CCUS in Brazil: Current policies and potential measures to encourage investment

· 7 min read

Brazil is about to break ground and adopt its first legislation to advance the development of carbon capture, utilization and storage (CCUS) projects. The introduction of relevant legislation and regulations is likely to bolster investor confidence, but additional incentives will likely be required, such as tax credits, to encourage CCUS investment.

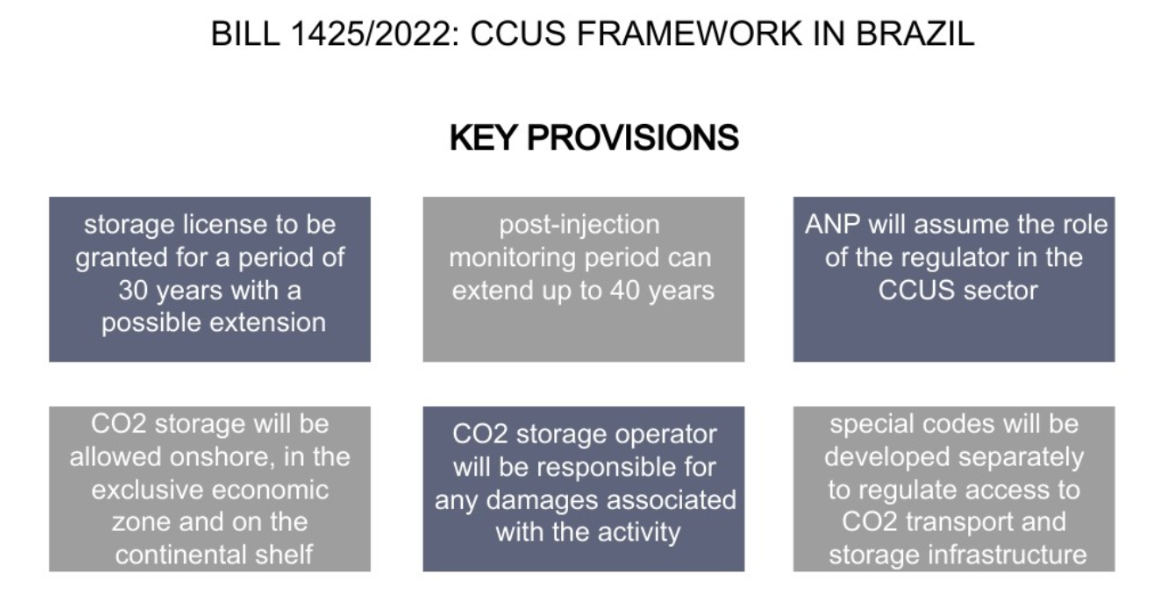

Brazil is currently seeing significant efforts in its parliament to establish legal and regulatory frameworks for CCUS. To date, a total of three bills have been submitted to the National Congress of Brazil, aiming to set federal-level rules, including Bill 1425/2022 that would establish the foundations of the CCUS framework. While the government does not provide direct funding to CCUS projects, the technology remains a strategic focus area for research and development (R&D) projects funded under the Oil and Gas R&D program contract clauses. However, in January 2024, the federal government announced an action plan aimed at developing the Brazilian industry with the potential to enable CCUS initiatives. This announcement is part of the plan called Neo-Industrialization Policy and will allocate USD 12 billion until 2026 to enhance innovation, decarbonization and productivity. It recognizes industrial decarbonization as a key factor of competitiveness, particularly considering Brazil's clean electricity matrix and widespread utilization of biomass and biofuels.

Meanwhile, the Oil, Natural Gas, and Biofuels Authority (ANP) is carrying out a regulatory study to assess its capabilities, needs, and the potential to reduce the risk of bottlenecks as the federal agency is expected to become the economic regulator and licensing authority for the CCUS sector following the adoption of the proposed legislation.

Today, Brazil’s largest carbon capture project is associated with EOR operations to facilitate incremental production in pre-salt giant fields. Its main operator Petrobras demonstrates interest in exploring new opportunities in large-scale CCUS. The company’s annual CO2 injection volumes of 7 million tons from offshore gas processing in the pre-salt areas are among the largest in the world and will be surpassed only in 2027 by the East Coast Cluster Project being developed in the UK. Based on its 2024-2028 Strategic Plan, Petrobras is performing studies for new CCUS projects strongly supported by R&D investment.

Separately, the ethanol industry eagerly awaits the introduction of Bioenergy with Carbon Capture and Storage (BECCS) under the RenovaBio scheme, Brazil’s clean fuel program focused on carbon credit generation and decarbonization targets. In 2023, the target of avoiding 37 million tons of carbon emissions was achieved serving as a robust candidate to enable small and medium-scale BECCS projects in the short-to-medium term.

To foster wider implementation of CCUS, it is essential to establish regulations for a Brazilian carbon market, preferably compatible with the successful RenovaBio scheme. This market will facilitate the monetization of projects beyond EOR or BECCS business models. Additionally, it will encourage the development of industrial CCUS clusters, incentivized by the announced Neo-Industrialization Policy.

The oil and gas producing countries in the North Sea are pursuing an ambitious plan to become the region’s carbon storage hub. Over the past five years, key players – Denmark, the Netherlands, Norway, and the United Kingdom – have made significant progress in developing and implementing CCUS policy and regulatory frameworks. In the meantime, a broad political consensus about the need to scale-up carbon capture and storage projects to address industrial emissions has become a distinctive feature of these countries that facilitated the adoption of required frameworks. The Brazilian government could consider the introduction of the following instruments to encourage CCUS projects:

Carbon tax. CO2 tax along with the participation in the Emissions Trading System of the European Union (EU ETS) remains Norway's primary mechanism to encourage GHG emission-reductions. For over two decades, Norwegian player Equinor has stored carbon dioxide at its two offshore projects, which allowed the company to reduce the payments under the national carbon tax scheme.

Subsidies. The allocation of budget funds through annual competitive rounds has been instrumental in facilitating CCUS projects in the Netherlands. The subsidy effectively acts as a contract for difference (CfD) between the strike (reference) price and the market price. However, projects have to compete with other emission-reduction technologies, such as hydrogen or renewables, and the government determines the ultimate amount of available funding during the review of applications, which creates uncertainty for CO2 storage developers.

State budget grants. Direct allocation of government funds via parliamentary approval is ensures long-term availability of state support for specific CCUS projects in Norway (Northern Lights). Ring-fencing a specific amount of budget funding available to CCUS projects is the approach pursued by the Danish government ($3.9 billion over a 15-year period on a per-ton of CO2 captured and stored basis), which could bolster investor confidence in the durability of state support over the longer-term.

Business models. The development and introduction of business models that establish funding, revenue- and risk-sharing arrangements across the entire CCUS value chain could be a game-changing solution to de-risk such projects in the United Kingdom. In addition, the government’s CCUS strategy includes over $25 billion to support CCUS projects, with funds likely to be allocated via contracts with individual capture, transport, and storage operators.

Storage licensing rounds. Regular offerings of prospective acreage for CO2 storage were launched in the United Kingdom in 2023, and they represent an important component of the long-term CCUS strategy. Scheduled storage licensing rounds are likely to provide much needed certainty around the future availability of storage areas.

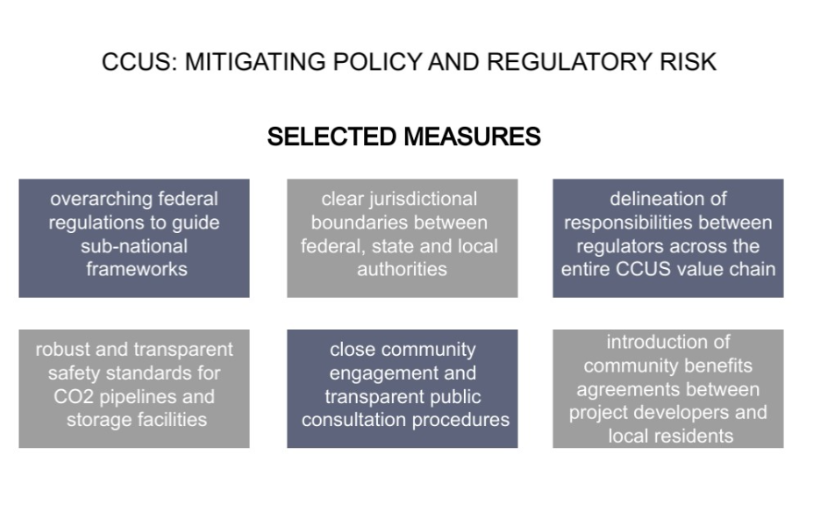

The United States has a relatively more complicated policy and regulatory environment in the CCUS sector compared to the North Sea region and offers several insights into the potential challenges companies could face when developing CO2 capture, transport and storage infrastructure, which are particularly relevant for Brazil given its administrative division.

Following the adoption of enhanced tax credits for CCUS (including CO2 for EOR) and direct air capture (DAC) under the 2022 Inflation Reduction Act (IRA), the United States has become an attractive destination for CCUS investment. In addition, over the past three years, Congress has also allocated billions of dollars to R&D and pilot CCUS projects as well as to regional hydrogen hubs, some of which are expected to include CCS facilities associated with the production of blue hydrogen.

However, the CCUS industry is facing a unique set of challenges as most current storage opportunities are located onshore and each state has its own regulatory framework for carbon dioxide transport and storage. In the case of CO2 storage, the primary difference between states is related to the long-term liability terms and conditions, i.e. how long the storage operator has to wait before transferring the liability over the sequestered carbon dioxide to the state. The duration of the “waiting period” and associated requirements are likely to impact the relative attractiveness of each state seeking CCUS investment. However, currently, the construction of carbon dioxide pipelines represents a major obstacle to advancing CCUS projects in the United States. The safety of CO2 pipelines, their impact on land and property values have become a significant concern among local residents, landowners, farmers, environmental activists, and in many cases state lawmakers and regulators. The lack of an overarching federal regulatory framework that would guide state-level regulations coupled with the low-level of public acceptance fuel uncertain investment climate in the CCUS industry in the United States.

The draft legislation pending approval by the Brazilian National Congress is a step in the right direction as it would establish a federal-level framework that would govern sub-national regulations. The potential focus on offshore CO2 storage opportunities is likely to mitigate the risks associated with public opposition to onshore storage facilities. Still, transporting carbon dioxide from onshore capture sites to coastal terminals via pipelines could become a challenge if such infrastructure would need to run through environmentally sensitive regions or densely populated areas.

Tiago Jacques, Operational Safety Deputy Superintendent at the Brazilian National Agency for Petroleum, Natural Gas and Biofuels - ANP, contributed to this article. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Labor Rights · Climate Change

illuminem briefings

Architecture · Carbon Capture & Storage

Barnabé Colin

Biodiversity · Nature

Euronews

Degrowth · Public Governance

Politico

Public Governance · Climate Change

Mongabay

Climate Change · Environmental Rights