· 5 min read

New report: “Blended Finance: When to use which instrument? Clusters and decision-making factors.”

Blended finance is gaining interest in ESG, sustainable finance, and impact investing circles. More and more people are realizing that, in order to scale financing solutions to address the world’s most significant challenges, like those captured in the Sustainable Development Goals (SDGs), we need to deploy governmental and philanthropic interventions to make impact projects investable for the deep pockets in finance: pension funds, insurance companies, and sovereign wealth funds. Blended finance is the catalyst for impact: it mobilizes institutional investment by making investable projects that would otherwise be considered uninvestable.

However, one of the barriers to expanding the blended finance pool is the complexity of blended finance transactions. Typically, a large number and variety of actors from across sectors are needed to structure a blended finance project. These can include development finance institutions, philanthropic organizations, impact-oriented fund managers, governmental agencies, entrepreneurs, sector-specialists and mission-driven organizations.

Another barrier is understanding the different financial contributions or instruments needed to structure a blended finance project. Generally, this is a combination of grants, first-loss tranches, technical assistance, impact-linked finance, and equity and debt (either concessional or not).

In light of these complexities, we should very much welcome the new report “Blended Finance: When to use which instrument? Clusters and decision-making factors,” based on a research project by the Initiative for Blended Finance at the University of Zurich, that was conducted together with the Center for Sustainable Finance & Private Wealth (CSP) at the University of Zurich, as well as Roots of Impact and the Bertha Centre for Social Innovation & Entrepreneurship at the UCT Graduate School of Business.

The report, co-authored by researchers Taeun Kwon, Barry Panulo, Stephen McCallum, Kelvin Ivankovik and Zaakir Essa, can perhaps best be compared to the “How to Play” instructions that came with this spiffy new board game you got for your birthday.

First, you’ve got your different blended finance instruments: grants, impact bonds, concessional debt, and so forth. The report describes what they are, why you might need them, and how well they go together with other instruments. It also lists some of the points of caution, or safety warnings: potential pitfalls in deploying each of the instruments and their limitations.

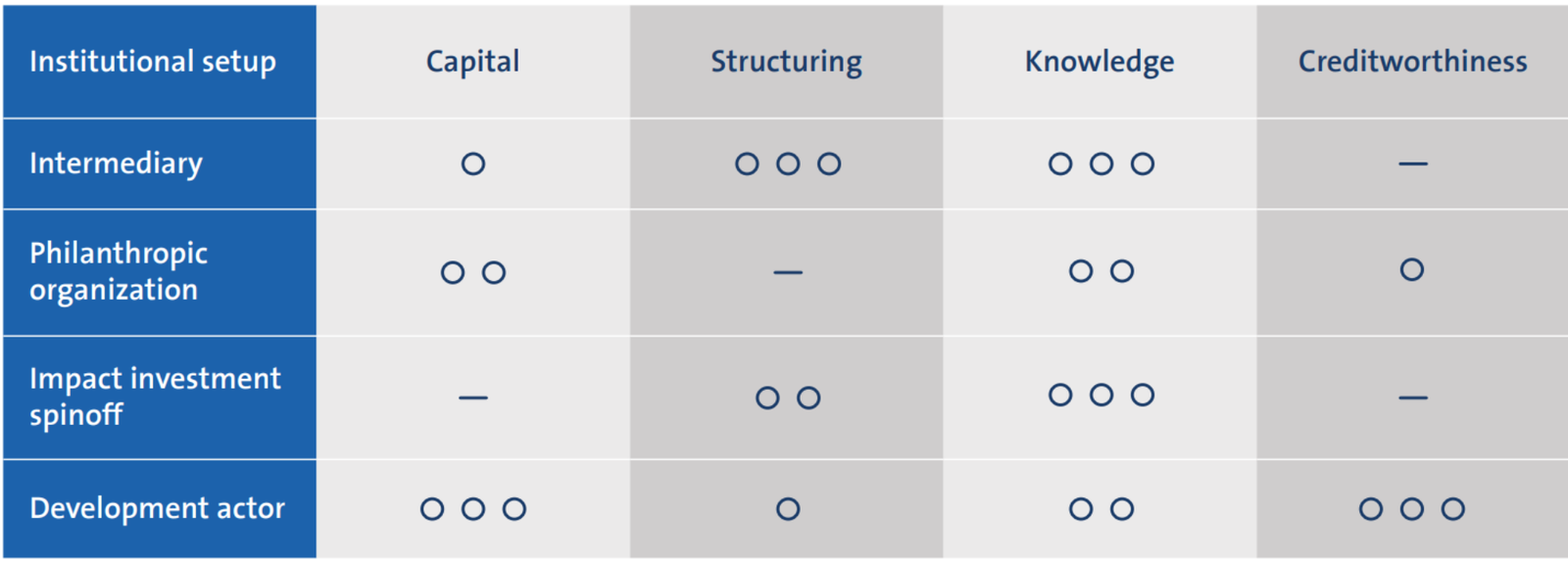

Second, you’ve got your different players in the blended finance space. These include philanthropic organizations, development actors, impact spin-offs, and financial intermediaries. The attributes and core competencies of each are explored in turn: what can they bring to the table? This can be capital, structuring capabilities, sector and/or regional knowledge, or reputation and creditworthiness.

Finally, you’ve got a set of 12 questions that can guide you in determining the instruments best suited to a given blended finance project and the institutions which should be involved. These questions include prompts like:

- Which role do I (the initiator) play in the transaction, and what can I bring to the table?

- How much capital can I deploy?

- What is my target financial return / what are my financial requirements?

- What kind of impact problem am I addressing?

- How does the investee want to scale? What is their growth trajectory?

- What is the maturity level of the intervention?

The report also provides insight into why blended finance can be so challenging: the necessity for collaboration between actors. While this has been a barrier to scaling blended finance thus far, it is also the factor that strengthens this approach. Different actors complement one another, as illustrated in the graphic below. Each has different resources to contribute. For instance, actors who have the capital can’t do the structuring, and those that can don’t have the capital.

Financial intermediaries, such as asset management firms, often have the necessary financial expertise to structure complex deals, but don’t own capital – at best they manage other organizations’ capital which typically comes with strict mandates and strings attached. At the same time, organizations that have (at least some) capital, such as development organizations, do not necessarily have access to the financial wizardry needed to set up the sophisticated vehicles that will deploy the capital.

There are also cultural considerations. These organizations often operate in different worlds and their employees haven’t necessarily had much contact with people in the other types of organizations. In other words, we need more of an international marketplace where these different actors can engage, learn about possible projects, and see if they can match institutional mandates, financial instruments, and expertise. These ‘macro’ factors – market conditions and sectors – will be the focus of the authors in the next phase of their research.

Nonetheless, this report is already a significant step in the right direction. By reviewing the academic literature and offering a solid taxonomy of the current research, interviewing many leading practitioners, and translating this combined knowledge into accessible explanations and a practical checklist, the authors of this report have made an important contribution to the practice of blended finance.

Every ESG professional, impact investor, and development finance expert would do well to read it.

And is invited to join the other players at the table, to play a couple of rounds of Blended Finance.

Editorial note: while Harald Walkate is affiliated as senior fellow with the Center for Sustainable Finance & Private Wealth (CSP) at the University of Zurich (one of the contributors to the report), he had no involvement in the research or writing of the report. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.