· 12 min read

Shipping is essential for global trade. Currently transporting 90% of world trade volumes, this volume is expected to double by 2030, underlining its global economic and strategic importance.

The industry emits 2.7% of global emissions. For some, that percentage doesn’t sound like a large number in proportion to how much trade it transports.

However, just 15 of the biggest ships emit more noxious oxides of nitrogen and sulphur than all of the world’s cars put together.

As demand for ocean freight is to triple by 2050, global shipping emissions are forecasted to increase to 17% by 2050.

To tackle this, the International Maritime Organization (IMO) have set an under ambitious target to reduce CO2 emissions by at least 70% by 2050.

But to successfully meet these IMO targets, the capital intensive shipping industry must overcome obstacles of thin margins, limited technology and a high dependency on a global supply of polluting energy-dense fuels.

Some Context — Choppy Waters Ahead

Currently, there are 55,000 seagoing vessels that run on highly polluting fuel with most using heavy fuel oil (HFO) or marine gas oil (MGO).

Both polluting fuels produce major sources of harmful emissions that cause substantial damage to human health and local ecosystems. Including nitrogen oxides (NOx), sulphur oxides (SOx), black carbon (BC) and particulate matter (PM).

To prevent further emissions, the transition to cleaner fuels is crucial for the shipping industry.

But as the sector explores several alternative clean fuels, including ammonia, green & blue hydrogen, methanol, batteries, biofuels and even nuclear propulsion, some industry stakeholders remain pessimistic believing they all have significant commercial and technical limitations.

Existing alternative cleaner fuels are costly. The requirement of substantial fuel storage onboard ships and fuel replenishment infrastructure in ports requires colossal improvements throughout the globe.

To put it bluntly, no zero-carbon alternative fuels are currently available and are still a long way off.

“Too many alternatives and not one viable solution” stated a Shipping Operator.

Even if a viable zero-carbon fuel was available today, given the average lifespan of a ship, the global fleet will take 20 to 30-years to transition.

To enable decarbonization with Paris’ goals, a 2019 analysis by UMAS suggests that net-zero alternative fuels need to make up 5% of the international shipping fuel mix by 2030, 27% by 2036 and 93% by 2046.

According to the University Maritime Advisory Services, to reach the IMO targets by 2050, the sector will need to invest at least $1.65 trillion to become more reliant upon energy efficient clean fuel types, propulsion solutions and other efficiency measures. 87% will need to be dedicated to creating fuel supply infrastructure.

What are the trends that marine start-ups need to lean into to reduce shipping emissions and help our planet stay afloat?

Ahoy! Ahoy! Start-ups!

The development of new technology through start-ups for shipping creates an exciting opportunity in terms of investment and the ability to harness the power of start-ups to aid the transition to reach decarbonisation.

Brian Østergaard Sørensen, vice president at MAN Energy Solutions, states, “No technology or company can do this alone which is why we need to join forces across the supply chain to meet this challenge.”

The following focus points are areas that start-up innovation can contribute to due to their flexibility and ability to scale quickly to help achieve shipping’s decarbonisation targets:

Performance/Retrofitting Optimization — A greater focus will be facilitated upon improving vessel performance and capability to use zero-emission fuels. The integration of sensors with IoT, machine learning and AI will increase the connectivity of ships. Moreover, improving hardware on ships via retrofitting to use scalable, zero-emission fuels (SZEFs) will extend ship lifetime and optimise efficiency, alleviating pressure to build zero-emission vessels.

Crew Systems — Greater emphasis needs to be placed on the ship crews needs. With the pandemic, the attitude of work environments has changed. For ship crews, this could mean wanting shorter contracts and safe work conditions. It is important to ensure ship crews feel integrated and satisfied for more shipping companies to function and meet decarbonisation targets.

Port Operation/Infrastructure– As the global supply chain networks expand, it is vital for ports to adapt and improve their operations and infrastructure to fit the decarbonisation of the industry. Although the majority of 4,900 ports across the globe are not using digital technology, greater demand for port digitalisation will occur. This also accounts for alternative fuel supply storage facilities, electrification of port vehicles and alternative materials for port construction to provide support for decarbonising vessels.

Alternative Fuels — To hit the UMAS target of achieving 5% of net-zero fuels in the international shipping fuel mix by 2030, the exploration of a range of alternative net-zero fuels and technologies is greatly upon us. With existing alternative fuels of marine bunkers and LNG, fuel flexibility is crucial to coordinate with other cleaner and cheaper alternative fuels. Biofuels, batteries, and green or blue hydrogen as well as methanol and ammonia. Otherwise, industry users could find themselves getting locked into single fuel choices. This applies to the entire value chain, including port infrastructures.

Collaboration — Although the maritime industry is fragmented, it is substantially interconnected across its supply chain. Collaborative action will be increasingly encouraged and is entirely possible. Especially between traditional industry leaders and start-ups, to overcome silo-thinking and existing systems.

Virginijus Sinkevičius, the European Commissioner for Environment, Oceans and Fisheries, believes collaboration between corporations and startups is necessary to overcome high barrier entries when startups attempt to enter the market as well support innovation to reach the correct places.

All Aboard

Increasing efforts across the start-up ecosystem are being made to stimulate start-up investment and innovation in the blue community to tackle decarbonisation challenges with some examples below:

Motion Ventures (Venture Capital) — A $30M consortium-driven venture capital fund launched by Rainmaking aims to support early-stage start-ups tackling challenges in the maritime time value chain.

BlueInvest(EU Community) — An EU Commission scheme that has to offer a range of services to stimulate early-stage sustainable technologies in the blue economy.

This includes both BlueInvest Grants which has dedicated itself to leveraging upwards of €100 million a year between 2021–2027 and BlueInvest Fund which is structured as an EFSI Equity Product to provide finance to funds that are wholly or partly targeting the blue economy or to individual enterprises backed by more general funds.

Yara Marine X Program(Accelerator Program) — A 3-month tailored early-stage start-up accelerator program that gives start-ups the opportunity to develop and pilot innovative solutions, facilitate partnerships, possible investments and gain hands-on support from Yara Marine Technologies’ industry competence, either in Oslo, Norway or Gothenburg, Sweden.

The top 10 startups that apply to the program will have the chance to enter into a live and/or digital pitch session and a board of industry experts will choose the winning startup(s). In turn, the chosen startups will participate in a 2-week bootcamp and a 3-month tailored program.

Applications are open now!

10 Maritime Start-up’s to Watch out for

1. Fuelsave

Founded in 2012, Fuelsave’s FS MARINE+ technology is a patented solution to reduce fuel consumption of marine diesel-powered engines & auxiliary systems and significantly reduce emissions.

The solution has been field-tested on high seas, certified, and approved by DNV GL as the world’s first onboard hydrogen generator and injection solution with gas & liquid injection mechanisms and processes.

Total Funding: $10M

Stage: Seed

Country: Germany

2. DeepSea Technologies

Founded in 2017, DeepSea Technologies is the leading shipping software company specialising in optimising vessel performance for ship owners and operators of commercial vessels including container ships, bulk carriers, LNG carriers and tankers.

The company works predominantly in the field of artificial intelligence, developing algorithms and platforms that allow vessels to consume less fuel, generate fewer emissions, predict future maintenance requirements, and travel optimal shipping routes.

With 4 products launched, they have collectively been used on 200+ vessels throughout the globe.

Total Funding: $3M

Stage: Series A

Country: Greece

3. Marine Digital GmbH

Founded in 2020, Marine Digital works in the Field of Vessel performance optimization offering edge hardware and AI technologies to provide fleet insights and reduce the fuel consumption of vessels.

The technology allows the fuel consumption of big vessels to decrease by 12% and related CO2 emission reduction by 600 tons per year per vessel. Marine Digital provides an affordable opportunity for non-giant marine companies to use the technology to reduce emissions and costs.

Total Funding: $1M

Stage: Pre-seed

Country: Germany

4. Burmester & Vogel

Founded in 2019, Burmester & Vogel delivers maritime software and services to the world’s most demanding commodity traders, industrial producers, bulk terminals, shipowners, shipbrokers, and port agents.

The solution is used to calculate laytime and demurrage for billions of tons of cargo each year. With B&V, companies save time, reduce risk, capture demurrage P&L, and spend less time demurrage.

Total Funding: $1.7M

Stage: Series A

Country: USA

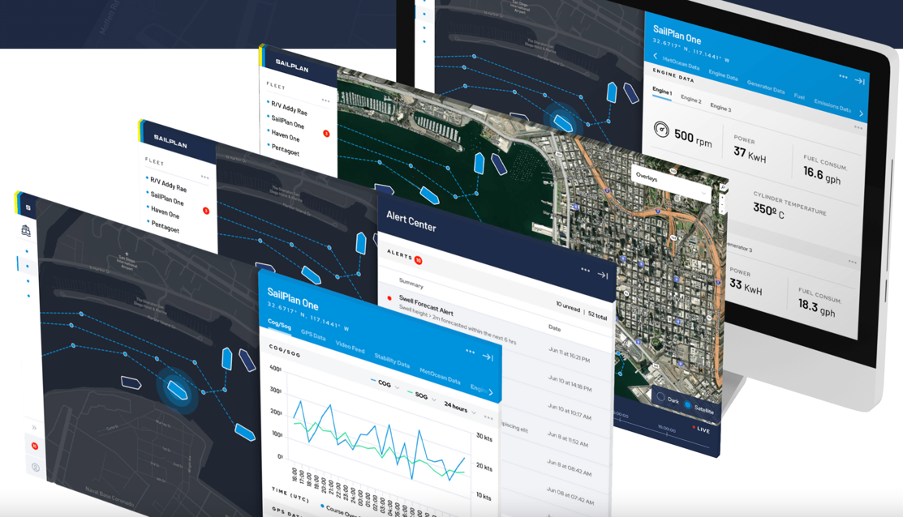

5. SailPlan

Founded in 2020, SailPlan is an emissions optimization platform that helps ship operators benchmark, optimize, and report fleet emissions with real-time data.

The company works with some of the most important names in shipping to deliver a cleaner future for the world and to reach net-zero.

Stage: Pre-Seed

Country: USA

6. Core Power

Founded in 2018 to bridge that gap and create an organization that would pave the way for the development and successful deployment of advanced reactor technologies for the maritime industries.

Core Power’s Molten Salt Reactor (MSR) is an advanced nuclear reactor that uses liquid fuel instead of solid fuel like most conventional reactors. The fuel salt in an MSR contains uranium fuel which keeps the fuel salt liquid at high temperature.

The start-up partners with leading international power, engineering, and innovation companies to deliver durable zero-emission energy for floating industrial production and deep-sea shipping.

Total Funding: $19.7M

Stage: Series B

Country: UK

7. Shone

Founded in 2017, Shone has built the most advanced digital co-pilot in the world to help shipowners protect their people and the environment by eliminating risk and reducing fuel consumption.

By using Artificial Intelligence, their technology assists the crew to ensure that they always operate at peak performance and deliver the value of shipping fleets. The collection and processing of huge amounts of data from multiple sources help crews always to make the best decisions relieving stress from the ship's crew and making ships safer.

Total Funding: $4.2M

Stage: Seed

Country: USA

Synchronizer — the first digital collaboration platform to digitalize the shipping industry

8. PortXchange

Founded in 2018, provides a centralized platform for sharing real-time information to align all the players in the maritime logistics chain during a port call.

Through improved collaboration, PortXchange ensures the avoidance of delays and makes port calls more predictable, efficient, and sustainable.

Country: Holland

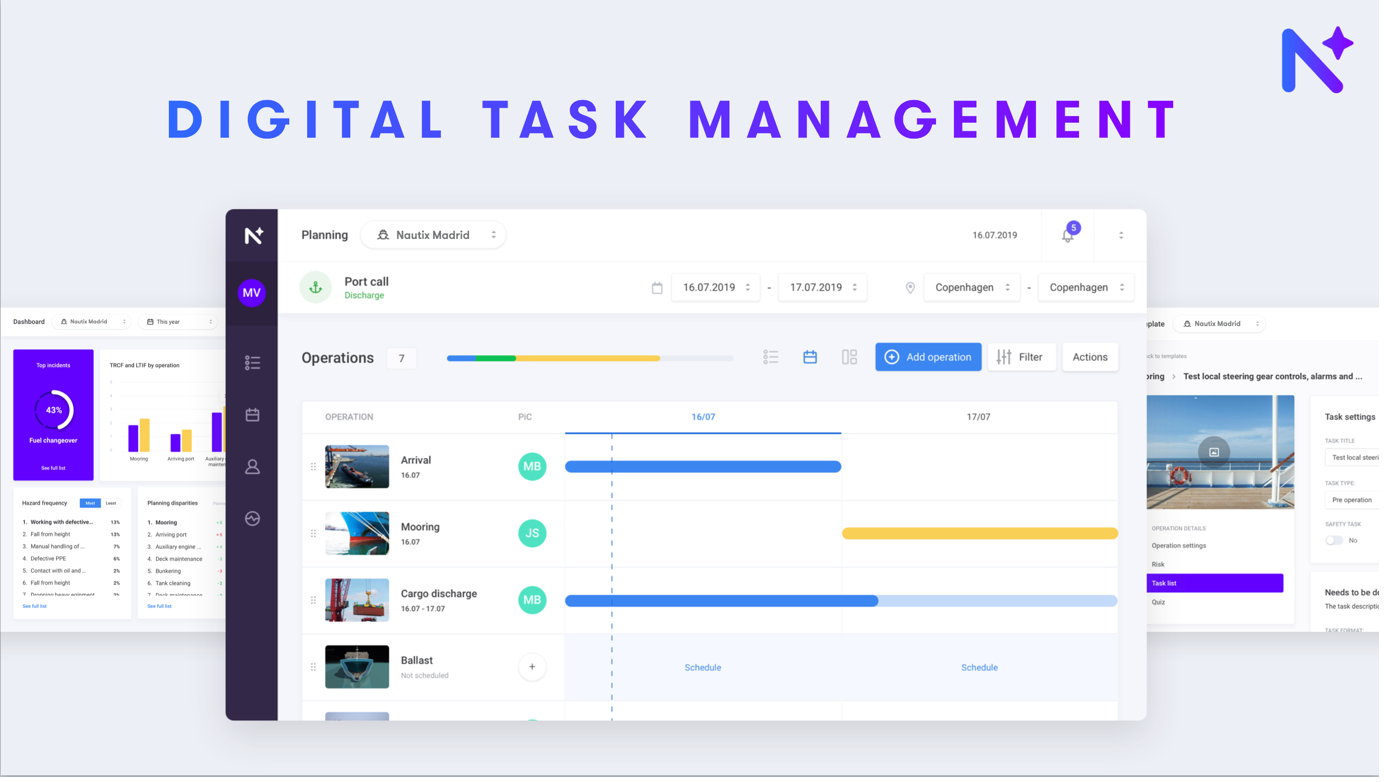

9. Nautix Technologies

Founded in 2018, Nautix has designed an innovative digital collaboration platform that brings the frontline workforce and office-based teams together to achieve next-level productivity. It’s uniquely designed for assets as well as contractual workforce management.

Nautix aims to support frontline workers who carry out critical operations in heavy-asset industries are often disconnected from the office-based teams.

Total Funding: $342k

Stage: Pre-seed

Country: Denmark

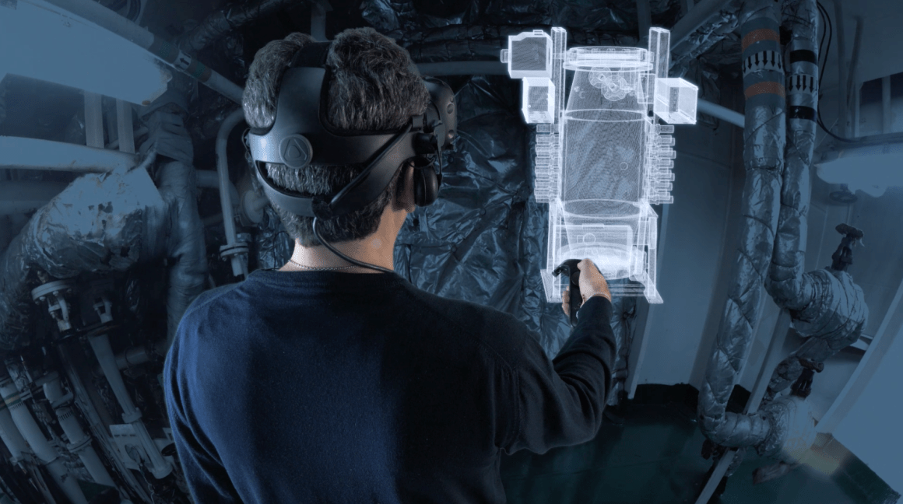

10. ShipReality

ShipReality Inc. has developed a real-time 3D “metaverse” platform for sustainable shipping with 3D CAD design, XR visualization, VR/MR enabled remote operations and GHG emissions reduction planning & compliance.

The company’s mission is to offer the most advanced end-to-end solution for shipping addressing lifecycle decarbonization needs from planning, to design, energy efficiency optimization and regulatory compliance with IMO 2050 > 70% CO2 intensity reduction targets for the global commercial fleet of 90,000 vessels.

Total Funding: $250K

Stage: Seed

Country: Greece

Taking the Plunge

The ability to implement net-zero technology is evident by Maersk who are aiming to achieve net-zero in 2040.

Their commitment has been validated by their recent actions. Maersk has ordered 12 of the world’s first container vessels that will run entirely on carbon-neutral methanol from shipbuilder Hyundai Heavy Industries costing $175m each unit.

Maersk’s move into methanol has stimulated interest in the potential maritime fuel to enable it the chance to become the industry go-to clean fuel. Singapore-based X-Press Feeders have ordered 16 small methanol-powered container ships from two Chinese shipbuilders.

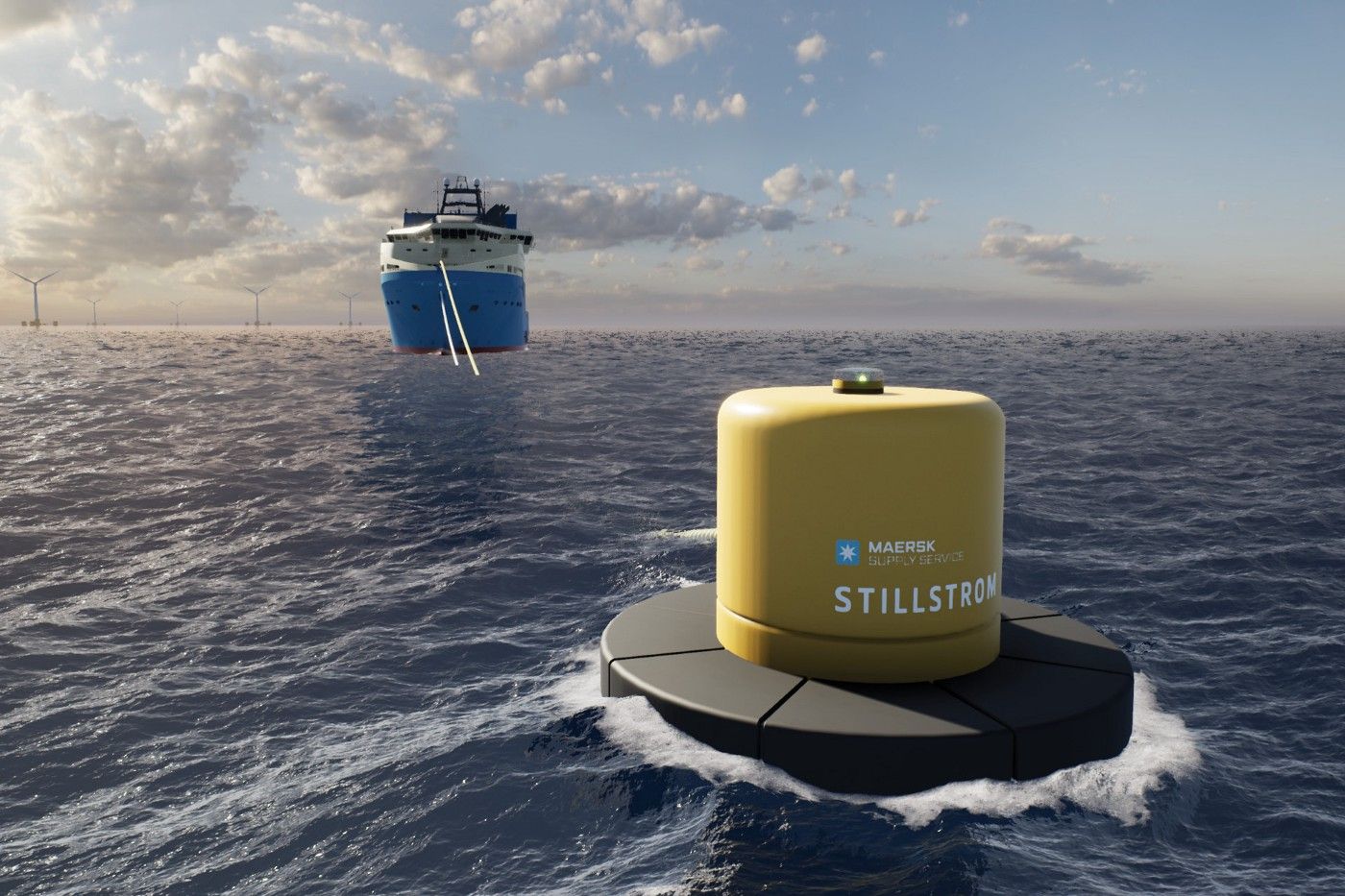

Further action is evident by Maersk Supply Service, a subsidiary of Maersk, who have launched Stillstrom— an offshore vessel-charging venture.

The device will deliver offshore electric charging solutions to vessels at hubs, ports, and offshore energy operations.

Yet, Maersk will face substantial industry barriers. Challenges of ensuring ports to create new bunkering facilities to accommodate their new carbon-neutral ships and whether they can procure enough bio methanol or e-methanol to fuel the ships.

Another activity to reach net-zero by Maersk is their investments in anything start-up supply chain-related as a corporate investor. This activity is evident by their investment in Vertoro, developing liquid lignin to use as a sustainable marine fuel.

However, not only Maersk has taken the plunge. Some of the world’s largest shipping companies have also committed to reaching net-zero, including — CMA CGM, DNV and MSC to showcase that industry leaders are looking forward but realistically, increased action is needed.

The Final Journey

For as long as shipping volumes continue to grow, the entire industry requires a dramatic and realistic transformational systematic shift with existing fleets, port infrastructure and the integration of new technology to deliver a trajectory for decarbonisation.

To get out of the “chicken and egg” paradox of neither ship owners nor fuel providers willing to make the initial Capex costs, greater collaboration with start-ups is necessary. Start-ups have the ability to provide low-cost, adaptable and specific technologies across the shipping value chain. Whether collaborating with a corporate partner or directly providing the product to help shipping organisations overcome the high industry barriers.

Hence, greater global collaborative support from governments, finance and industry is vital for nurturing start-up growth and play a role in supporting the collective journey to the global net-zero shipping industry before greater damage is inflicted upon port cities, the oceans, and the atmosphere.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.