· 8 min read

In 2015, under article 6 of the Paris Agreement, two new international carbon markets were decided on. During COP26 in Glasgow, technicalities and guidelines for these new markets were finalised, which allows for the full implementation of the Paris Agreement [1].

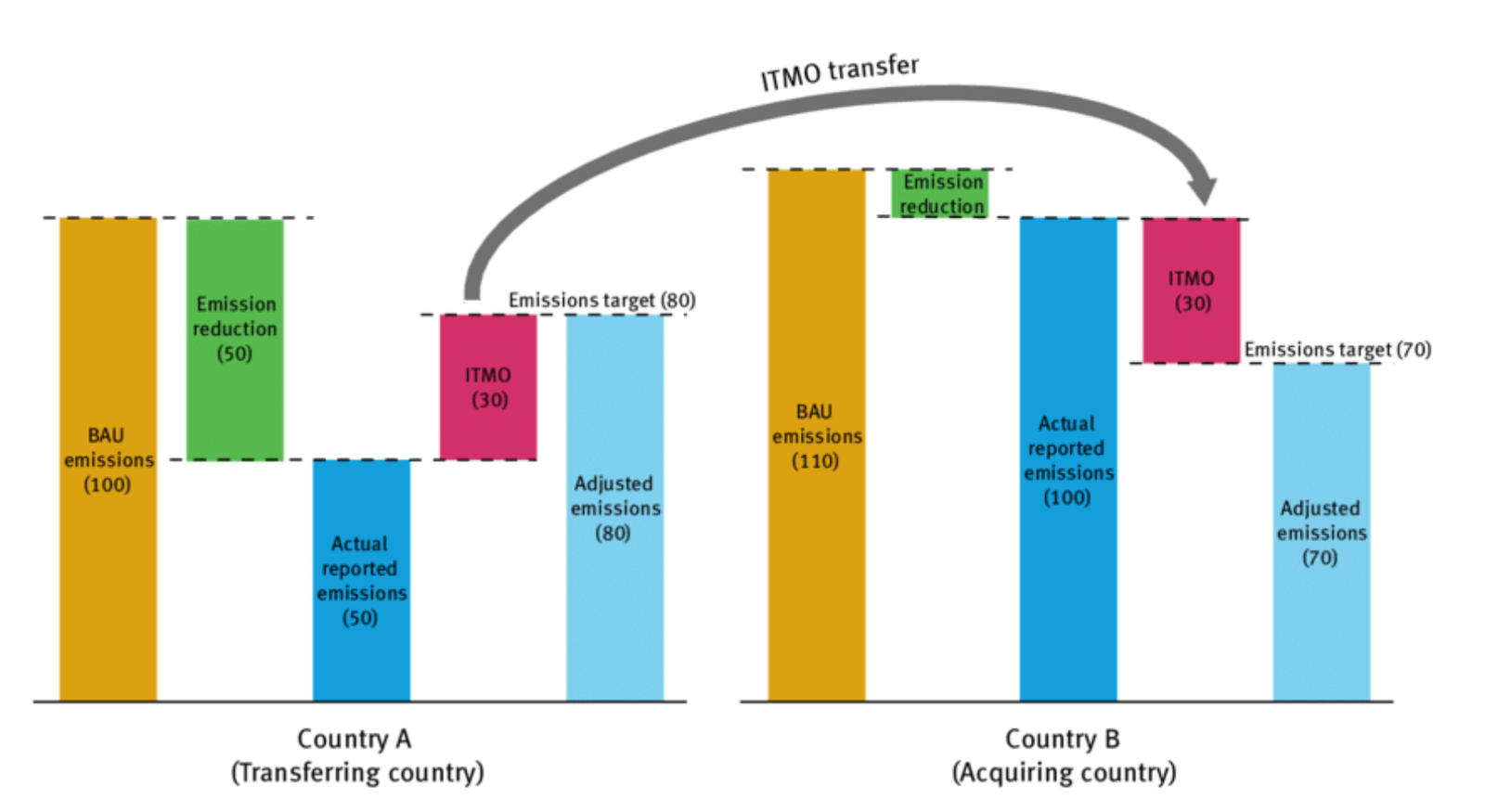

Under Article 6.2 of the Paris Agreement, the first carbon market allows countries to voluntarily trade greenhouse gas (GHG) reductions or sequestration amongst each other. A country that has overachieved its climate pledges can sell the extra emission reductions to another country that can use it to reach its own climate targets (Fig. 1) [2]. Under Article 6.4, the second mechanism creates a carbon market where emission reductions from either states or private entities can be traded, which will be governed by a UN body [3].

Trading GHG reductions can help countries and private entities efficiently meet their emission reduction targets, which for countries are known as nationally determined contributions (NDCs) [4].

What are carbon markets?

Carbon markets put a price on GHG emissions and allow the subsequent trading of either carbon credits or carbon offsets. Tradability is one of the greatest advantages of carbon markets since it allows for economically efficient GHG reductions. Emissions reduction (or offset) will occur where the abatement costs for one unit of emissions are lowest. Due to lax environmental laws and regulations, abating emissions in developing countries is often cheaper than abating the same amount of emissions in developed countries where, thanks to tight regulation, the easy gains are already implemented. Utilising this cost-effective mechanism could either dramatically reduce the cost of achieving a given emission reduction target or reach a more ambitious target with the initial cost [5].

The fear of economic upheaval caused by an abandoning of coal prompted India to change a clause’s wording from “phase out” to the “phase down” of coal, causing great controversy at the COP26 [3]. Ultimately, this reflects the incongruity between the reality for developing countries and the pace expected of them.

Yet, some conditions must be met to assure the integrity of carbon offsets and carbon markets.

GHG reductions that are traded on a carbon market must be additional, measurable, and permanent to guarantee the integrity of the market.

If a GHG reduction or offset project would not have happened without the revenues of selling so-called carbon credits on a carbon market, the project and thus the GHG reduction is deemed additional [6]. Moreover, a measurable baseline must be defined. The baseline refers to the amount of GHG emissions that would have occurred, had the reduction or offset project not been implemented and it is essential for calculating the amount of GHG reduction the project achieves [7]. Furthermore, any reduction of GHG emissions that result in carbon credits, must be permanent. Generally, 100 years is an internationally recognised norm for permanence [8].

In a nutshell, carbon markets allow for the cheapest emissions reduction to occur, as long as certain quality criteria are met to assure the integrity of GHG reductions.

The case of the Clean Development Mechanism

The Clean Development Mechanism (CDM), established under the Kyoto Protocol [9], was one of the first carbon markets [8]. The CDM creates certified emissions reductions (CER) certificates arising from emission reduction projects in developing countries, which can then be traded. It allows developed countries to buy CERs originating in developing countries to meet their own emission reduction targets, which they committed to under the Kyoto Protocol [8]. However, the quality and integrity of the CDM are contentious. A 2016 study [10] questioned the additionality and accuracy of emissions reductions of up to 85% of all issued CER credits of the CDM between 2013 and 2020, dealing a considerable blow to the environmental integrity of CERs. Moreover, the CDM is currently the crediting mechanism that issued most carbon credits, meaning the findings are not only worrisome for the CDM itself but also for the entire carbon offset industry [8]. The fact that the United Nations (UN) developed the CDM adds to the worry. The new carbon market will need to learn from and address the CDM’s shortcomings.

What is the new agreement about?

The Paris Agreement states some conditions which the two new carbon markets have to meet which are: 1. They must raise ambition in mitigation actions and achieve an overall mitigation effect. 2. Double counting of emission reductions must be avoided. 3. A part of the money generated (“share of proceeds”) in the secondary market (Article 6.4) must be channelled towards adaptation funding in developing countries.

After six years of unsuccessful negotiations, COP26 saw an agreement on the “rulebook” for the new carbon markets. Firstly, some carryovers of old emission reduction credits, which were generated under the CDM but are widely seen as very low in quality will be allowed to be traded on the new markets. The use of old CDM credits is limited to those generated after 2013, yet the exact number of old certificates that can be traded in the new carbon market is not known exactly [11]. The carryover credits impede the environmental integrity of the new markets and will likely depress carbon credit prices, which discourages new GHG reduction projects. However, the outcome could have been worse if CDM credits generated before 2013 would have been allowed to be carried over as well.

Moreover, there is a general problem with ambitious NDCs and emission reduction trading. Every country decides how ambitious it wants to be regarding its domestic emission reduction (i.e. NDC). This gives countries an incentive to set themselves less ambitious NDCs because they can sell any emission reduction that goes beyond its NDC and generate export revenue [12] (Fig.1).

Additionally, it has been agreed that five percent of the proceeds (“share of proceeds”) from the voluntary carbon market (Article 6.4) will be funnelled to the UN Adaptation Fund which finances climate change adaptation projects in developing countries [11].

Overall, the first condition has not been met entirely. The carryover of low-quality CDM credits and the incentive for countries to set unambitious NCDs is a pressing concern. Moreover, some countries and non-governmental organisations would have liked to include the first carbon market (Article 6.2) in the “share of proceeds” agreement.

Figure 1 graphically depicts the carbon trade between two countries under Article 6.2 of the Paris Agreement. Country A outperformed on its emission reductions. The outperformance (positive difference between emissions target and actual emissions) can be sold to Country B, which underperformed on its emission reductions (negative difference between emissions target and actual emissions).

Moreover, Figure 1 shows that both countries have an incentive to set themselves “unambitious” NDCs. If Country A’s emission target would be 90 instead of 80, it could sell 10 more units of emission reductions. Similarly, if Country B’s emission target would be 80 instead of 70, it would have to buy 10 units less of emission reductions.

The figure also shows how double counting will be avoided using corresponding adjustment. Country A’s emission reduction sales will be added back to its own emissions (on an accounting basis – not literally). Similarly, Country B’s emissions will be reduced by the amount of emission reductions it buys (again on an accounting basis).

This article is also featured on the London Journal of Energy. Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

References

[3.] ( After COP26: India’s crucial decade [Internet]. The Third Pole. 2021 [cited 12 December 2021]. )

[8.] Arndt C, Arent D, Hartley F, Merven B, Mondal A. Faster Than You Think: Renewable Energy and Developing Countries. Annual Review of Resource Economics. 2019;11(1):149-168.

[12.] Majid M. Renewable energy for sustainable development in India: current status, future prospects, challenges, employment, and investment opportunities. Energy, Sustainability and Society. 2020;10.

[14.] Vanegas Cantarero M. Of renewable energy, energy democracy, and sustainable development: A roadmap to accelerate the energy transition in developing countries. Energy Research & Social Science. 2020;70:101716.