"Constraining oil supply is key to cutting demand" - an exclusive interview with the Founder of 'Follow This'

· 6 min read

Oil prices might be riding high on robust post-Covid demand, but don’t expect supply-side pressures to relent. The Dutch pressure group whose climate resolutions are winning over investors, is redoubling its campaign to force international oil companies to slash Scope 3 emissions this decade. Outspoken founder Mark van Baal believes this won’t happen unless shareholders oblige IOCs to halt exploration and invest in renewables. He told us that the onus is on Western IOCs to lead the oil industry into a post-crude future – and ignore short-term market signals along the way.

Follow This founder Mark van Baal at a London symposium in 2019

Oil is the new tobacco. ESG investing is all the rage on Wall Street. Even providing IOCs with services such as underwriting or advanced computing is becoming frowned upon – let alone financing their exploration and production activities.

Combined with insatiable demand for commodities to fuel the global economic recovery, these factors are conspiring to keep oil prices high. Yet IOC shareholders are increasingly voting to tie the hands of Big Oil bosses, who hope to secure bumper profits during a period of structural market tightness.

Amsterdam-based pressure group Follow This has been instrumental in energising this movement by tapping into shareholder appetite for change. The organisation won notable victories this year at the AGMs of Chevron and ConocoPhillips, and support for its climate resolutions is rising among shareholders at BP and Shell.

Mark van Baal is adamant that stoking the fires of discontent among typically conservative institutional shareholders is the only viable route to emissions reductions. In a wide-ranging interview with us, the Follow This founder rejected the view that tackling the more difficult challenge of curbing oil demand might yield better results:

“That’s an argument the oil industry is using a lot, ‘it’s not a supply-side problem, it’s a demand-side problem’. Everybody has to do their fair share to achieve the Paris climate agreement, which means that consumers have to buy renewables.

“But let’s face the fact that they haven’t been offered this, Shell didn’t offer any renewable products before 2017, I think. It is very easy to say consumers aren’t buying it if you aren’t offering it, so it is really the supply side that has to change.”

Shell CEO Ben van Beurden describes as a “fallacy” the idea that constraining oil supply will force the world to transition to lower carbon sources. “Ultimately, our customers will have to make the transition,” the Shell boss said recently.

Van Baal sees Shell’s focus on oil demand and ‘consumer choices’ as the latest in a long string of attempts to steer the conversation away from meaningful (but less profitable) action on Scope 3 emissions:

“Talking about consumer choices is deflection and the oil industry have been masters in deflection. By the end of the 1980s they knew what was going on and they decided to deflect public opinion to whether climate change was real or not. They kept us debating about that for a couple of decades.

“When that debate was settled they said, ‘let’s discuss consumer choices’. Now they are saying ‘let’s discuss 2050’. Shareholders are losing their patience, they see the track record of the oil industry and want change and that’s why they vote for climate resolutions.”

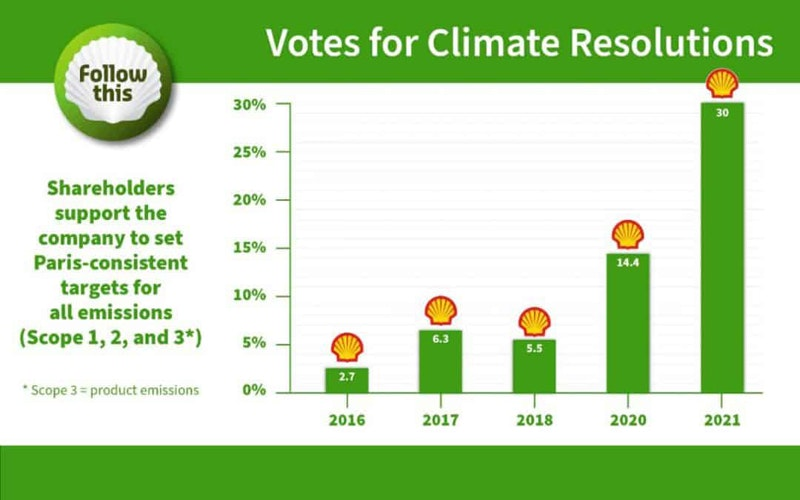

Support for climate action is on a firm upward trajectory at Shell, with 30% of shareholders voting in favour of a Follow This resolution this year – more than double the percentage achieved in 2020:

Van Baal believes the tide is turning because pension funds and other institutional investors are starting to consider the wider impact on their portfolios from the ravages of anthropogenic global heating.

“The oil industry is talking about 2050 but not taking enough action in the next 10 years. Even BP knows. We tried to negotiate a joint shareholder resolution but we didn’t agree on it because we said, ‘OK, our limits are the Paris climate agreement. And the Paris climate agreement dictates decreasing emissions by 2030, not increasing’. That was the key stumbling block.

“The good thing is that the investors are no longer accepting it. Investors are shifting their decision-making from what’s best for the company to what’s best for their portfolio, AKA best for the climate. That’s the key thing I saw changing.

“Five years ago investors would go with that narrative, ‘yes we are looking at a very profitable decade, so please give us maximum flexibility to maximise profit because that’s your fiduciary duty. You have to make sure you can pay your pensions’.

“Now the investors are saying ‘sorry, there’s something much bigger at stake and that’s the climate that’s threatening all our assets, not only yours, so we are going to put constraints on you’.”

Van Baal acknowledges he is targeting a comparatively small part of the oil industry. Western IOCs account for only 20% of global oil production, and are the ones transitioning arguably much faster than national oil companies – which account for around 60% of global oil production. Again, he sees no reason to doubt the merit of the Follow This strategy:

“Let’s first look at the numbers. Shell says they are transitioning much faster. In the last five years while they have been talking a lot more about action on climate, a mere 3% of their investment went on renewables. 97% still went to fossil fuels. OK, 3% is more than 0%, but you can’t claim to be in a fast transition.

“The IOCs have the brains and the ability to drive the energy transition. If they prove we can shift from fossil fuels to renewables, the NOCs will follow. It all comes down to whether you believe the battle between fossil fuels and renewables will be easily won by renewables, which I do, because technology is getting cheaper.”

NOCs might be dragging their feet now but they are owned by governments that signed the Paris climate accord, so they are obliged to act on emissions sooner or later, he argues. Diversifying NOC revenues will become an increasingly urgent priority for political reasons, too:

“These NOCs are in countries where government budgets completely depend on fossil fuels. They must realise if they don’t transition they will lose their revenues. It is a little bit cynical, but if you don’t have these huge revenue streams you will have to ask for taxes, you have to tax your citizens. And as soon as you start taxing your citizens they also want democracy.”

This article first appeared on Energy Flux. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Solar · Renewables

illuminem briefings

Energy Transition · Public Governance

Olaoluwa John Adeleke

Human Rights · Environmental Rights

The Wall Street Journal

Energy Transition · Energy Management & Efficiency

Eco Business

Energy Transition · Energy Management & Efficiency

The Wall Street Journal

Nuclear · Power & Utilities