Why Carbon Capture is not the equal of Hydrogen

· 2 min read

Question. Why do investors display such eagerness to invest in green Hydrogen but are so disinclined to spend on carbon capture projects?

The technology is unproven and is way too expensive at present to any kind of make economic sense, but enough about Hydrogen. Carbon capture has been working effectively for fifty years or more yet still it has not seen a wider take up. Why is that?

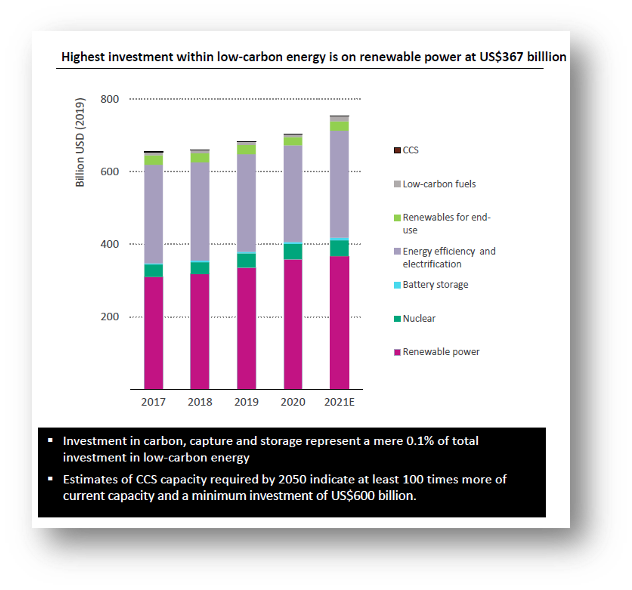

Carbon capture, utilisation and storage (CCUS) will need to form a key pillar of efforts to put the world on the path to net-zero emissions, so say the IEA. If it is good enough for the IEA to claim it needs to be an integral part of the decarbonisation mix, then why not for investors? Carbon capture currently only represents 0.2% of energy related CO2 emissions, yet all technology, theoretically at least, has a role to play in cutting emissions.

Then what are the driving causes of the imbalance? Simply put, Hydrogen has an obvious user base. Essentially anybody who wants a clean burning fuel or to reduce their hydrocarbon consumption would gladly look at solutions involved this highly combustible gas. However, who is the client for carbon capture? Who benefits? That, I feel, is the real heart of the question.

From a purely economic perspective carbon capture makes little sense. Spend an inordinate amount of money to produce a substance that you are going to do little more with than shove back down into the ground. It starts to look more attractive when the government gives subsidies of up to $180 a ton, as is being proposed in the US 45Q tax credit.

What about EOR I hear you say? Yes, it can be used to drive some more hydrocarbons out of the ground, which does account for over a third of captured CO2 use at present. The problem with this is the same as the problem with Blue Hydrogen. It is tainted by the whiff of hydrocarbon use, not something any shareholder or investor wants to be associated with.

CCS then is simply a product without a customer. Big money will not be invested if the only real return is dependent on carbon pricing or government subsidy. This kind of risk is not something you base a long-term multimillion dollar investment around unless you have a crystal ball. It appears then that for the time being at least, carbon capture is simply not the equal of hydrogen.

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Hydrogen · Green Hydrogen

illuminem briefings

Sustainable Finance · Biomass

illuminem briefings

Hydrogen · Electric Vehicles

Hydrogen Europe

Energy · Hydrogen

Energies Media

Green Hydrogen · Hydrogen

H2-View

Hydrogen · Sustainable Mobility