· 7 min read

Global CO₂ reduction targets face political headwinds. But interest in carbon capture and storage (CCUS) remains high, for several reasons. Emissions in some major sectors (e.g. cement, steel and chemicals) are proving hard to abate through electrification or efficiency gains: carbon capture may offer a way forward here. The growing reach of carbon pricing mechanisms (e.g. the EU Emissions Trading System) may also give carbon removals tangible financial value, making more projects economically viable. In addition, the development of carbon capture systems is proving an exciting platform for technological innovation.

Companies are also well aware that, even if decarbonization policies weaken in the short term, future reregulation is possible. The scientific consensus (e.g. the Intergovernmental Panel on Climate Change and International Energy Agency) is that carbon removal will be necessary to meet net zero targets, given residual emissions in agriculture and industry. CCUS will therefore become an essential structural component of long-term climate strategies and risk management, both for governments and the corporate sector.

CCUS is not a single solution to the problem of CO2 emissions. It consists of many approaches and technologies. A few are already viable – but most are not yet implementable at a meaningful scale, or without considerable financial support.

The most established carbon capture processes are nature-based, e.g. reforestation. These could be expanded but are not infinitely scalable. Hence my focus here is on technology-based approaches. Here’s a very brief and very incomplete snapshot of what they currently are:

Carbon capture can be done from the atmosphere – so-called direct air capture (DAC). This is expensive, largely due to high energy costs, although “low tech” solutions, such as the use of crushed rocks on farmland, show promise. As a result, more effort is going into capturing carbon close to the point of emission (e.g. a power or industrial plant using fossil fuel). Various methods exist for doing this, either through treating the fossil fuel pre-combustion, or through removing CO2 from the resulting emissions.

What can the resulting CO2 be used for? One established use is to pump it into depleted oil fields to both extract more oil (enhanced oil recovery, EOR) and permanently store the injected CO2. But CO2, cost permitting, can be used to create chemicals or industrial fuels, including fertilizer. In terms of storage, most is currently in geological form, for example in saline aquifers or depleted oil and gas reservoirs, perhaps using chemicals to ultimately turn CO2 into minerals.

As noted above, the brevity of this summary means that it can only mention the main approaches. And things get even more interesting when capture, use and storage are combined – including when bioenergy is combined with CCUS – so-called BECCS.

It’s all very exciting stuff, despite the concerns noted above about technological and economic viability and some worries about the overall environmental impact of certain forms of CCUS (e.g. using captured CO2 to create hydrogen).

Many national governments are sufficiently interested to support both individual CCUS technologies and their integration (note, for example, the UK government’s plans for seven CCUS industrial clusters). The EU has carbon storage targets and many other initiatives exist elsewhere in the world: Canada[i], for example, has been amongst several countries announcing new CO2 initiatives in 2025. Although much has been made of the U.S. administration’s recent cancellation of many projects involving carbon-capture technologies, there remains enthusiasm for CCUS in the form of enhanced oil recovery (see above) which is seen as supportive of the local oil industry), and tax credits for this remain in place. China is particularly involved in CCUS and it is likely to make a noticeable contribution to that country’s CO2 emissions reduction.[ii]

Some also argue that high income fossil-fuel exporting countries, in particular, do not just have a responsibility to encourage CCUS development and implementation, but are also well positioned to do so. These countries may have the technical ability, financial resources and anchor industries for the necessary investment, policy targeting and knowledge sharing around CCUS. Clusters of CO2 sites and storage also offers the opportunity of important economies of scale.[iii]

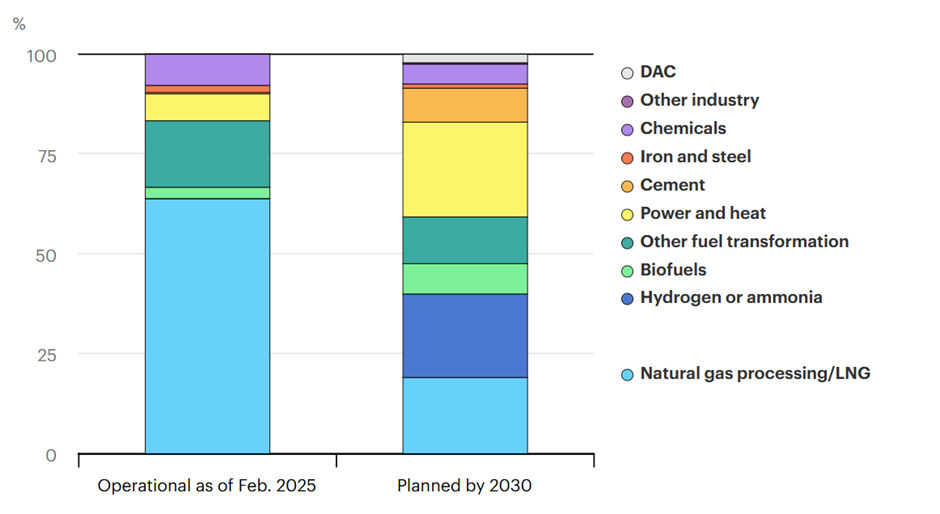

CCUS enthusiasts also point to a growing global pipeline of CCUS projects. The IEA reckons that by 2035 these planned projects should have a capture capacity of over 300mn tons of CO2/year – although this should be seen in the context of current global CO2 emissions of over 38bn tons/year. Any forecasts around the feasible deployment of CCUS, and its ability to limit temperature rises, of course require major assumptions about future project growth and failure rates. There are some interesting possible historical parallels here, for example with the past deployment of solar and nuclear power.[iv]

Figure: Operational and planned capture capacity

Source: CCUS Projects Explorer - Data Tools IEA

Investors are interested in the sector: these are technologies that could make a major contribution to reducing climate change. But CCUS remains a complex area to invest into. As noted, technologies are still evolving and getting the economics right may still depend on combining them in hubs, implying substantial spending on supporting infrastructure. As a result, this remains an area where government funding is likely to remain crucial in many economies – with commercial investors well aware that there is a risk that some of this funding could be withdrawn in the future.

I think that investors will continue to approach CCUS from different angles. There is scope for investing (early stage, perhaps via venture capital or other private markets) in firms developing the technologies for CCUS – with obvious risks if the technologies prove unviable or are superseded by better ones. Investing directly in publicly-quoted firms operating CCUS facilities may be problematic: current CCUS users tend to be in hydrocarbons or heavy industry sectors, with CCUS operations forming only a very small part of their overall investor profile.

Investors may therefore look to explicitly sustainable investable innovations. These could include green or blue bonds which include CCUS commitments at a project or small nation level. But there has also been much discussion of the potential role of carbon credit markets in funding CCUS initiatives. Carbon credits could, in theory, introduce much-needed market dynamics into this area. Both compliance (e.g. national “cap-and-trade schemes”) and voluntary carbon markets already exist, the latter being an established way of funding nature-based carbon removal. Recent related initiatives such as the EU’s Carbon Border Adjustment Mechanism (CBAM) may create further incentives for CCUS.

In the long run, I think carbon credit markets may provide important incentives and funding for CCUS. But I think it’s important to be realistic about what carbon markets can achieve on a shorter-term view. Larger firms in high carbon emitting industries will of course be incentivised by the prospect of CCUS deployment reducing the amount of compliance carbon credits that they are required to buy to meet national caps (or through it giving them the ability to sell credits). But, for other firms, the prospect of financing CCUS development via carbon credits in the separate voluntary carbon credit (VCC) markets may be limited. Major efforts continue to make these VCC markets more transparent and credible (in terms of verification of carbon captured). But, in the immediate future, the price of carbon credits in these markets seem likely to continue to vary greatly across carbon projects and remain much lower than for compliance markets. Fundamentally, purchasers of VCC credits are largely buying them out of a desire to show their support for carbon removal, rather than through hard economic necessity: demand for such credits will therefore remain unpredictable. Economic factors tend to prove more important than good intentions.

CCUS, if it happens at scale, really could change the world, making it much easier for us to combine continued global growth and lower CO2 emissions. So, let’s hope that technological progress is rapid and that this encourages funding and the development of effective funding mechanisms. This could be sustainable investment at its best.

This article is also published on Linkedin. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[i] Canada Invests in Cutting-Edge Carbon Capture and Storage to Drive Clean Energy Innovation - Canada.ca

[ii] CCUS development in China and forecast its contribution to emission reduction | Scientific Reports