Climate unicorns: the myth becoming a reality

· 6 min read

Counting unicorns does not sound a task for serious financial analysts.

Even in the business context, the idea of a unicorn – a privately-owned company valued at over a billion dollars – may be perceived as too arbitrary to have any meaningful significance.

But a new breed of unicorn is emerging that should draw attention: the climate unicorn, a billion-dollar company designing solutions to combat climate change.

For those familiar with the term, unicorns typically draw connotations with software start-ups incubated in Silicon Valley that operate smartphones and social media platforms. Much less so asset-heavy companies located in industrial parks across the world’s manufacturing hubs, a much more common profile in the land of climate unicorns.

For now, they remain a rare species, but they’re backed for a bright future by some. Including BlackRock’s CEO:

"It is my belief that the next 1,000 unicorns […] won’t be a search engine, won’t be a media company, they’ll be businesses developing green hydrogen, green agriculture, green steel, and green cement."

When this statement was made by Larry Fink in 2021, such businesses were few and far between.

Yet two years on, Fink’s fantasy is slowly materializing. A millennium of climate unicorns will almost certainly emerge. However, the profile of the current population is far less colourful than the institutional investing guru describes; and, unlike the mythical type, the life of a climate unicorn is certainly not always full of happily-ever-afters.

Slowly but surely, climate unicorns are gathering momentum.

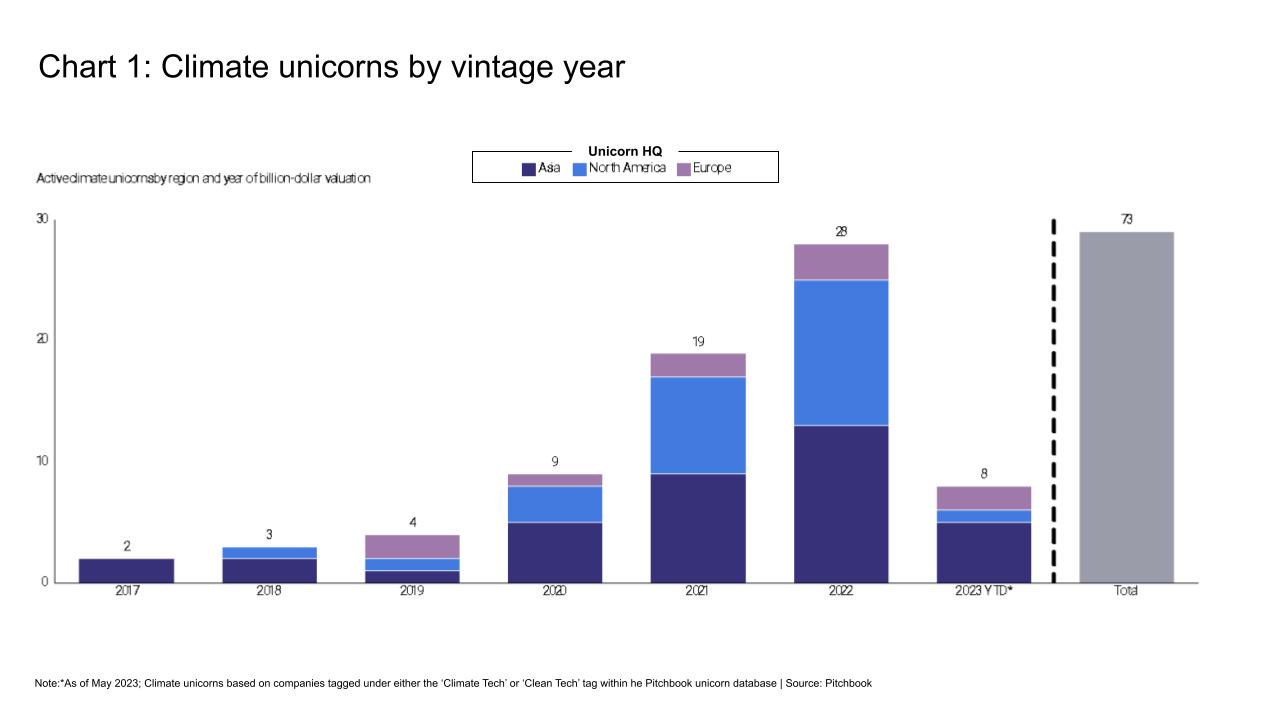

At present, there are 78 active unicorns with a link to cleantech or climate tech, according to investor analytics firm Pitchbook. This represents a combined valuation of over $200 billion. Even amidst difficult financing conditions, the first five months of 2023 have seen eight climate unicorn births.

At the current rate, this year will likely not match the 28 climate unicorns that emerged during 2022. But what is significant within the context of the wider tech landscape is the growing proportion of new climate unicorns within the overall unicorn cohort. So far in 2023, this share is 31%, compared to just 6% in 2019.

Depending on the macro-economic climate, it is not unrealistic to think we could see a century of active climate unicorns by the end of 2024. Whilst Fink's millennium seems further on the horizon, the last two years have seen a tripling of new climate unicorns.

At that growth rate, that would see number one thousand emerge just before 2030.

Yet, so far in the tale of the climate unicorn, growth in numbers has not been met by growth in variety. This is true both at the sector level and at the region level.

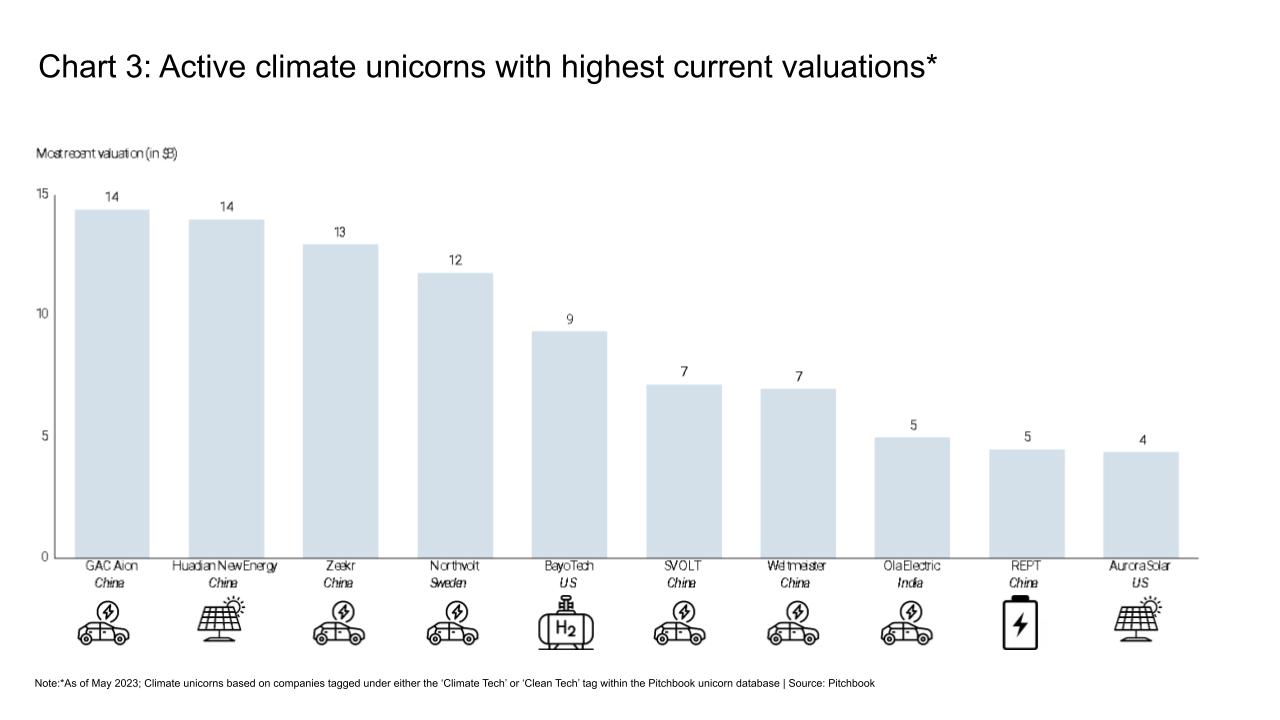

Of the current climate unicorn cohort, 60% are active in two sub-sectors. Firstly, clean mobility, with the group led by a series of Chinese EV OEMs, including GAC Aion and Zeekr, valued at $14 billion and $13 billion respectively. Secondly, renewable energy, where Chinese solar and wind developer Huadian New Energy leads the herd with a $14 billion price tag.

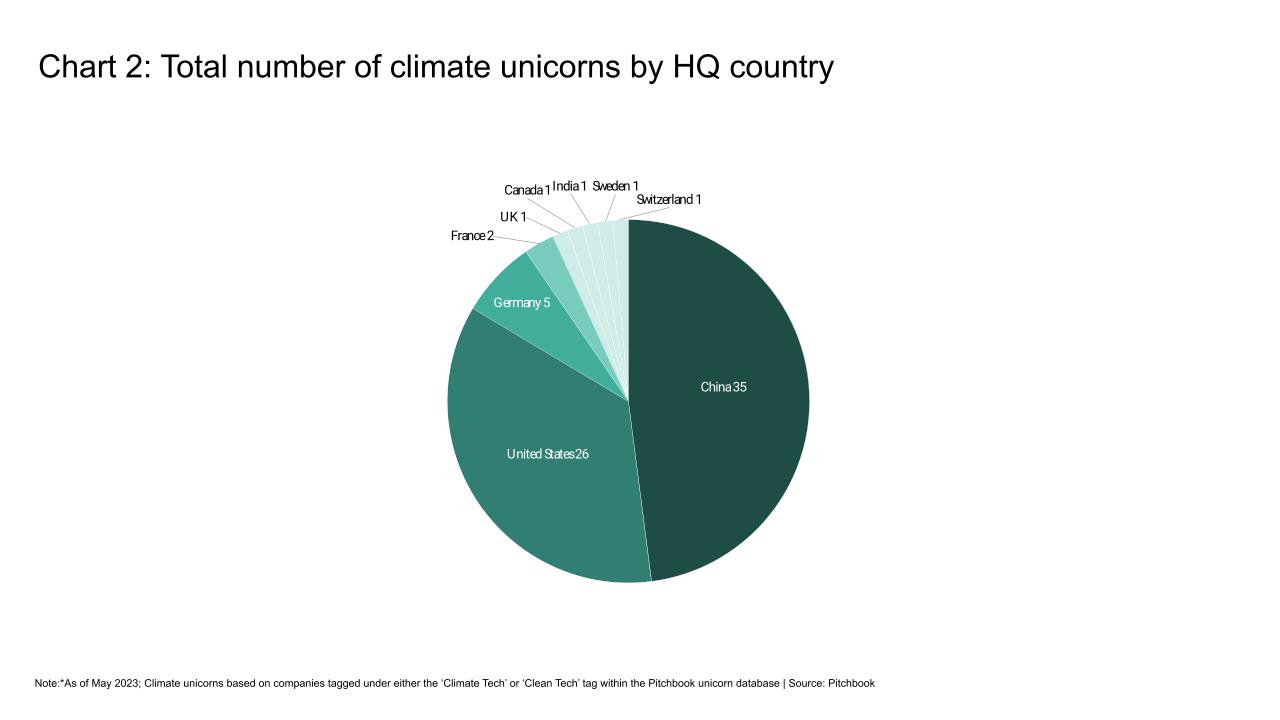

This limited geographical diversity among the big hitters is reflected across the wider group. Chinese companies represent 55% of the combined value of global climate unicorns. A further 27% is based in the US, home to companies such as hydrogen equipment developer Bayotech and Aurora Solar. There is little evidence of this dynamic shifting: the pair host 24 out of the 28 unicorns born in 2022.

Beyond the Sino-American axis, the climate unicorn pool is shallow. Germany and France are the only multi-company contributors. They provide five and two firms to the list respectively (this includes French photovoltaics producer Amarenco who, following a March 2023 funding round, can boast the title of the group's youngest climate unicorn). That leaves five countries - United Kingdom, Sweden, Canada, India, and Switzerland - who each provide a single entity to complete the list.

This lack of diversity reflects the ongoing nascency of many ‘green’ markets, including those referenced by Fink. The opportunity within these markets should serve as an impetus for ongoing capital deployment into nascent but high-growth sub-sectors of the climate transition. As electric mobility and renewables are showing, the size of the prize is colossal.

The focus so far has been on 'active' unicorns, those both valued at $1 billion and under private ownership. A more holistic appraisal of Fink's prediction requires considering two more subsets.

Firstly, the ‘post-unicorns', Billion-dollar companies now listed on public stock exchanges, therefore not meeting the privately-owned criterion. An afterlife in the public markets - with much more rigorous and real-time scrutiny from investors – has shown to be both lucrative and perilous for unicorns.

American EV manufacturer Rivian has seen both sides. After the company’s IPO in November 2021 resulted in a market valuation of $65B, the title of 'unicorn' almost seemed an insult. However, turbulent equity markets and supply-chain lawsuits have since popped the Rivian bubble, seeing its valuation tank to below $15B.

Secondly, the ‘ex-unicorns': those who hit the billion-dollar benchmark before declining into insolvency.

The most recent slain unicorn in Pitchbook’s database is BritishVolt. Lauded as the future of the UK automotive industry, the UK-based start-up planned to produce 30-gigawatt hours of batteries per year, powering hundreds of thousands of cars. However, difficulties securing investment forced BritishVolt into administration in January 2023, leaving behind the eerily empty Gigafactory that it was hoped would employ 3,000 individuals in North-East England.

Admittedly, there may be a faint pulse left in this ex-unicorn: it was subject to a distressed takeover by Australian auto manufacturer Recharge Industries in February 2023. However, at a reported purchase value of just £8.6 million, BritishVolt is a shadow of its former size.

This speaks to an important lesson not quite consistent with children's storybooks: unicorns are not immortal.

Fink will just have to hope there are enough fair maiden investors around to keep a thousand of them safe!

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Aaron Bruckbauer

Pollution · Greenwashing

Jonathan Lishawa

AI · Energy Transition

Glen Jordan

Sustainable Lifestyle · Sustainable Living

Carbon Herald

Carbon Removal · Corporate Governance

Fibre2Fashion

Carbon · Fashion

Australian Financial Review

Carbon Market · Agriculture