· 5 min read

There is no doubt that Boards globally are increasingly attuned to the drums declaring the importance of ESG. While this attentiveness is welcome, it doesn’t yet go far enough.

Geopolitical and conflict risk is spiking, social expectations have shifted, and traditional boardrooms are ill-prepared to tackle the risks - and the opportunities - arising. The inter-related challenges facing Boards extend well beyond the ‘ESG’ basics and few Boards have yet positioned themselves to strategically respond.

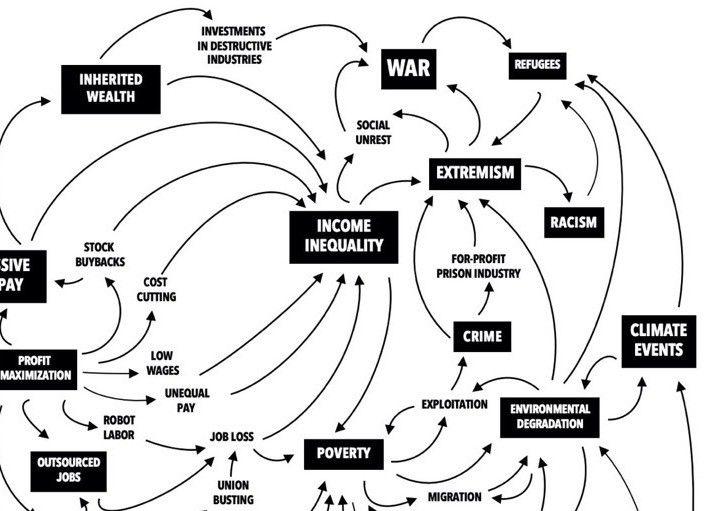

And respond Boards must to meet the so-called polycrisis. A pandemic, rising inequality, the impacts of climate change, a decade of increasing conflict and now wars in, amongst others Ukraine and Myanmar, both notable sites of critical minerals. We are seeing supply chains falter, food insecurity spiral, inflation spike, and already marginalized groups, communities and nations bearing the brunt.

Without correction the challenge only deepens with the prospect of more contestation over resources, more inequality, more environmental degradation, and in time, more conflict.

As a powerful force, business is central to our current economic system and society. Acknowledged or not, businesses impact the world around them every day. No matter the sector, knowingly harmful or born green, businesses are not neutral players. In turn, business has a central role in rising to the challenges we collectively face.

The tide of recognition of the multifaceted role of business in society is gaining momentum. Indeed in the wake of moves such as Patagonia’s decision to make the environment it’s only shareholder and the AGL shakeup, we appear to have reached a tipping point of negative impact and public perception – corporate reputational risk is at an all time high – which means incentives are well placed for change.

Moreover, investors are demanding businesses meet rapidly rising sustainability standards. Millennials are leaving companies to accept lower salaries with competitors who demonstrate positive purpose. Consumers understand the power of their dollar and are shifting their loyalty – from superannuation fund to makeup brand – based on values alignment. Shareholders are divesting assets linked to environmental damage, forced labour and modern slavery. To be viable and competitive over the near and medium term, companies must now engage strategically and operationally to address their impact – positive or negative – on the world.

ESG to the rescue then? Sadly, no. ESG was designed to manage business risk and begin to raise baseline standards across environmental, social and governance considerations. While extremely valuable, ESG wasn’t designed to comprehensively address our current context. Even the broader conceptualisation of sustainability, transformative in many ways, doesn’t guide or require business to respond to the breadth and complex interplay between the challenges now faced.

Boards today need to know how to navigate this new environment of both internal and external risk and take strategically aligned, positive action. Unfortunately, too often, advisors limit the scope of their advice to profit + minimum ESG standards. Many still assume they can spin their way out of a fundamental shift in expectations with some slick reporting and box ticking. If ever it was, that is no longer the case, as regulator’s recent moves to addressgreenwashing make clear. Communicating business practices is important, but it must be based on substance. Measurement and transparent reporting are essential, yes, but the demands on business are changing at a rapid pace, and governments are increasingly intervening.

It’s time to do what business can do best - front-foot purpose-driven, solutions focused strategy. It’s time for business to move past glossy ESG minimalism and deliver real action and positive impact.

As some have argued, business’ legitimate objective to turn a profit needs to be balanced with a proper valuing of social and environmental returns. Look no further than the challenge the world faces in navigating a path to net zero. With more mining needed to achieve the transition, if profit is the sole motive, we will supercharge conflict and human rights abuses in supply chains. It can and must be done the right way, for people, profit and planet. And business’ role in this is central; in fact, we can’t do it without them.

However, it is all well and good to exhort businesses to ‘embrace purpose, ‘do good’ and ‘do better’, but these skills aren’t universally honed – yet – in the business sector. Deep skill and knowledge around creating positive social and environmental impact– and indeed how not to increase inequality, environmental harm and conflict – predominantly sits outside the business sector. And therein lies a challenge.

For business to wield its power more effectively and positively, and to realize the potential for delivering on social purpose requires different perspectives, training and capabilities.

Boardrooms now need to lead the way and ensure their Directors have the right knowledge and skills. The capability sought must then be focused on the delivery of tangible positive impact, which over the long term drives risk down and profit up. Practical, evidence-based and aligned action is now needed from every Board. It will take humility to diversify knowledge around the board table, courage to broaden the concept of fiduciary duty to an wholistic one, and vision to carve an innovative path ahead.

Amid a chaotic moment, the choices Boards make now are make or break. Astute boards will chart a course to competitive advantage. Those less visionary will be left behind.

This article is also published on the author's blog. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.