Carbon developer ecosystem: a highly fragmented market in fast evolution

· 5 min read

2022 saw a real appreciation for the work of carbon project developers, in what we believe was a record year for the number of financing rounds announced into carbon project developers.

This result comes despite the existential crisis that the voluntary carbon market (VCM) is facing as a result of the continued erosion of trust from corporate buyers around the question of quality, and increased policy uncertainty as a result of the expected convergence between voluntary and compliance markets.

This change of tone is coming after 2021, a record year in terms of carbon credit issuances for the voluntary carbon market, and fueled by an increasing awareness on the need to accelerate funding requirements for carbon credit generation to meet large net zero corporate demand for voluntary carbon offsets through to 2030 and beyond.

In a new report, Abatable estimates that 2022 recorded over $10bn worth of transactions (across over 60 deals announced) into upstream investments directly contributing to carbon credit generation (including new carbon fund announcements, equity transactions and carbon purchase agreements), which could result in a step-change ability for this market to scale supply. Such a large uptick in carbon credit generation may require a rethinking into long-term implications for pricing and demand & supply dynamics in the VCM.

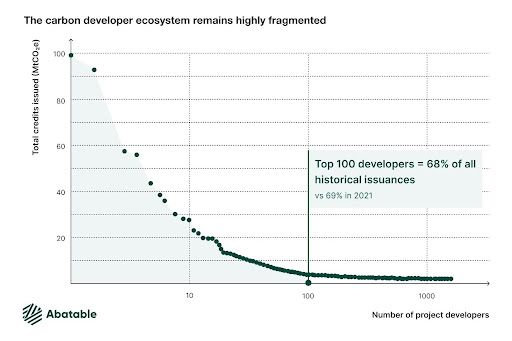

Our annual State of the Carbon Developer Ecosystem report highlights how the developer ecosystem is going through a fundamental transformation. Despite it remaining a highly fragmented market dominated by local players, the wider availability of financing options has allowed existing experienced developers to upsize ambitions and execute on expansion plans into new project types and scale their blueprint projects into adjacent regions.

As such, 2022 saw a large number of developers turn from country-specific into regional or global operators.

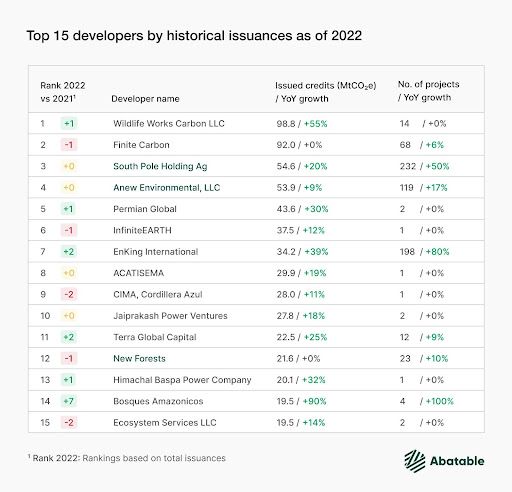

The VCM also started to observe the first signs of market consolidation during 2022, with the % of historical issuances in the Top 15 developers (across all project types) increasing by one percentage, from 34% at the end of 2021, to 35% in 2022.

Over the course of 2022, significant M&A activity was announced, including South Pole (ranking Top 3 developer in the Abatable Global Developer league table) acquiring three companies (including Italian based carbon developer, Carbonsink).

Another major acquisition was closed by Mitsui who acquired global forestry developer and investor New Forests.

Finally private equity firm TPG announced the creation of Anew Climate from the merger of US-based developers Bluesource and Element Markets (now the combined entity ranking Top 4 in the Abatable Global Developer league table).

This market has also started to see an increasing level of competition for access, resulting in corporates and carbon funds forced to increase their risk appetite and back projects at earlier stages of developments, in exchange for discounts on carbon credit prices secured via multi-year commitments and partnerships.

As highlighted in one of our recent articles, the carbon finance model is fast changing alongside the Carbon Project Development Curve, with increasingly larger corporate and carbon funds participation in earlier stages of development, which we think could result in a diminishing role for financial intermediation in this market in the future.

By analysing the evolution of this market through a developer lens, we have come to appreciate, through over 300 developer interactions, the multiple roles a carbon project developer can play across the value chain.

We have come to appreciate the importance of finding a framework to be defining what “carbon developer” means. Over 2022, differences in carbon development approaches became more apparent as the number of new entrants increased.

2022 saw over 180 new developers enter the market (with projects listed across the four most established carbon registries). Those brought to market 500 new projects, contributing to an estimated 100 million carbon credits in annual issuances.

A developer is often understood as a project implementer who implements, verifies and issues carbon credits. However, that model has evolved over time to include carbon consultancies firms who support implementation partners with carbon asset development, and in some cases support those with access to finance and carbon credit sales to corporate buyers.

In 2022, the ecosystem of developers saw another category emerge, that of “aggregators”, or firms who develop diversified, global carbon portfolios and work as incubators by supporting the scalable development of projects through financing and/or MRV solutions.

This new category also includes companies that may have started as nature-based MRV providers (e.g. Boomitra, Pachama and Revalue Nature) but have since taken a greater role in earlier stages of carbon project development. Another developer category was that of CDR technology companies, which over the course of 2022 saw more of their projects listed under established carbon registries.

We are expecting developers to continue to convert old Clean Development Mechanism (CDM) projects to established credit programs as well as continued entry of new CDR projects and aggregators.

We expect a slowdown in funding of cookstove projects due to the anticipated supply build-up within this project category and a refocus of funding into large-scale nature-based solutions.

Given the expected convergence between voluntary and compliance markets due to Article 6 programs, we expect players to explore diversifying their development portfolios to include jurisdictionally “nested” projects as a way to build optionality and eligibility under Article 6 bilateral deals.

We remain excited to see what 2023 has in store for the carbon developer ecosystem. While market forces suggest an economic slowdown, it remains to be seen how short-term dynamics may play out at the intersection between supply and demand in the VCM.

We expect a slowdown in financing activity for next year, whilst investors are seeking more clarity on the ability for high quality projects to sustain price premiums relative to still maturing commoditized benchmarks. Such clarity can also be provided as climate legislative frameworks and policies shape up even more over the course of the year, and into 2024, hopefully allowing the market to emerge from an existential period it is experiencing right now.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Carbon Regulations · Carbon Market

illuminem briefings

Carbon Market · Public Governance

illuminem briefings

Carbon Regulations · Public Governance

Euractiv

Carbon Market · Public Governance

CBC News

Carbon Market · Public Governance

Financial Times

Carbon Market · Public Governance