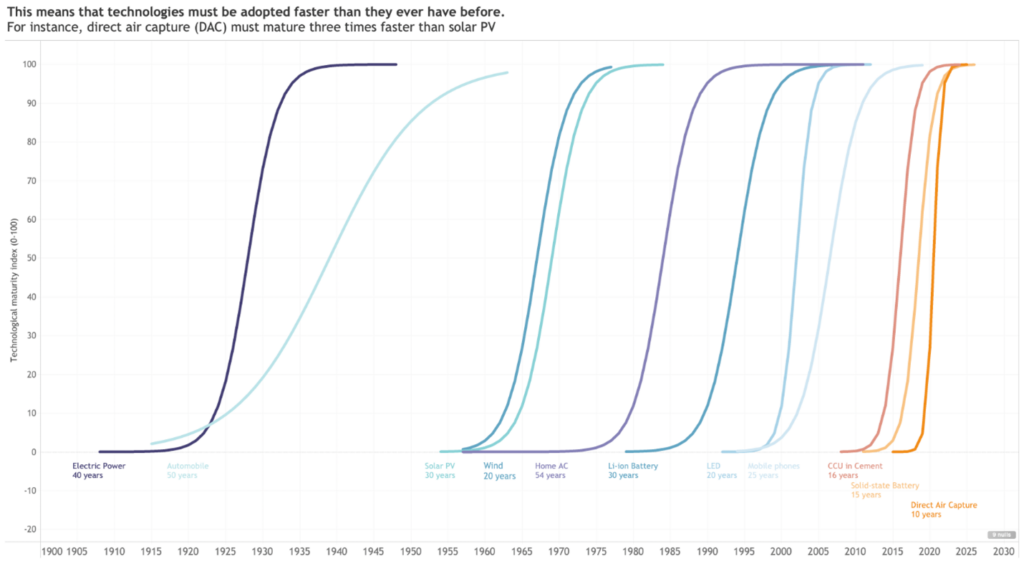

What’s more, policy needs to incentivize technology transitions at speeds we’ve never seen. Hydrogen and direct air capture, for example, need to go from prototype to market maturity in the span of a decade, when it took solar PV 30 years to go through its own transition. The figure below shows simplified pathways of historical and ongoing technological transitions to illustrate how unprecedented such speed would be. Further, this innovation process is not linear — as historical cases show — many technologies are likely to regress backward or fail altogether. The public policy approach, therefore, needs to be “entrepreneurial,” in the sense of encouraging failed attempts and embracing risks that are untenable for private capital funders. Without the ability to learn from failures, these hiccups along the way will slow innovation and postpone the adoption of the solutions we need.

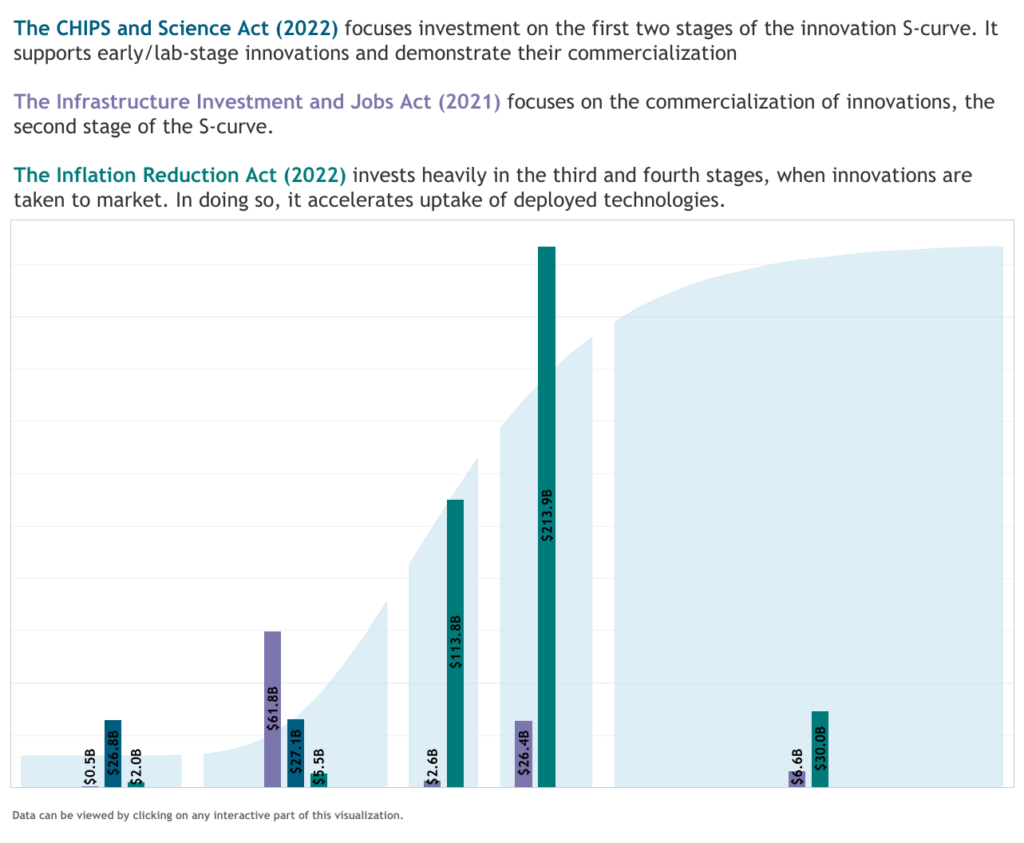

What’s so striking about the climate legislation enacted during the 117th Congress is how closely it has followed this advice. The provisions in the three bills invest throughout the adoption curve, encourage innovation at break-neck speed, back multiple technological solutions, and embrace risk. The figure below shows the total spending of all climate-related provisions in the three bills, categorized by their expected impact along the S-Curve of technological adoption. As one might hope, spending is concentrated in the first four phases, where private markets are less likely to invest in research, development, demonstration, and early commercialization.

By and large, the CHIPS and Science Act ($54 billion in total climate-related authorizations) focuses on the first two stages of the adoption curve, supporting not only basic energy research but also a series of programs designed to help researchers commercialize their ideas, such as additional funding for the Advanced Research Projects Agency – Energy (ARPA-E), and establishing a new Directorate for Technology, Innovation, and Partnerships at the National Science Foundation.

Importantly, this $54 billion reflects Congressional authorizations, not appropriations, meaning Congress still needs to approve funding in budget negotiations. Already, the Biden Administration’s FY2023 budget request for clean energy RD&D would be a 25% increase over FY2021 enacted levels, and it is likely that CHIPS authorizations will encourage Congress to continue along that growth trajectory.

The IIJA ($98 billion) picks up where CHIPS leaves off by investing billions in applied innovation, mostly through grant funding for clean energy demonstration projects, but also by supporting the connective infrastructure and supply chains needed to scale quickly. To accelerate the early adoption and system integration of these technologies, the IRA ($362 billion) then provides a hefty demand signal through a range of new and expanded tax credits, among numerous other climate-related provisions.**

Together, these three bills signal that “[t]he era of passive, hands-off government is over.”

In addition to supporting technology innovation within these phases, policy solutions should be focused on helping technologies cross the “valleys of death” that exist between each phase of their transition to mass adoption. It’s hard enough coming up with a new technological solution, but turning that idea into a prototype or that protype into a commercial business opportunity requires a totally different set of skills and an entirely new network of stakeholders. These valleys of death are typically where both public and private funding has been in short supply and why public policy can have an outsized impact that helps catalyze the forces of private investment.

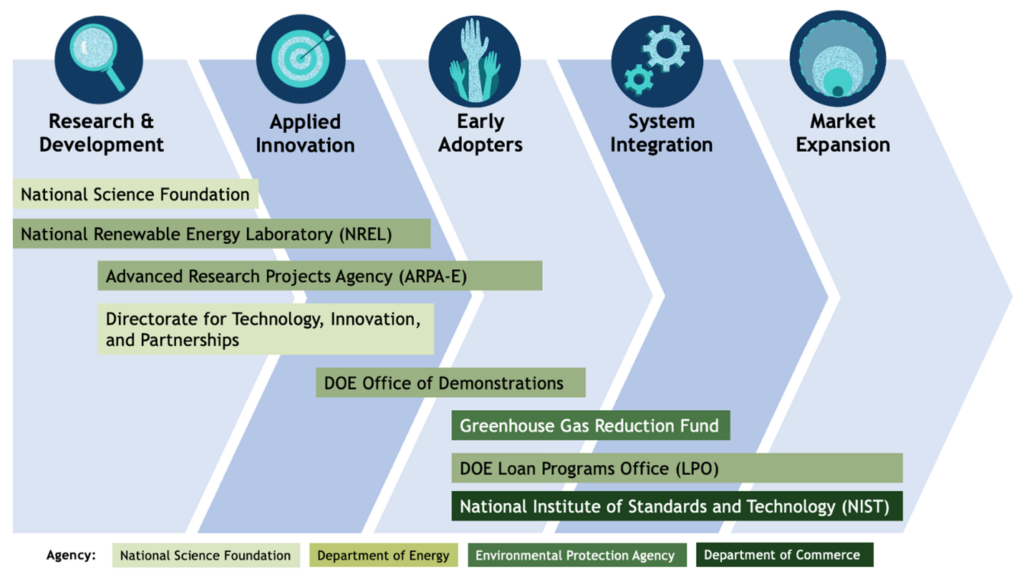

As the graphic below illustrates, the clean energy innovation chain now has one or more organizations dedicated to navigating the complex process of transitioning from one phase to the next, crossing each valley of death in turn. Improved capacity in these institutions not only makes it more likely the United States will see rapid advances in novel technologies over the coming decade, but that private entrepreneurs, developers, and investors are better positioned to turn these innovations into widely used, economically competitive products.

While some of these agencies are new — such as the Directorate for Technologies, Innovation, and Partnerships, and the DOE Office of Demonstrations — many build off the successful models of catalyzing private investment that came out of the Obama administration. This includes ARPA-E, sometimes called the “model innovation agency” for its particular success among government agencies and within the DOE in commercializing novel technologies.

Former President Obama also launched DOE’s Loan Programs Office (LPO), which receives a huge boost from this legislation. The LPO famously provided an early loan to Tesla, now the world’s most valuable car company, and loan guarantees to the first five utility-scale solar projects in the country, helping launch a new, multibillion dollar industry. While the $27 billion Greenhouse Gas Reduction Fund, created in the IRA, is technically a new initiative, it will likely be used to help scale the existing 21 sub-national green banks around the country (and possibly get several more off the ground), which have catalyzed over $7 billion in private investment through innovative financing mechanisms and flexible products.

For many, including key Biden White House advisors, these bills also represent the return of industrial policy to Congress, building on ideas that have underpinned American economic policy since Alexander Hamilton. Also described as a “strategic-industry competitiveness” framework, this legislation collectively emphasizes the critical role of certain clean energy industries, and in particular, the importance of localized manufacturing and secure global supply chains.

Recent supply chain volatility in response to global instability has highlighted the risks of “just-in-time” production and offshoring manufacturing to a select few low-cost countries. China, for example, dominates almost every facet of the solar and battery supply chains, contributing to significant bottlenecks in the deployment of these technologies in the United States; bottlenecks that are likely to last for several years.

While not all manufacturing can, or should, be reshored, the three bills contain many important provisions that will reduce US reliance on global supply chains and encourage manufacturers to invest in new capabilities where they are likely to have a competitive advantage internationally. Further, there is good evidence to suggest that locating manufacturing facilities near research labs in a healthy “industrial ecosystem” helps improve the pace of technological innovation and encourages companies to experiment more with new products and processes.

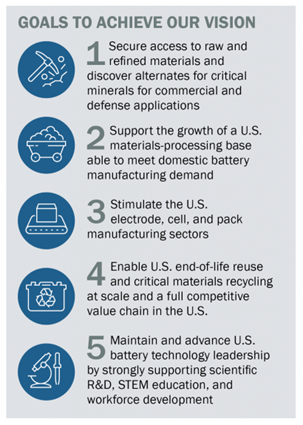

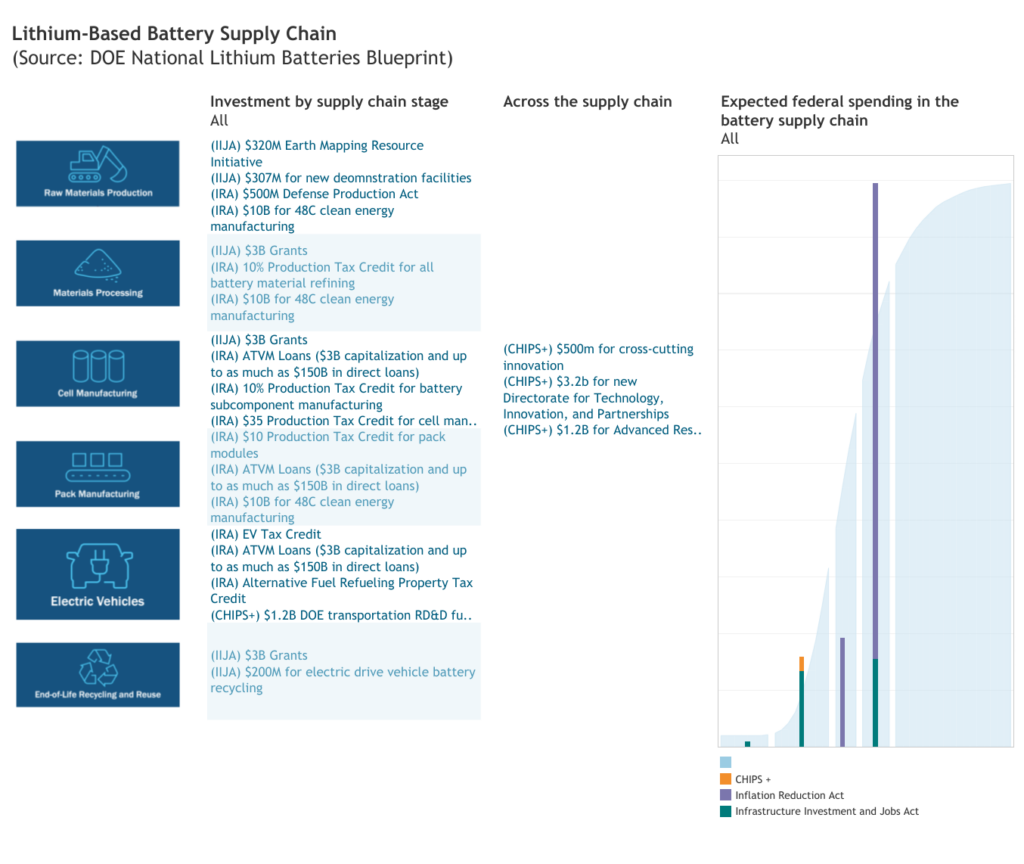

The policy mechanisms and public institutions for bolstering competitiveness and reshoring manufacturing will differ by sector. It is instructive, therefore, to focus on one, such as the electric vehicles and battery supply chain, to see how specific provisions in these bills will interact. Any good industrial policy starts with a goal, or a “mission,” and for the battery supply chain, this was laid out in the National Blueprint for Lithium Batteries last year (see Figure).

Each of these five goals and every major segment of the battery supply chain benefits from one or more provisions contained in these bills. It is this vertical coordination that indicates industrial policy in action, and is the major differentiator from the economic policies of the past forty years. As the figure below illustrates, these industrial policies include R&D funding for battery chemistry substitutes, grants for battery materials processing, battery manufacturing production tax credits, removing the cap constraining the LPO’s ability to loan to manufacturers, and demand-side credits for EV purchases.

Through the integrated efforts of these three bills, the industry now has a coherent, nearly comprehensive green industrial policy that looks likely to make US producers competitive with China, help bring forward the tipping point where EVs cost as much up-front as gas-powered vehicles, and dramatically accelerates the transition to an electrified transportation sector.

The lithium-ion battery supply chain is just one example of how the three climate bills of the 117th Congress provide the spending, incentives, and institutions for a new era in the clean energy transition. They accelerate innovation throughout the technology adoption curve; help ideas generate additional private capital at critical junctures in that process; and support key industries with an industrial policy perspective that will begin to reshore clean energy supply chains. Of course, there are a range of implementation questions, investment barriers, and regulatory hurdles that remain in the way of a smooth and accelerated clean energy transition.

No provisions in these bills work without the ingenuity of American inventors, the entrepreneurial spirit of our businesses, the dedication of public servants, the risk tolerance of our investors, or the perseverance of our people. It will be up to everyone, public and private, to leverage the tools, incentives, guidance, and funding contained within these bills. It’s going to be hard, but it’ll be worth it.

Time to get to work.

*Most of the spending in the CHIPS and Science Act represents authorizations to spend a certain amount but are not budget appropriations, which provide funding. Congress will need to vote each year to deliver the amounts promised in these authorizations.

**The Inflation Reduction Act includes appropriations for agriculture, land, and resilience, but we do not include these in our analysis as they do not target clean energy technology supply chains.

This article is also published by RMI. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Oil & Gas · Ethical Governance

illuminem briefings

Climate Change · Insurance

illuminem briefings

Labor Rights · Climate Change

The Guardian

Power Grid · Climate Change

NPR

Climate Change · Public Governance

BBC

Biodiversity · Climate Change