· 6 min read

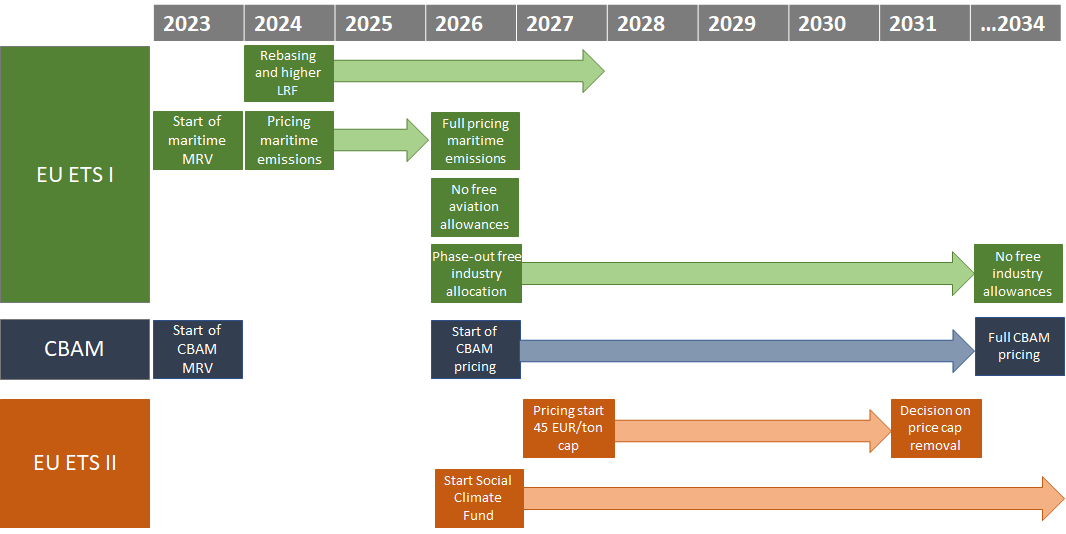

Much of the climate ambition of the EU hinges on the bloc’s emission trading system (EU ETS). During December 2022, the Council and the European Parliament reached important agreements on the “Fit for 55” proposals. Specifically, new rules for the existing EU ETS, the implementation of a carbon border adjustment mechanism (CBAM) and the introduction of a new EU ETS for emissions from buildings and road transport are in sight. With these revisions implemented the EU would edge closer to its 2030 climate targets, but question marks remain.

In the first part of this series, we looked at changes to the EU ETS I, free allocations and the new Carbon Border Adjustment Mechanism (CBAM). In this second article we shed light on the new EU ETS II on buildings and road transport and on the utilisation of revenues from auctioning emission allowances by governments.

The EU ETS II: Pricing CO2-emissions from buildings, road transport and fuels in other sectors

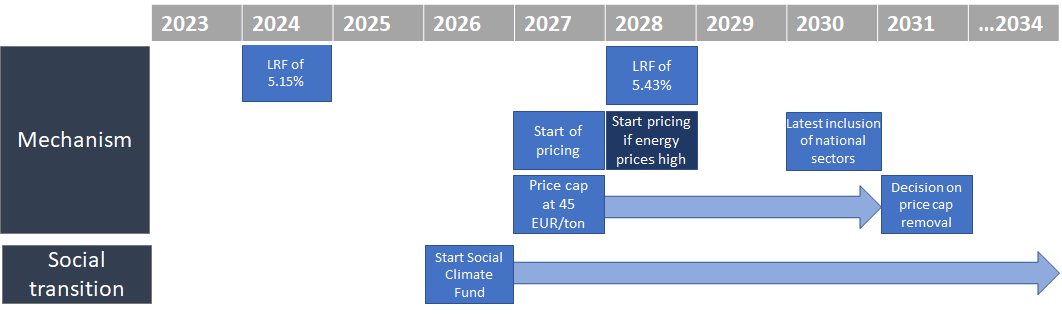

A separate emission trading system will be introduced for emissions currently not priced across the entire EU. This EU ETS II will include emissions from the building sector as well as from road transport and the usage of fuels in other, as of now not defined, sectors. The EU ETS II will however only become operational from 2027 earliest, while high energy prices later this decade may even postpone the start until 2028. Not all details have been worked out yet, especially as member states are allowed to exempt fuel suppliers from the EU ETS II in case a national carbon price scheme with a price level equivalent or higher than the EU system exists (compare Figure 1 for the EU ETS II implementation timeline).

This leads to another important not entirely finalised aspect: An emission reduction trajectory with a high annual linear reduction factor (LRF) of more than 5% should be in place from 2024 onwards to achieve a total emission reduction of compliant sectors of about 60% by 2030 compared to 2005. However, the EU ETS II will start pricing emissions only in 2027. Furthermore, once prices for allowances under the EU ETS II are higher than 45 EUR/ton over a certain period of time, additional allowances will be released to increase the supply on the market.

Effectively, the EU ETS II in its currently discussed shape and form will be closer to a carbon tax with a maximum price level of 45 EUR/ton at least until 2030. From then onwards no price cap is foreseen as of now. A low price of 45 EUR/ton would be far below the actual CO2-avoidance costs ranging between 100-300 EUR/ton in the building and road transport sectors. Clearly, the price signal in the EU ETS II will not be high enough to incentivise the adoption of low-carbon technologies alone.

With all these higher ambitions and new pricing schemes, one very important question of course remains: Where will the money from EU ETS I, CBAM and EU ETS II go to and what will it be used for?

Auction income for climate and social measures only

The allocation of income for the existing Innovation Fund, which supports industrial decarbonisation, will be stocked up from 450 million to 575 million emission allowances (EUA). At an average price of 90 EUR/ton this represents a monetary value of more than 50 billion EUR to be allocated to decarbonisation projects. In addition, earnings of EU member states from auction income must now be entirely used for climate measures. However, the Modernisation Fund for less wealthy member states still allows some investments into fossil infrastructures.

One of the largest concerns of the European Parliament was that the introduction of the EU ETS II will predominantly hurt economically weaker states and citizens. Therefore, the current agreement allocates 50% of the income from the EU ETS II to the newly introduced Social Climate Fund. It should support vulnerable households and small businesses to cope with the price increase of fuels. The fund would start operation already in 2026, one year before the actual pricing scheme commences, and is set up to run until 2032 for now. It is supposed to have a budget of about 65 billion EUR for social climate measures such as renovation in social housing to direct income support. The remaining 50% of the income passes to the EU national states, which must use the money for social climate measures in the building and transport sector as well. An estimated total of 87 billion EUR will thus be allocated to reduce social hardships due to more comprehensive carbon pricing. This sounds like a huge amount of money but is actually being dwarfed by expenditures to alleviate the current fossil energy price crisis: Germany alone will make available up to 200 billion EUR for consumer price breaks if necessary.

What to make of all the news?

The EU emission trading space will become more complex with additional sectors and phased-out free allocation, the pricing of imports through CBAM and the new EU ETS II for sectors currently not under a pricing scheme at all. Figure 2 provides an overview of the entire implementation timeline of the most important changes.

Players from all sectors must act now to understand the extent to which they are exposed to regulatory and carbon pricing risks and how to prepare themselves. Our seven main take-aways are the following:

- If implemented, the increased ambition in the EU ETS I can have the potential to bring the EU towards is 2030 climate targets.

- Phasing out free allocations for industries means a much higher exposure to carbon price risks for industrials and “real” incentives to make progress on industrial decarbonisation.

- The implementation of CBAM incentivises climate action in non-EU countries while setting the stage for much confusion concerning greenhouse gas measurement, reporting and verification (MRV) along with the need for importers to understand the EU ETS and start hedging.

- Until 2026 supply of emission allowances in the EU ETS I will remain adequate while the full-scale implementation of several mechanisms from 2027 onwards will lead to higher prices and lower supply of EUA.

- Carbon prices of above 100 EUR/ton in the EU ETS I will be common during this decade, especially if the macro-economic situation normalises.

- The implementation of the EU ETS II is less ambitious with a price cap of 45 EUR/ton and will likely not drive decarbonisation in the sectors under question until 2030.

- The EU ETS II will however provide a common ground for pricing emissions in other sectors in the EU and bring about 75% of the bloc’s emissions under a pricing scheme.

This article is also published on Carboneer. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.