Climate investing: Myths, realities, and decarbonising the economy through private equity

Dall-E

Dall-E Dall-E

Dall-E· 7 min read

The Intergovernmental Panel on Climate Change (IPCC) has been warning us since the 1990s about the urgency of addressing climate change. Today, climate crises and catastrophes frequently make headlines. Despite global challenges like COVID-19, inflation, and geopolitical tensions, climate action cannot be sidelined. In this Q&A, the author addresses key questions to explore the myths and realities of climate investment and outlines Tikehau Capital’s approach to decarbonisation.

I believe this is a common misconception. While innovation can help, we already have the necessary tools to reduce emissions significantly. Measures like insulating buildings, electrifying transport and generating lowcarbon electricity are achievable today with existing technology. What’s needed is large-scale implementation, which requires engineering, manufacturing and local labour, rather than waitingfor a breakthrough technology.

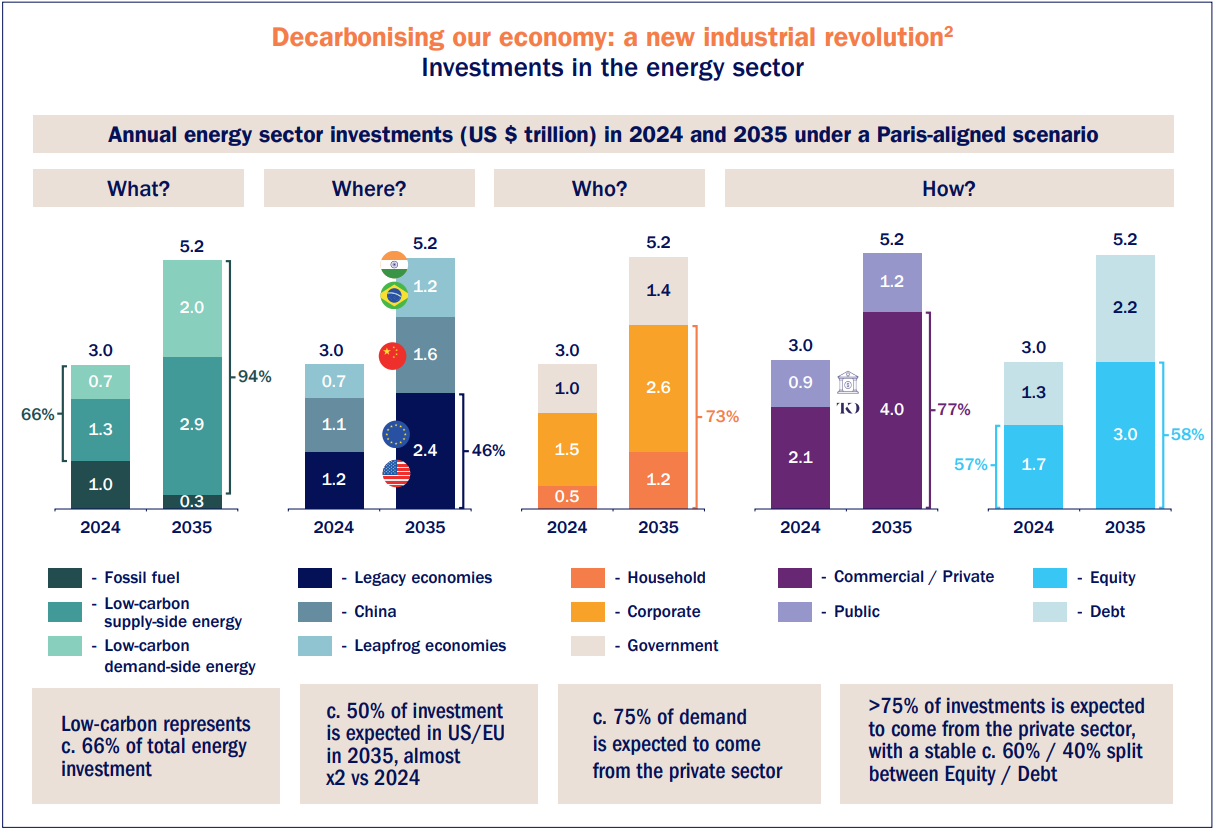

No, in my opinion, this idea is outdated. In 2023, investments in low-carbon energy exceeded $2 trillion1, more than doubling what’s spent on fossil fuels and surpassing 2018’s decarbonisation investments. I believe this shift is comparable to the Industrial Revolution and is expected to grow, with projections indicating that two-thirds of energy spending will go toward low-carbon solutions in the next decade.

Blaming emerging economies misses the point. Historically, Europe and the U.S. are the largest cumulative carbon emitters. While China is a significant contributor, it mostly produces goods for Western markets. The immediate focus should be on reducing the carbon footprint of existing assets in developed countries, as this is where most decarbonisation investments are already directed.

I believe it's a misconception that decarbonisation needs huge government subsidies. Currently, fossil fuels receive more subsidies than renewables. The private sector is already driving 75% of decarbonisation demand2, with corporations investing due to the economic benefits—energy security and cost reduction—rather than just environmental concerns. Decarbonisation makes financial sense in a world where fossil fuel production is in decline.

Counterintuitively government funds are not the primary source of financing. Private sector investments account for three-quarters of low-carbon investments. Companies are investing in decarbonisation because it aligns with their profitability objectives. Equity funds and debt financing are critical in supporting businesses’ carbon footprint reductions, showing that sustainable practices can be financially rewarding without government intervention.

Geopolitical tensions are not a barrier; in fact, they could be accelerating the shift to decarbonisation. For example, the war in Ukraine revealed Europe’s dependence on fossil fuel imports, spurring efforts toward energy sovereignty. In the U.S., domestic fossil fuel production supports decarbonisation and energy exports, while China is reducing reliance on oil and gas through electrification. Geopolitical instability is pushing nations toward low-carbon energy solutions.

I think the true barriers are workforce shortages and critical mineral availability. Decarbonisation requires a large, skilled workforce for electrification, retrofitting and infrastructure projects. Additionally, critical minerals like copper are essential for the transition and increasing production is slow and costly. These factors present significant challenges to a rapid transition.

Moving forward requires practical action based on feasibility, not hopeful promises. The transition from fossil fuels to electricity is a shift from mining fossil fuels to mining critical minerals. To succeed, circular economic models are vital, as the planet’s limited resources require sustainable practices.

While the transition is difficult, it is achievable with grounded, practical steps to address workforce shortages and mineral supply issues.

In this evolving landscape, asset managers like Tikehau Capital have a pivotal role to play in channelling savings into investments that support the transition to a decarbonised economy.

At Tikehau Capital, we have been investing in the energy transition since 2013. Our ambition is to be a leading investor across the decarbonisation theme and to generate attractive long-term capital appreciation for our investors through a private equity investment strategy3 that will also seek to produce measurable sustainability and impact goals. Our private equity investment strategy takes a two-fold approach: (i) sectorfocused, targeting key sectors driving CO2 emissions, including energy production, industry, buildings and transportation; and (ii) solution-orientated, identifying the most impactful solutions and their key value-adding enablers and components within the value chain of those solutions, such as efficiency, electrification, lowcarbon energy & inputs and climate adaptation. We invest in companies generating €20m to €100m EBITDA across Europe and North America.

Since 2013, the firm4 has invested c. €1.9 billion in 23 companies5 focused on global electrification, energy efficiency, low-carbon energy and inputs, and climate change adaptation. This makes Tikehau Capital one of the largest private equity players dedicated to supporting companies leading the charge in decarbonising the economy.

Ths article is also published on Tikehau Capital. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

This article prepared by Tikehau Capital does not meet the legal requirements designed to promote impartial analysis. It does not constitute an offer to sell securities or investment advisory services. This document contains general information only and is not intended to represent general or specific investment advice. Communication of any document or information relating to the investment funds managed by Tikehau Investment Management and mentioned in this document is limited or restricted in certain states or jurisdictions. These investment funds may be reserved for professional and knowledgeable investors. This document is not intended to be communicated to and may not be relied upon by any person or entity in any jurisdiction or country where such distribution or use would be contrary to applicable law or regulations. This document has not been verified or approved by a supervisory authority. Past performance is not a reliable indicator of future results and targets are not guaranteed. Certain statements and forecasts are based on current expectations, current market and economic conditions, estimates, projections, and opinions of Tikehau Capital and/or its affiliates. Due to various risks and uncertainties, actual results may differ materially from those reflected or anticipated in these projections or in any of the case studies or forecasts. All references to Tikehau Capital’s advisory activities in the United States or with respect to US persons refer to Tikehau Capital North America. A decision to invest in a fund should be made only after a careful and thorough review of the documentation and after consulting with an appropriate professional. Tikehau Capital shall not be held liable for any decision made on the basis of this document.

illuminem briefings

Net Zero · Public Governance

illuminem briefings

Public Governance · Corporate Governance

illuminem briefings

Ethical Governance · Corporate Governance

Sustainable Views

Corporate Sustainability · Human Rights

Euractiv

Net Zero · Public Governance

Politico

Public Governance · Corporate Sustainability