· 9 min read

DeFi promises to reduce costs and make financial services accessible to all. In this article, we contextualize DeFi's value proposition with a specific use case to deliver substantial socioeconomic benefits: tokenized debt bond[2] to finance an operational hydropower plant in Rwanda, Africa. Before we get there, let's take a step back.

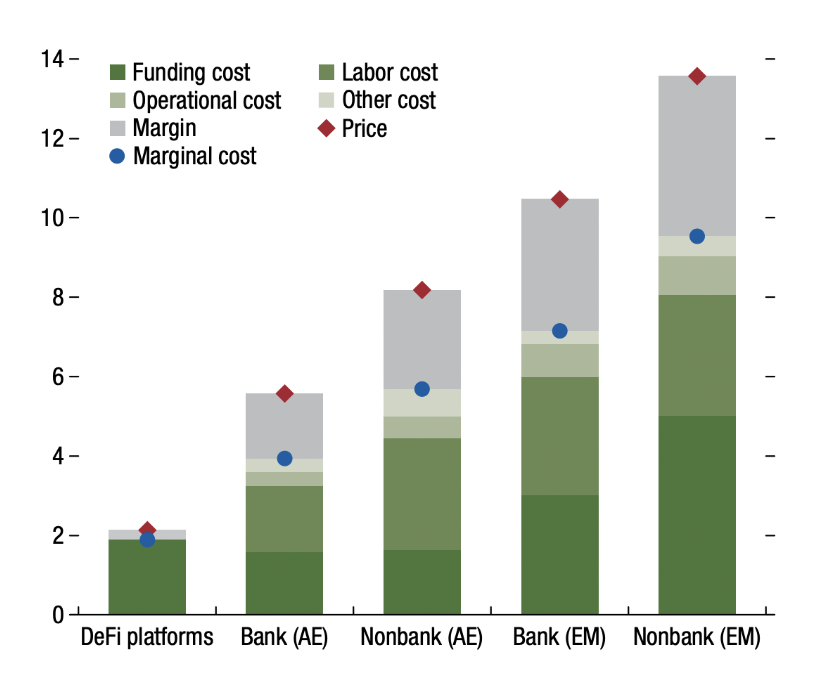

Traditional financial intermediaries (TradFi) create friction in infrastructure financing through access thresholds, time delays, fees, inaccurate, and sparse information. Against the backdrop of the climate emergency, we are significantly missing our financing targets for key projects such as renewable energy investments, which need to increase by more than seven-fold — from less than $150 billion in 2021 to over $1 trillion —to meet climate goals. However, with traditional financing models, the sustainable infrastructure asset class remains attractive to only a small group of institutional investors. At the same time, impact investors are looking for ways to provide capital for such projects. Still, they have difficulty competing against a multi-layered and insular securitization industry. These inefficiencies result in most sustainable infrastructure projects failing to materialize. We need to address the cause, not the symptoms, to solve the problem.

This creates immense opportunities. If investors were able to seamlessly transfer all claims, rights, and obligations under an original and secure contract to a third party, it would significantly reduce the cost of capital and eliminate reliance on a financial intermediary. Hence, a tempting alternative to facilitate the flow of settlements between asset originators and investors is the use of smart contracts (self-executing rules) running on blockchains (distributed databases). Academic literature details how decentralized finance (DeFi), financial services built on blockchains, enable investors and asset originators to overcome current barriers of liquidity, transparency, transaction costs, and scale. Even the centralized financial conglomerates IMF, WEF and SFIG[2] agree on the transformative potential of DeFi (Applying Blockchain in Securitization, Global Financial Stability Report, WEF infrastructure article).

In fact, what Adam Smith referred to as "the invisible hand" in 1776 may manifest itself much more clearly in how DeFi, compared to centralized TradFi, drives trade and financial contracting to promote a sustainable future, an idea that is reflected in Adam Smith’s quote nearly two hundred and fifty years ago:

“(the individual) intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain; and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest, he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.” - Adam Smith, 1776.

The ideal DeFi wedge

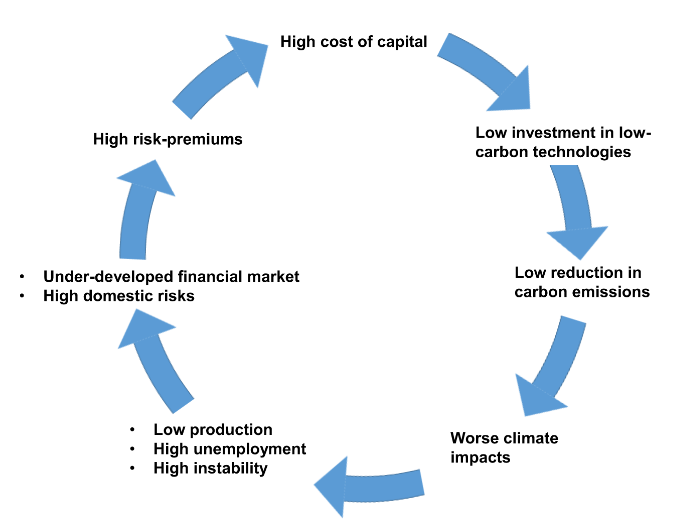

High capital costs further delay the energy transition and GHG reduction, increasing the risk perception of climate change infrastructure. The negative feedback loop is particularly pronounced for developing countries that suffer disproportionately from climate change impacts. As a result, developing countries are caught in the climate finance trap, exacerbated by high financing costs.

With permissionless access to digital dollars, individuals trapped in poorly developed currency systems may reverse the negative climate finance feedback loop. Developing countries are at the forefront of utilizing DeFi for savings and loans, payments, and investing. A large fraction of the population in economies like Argentina, Venezuela, Nigeria, and Kenya exemplifies how DeFi provides a better store of value than the existing centralized financial infrastructure.

In a thorough review of DeFi's value proposition, we find that the ideal area where the technology has the greatest potential to deliver significant socioeconomic benefits is the a) senior debt tranche for b) renewable energy in c) emerging markets issued on the d) Ethereum blockchain.

Why do we reach this conclusion? Let’s go through the arguments step-by-step:

- Why senior debt tranche? Senior debt holders are the first to have a claim on the assets. When borrowers retain most of the equity, incentives are also aligned, and operational standards are ensured to be satisfactory.

- Why renewable energy? Nearly two-thirds of global greenhouse gas (GHG) emissions stem from the production and use of energy. This puts the energy sector at the core of efforts to combat climate. Yet, as referenced above in this article, renewable energy remains significantly underfunded.

- Why Ethereum blockchain? ERC-20, the most popular contract standard which runs on Ethereum, has seen multiple upgrades and extensions. Moving from Proof-of-Work to Proof-of-Stake also leads to the drop in energy requirements by 99.95% This makes it one of the most environmentally friendly blockchains.

- Why emerging markets? Emerging markets, and Africa in particular, has been at the epicentre of an ongoing global dialogue around the issue of energy poverty. More than half of the world's population without access to electricity lives there. Yet, a tremendous renewable energy potential remains untapped. Moreover, the Global Climate Risk Index 2021 indicates that the world's poorest countries are most susceptible to the damage produced by climate change, even though they have the lowest industrial pollution levels. Evidence suggests that the initial inequality experienced by countries of the Global South puts them at a disadvantage, where they are particularly vulnerable to climate change impacts. Consequently, climate change widens existing global inequalities, undermining poverty reduction efforts. A report by the World Bank estimates that the ecological crisis might drive up to 135 million people into poverty by 2030.

Agatobwe case study: a digital bond token

The International Renewable Energy Agency (IRENA) estimates that Africa's operational renewable energy capacity could reach 310 GW by 2030 if the annual financing gap were closed. This would put the continent at the forefront of renewable energy generation worldwide. The barrier to building energy capacity in Africa lies in its financing. Using the example of a digital hydropower bond issuance for Agatobwe, we show an innovative approach to break this impasse.

Agatobwe is a hydroelectric plant situated in Rwanda, Africa, developed by Malthe Winje AS (MW), est. 1922, a Norwegian infrastructure developer with 15 years of footing in East Africa. MW has support from Norwegian government agencies NORAD, Norec, and NORFUND and is well positioned to scale crucial renewable energy infrastructure in Africa. Nonetheless, MW is underserved by TradFi. Realizing the potential of DeFi, MW seeks to re-finance its operational projects by issuing a green bond on the Ethereum blockchain.

MW has partnered with Frigg[3], a Swiss-based software company, to establish a regulatory compliant bond creditor relation page where creditors can evaluate the bond token and execute buy-/sell-orders. The bonds, named “AgaTobwe Token bonds” (ATT)[4], are issued in Switzerland, a country on the vanguard of blockchain innovation[5]. Below we summarize key benefits that DeFi brings for the ATT issuance.

- Observation #1 – permissionless innovation and functional interoperability: DeFi resembles a series of modular building blocks. This means that the ATT can be sent across ecosystems, improving liquidity, and reducing fragmentation of bridged assets. As an example, ATT holders can become Liquidity Providers (LPs) by depositing a paired token (ATT and e.g., USDC or ETH) into a liquidity pool on a decentralized exchange. As LPs they earn fees from providing liquidity as Automatic Market Makers (AMMs), facilitating swaps between ATT and USDC, while improving liquidity for the ATT.

- Observation #2 – reduced friction, transaction costs, and faster settlement: Transactions are matched instantly and can be traded 24/7. The average transaction time is 12 sec and costs $ 0.39 per trade.

- Observation #3 – improved transparency: ATT investors know exactly where the money is sent (“The recipient Wallet address of the Issuer is 0xa7db365e49021049ec81D1F5B184F52Fe1DD9279”) and the intended purpose of the proceeds (“repay intra-group debt, to finance the construction of other hydropower facilities in the area”), all visible in the registration agreement on the issuers website. Additionally, the website integrates real-time data from IoT devices that are installed to the underlying asset. These feed real-time project statistics, such as produced electricity and carbon avoidance, and allow Investors to more accurately assess the issuer ability to service ATT obligations.

- Observation #4 – improved market access: ATT is offered to investors that pass an automated Know Your Customer (KYC) and Anti-Money Laundering (AML) check[6]. The Decentralized Identity (DID) solution that Frigg.eco has integrated promotes cross-platform interaction, reducing administrative efforts on the user as a KYC/AML check only needs to be passed once.

The culmination of these efficiency gains show how DeFi lays the foundations of propelling a truly decentralized global economy that, emerging markets, can easily embrace, participate in, and leverage to exit the climate finance trap they are in.

Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Footnotes

[1] With a bond token, we refer to Ledger-based securities constituent with the ERC20 standard and as defined in article 973d ss. of the Swiss Code of Obligations. The tokens are being governed by the smart contract that is fully owned and controlled by the issuer. Hence, the tokens do not constitute a derivative token, where reference is made to a bond outside of the blockchain.

[2] Structured Finance Industry Group (SFIG)

[3] Frigg.eco is a Swiss based software as a service company, tokenizes green bonds into constituent ERC-20s, allowing each to trade Uniswap, a permissionless Decentralized Exchange, and beyond, harnessing the full power of the Swiss DLT bill.

[4] The bonds are issued in accordance with the Swiss Code of Obligations on the basis ledger-based securities, as introduced by the Federal Act on the Adaptation of Federal Law to Developments in Distributed Ledger Technology (DLT bill). The rights of investors are laid out in the Registration Agreement and the Terms of Issue. Visit https://www.agatobwe.eco/

[5] Switzerland is one of the leading locations in the area of distributed ledger technology (DLT) and blockchain. The Green Fintech Network, a Swiss government body, aims to further promote DeFi alternatives, especially in the field of sustainable finance.

[6] The Issue has not been registered and will not be registered under the U.S. Securities Act of 1993 and may not be offered or sold to residents of the United States of America.

The Issue is offered only to persons (aged 18 years or older) or entities who are not residents of, citizens of, are incorporated in, or have a registered office in any “Restricted Territory.”

The term Restricted Territory includes the United States of America (including its territories) or any jurisdictions in which the sale of cryptocurrencies are prohibited, restricted or unauthorized in any form or manner whether in full or in part under the laws, regulatory requirements or rules in such jurisdiction; or any state, country, or region that is subject to sanctions enforced by the United States, such as the Specially Designed Nationals and Blocked Persons List (“SDN List”) and Consolidated Sanctions List (“Non-SDN Lists”), the United Kingdom, or the European Union.