Building faith in markets

· 6 min read

On the eve of Earth Day 2024, let’s start with some good news and some bad news. The good news is that the EU confirmed last week that EUR3.5bn would be allocated this year to 40 ocean-related initiatives. The bad news is that a major coral bleaching event due to ocean warming now seems to be underway – see this image taken by Prof. Callum Roberts a couple of days ago in Magoodhoo in the Maldives, but you will have seen the distressing photographs also on global media.

Coral Bleaching in Magoodhoo, The Maldives April 2024

A report by the National Oceanic and Atmospheric Administration (NOAA) and the International Coral Reef Initiative (ICRI) says that at least 53 countries, local economies, and territories have suffered bleaching since early 2023. In case you are interested in Deutsche Bank´s activities to improve this critical issue, the following may be worth taking a look at the Deutsche Bank Ocean Resilience Philanthropy Fund Status Update.

For various reasons, investors have remained rather wary of so-called voluntary carbon markets. These allow firms to voluntarily offset carbon emissions by buying credits in external projects that either reduce or avoid carbon emissions (e.g. renewable energy) or remove carbon from the atmosphere (e.g. forest development).

Why this wariness? Voluntary carbon offsets are a noble intention but, in reality, such markets have suffered from concerns about transparency, quality, and a lack of standardisation. The market has remained small in comparison with the more tightly regulated compliance market, where energy-intensive sectors compete for officially determined carbon allowances.

Efforts to improve voluntary carbon markets appear however to be gathering pace. The Integrity Council for the Voluntary Carbon Market announced earlier this month that it plans to label approved credits with a Core Carbon Principles (CCP) stamp. Public consultation will start in May and the Core Carbon Principles and Assessment Framework will launch in Q3. In parallel, the European Union is developing a Carbon Removal Certification Framework, aiming to create clear definitions and standards for carbon removal projects within the EU.

Will such initiatives prove to be a turning point? Change will come, but not overnight. And, as my colleague Daniel Sacco points out, success here will likely involve a degree of pain. He points to Bloomberg´s estimates that only 57% of the current voluntary credits supply will be able to comply with the stricter standards. There have been high levels of retirement of voluntary carbon credits in recent months, perhaps due to a desire to get some less compliant voluntary credits off institutions’ books before more demanding regulations kick in.

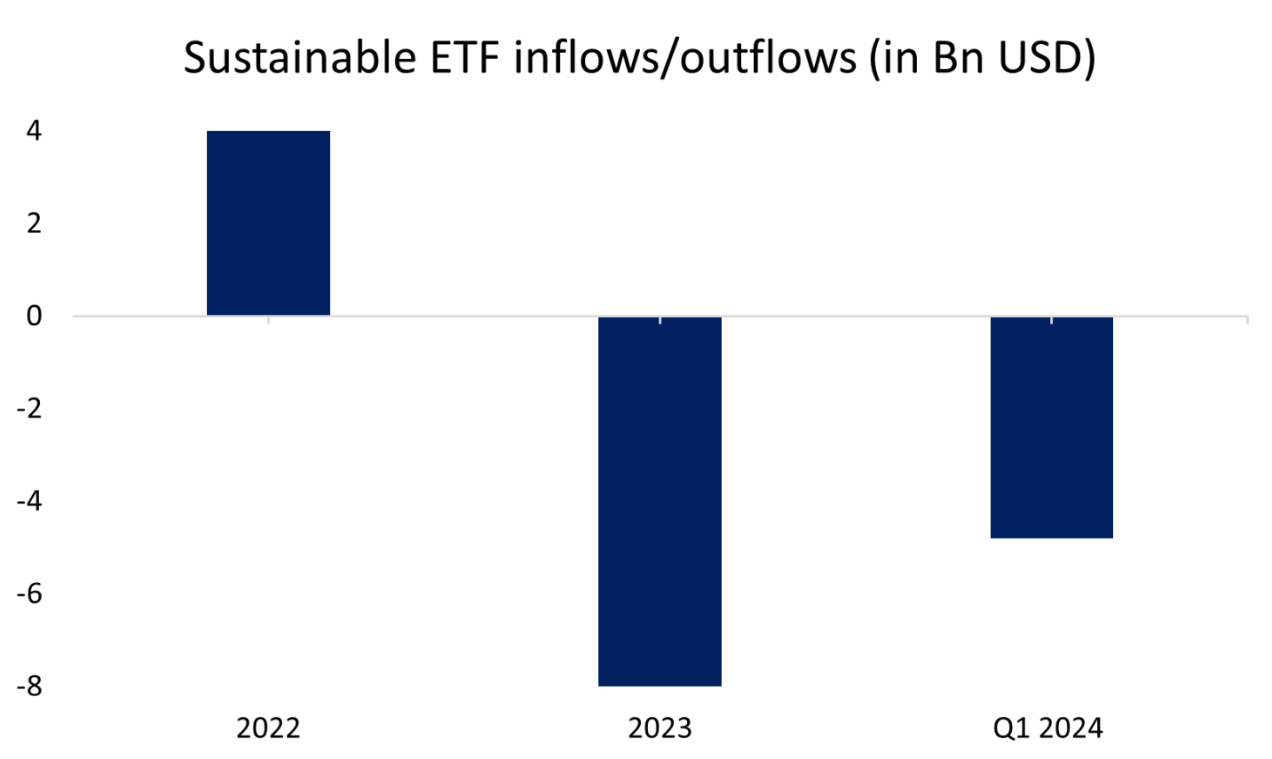

Considerable attention is often paid to data on ESG fund flows, which is readily available. Morningstar recently published data on ETF (exchange traded fund, e.g. “passive”) flows for Q1. These revealed that sustainable ETFs lost USD-4.8bn in Q1 2024, the biggest quarterly outflow since Q1 2023, albeit with losses concentrated on two U.S. sustainable funds.

Source: Morningstar. Data as of April 3, 2024.

Does this signal that overall interest in sustainable investing is waning? No, I don’t think so – but we can draw some useful lessons from the Q1 2024 ETF data. The first is that assigning precise reasons for investment decisions is often difficult. In Q1, an additional factor will have been the market’s focus on tech (e.g. the U.S. “Magnificent 7”), perhaps drawing some investment away from sustainable funds. A second lesson is that the detail in the data is important: As we get more complete data in the coming weeks, including open-ended funds and regional data, underlying trends may become more apparent.

For me, the key split may be between U.S. and European sustainable funds. Can we establish the real impact of U.S. policy initiatives discouraging sustainable investment and general political “noise” on fund flows? Will European interest in sustainable funds stay solid – and what will be the impact of the release of European Securities and Market Authority (ESMA) sustainable regulatory requirements in the coming weeks?

As part of the discussion around how to build sustainable economies, there’s a lot of talk about rethinking global value chains. Renewable energy infrastructure projects are a good example of this, linking new (largely emerging market) suppliers of power with (largely developed market) consumers. Prominent proposed examples include hydrogen (Namibia>Germany) and solar (Morocco>UK). Our long-term investment themes also explore changing value chains in different areas.

My worry is that we tend only to think about these value chains from our own perspective, that of the consumer. So, we often define their economic rationality with a narrow perspective. We don’t pay enough attention to their political or social costs for the supplier. Do these projects square with the supplier country’s development aims (e.g. labour market transition) and how will they impact macroeconomic data (e.g. inflation etc.).

Such deals may also move us from a multilateral world to one characterised by potentially troubled bilateral relationships – which prove difficult to reset, given the amount of fixed infrastructure involved. Close families are not always happy families. If we sparked your interest on this topic, our Investing themes might also be worth taking a look at: Investing themes | Insights | Deutsche Bank Wealth Management (deutschewealth.com).

Match the number to the issue: Seven.

Answer: The number of publicly-funded electric vehicle (EV) charging stations built in the U.S. so far as part of a Biden-administration plan to build 500,000. But don’t panic, EV owners! Construction of publicly-funded charging points is expected to accelerate this year as bureaucratic inertia is overcome. Private-sector charging infrastructure also continues to grow, with 20% more EV charging stations at the end of 2023 than a year earlier.

A report I’ve read recently from the U.S. Environmental Protection Agency (EPA) underlines the need for food system change. It estimates that 58% of methane emissions from U.S. municipal solid waste landfills are from food waste: in total, such landfills are the third largest source of methane emissions from human activities in the U.S. We explore food waste and other problems with the global food chain, and their environmental and investment implications in a recent report, which can be found here: CIO Special – LTIT: Sustainable Food Systems – favourable entry points ahead? | Investing Themes (deutschewealth.com).

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Pollution · Nature

illuminem briefings

Climate Change · Effects

Kasper Benjamin Reimer Bjørkskov

Degrowth · Regeneration

Politico

Public Governance · Climate Change

CNN

Pollution · Nature

The Guardian

Effects · Climate Change