· 8 min read

Today, it is difficult to find a headline relating to cryptocurrency and the environment that does not contain some reference to the extraordinary energy costs of the two largest blockchains, Bitcoin and Ethereum. This is because Bitcoin and Ethereum account for the vast majority of cryptocurrency transactions.

The energy consumption and carbon emissions

Both Bitcoin and Ethereum blockchains maintain their integrity by relying on the resource-intensive proof-of-work (PoW) consensus procedures. This involves a swarm of computers located all over the world engaging in a process known as “mining” to compete with one another in order to process transactions.

The mining analogy is appropriate. According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), bitcoin mining requires 135 terawatt-hours of electricity annually, which is more than Norway consumes in a year. Bitcoin, the so-called “digital gold” of cryptocurrencies, consumes more energy than the actual gold mining sector, according to the CBECI.

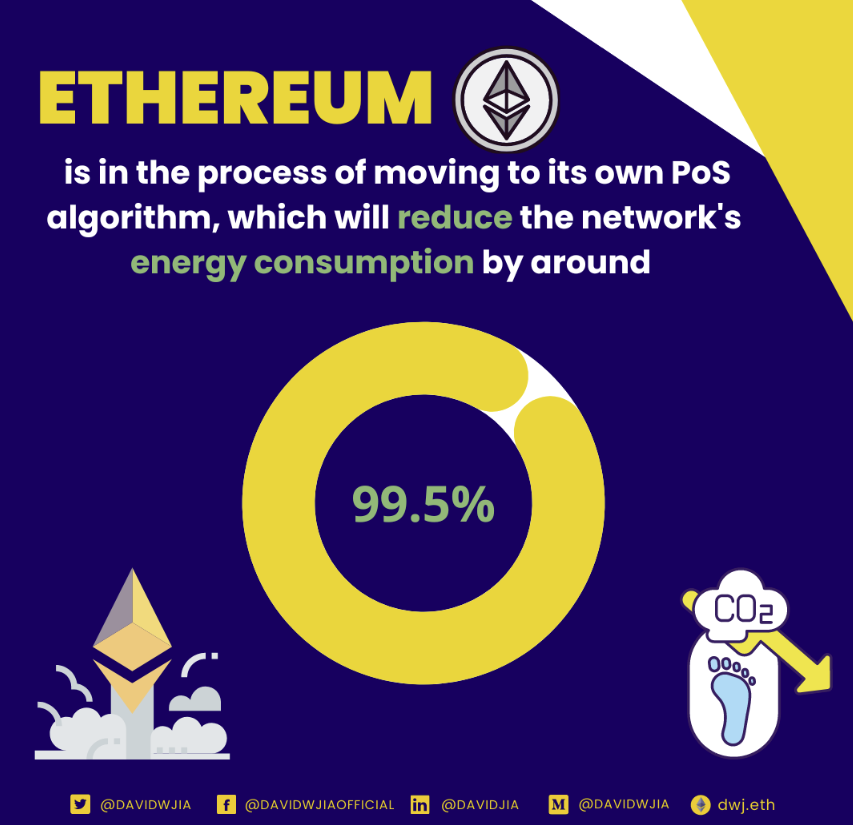

While crypto’s energy consumption is enormous, many in the sector warn that basic comparisons like this are deceptive, especially when one considers the proportion of mining energy that comes from renewable sources (this, too, is debated). In addition, not all blockchains demand the same amount of electricity. Outside of Bitcoin and Ethereum, the majority of significant blockchains use a more durable proof-of-stake (PoS) consensus method. According to the Ethereum Foundation, Ethereum is in the process of moving to its own PoS algorithm, which will reduce the network’s energy consumption by around 99.5%.

Regardless of crypto’s net carbon footprint, it will likely be some time before the public reconsiders blockchain technology as an environmental concern.

Blockchain’s potential in fighting carbon emissions

The distributed ledger technology, better known as blockchain technology, is a powerful tool that has the potential to dramatically increase the openness, accountability, and traceability of greenhouse gas emissions. It assists businesses in providing data on carbon emissions that is improved in terms of accuracy, reliability, standardization, and accessibility.

Through the use of smart contracts, blockchain technology can be put to work to improve calculations, tracking, and reporting about the reduction of carbon footprints across the entire value chain. Instant authentication, verification of real-time data, and clear data records are all things that it is able to give.

Technologies based on blockchain have the potential to turn the independent activities of corporations into a networked effort. In addition, it is able to precisely identify the contributions that individual actors contribute to the reduction of the carbon footprint they leave behind. A win-win situation is created for all parties involved when there is healthy competition and market-based incentives.

Startups in the field of environmentally friendly technologies are an essential part of this process. They create platforms that are enabled by blockchain technology and bring together all stakeholders, including citizens, companies, and governments. Both breadth and depth are provided by the decentralized approach that blockchain technology uses. It gets everyone involved and makes it possible for them to contribute to the computation. It makes possible the tracking and reporting of reductions in greenhouse gas emissions along the whole supply chain, including manufacturers, suppliers, distributors, and end users of the product.

The advancements made in blockchain technologies are important enablers for the formation of cooperative efforts to combat climate change. It is of the utmost significance that the distinctive value that clean technology entrepreneurs bring to this process be acknowledged. Both public and private investors are beginning to recognize the exceptional value that they offer.

A long road to zero

In 2020, fossil fuels still accounted for around 80 percent of total energy use. According to research published by the International Energy Agency in July 2021, global power demand was anticipated to increase by approximately 5% in 2021 and 4% this year, after declining by 1% in 2020. Despite an unparalleled increase in the quantity and rate of deployment of renewable energy sources over the past two decades, this expanding demand is not being met by green energy. The proportion of renewable energy in the global energy mix grew by only 1.1% between 2000 and 2010, and by 3.5% between 2010 and 2020, but only between 2019 and 2020.

The focus of government officials and policymakers must be on achieving climate change targets while preserving a sustainable energy supply and affordable energy access. The solution is to significantly increase investments in clean energy, such as renewables and energy efficiency.

There are, however, political and frequently technical obstacles to acting swiftly. If the global economy continues to produce excessive amounts of carbon dioxide in countries that could decarbonize more rapidly, we will need to place a larger priority on carbon dioxide removals in addition to accelerating reductions in other regions. One method of financing and facilitating these operations is through voluntary carbon markets (VCMs).

Voluntary carbon markets

By definition, the VCM is driven by private, voluntary activities and is not governed by governments. Governments can utilize the VCM to accelerate emission reductions and focus funds on areas where they are most needed. In accordance with the new Article 6 regulation, governments will be responsible for choosing which carbon credits can be used to fulfill mitigation commitments.

The voluntary carbon market has expanded significantly during the past five years, both in terms of the number of carbon credits and the number of project developers, investors, and buyers seeking to meet corporate climate commitments. From 2020 to 2030, the volume of VCM credits could increase by 15 times. At COP26 in Glasgow, carbon markets were in the spotlight as Parties to the Paris Agreement finally agreed on the long-awaited and much-discussed rulebook for Article 6, which governs how carbon credits can be utilized and exchanged under the Agreement.

The role of the VCMs

To keep global warming at 1.5 C, the world must immediately slash emissions. According to scientific research, we must halve global emissions by 2030 in order to reach net zero by 2050. The report also indicates that natural climate solutions (NCS), which aim to protect, restore, and better manage forests, soils, and wetlands, can achieve one-third of the cost-effective emission reductions required by 2030 (up to 10Gt per year). The voluntary carbon market enables investors, governments, non-governmental organizations, and enterprises to voluntarily acquire carbon credits representing verified emission reductions. This is a vital instrument for unlocking the full potential of NCS, which has been historically underfunded and devalued.

For NCS to reach their full potential, we must assign a monetary value to the advantages they give, such as carbon storage, water filtration, oxygen production, and biodiversity promotion. Additionally, we must release massive amounts of private wealth. The VCM is the first global private market to truly value at scale the service an ecosystem gives to the earth, in this instance carbon storage. The VCM is by no means the only solution for funding NCS, but it is an extremely significant and immediately applicable approach.

Integrity and trustworthiness are vital for the VCM to function as a source of these crucial funds. On the supply side, we must ensure that the underlying carbon credits are of the highest quality, and on the demand side, we must prevent “greenwashing” by ensuring that these credits do not allow companies to avoid reducing their own emissions. In order to do this, initiatives such as the Integrity Council for Voluntary Carbon Markets and the Voluntary Carbon Credits Integrity Initiative have been developed.

Blockchain’s role in the carbon market

Blockchain offers the potential to increase verifiability and minimize transaction costs, and to a lesser extent address the challenges of forestry initiatives’ additionality and permanence.

Established blockchain-based projects appear to function independently of existing VCM actors in that, despite offering carbon credits, it is unclear whether there are formal procedures and which third-party bodies are validating these carbon credits for usage against net-zero targets. Given the nature of blockchain-based projects, the authentication and approval of these credits should be simpler than with traditional ones. Technically, however, additional innovation may be necessary to permit the “linking” of carbon markets to enable the seamless transmission of value across various blockchain platforms. Multiple blockchains can be coupled with ‘traditional’ blockchain solutions, which already incorporate this capability within their designs.

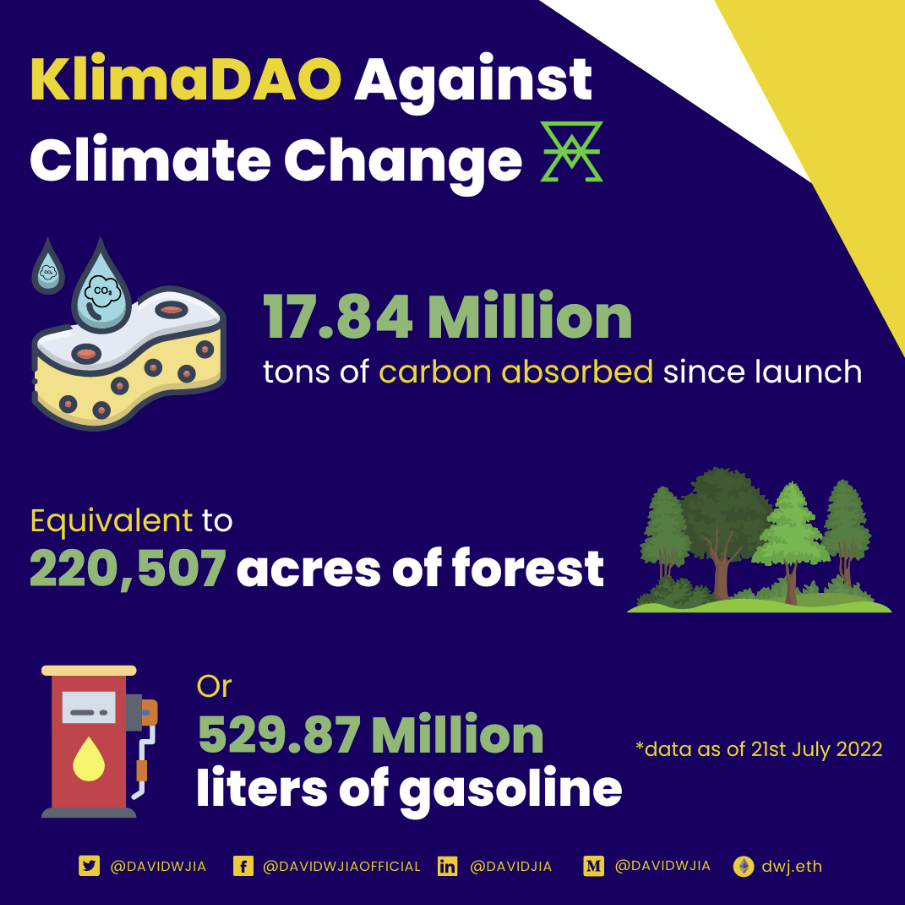

Existing blockchain-based projects range in scope and goals, with some focusing on carbon offsets and others on ecological restoration. In Nepal (habitat and soil restoration), Madagascar (carbon sequestration with mangrove trees), and Indonesia (carbon sequestration with mangrove trees), for instance, the blockchain-based platform Veritree offers a variety of initiatives with varying consequences on climate change (carbon sequestration and coastal erosion). Veritree’s alliances include Samsung and Cardano. Another example is Treecycle, a major forestry operation that aims to plant 10 million trees on unused land in Paraguay. Treecycle sells ‘TREE’ tokens, which are linked to real trees and constructed on a proof-of-stake blockchain. It does not currently offer offsets but is monitoring the market’s evolution and may modify its business model accordingly. In addition, since its inception in October 2021, KlimaDAO has acquired 17.8 million carbon credits, which is equivalent to 89,236 hectares of forest.

Moving forward

Wouldn’t the world be improved if every business followed this vision? Some have referred to it as “the way to net zero with high aspirations,” which is a nice message. It avoids the use of terms like “carbon neutral” and “offsetting,” whose definitions are contested and which have become unhelpfully laden.

Regarding this subject of how to shift to net zero, we should use the simplest terminology possible. So much of the discussion and argument surrounding carbon markets is mind-bogglingly complicated. However, NCSs are more likely to realize their full potential if they are supported by the VCM and private money. So let’s move on to the very real task of expanding the initiatives and programs that put theory into practice in the actual world.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.