A new bill in Brazil as a virtuous tipping point for the voluntary carbon markets?

· 8 min read

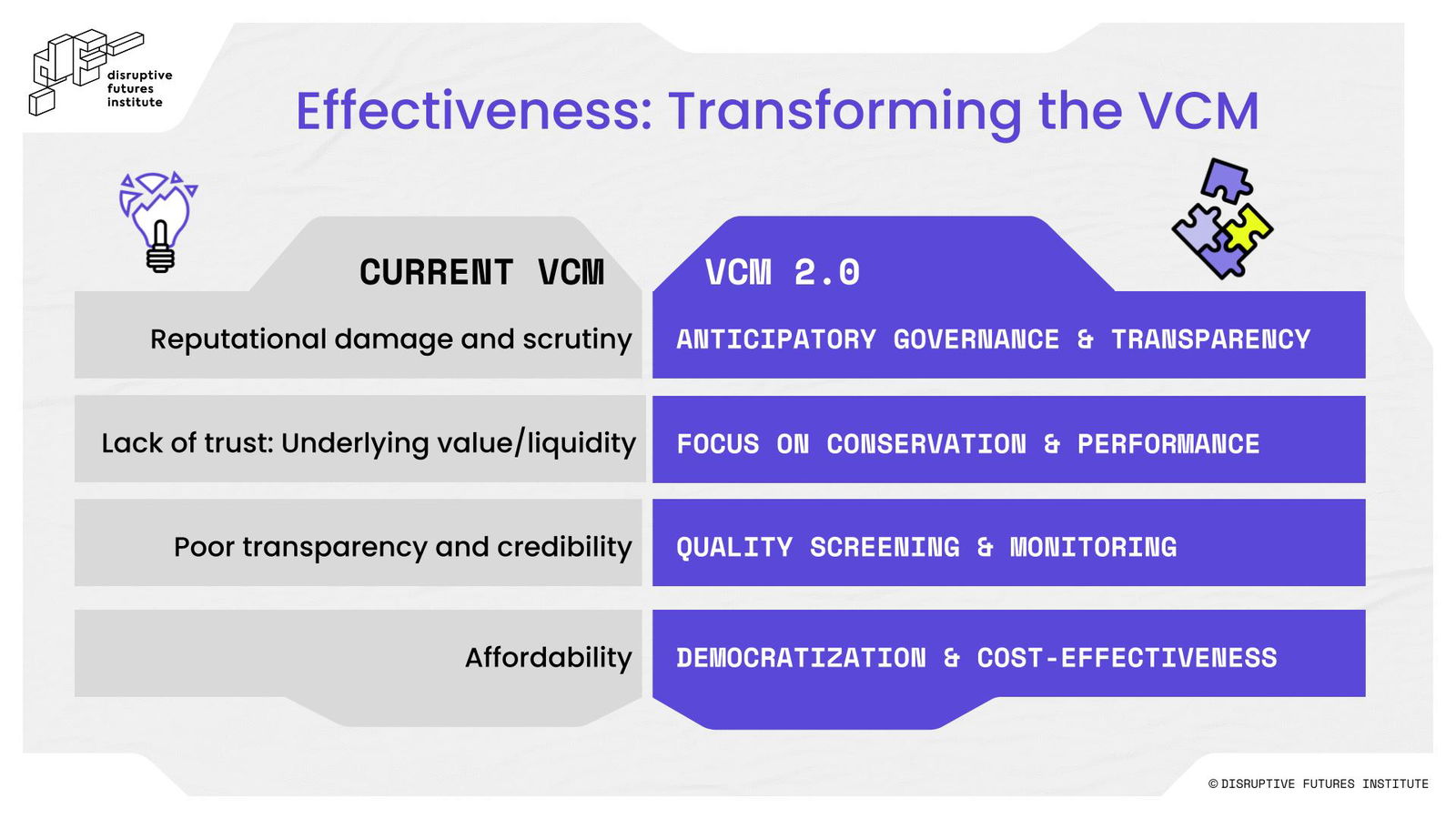

Voluntary Carbon Markets (VCMs) are a growing market-based mechanism to achieve decarbonization by creating carbon credits via offset methods. VCMs are markets where firms can abate carbon emissions to generate carbon credits for purchase - often by large institutional actors. Purchasers of carbon credits frequently use them as a form of carbon offset, which supports the net-zero agenda of many modern companies. While VCMs create new market-based incentive structures for carbon abatement, their integrity is often critiqued as lackluster, untransparent, and poorly verified.

VCMs have many promising aspects, but they do not constitute direct emissions reduction. Instead, carbon abatement via offsets are often based on avoided deforestation or avoided emissions, compared to a baseline where offsets were not used.

The abatement of extra emissions due to offsets is termed “additionality”. Additionality is a key characteristic of high-integrity carbon offsets.

Despite challenges in ensuring additionality, the carbon credit market could surge in importance due to upcoming regulations requiring decarbonization targets. These regulations often aim to incentivize emissions reductions. According to Morgan Stanley, the voluntary carbon-offset market is projected to expand from $2 billion in 2020 to around $100 billion in 2030 and approximately $250 billion by 2050. Morgan Stanley also asserts that the world must remove at least one billion tons (one gigaton) of carbon dioxide annually by 2030 to meet various national and corporate targets and forthcoming regulatory requirements. Avoidance or reduction credits could total up to 10 gigatons per year, although there is continued debate regarding how to define scientifically sound carbon credit verification.

It is naive to ignore the growing role of carbon markets and offsets, which are expanding rapidly as a tool for addressing climate change. So the important question is - how do we measure and verify carbon abatement through VCMs in a proper, robust manner underpinned by integrity? In other words, as the world increasingly turns to carbon offsets, we must ensure that they deliver on their promise of effective, verifiable climate solutions.

Organizations face unprecedented scrutiny regarding the effectiveness of their climate actions, especially in the context of VCMs and carbon offsets.

Given the scrutiny from shareholders and consumers, companies have an increasing incentive to undertake ESG practices. Additionally, organizations face substantial carbon transition risk as global markets move to a lower-carbon future. Organizations which are seen to deliver sustainable futures may reap benefits, while those which neglect the environment will be exposed to potential value erosion, including through stakeholder scrutiny, shareholder criticism, and litigation.

However, in this context, companies have a perverse incentive to greenwash and obscure their sustainability practices. The reputation of VCMs has become undermined by issues of integrity, particularly regarding the legitimacy of their carbon abatement claims, and equity, with regard to which they further entrench institutional power asymmetries in carbon markets and lock-out less powerful stakeholders.

This beckons the question - what are the pathways for effective carbon credit verification?

Brazil is emerging as a significant player in the global carbon credit market, thanks to its extensive biomes and potential for carbon reduction through avoided deforestation, reforestation, and sustainable agriculture.

BloombergNEF estimates that Brazil could offset 30.5 billion metric tons of CO₂ by 2050, underscoring its potential in voluntary carbon markets. In 2021, Brazil introduced the Green Rural Product Note (CPR Verde), a mechanism allowing rural producers to secure financial resources based on the carbon stock of their land. This incentivizes sustainable practices, reducing climate transition risks for the agribusiness sector while embracing carbon market opportunities. However, challenges persist, including the lack of integration between voluntary and regulated markets and global scrutiny of misleading carbon credit programs. Despite these hurdles, Brazil's maturing market and the rise of local certifiers may help establish credibility and scalability.

Lux Carbon Standard (LuxCS) is one of these local certifiers. In fact, LuxCS is Brazil’s first domestic carbon credit certifier, and is at the forefront of this transformation, aiming to scale and democratize a higher-quality carbon credit market while fostering trust among stakeholders.

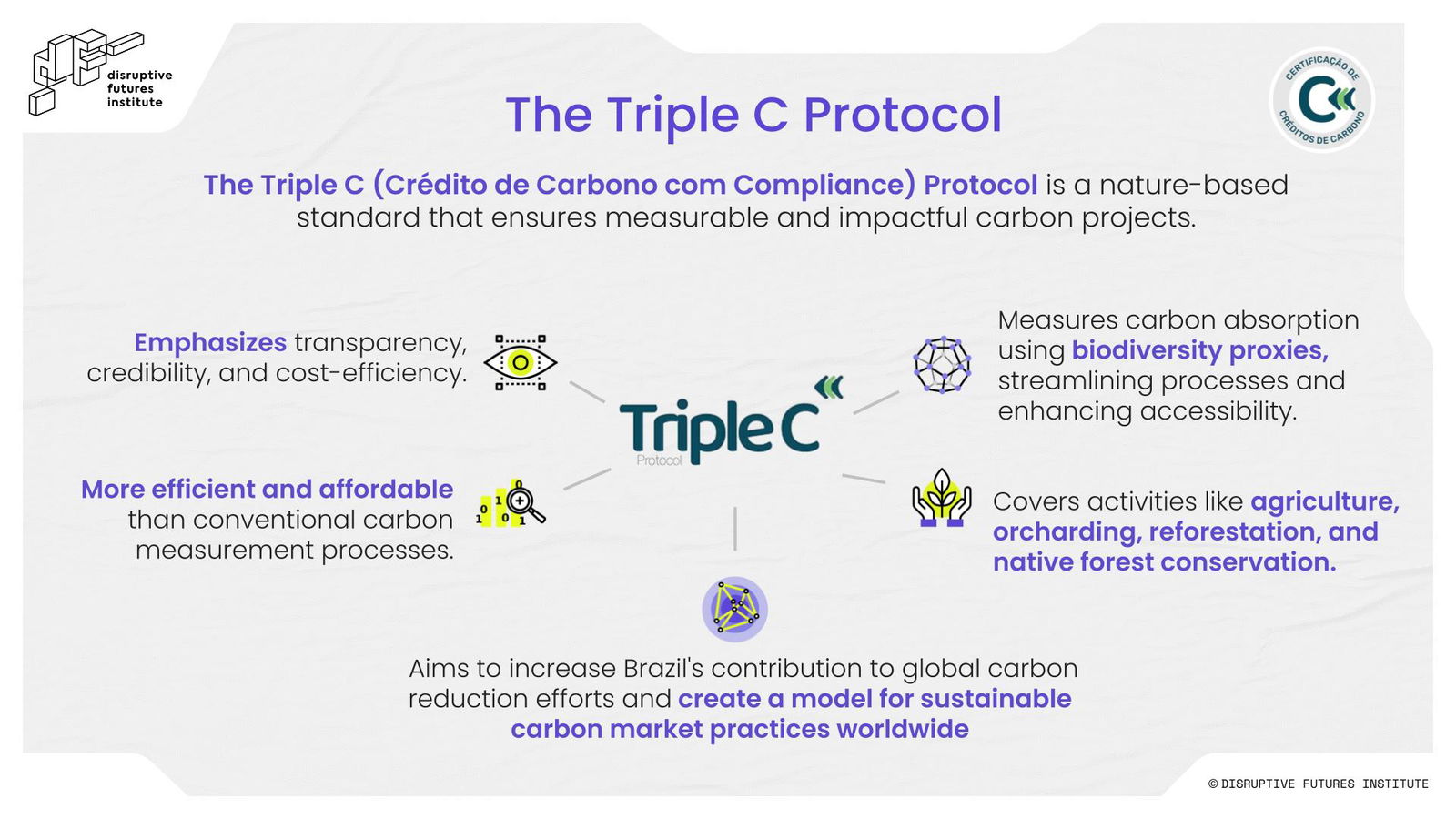

LuxCS’s approach centers on its proprietary Triple C Protocol (Crédito de Carbono com Compliance), a nature-based standard ensuring measurable and impactful carbon projects. This protocol emphasizes transparency, credibility, and cost-efficiency, leveraging Brazil's geographic and cultural context to lower certification costs and expand participation to projects in underrepresented regions. Unlike conventional methods, which focus on avoided emissions and require resource-intensive baseline data, the Triple C Protocol measures carbon absorption using biodiversity proxies. This streamlines processes while enhancing accessibility for projects involving agriculture, reforestation, and native forest conservation.

The Protocol covers activities like agriculture, orcharding, reforestation, and native forest conservation. These combined efforts aim to increase VCM participation in Brazil, accelerate positive environmental impact, and enhance the credibility of the market. LuxCS follows the guidance of key organizations like Science Based Targets initiative (SBTi), the Integrity Council for the Voluntary Carbon Market (ICVCM), and the Voluntary Carbon Markets Integrity Initiative (VCMII).

The Triple C Protocol is more efficient and affordable than conventional carbon measurement processes, as it focuses on biodiversity proxy information rather than time-intensive carbon measurement processes. Most carbon credit programs seek to avoid emissions, which requires burdensome baseline data collection. Instead, the reliance on biodiversity characteristics measures the carbon that has already been absorbed in the land, precluding resource-intensive baselines. As another differentiator, LuxCS covers both avoided deforestation, similar to REDD+ (Reducing Emissions from Deforestation and Forest Degradation in Developing countries), and afforestation, reforestation, and restoration (ARR) conservation practices.

By leveraging innovative methodologies and fostering trust, LuxCS intends to increase Brazil’s contribution to global carbon reduction efforts, enhance biodiversity, and create a model for sustainable carbon market practices worldwide.

Most recently, LuxCS has demonstrated its impactful practices through its contribution to Bill 182/2024.

Tipping points, or inflection points, arise when small changes interact and enable the emergence of watershed changes that replace past paradigms and assumptions. With Bill 182/2024, Brazil could be paving pathways to a virtuous inflection point for structural transformations to deliver on environmental responsibilities for carbon offset markets.

We can achieve virtuous tipping points as effective initiatives align and accelerate.

LuxCS made major contributions to Bill 182/2024, which the Brazilian senate approved on 13 November 2024, and was sanctioned on 11 December 2024. This bill established the regulated carbon market in Brazil and set provisions for the voluntary carbon market.

The bill represents a significant advancement for the Brazilian carbon market, offering a framework that can serve as a global reference due to its relatively light and modern provisions, enhancing the market’s ability to respond to climate changes and financial market demands.

Importantly, it clarifies that the landowners hold the rights related to carbon credits and the management of their generation. This clarification on ownership has two major positive impacts:

It shifts the power in the relationship from project developers to landowners, the actual credit generators.

It provides the landowners, who have the greatest responsibilities related to the projects, to keep more of the revenue from credit generation, rather than the developers.

Both Bill 182/2024 - and LuxCS as a certifier - adopt conservation and restoration as basic principles. Mere maintenance of areas is no longer sufficient for generating effective carbon credits; there must always be improvements, including in water resources, biodiversity, local socioeconomic development, and more. This higher standard may allow credits to be integrated more easily into international markets through the financial system, providing greater stability and market understanding.

Bill 182/2024 also plans complete interoperability between the regulated and voluntary markets, with the possibility of converting voluntary market credits to regulated market credits - provided the methodology is accredited by the Managing Body of the Brazilian Emissions Trading System (Sistema Brasileiro de Comércio de Emissões - SBCE).

The securities market authority in Brazil (Comissão de Valores Mobiliários - CVM) will handle the regulation of stakeholders and mechanisms for trading carbon credits. Brazilian legislation aims to define carbon credits as a security (tradable assets). This will facilitate the entry of market resources to help finance international efforts to combat the climate emergency. Notably, the CVM has already allowed certain investment funds, particularly those focused on agribusiness, to include carbon credits generated within the sector among their assets. This development, which occurred before Bill 182/2024 was proposed, may foreshadow an intensification of investment following the implementation of the new legislation's mechanisms, potentially attracting more capital to climate-related projects.

Ultimately, the bill represents a clear global advancement in the voluntary carbon market, its relationship with regulated carbon markets, and the global financial markets. Through its active consultation in drafting the bill, LuxCS has solidified its role as a market integrator and its technical and market expertise.

The goal of LuxCS is to effectively scale and operationalize a high-integrity market, and take this modern and functional model to other parts of the world - promoting greater global integration of the carbon market itself.

Bill 182/2024 represents a major shift in the regulatory characteristics of VCMs, which has important implications for the social and environmental dimensions of VCMs. The way this bill has been shaped is a testimony to the system innovations LuxCS is driving in transforming the VCM space.

While LuxCS is currently operating in Brazil, it intends to expand to other regions of the world. For instance, the Asia-Pacific is a major frontier for combating climate change, and also presents major opportunities for making lucrative returns via VCMs. Resultantly, LuxCS is pursuing opportunities in this region, which shares certain features with its Brazilian biomes, market characteristics, and need for systems-wide democratization.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Carbon Market · Public Governance

illuminem briefings

Carbon · Environmental Sustainability

Inside Climate News

Carbon · Public Governance

Interesting Engineering

Carbon Capture & Storage · Architecture

Carbon Herald

Carbon Capture & Storage · Maritime