Addressing the "license to pollute" critiques of net zero: the two-ledger system

· 10 min read

Over the last year, we have seen a significant growth in the critique of net-zero commitments and carbon offsets, both in the form of articles and lawsuits against corporate claims which has led to corporates no longer using carbon credits outside of their value chain to meet their net-zero commitment. These critiques often revolve around the “license to pollute” narrative that carbon credits used as an offset are allowing corporations to continue polluting. And I’ll be the first to admit that these critiques have some validity. A carbon neutral or zero claim made by a corporation that has made little or no effort to decarbonize is a license to pollute.

So how do we address this moral hazard? Don’t blend the bad and the good together. Separate corporate climate harm from corporate climate good and track and set targets for both — it’s time to explore the two-ledger system.

The theory behind a two-ledger system is quite simple. Instead of combining all corporate climate impacts into a single metric (net zero or carbon neutral), keep the “harm” that corporates are doing to the climate separate from the “good” they are doing for the climate and track and set targets for each of them separately. The main critique of offsets is that they are a license to pollute, so let’s create a system that doesn’t allow that to occur. A two-ledger system where one ledger counts corporate emissions and creates clear targets around decarbonization. Another ledger counting corporate contributions to avoided emissions and carbon removal, the “good” ledger, will have its own unique targets.

It seems that the current public sentiment is against blending the two ledgers into a net-zero metric because it is an oversimplification and obscures the true actions of corporates - so it’s harder to understand if corporates are truly making progress on decarbonization. And, we should have insight into how much corporates are contributing to climate mitigation beyond their own footprint and the types of mitigation they are supporting.

Within the two ledger framework, there are at least three options that I can see for the structure:

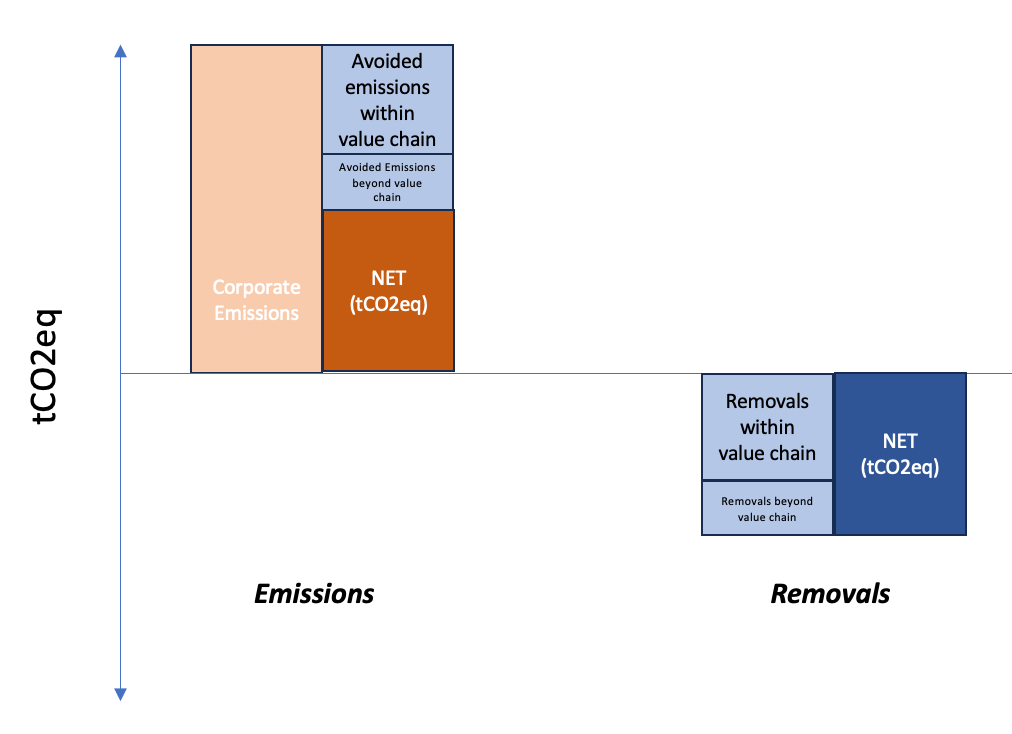

1. Value chain approach: Include all of the corporate footprint within Ledger A (within the value chain), whether an avoided emission or a carbon removal/Ledger B includes all of the corporate climate mitigation action outside of its value chain, again, whether an avoided emission or a removal.

2. Emissions and removals approach: Have Ledger A dedicated solely to emissions, so any avoided emissions whether inside or outside of a corporate value chain would be quantified within the same ledger. Ledger B would be dedicated solely to counting removals that the corporation can claim, again whether inside or outside of its value chain.

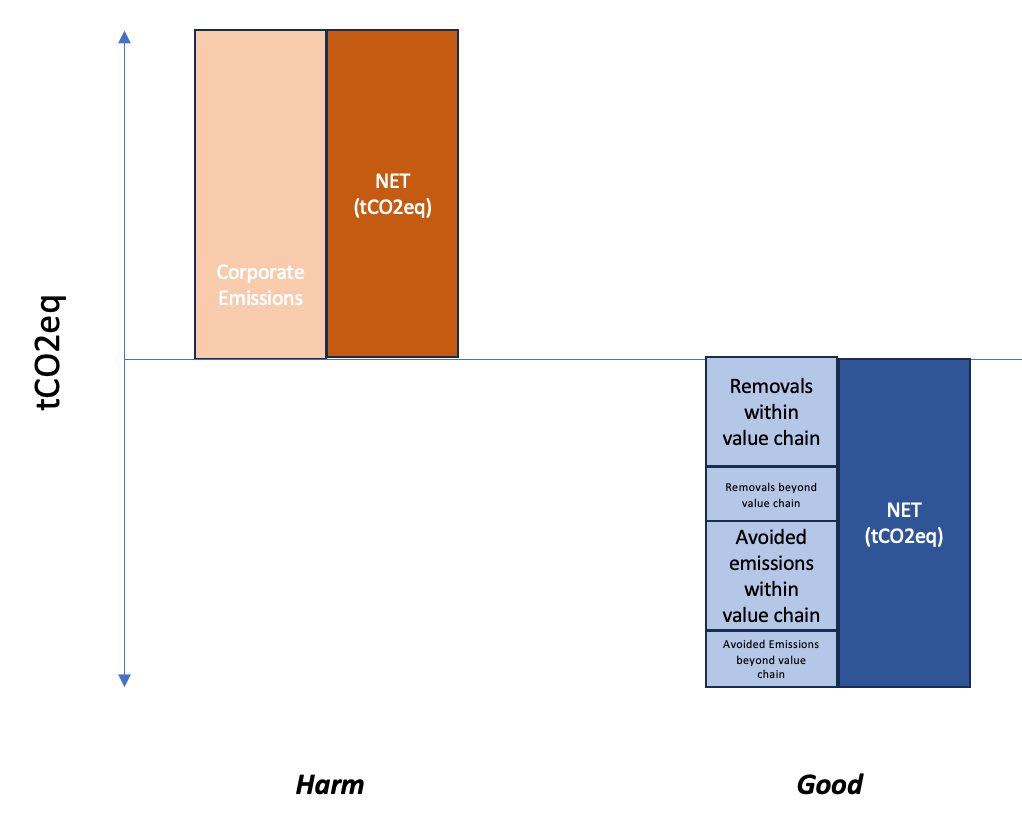

3. Strict harm and good approach: A third option would be to strictly separate harm and good. Any corporate emissions are in the Harm Ledger and any contribution to climate mitigation beyond decarbonization, whether within or outside of the value chain is accounted for in the Good Ledger. Recognizing that the nomenclature for the ledgers in this approach could likely use some work.

There are benefits and drawbacks. The value chain approach has the benefit of directly measuring the impact of a company's activities relative to its ‘contributions’. But the downside is that it mixes avoided emissions and removals which some folks in the carbon accounting world might disagree with. If we do go with the value chain approach, we need to make sure that we have as robust certification systems within the value chain (insetting) as we do for climate mitigation outside of the value chain. The other potential limitation of the value chain approach is simply that it might not get corporate traction because it feels distant and corporates might think that their contributions or “good” behavior beyond their value chain won’t be appreciated by consumers. I think as long as the impact is clear and robust, consumers might even value it more, this is where the branding is critical.

The emissions and removals approach has the benefit of a clear separation between emissions (counting emissions and avoided emissions) and removals. But, it’s harder to tell what is the core company footprint versus what falls outside of the company footprint. My sense is that public opinion would prefer a clearer view of the company footprint vs. contribution over the separation of emissions and removals.

The strict harm and good approach clearly differentiates between actions that corporations are taking that cause harm to the climate and actions that have positive impacts on the climate. Another benefit is that corporates will have to report any climate mitigation contributions whether within or outside of their value chain and ideally meet the same bar for quality in either case. This addresses some of the current issues with insetting, that there is not nearly as much oversight and verification of outcomes for insetting as there is for credits outside of the value chain that is transacted on the voluntary market. I haven’t yet thought of a specific drawback to the Strict Harm and Good Approach, so this is currently the front-runner in my mind. But please let me know if I have a blind spot here, I am sure I haven’t thought through all of the potential implications.

For all approaches within the two-ledger system, the use of avoided emissions is permitted. This is based on the clear prioritization of protecting existing natural carbon sinks as set out in Project Drawdown, recognizing that there needs to be stronger oversight on baseline and additionality for those units whether within or outside of the value chain.

The two-ledger system would move us away from the concept of offsets entirely. My sense is that this would reduce the criticism of nature-based solutions being used as a contribution to climate mitigation. Even if nature solutions have certain limitations regarding permanence, if they fall into a “good” ledger that is a contribution to broader climate mitigation action and not used within an offsetting structure, I wonder if we would hear less criticism of the use of these credits towards contribution climate mitigation.

Perhaps even more interestingly, the two-ledger system has very interesting potential to expand to include other impact areas in the form of additional harm and good ledgers such as biodiversity and other ecosystem services. Both TNFD and SBTN have been set up to track both the harm that corporates are doing to the environment and the contributions they are making towards nature-positive action. So one could easily see an expansion to a full slate of harm ledgers and good ledgers that go far beyond carbon.

Think critically and see what others think! It’s my opinion that we should be seriously considering a pivot towards a Two-Ledger System to address the “license to pollute” issues of net zero and offsets and ensure corporates are taking clear action to decarbonize and contribute to climate mitigation, in a transparent manner that inspires consumers to build trust in corporate values and purchase their product. But I am curious if others agree.

If you agree, spread the word! How do we make this pivot a reality? Changing the fundamental accounting system for corporate climate claims is a multi-stakeholder advocacy initiative. It will require lobbying SBTi, VCMI and GHG Protocol and likely getting many of the leading corporates taking climate action to endorse the new structure. But once the momentum starts to build, adoption of the two ledger system could happen quite quickly. If you know folks who are in positions of influence, please share this proposal with them. And if you sit within these organizations, I’d love to have a conversation to get your reflections.

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Carbon Removal · Carbon

illuminem briefings

Carbon Removal · Net Zero

illuminem briefings

Biodiversity · Carbon Removal

Carbon Herald

Carbon Removal · Corporate Governance

ESG Today

Carbon Removal · Sustainable Finance

World Economic Forum

Carbon Removal · Sustainable Investment