Carbon removal market 2023 mid-year progress report

· 21 min read

illuminem briefings

Carbon Removal · Carbon

illuminem briefings

Carbon Removal · Net Zero

illuminem briefings

Biodiversity · Carbon Removal

World Economic Forum

Carbon Removal · Sustainable Investment

Carbon Herald

Carbon Removal · Net Zero

ESG News

Carbon Removal · Corporate Governance

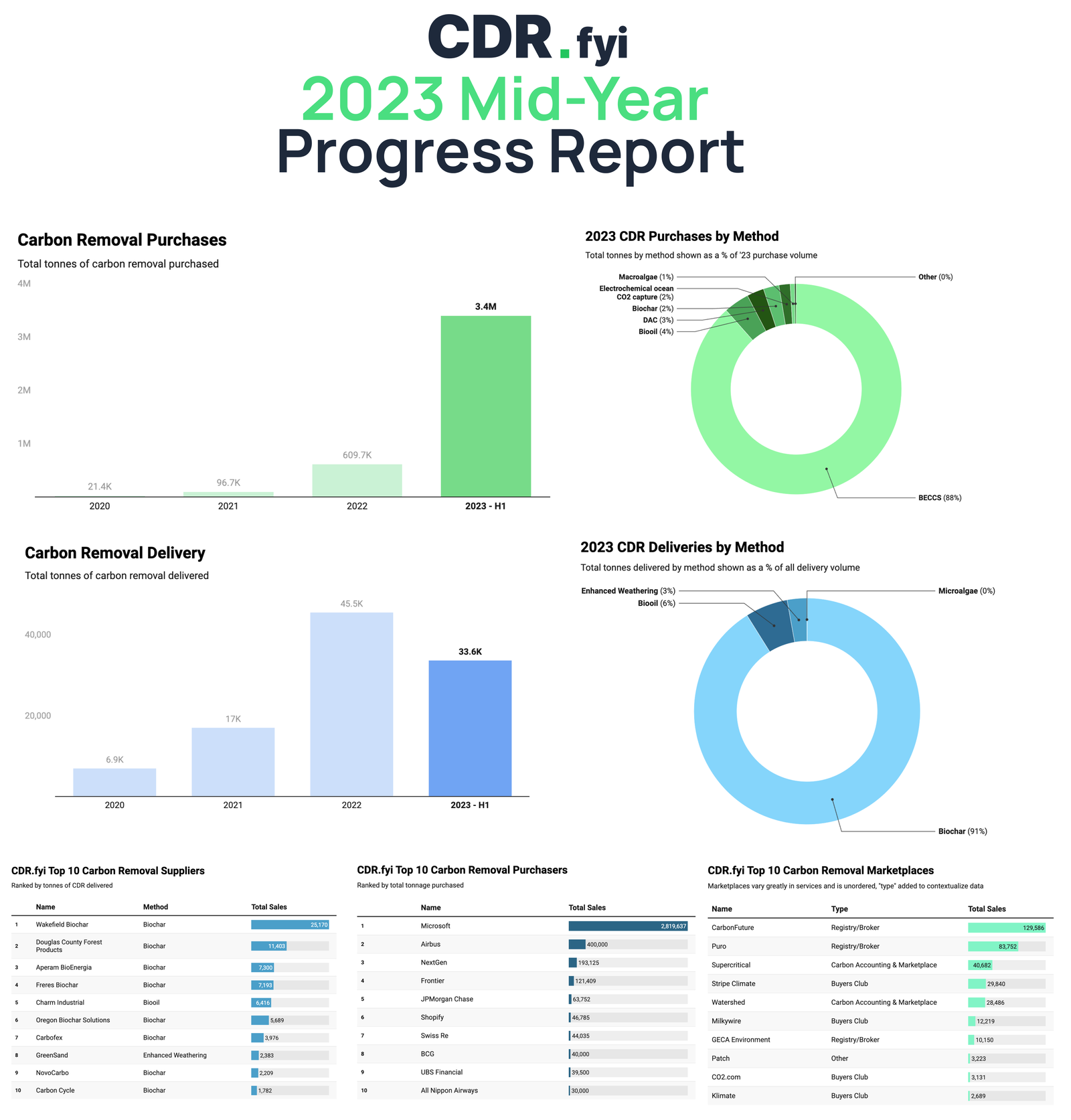

This report dives into 2023’s progress in the high-permanence carbon dioxide removal market (data cutoff: August 1st, 2023). It examines the key trends and surface insights & opportunities to accelerate the CDR market to the gigatonne-scale necessary to reach our 2050 climate targets.

Carbon Dioxide Removal (CDR) continues to scale rapidly in 2023, despite broader macroeconomic headwinds and uncertainties. While we’re excited by the progress, current transactions stand at a fraction of where we need to be in the decades to come.

Cumulatively, 4.1 million metric tonnes of Carbon Dioxide Removal (CDR) have been purchased, with only 2.6% delivered (~109k tonnes). Achieving gigatonne-scale per year of removals requires an ambitious growth trajectory — a 40–50% compound annual growth rate over the next 27 years.

While there is significant market momentum, it’s essential to recognize the larger perspective. The cumulative CDR purchases, even with this robust growth, amount to just 0.04% of the 10Gt-scale that could be required by 2050.

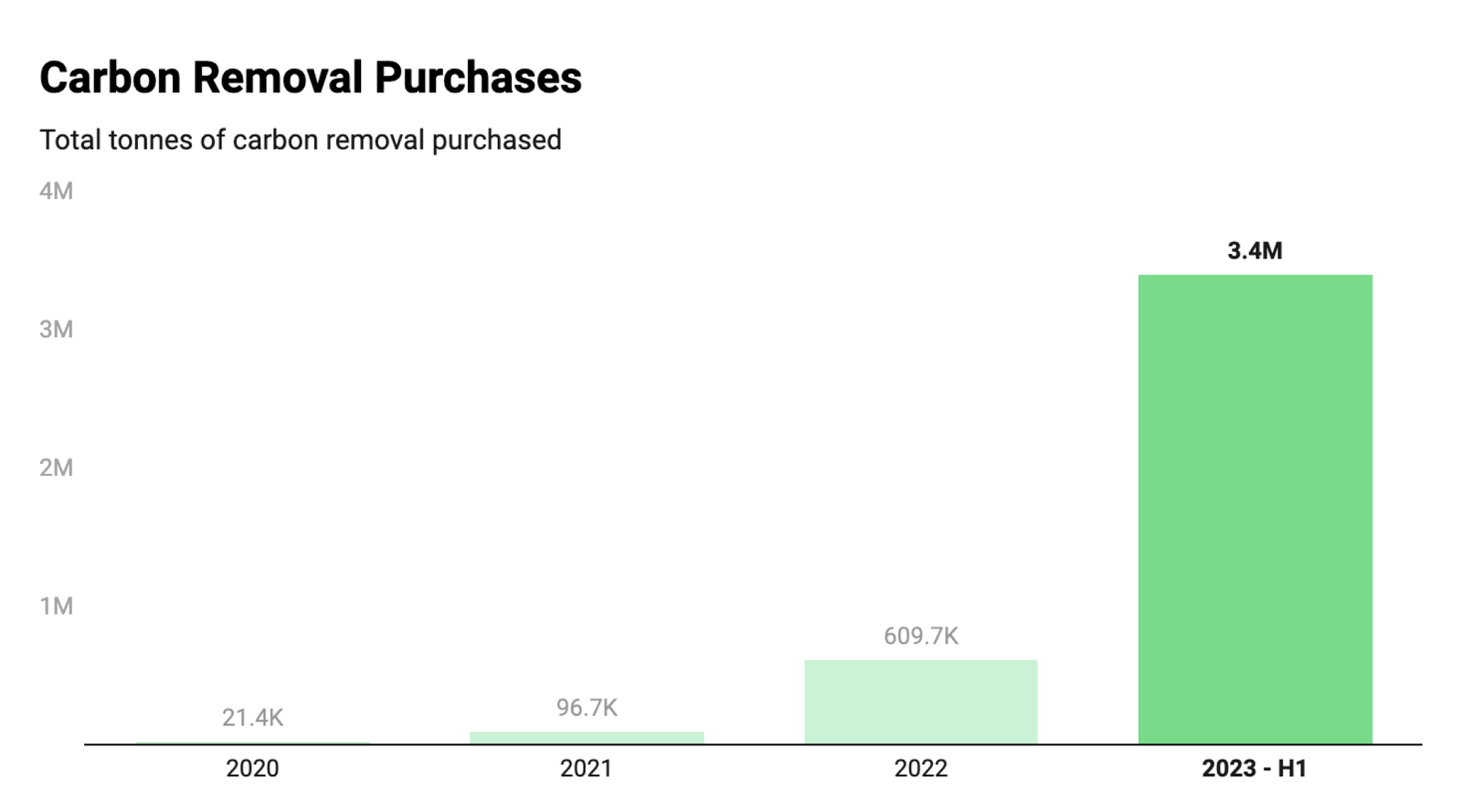

The first half of 2023 has been a defining period for the carbon removal market. Purchases soared to approximately 3,398,763 tonnes, showcasing strong growth of 5.6x compared to the full-year 2022.

Market growth is driven by a few significant transactions. Specifically, the three largest purchases account for an overwhelming 94% of this year’s total CDR purchases to date.

In May, Ørsted and Microsoft announced a monumental 2,760,000 tonne purchase of CDR. This was followed by considerable purchases by NextGen (193,125 tonnes), the Frontier<>Charm Industrial offtake agreement (112,000 tonnes), and JP Morgan’s 800,000 tonne, $200 million CDR commitment to buy from Climeworks, Charm and CO280 (the bulk of the volume is in MOU/LOI stage).

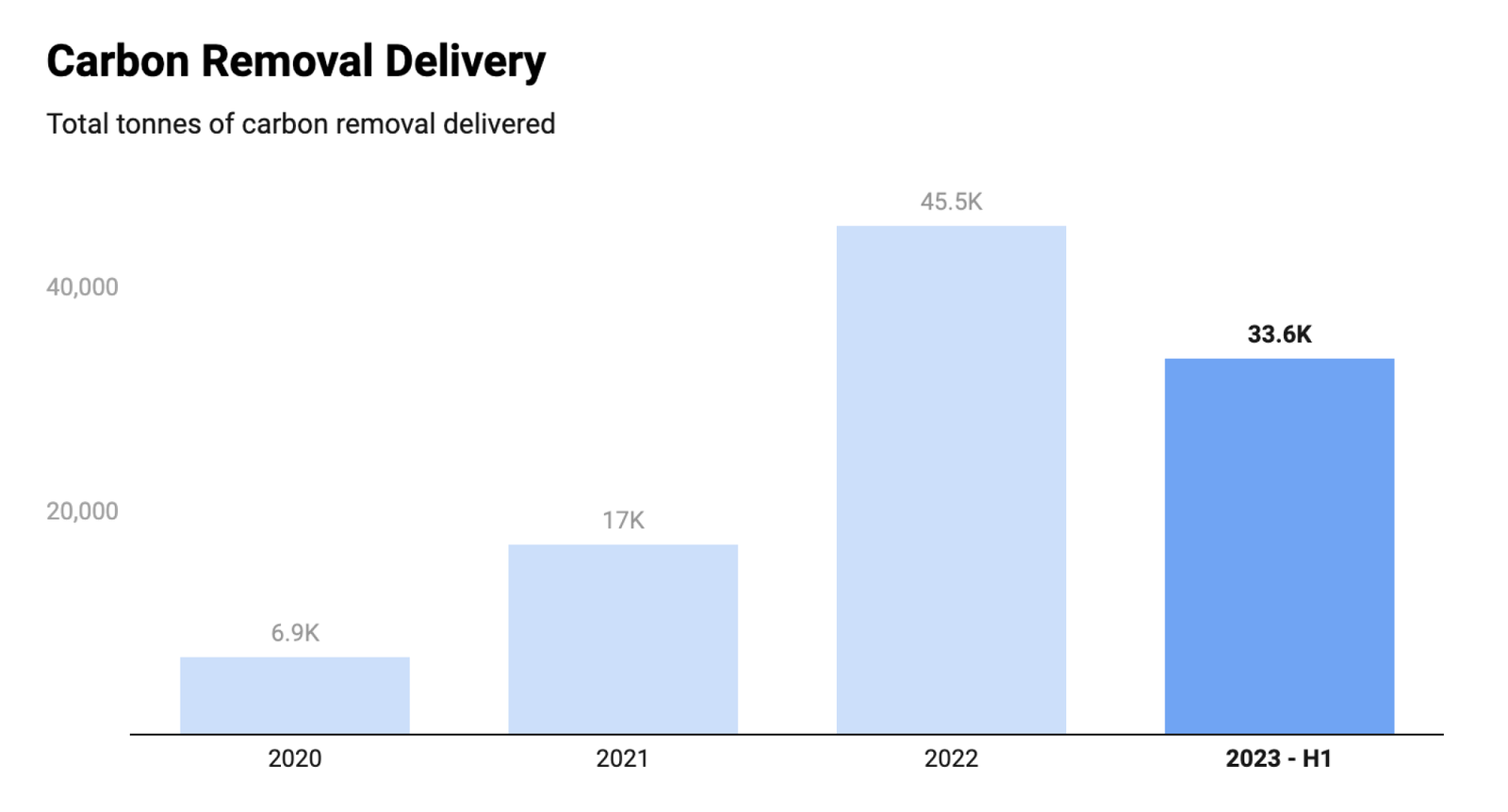

Despite the soaring purchases in 2023, the delivery of CDR lags. A total of 33,636 tonnes have been delivered in 2023, pacing slightly ahead of the same period in 2022. 21 suppliers have made a delivery this year vs 19 suppliers over the same period last year.

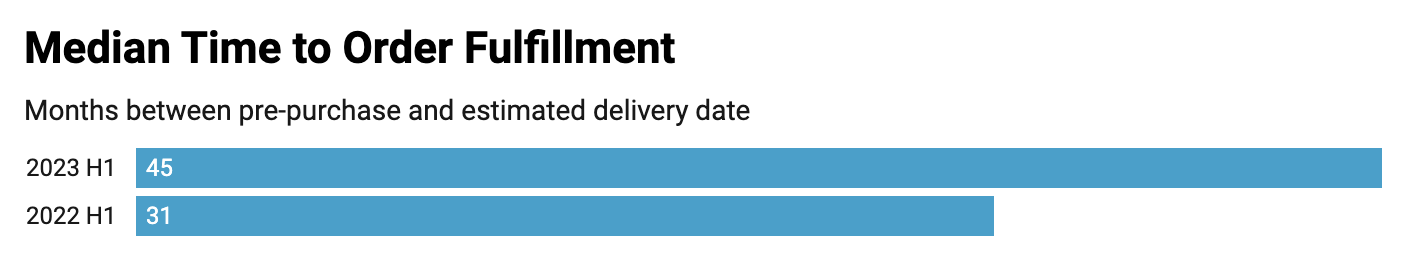

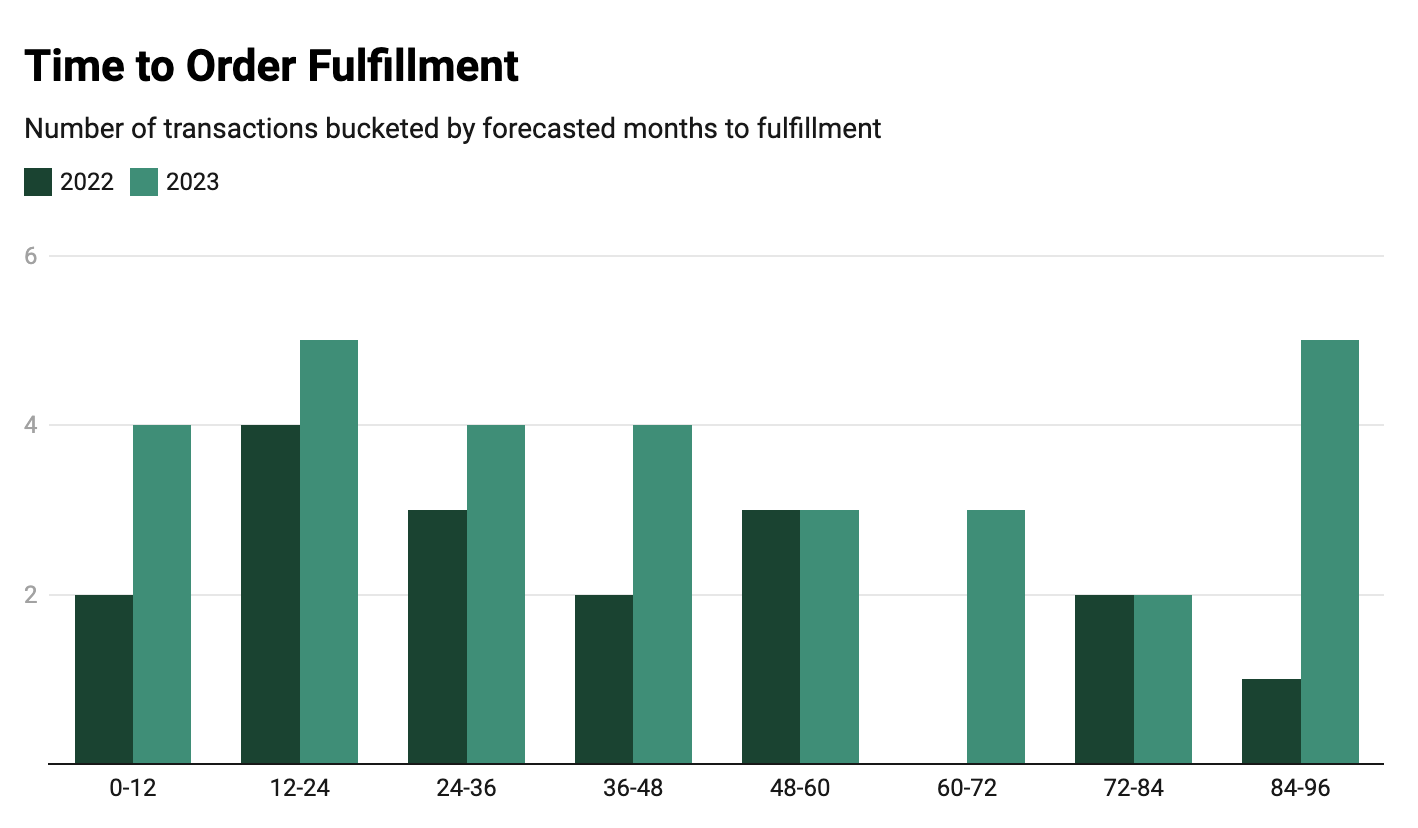

Time to order fulfillment is a measure of the length of time between the pre-purchase and the estimated delivery. In 2023, we have seen the median time to order fulfillment increase by over 14 months, compared to 2022.

This indicates two things. First, corporate buyers are demonstrating greater comfort in the length of forward deliveries. Second, it indicates that buyers are making long-term commitments to CDR and are “locking up future supply” to align with decadal decarbonize goals.

Buyers in 2023 are exhibiting more confidence in forward purchases, making orders for deliveries that are more than 5 years out. The orders are also spread evenly across the upcoming 9 years.

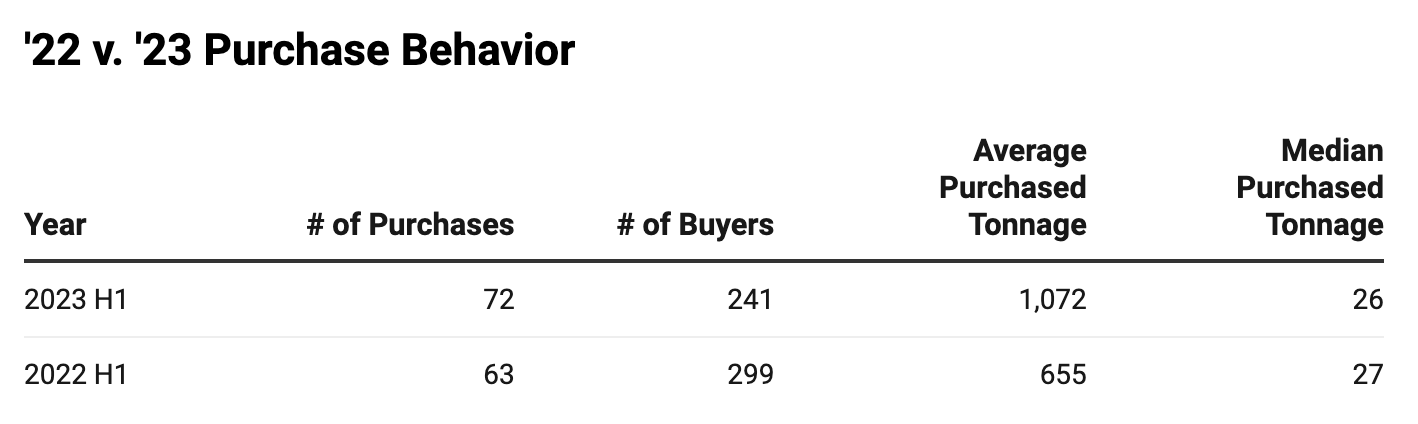

The number of purchasers grew slightly (+14%) compared to the same period last year.

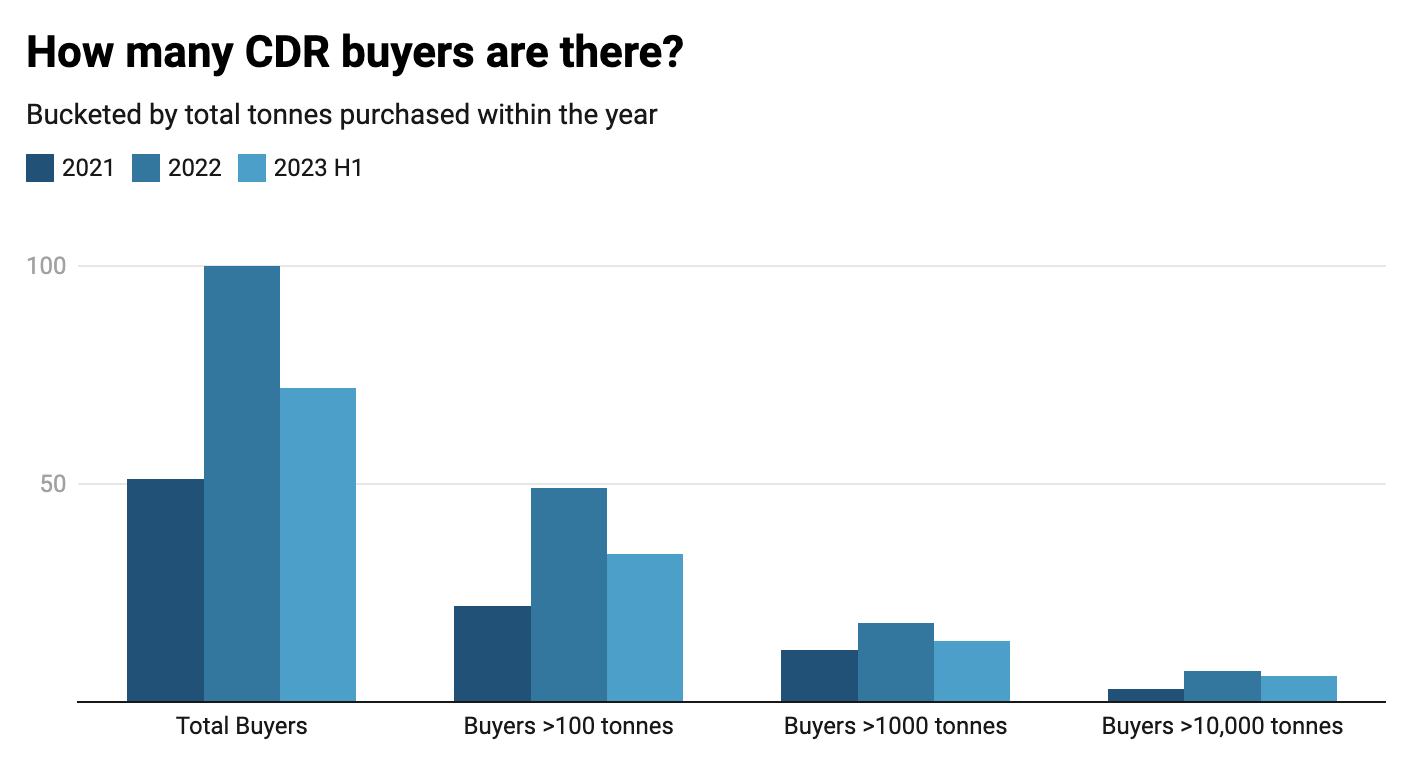

In 2021, 51 companies made a CDR purchase, in 2022 that increased to 100 and in 2023 H1 there were 72 buyers.

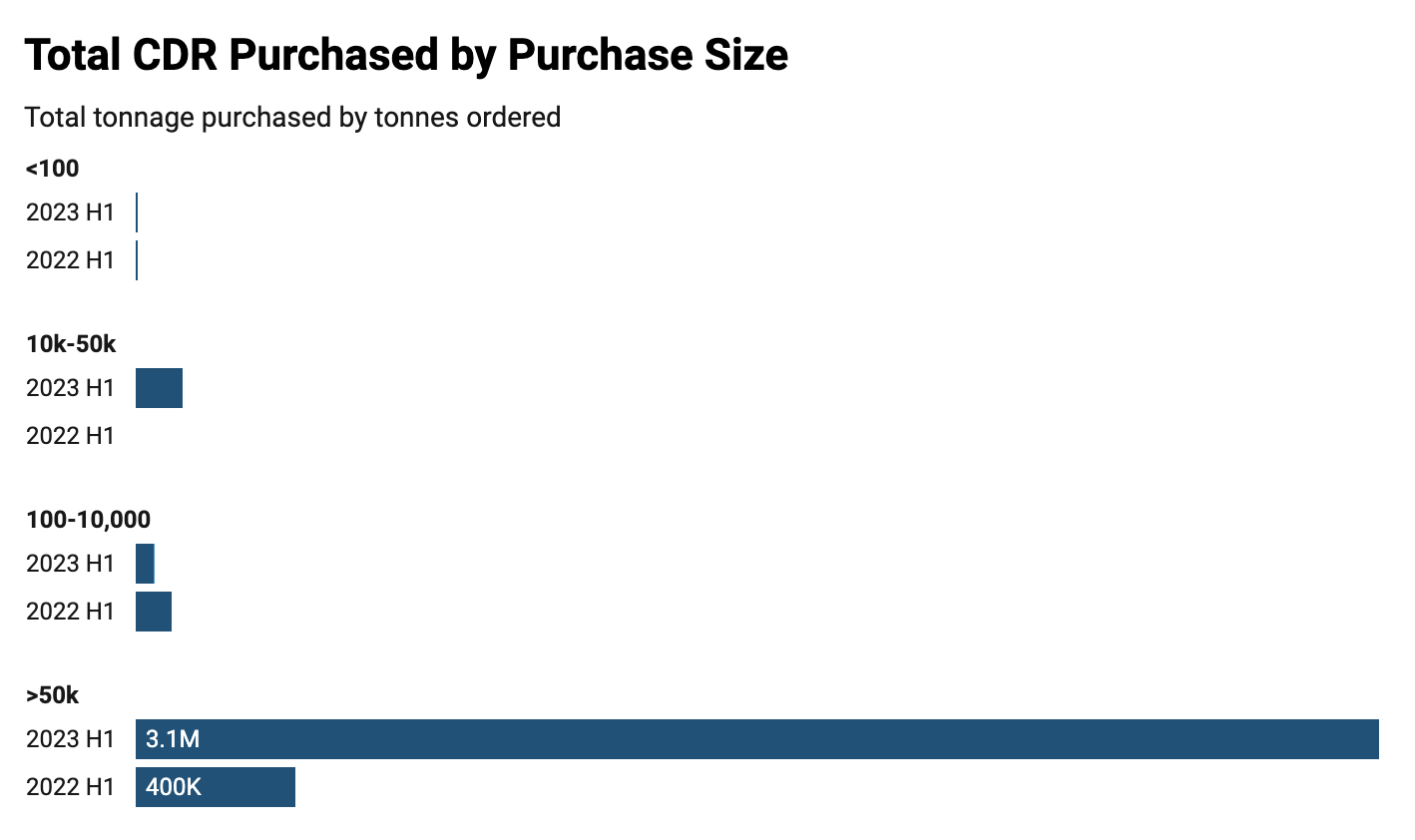

The vast majority of tonnage 2023 H1 orders were large orders — orders >50k tonnes. In total, large orders (including the Ørsted, NextGen, and Frontier-Charm deals) account for 95% of the 2023 volume.

Outside of large purchases, we still see more buyers (+19%) ordering more tonnes (+61%) compared to 2022. The vast majority of buyers are purchasing <100 tonnes annually.

The number of buyers purchasing over 1000 tonnes (still a very small amount considering corporate footprints) is low but growing. In 2022, 18 companies bought >1000 tonnes and in the 2023 H1, 14 did.

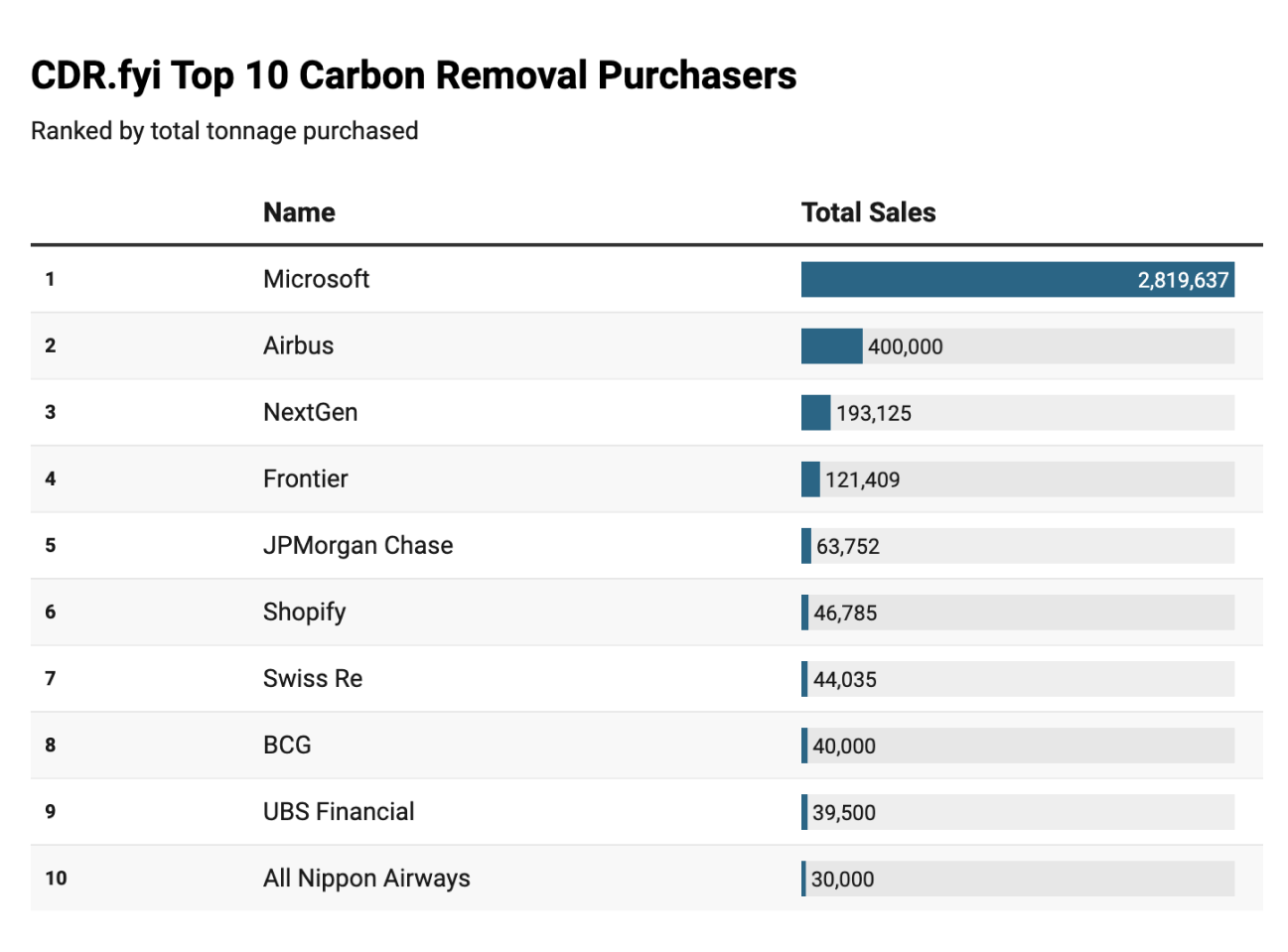

There is a core group of big buyers. The companies that have bought more than 10,000 tonnes aggregated over all years are Microsoft, JPMorgan Chase, Airbus, NextGen, Frontier, Boeing, Shopify, Swiss Re, BCG, UBS Financial, XTX Markets, Stripe, Klarna and H&M Group. Of those, only NextGen, BCG and Boeing are new large buyers for 2023. Many of these buyers are increasing the size of their CDR portfolios significantly this year.

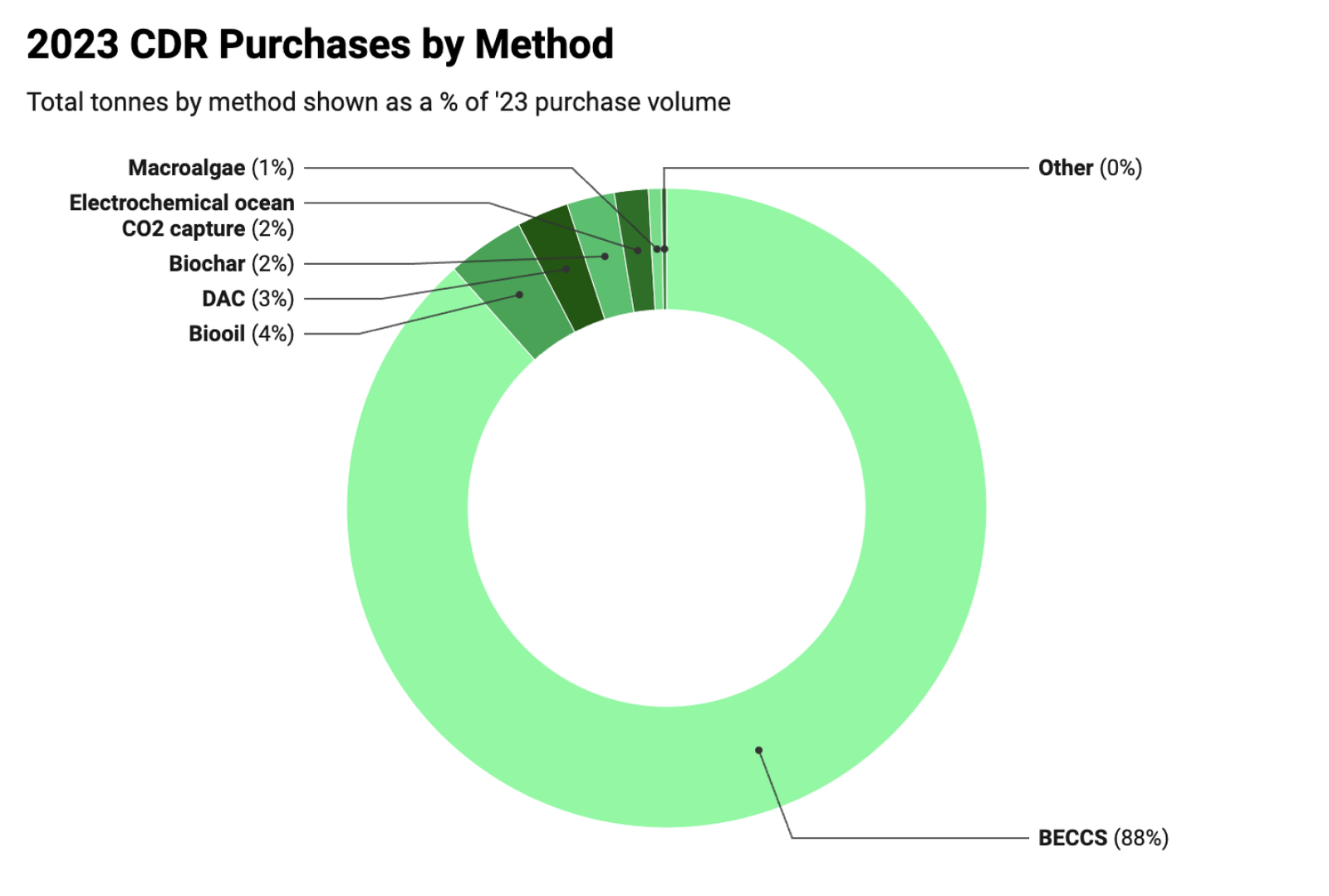

In 2023, the distribution of CDR methods showcases some shifts in method trends:

The presence of diverse methods like Macroalgae, Enhanced Weathering, and Biomass Removal, albeit with smaller percentages, suggests that the carbon removal market continues to explore and invest in a variety of solutions. Different carbon removal techniques have varying levels of scalability potential; reversal risk; future cost curves; ability to monitor, report and verify (MRV); and co-benefits. Paired with the uncertainties of early-stage technology, this dynamic encourages experimentation and a “let a hundred flowers bloom” approach.

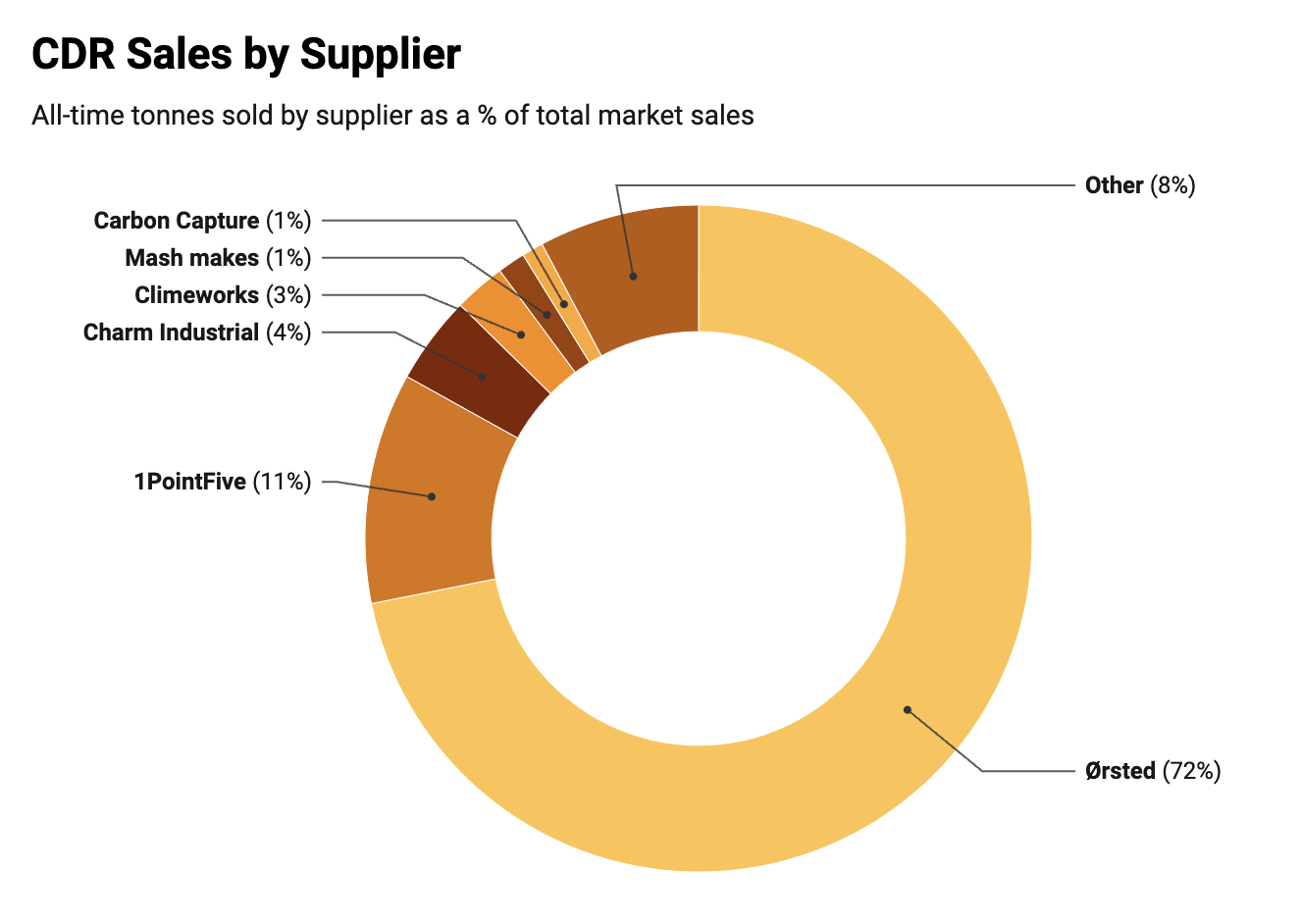

Looking at the individual companies behind the methods, we see Ørsted (BECCS) dominating thanks to the Microsoft purchase, followed by 1PointFive (DAC) and then Charm (Biooil) and Climeworks (DAC).

Deliveries by method are equally concentrated in a small number of methods. In contrast to purchases, biochar accounts for 91% of deliveries, with biooil (6%) and enhanced weathering (3%) filling in the rest.

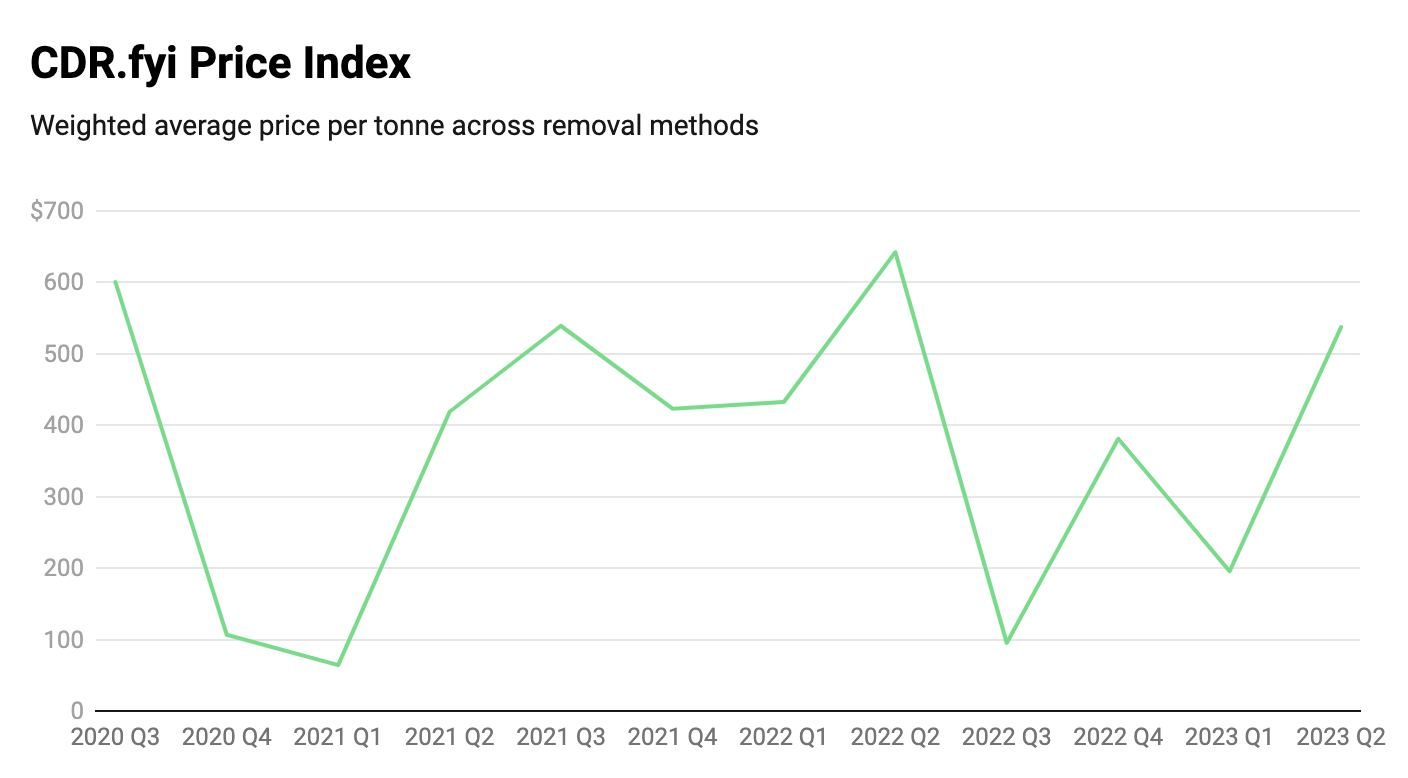

The CDR.fyi Price Index for H1 2023 is $450/tCO2. This is a slight decline from 2022, driven by increased adoption of higher-priced CDR methods.

Shown below is a quarterly breakdown of the CDR.fyi Price Index:

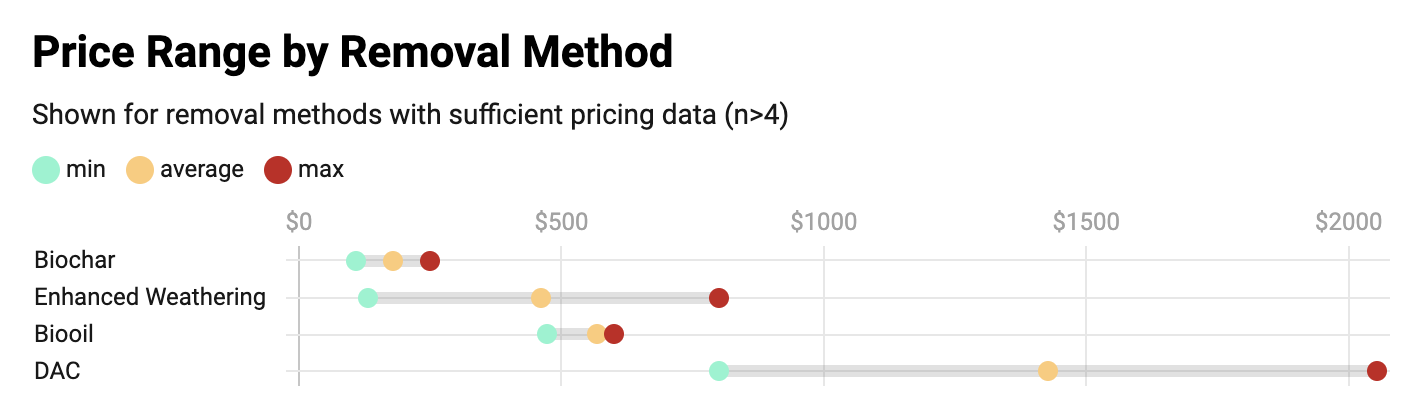

There continues to be wide price variance between methods, as well as within methods. This indicates that the market is still highly illiquid, and dependent on individual transaction terms and negotiations.

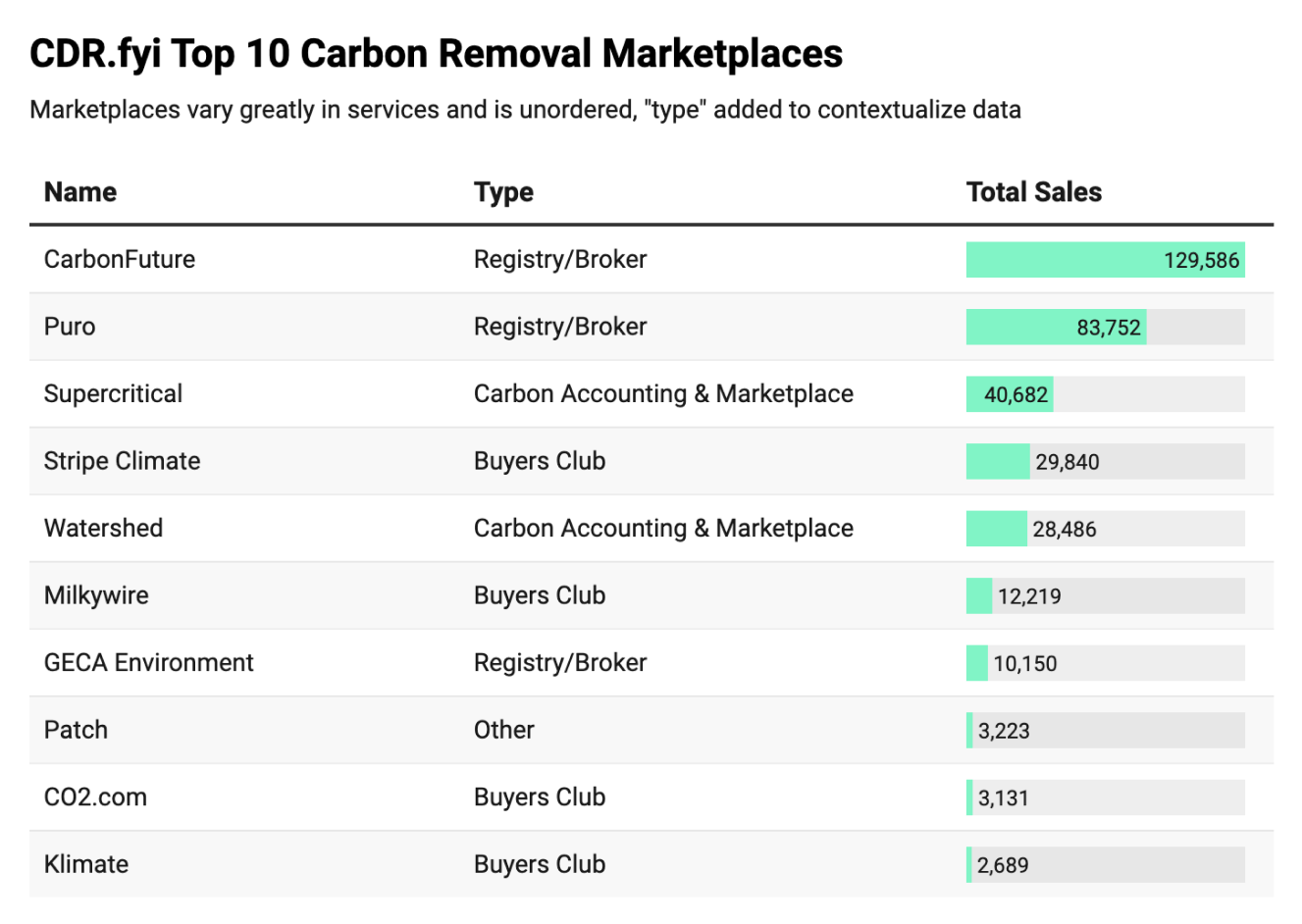

Note: All leaderboards are based on reported and available data

The CDR.fyi 2023 mid-year progress Report reveals an encouraging surge in the CDR market, with purchases already increased by 437% compared to full-year 2022. Our forecast models estimate we will end 2023 with 6M total tonnes sold, which would represent ~10x growth from 2022.

We also see an increase in the number of companies purchasing CDR, although the majority of these purchases are <100 tonnes. The market is largely driven by a core group of major buyers, with three major purchases accounting for 95% of the total CDR purchases this year.

To achieve sustained growth, the core group of large buyers needs to expand. A select few have demonstrated leadership by getting into this new market, but the vast majority of companies are sitting on the sidelines. There are hundreds of other players that are of similar sizes and capabilities to Microsoft, Stripe and JPMorgan that could start purchasing carbon removal. The majority of CDR suppliers have not yet made any sales at all, representing potential future CDR supply capacity in need of first-buyers.

The endgame for CDR is government procurement. The public sector is the only actor with the means to purchase CDR at scale, and we are seeing progress towards public sector involvement. The United States government will be the first of any government to directly pay suppliers for CDR. This program, expected to be announced in the near future, will run through the US Department of Energy to “establish a competitive purchasing pilot program for the purchase of carbon dioxide removed from the atmosphere or upper hydrosphere.”

In an emerging market like CDR, buyers play two roles. The obvious one — buyers bring capital to help scale the market, and aid suppliers to fulfill their potential. CDR cannot go from tens of thousands of tonnes to billions in just a few years. To remove gigatonnes by 2050, we need to be in the tens of millions of tonnes delivered by the end of this decade. The scale-up will lead to learning-by-doing, building up the necessary infrastructure and setting prices on a downward and more accessible trajectory for a greater pool of buyers as capacity and delivery increase.

The second role buyers play is to speed up innovation and help build a more diverse supplier ecosystem. The best methods to remove carbon might not have been invented yet; many promising methods remain in their infancy, taking their first steps into real-world demonstration. At this early stage of the market, the second role is arguably even more important than the first one. The gross volume of tonnes purchased is the headline number that we all look at, but it hides this critical second role that buyers play in the market. The size of most purchases is merely in the hundreds of tonnes; however, if those small purchases enable suppliers of new and innovative CDR methods to take their technologies out of the lab and into a first-of-a-kind facility that might scale significantly in the future, then the currently reported purchase volume understates their potential future impact.

As such, we encourage and support increased purchases, both in-depth — increasing the capacity and driving down the cost of existing methods — and in breadth — to nurture new methods that we hope will be proven out and increase their contribution to our CDR needs in the future.

Authors & Contributors: Robert Höglund, Kevin Niparko, Kohzy Koh, Alex Rink, Laurène Petitjean, Quentin Servais-Laval, Tankson Chen, Arielle Biro, Jamie Wong

This report is also published on CDR.fyi's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.