What does the new SBTI net-zero standard mean for carbon removal and carbon markets?

· 4 min read

Radical emission cuts, a new role for avoided emissions credits, and required permanent removals are bound to change voluntary carbon markets.

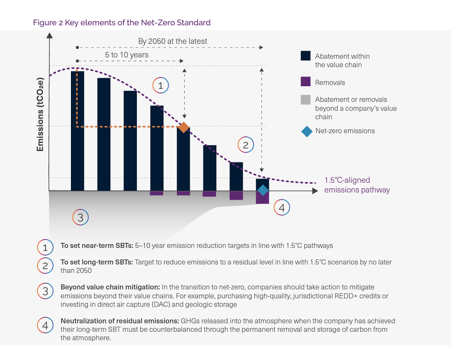

Net-zero has been a target lacking a definition. Even though over 80 percent of the global economy is covered by net-zero targets and thousands of companies have set their own, there hasn't been a clear, agreed-upon definition of what it means to have reached net-zero. Some companies have claimed to have already reached it using carbon credits, others have offered no definition of how they plan to reach the target. Now, the lack of guidance for companies changes with the launch of the Science-based target initiatives net-zero standard. I have been part of the expert advisory group for the initiative and am glad to see robust criteria emerge.

The standard set a very high bar for science-based net-zero targets. It requires companies to reduce emissions by at least 90% in all three scopes before reaching net-zero. It also requires that the remaining emissions are neutralized with permanent removals, not avoided emissions credits.

Looking at the details companies can choose between an absolute reduction target or an intensity one (ton CO2eq per dollar in revenue). Intensity targets are only allowed for Scope 3 and require 97% reductions. This translates to an approximate 11% reduction in emissions intensity per year from 2020 to 2050. Such drastic reductions would mean that even if a company becomes 30 times bigger between 2020 and 2050, it would still have lower absolute emissions in 2050 than in 2020.

However, a company can exclude 10% of its scope 3 emissions when setting the target and calculating its progress. Those could be from many small suppliers in companies long-tail of value chain emissions that are hard to engage with. The 10% would still need to be removed with permanent removals to fulfill net-zero though.

The standard defines a clear role for permanent carbon removal technologies in net-zero targets but limits the usage. However, there will be a need for companies to go beyond neutralizing their residual emissions. This since a majority of global emissions are unlikely to follow such steep reductions as required in the standard. Ambitious companies and countries will need to dive into the negative territory and start removing more than they emit, for example by also removing all their historical emissions.

Only permanent removals will suffice for net-zero in the standard, and short-term removals without safeguards to ensure long-lived storage are not allowed. The SBTI encourages companies to also set near-term targets for removals and to invest in removal technologies today so that the methods needed are available at scale by mid-century.

I expect the standard to increase the interest in durable carbon removal technologies. The sector is extremely small today with, in my estimate, less than 50 000 tons of CO2 being removed and sold as removals this year. To grow to 5 billion tons per year, (roughly 10% of global GHG emissions) the market for permanent removals would need to become 100 000 times larger.

Carbon removal is not the only sector in need of climate finance though. There is a great need to restore and protect ecosystems and finance the decarbonization of the global economy. The Net-zero standard also encourages companies to support other types of external climate mitigation on the way towards net-zero.

The SBTI has moved away from calling this pre-net zero support "compensation" and instead refers to "beyond value chain mitigation". (In contrast to neutralisation, which is the term for removing residual emissions.) This is a clear improvement and in line with what I and many others in the advisory group have been advocating for. Compensation and claims like carbon neutrality imply that the climate is no worse off even if a company continues to emit since carbon credits have been purchased. Such claims are very difficult to uphold with the vast majority of today's carbon credits.

High-quality carbon credits can however still be used to support climate action even if no offset or compensation claim is made on the back of them. Carbon markets can play an important role in channeling funds to effective projects but needs to shift the focus towards quality rather than on cost. There are also non-carbon credit projects that can be important and effective to support, such as advocacy projects, R&D, and the work of grassroot organisations. Early next year the SBTI will return with more guidance on beyond value chain mitigation. In the meantime, I expect to see a lot of companies adjusting strategies for what has been their offsetting commitments.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change