Transition driving forces: The road for net zero in 2050

· 7 min read

The world is undergoing an energy transition, from a system based on fossil fuels to a system based on renewable and sustainable energy, to reduce global greenhouse gas (GHG) emissions and avoid the most serious impacts of a rapidly changing climate. Recently companies and governments around the global have been committing to achieve a “net-zero target by 2050”. The term embraces the concept that any GHG emissions are balanced by absorbing, or physically capturing, an equivalent amount from the atmosphere by 2050. This is required to meet the 1.5°C global warming target in the Paris Agreement, global carbon emissions should reach net-zero around mid-century.

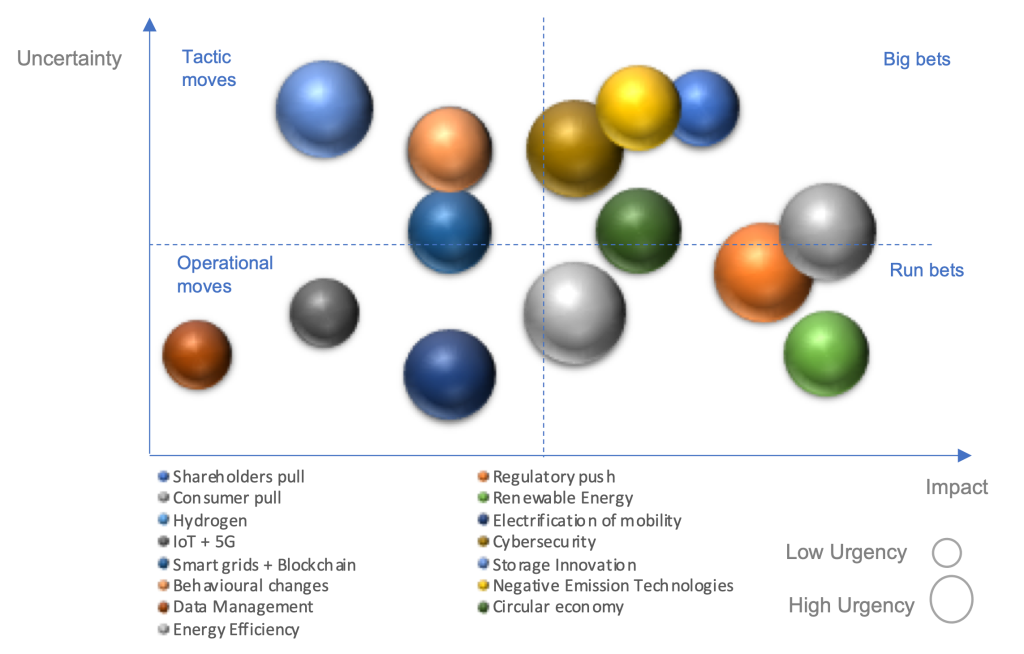

To assess the future pathway for a net-zero future by 2050, I surveyed 50 Global Energy Leaders and identified 15 key driving forces that can accelerate or urge the speed the world can achieve a net-carbon zero future.

I identified 15 driving forces that will shape and accelerate the pathway to achieve a net-carbon zero target by 2050.

The driving forces were measured by:

In the survey map, there are four areas where Energy Leaders are currently focusing:

The size of the bubble represents the urgency of this issue to accelerate the urgency.

The Big Bets is the quadrant driven by forces such as shareholders pull, negative emission technologies, consumer pull, cybersecurity and circular economy. The last three are highly urgent. This is supported by the fact that these three forces not only can shape but also disrupt the current energy system and accelerate the speed of a net-carbon zero by 2050.

The Run Bets are initiatives that Leaders consider will provide a high impact and can accelerate the speed of the net-zero carbon target by 2050. It is less uncertain given some of these forces are provided concepts of their potential impact. Such issues are driven by regulatory push created by a need for more sustainability and carbon target compliance, renewable energy and energy efficiency solutions.

The Operational Moves are identified by forces with relevant impacts and low uncertainty and hence where Leaders are acting today: data management, IoT and 5G digitalisation solutions critical for resources optimisation, as well as grid management. Additionally, the electrification of mobility is the force that keeps Energy Leaders awake at night given the impact is already taken on reshaping the energy infrastructure system.

The Tactical Moves is the quadrant driven by three forces: shareholders pull, behavioural changes, smart grids and blockchain are highly uncertain to bring an immediate impact given the maturity of these forces across the globe.

The survey was taken in the week of 17th May 2021 from 50 Global Energy Leaders across the globe, working in the energy sector, and based on the following 15 driving forces and market dynamics.

1. Negative Emission Solutions: Negative emission solutions include solutions that neutralise the carbon emissions, for example: carbon capture sequestration and storage (CCUS), reforestation, ocean fertilisation. These technologies have a low degree of maturity, but the CCUS technologies alone are projected to be a $6 billion dollar market with a yearly growth of 27%.

2. Alternative Fuels: These include biofuels, and LNG but not hydrogen. The use of alternative fuels can reduce at least 40% of the emissions. According to the International Energy Agency, biofuel production would need to triple by 2030 to meet targets for sustainable growth. Biofuels are somewhat controversial in the environmental movement due to the food versus fuel debate.

3. Hydrogen (alternative fuel): Hydrogen is one of the most important of such fuels, as it can provide a viable solution for the aviation sector, one of the most difficult sectors to decarbonise. Hydrogen can also be a critical element for the decarbonisation and electrification of cities

4. Policy Design Push: On top of the Paris Agreement, signed in 2016 by 198 countries to maintain the increase in global average temperature within 2C, individual countries are implementing domestic environmental policies and funding various sectors, e.g. EU Green deal investment plan of €1 Trillion to finance and design green polices; UK banning diesel vehicles in 2050, and has issued net carbon directives for the construction sector.

5. Shareholder Push: A group of 70 pension funds and insurance responsible for $3 trillion in investments are committed to migrating to a net carbon zero portfolio. Top major oil and gas companies created OGCI, Oil and Gas Climate Initiative to accelerate response to climate change.

6. Energy Efficiency: Energy efficiency has an enormous potential. The energy savings from net zero housing can reduce heating costs by 75% to 90%, and these new dwellings also have a much longer life-span. The market for energy efficiency investment in 2011 was $360 billion according IEA.

7. IoT and 5G: Digitalisation is a pervasive trend and technologies like loT and 5G are already contributing to the reduction of carbon emissions, by making remote operations viable and reducing signal delays. IoT and 5G will be critical to facilitate integration of renewables into the grid.

8. Renewable Energy: Today the share of renewable energy in the power sector is expected to increase from 31% to 100% by 2050, mostly through solar and wind power generation. It will only be possible to achieve this with new approaches to the power system, market operations and regulation.

9. Consumer Pull: There is a growing public demand for organizations, cities, and countries for a rapid transition to net carbon future. Strikes and global protests have increased globally. Prosumers will define the way some of the utility companies need to operate in the future.

10. Electrification of Mobility: The EU has invested heavily in the electrification of mobility by providing extensive support for electric vehicle research and ecosystem operators. However, there are still bottlenecks in the grid and in the technologies, arising from the need for battery life, charging stations, home charging, smart grid connections. Vehicle design and human-car interaction will continue to evolve, increasingly reinforcing the attractiveness of these technologies.

11. Storage: The optimal storage of energy that balances demand and supply is at the centre of this transformation. For example, storage is a key enabling technology for the advancement of hydrogen as a fuel and fuel cells. Recognising the pivotal role of storage technologies, venture capital firms poured nearly $2 billion into battery technology companies in 2019, doubling the amount the year before.

12. Cybersecurity: Digitalisation brings many benefits to the electricity system but raises risks such as cybersecurity that threat the infrastructure resilience. Cyberattacks are among the top ten global risks. Research from Hornet Security, a German cloud security vendor, identifies energy as the number one target for cyberattacks, attracting 16% of all attacks worldwide.

13. Behavioural Changes: Recent studies have shown that human behaviour is as important as the physical characteristics of a building in influencing energy use, and that carbon emissions from houses are most sensitive to internal temperature changes, largely dependent on human behaviour. Also, corporate patterns can change the way we consume energy from travel to new habits.

14. Data Management: It is estimated that more than 700 million smart meters will be installed globally by 2020, leading to +360 petabyte of data a year. TM Research predicts that the global utility company expenditure on data and analytics will grow to USD $3.8B in 2021. A well-defined data management framework would consider the prioritisation of data, its classification, required storage, analysis, and architecture. Doing it will help energy companies realise significant cost savings and energy data processing optimisation while developing a state of art data process.

15. Circular Economy: Circular economy could help the industry better address long-standing challenges around improving efficiency and reducing the need for rare, raw materials (like cobalt for EV batterie). Circular economy which involves sharing, leasing, reusing, repairing, refurbishing, and recycling existing materials and products if possible.

This article first appeared on CMarkits. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Biodiversity · Nature

illuminem

illuminemX · Environmental Sustainability

illuminem briefings

Carbon Market · Carbon

The Guardian

Carbon · Biodiversity

The Washington Post

Biodiversity · Nature

Carbon Herald

Carbon Market · Public Governance