· 7 min read

Aligning to the heightened sense of urgency to tackle climate change, money is pouring into the maturing asset class of climate technology at an unprecedented rate to decarbonise carbon-intensive sectors to help prevent the increasing existential threat of climate change.

Highlighted in the Net Zero by 2050 report by the International Energy Agency (IEA) that

in 2050, almost half the [forecast emissions] reductions come from technologies that are currently at the demonstration or prototype phase.

The reality is that these technologies exist but have not yet reached scale — and society needs them to scale as quickly as possible. It’s a scenario that plays to the strengths of venture capitalists (VCs), which has a successful track record in scaling up technology rapidly.

For VCs, climate change is a perfect storm of disruption offering plenty of promise not only for financial returns but also environmental, and social by investing in early-stage climate tech startups to overcome the ‘valley of death.’

The decarbonisation opportunity over the coming decades is the biggest business opportunity since the Internet revolution, perhaps even 100x bigger than that revolution. So imagine the Googles, Amazons, etc., we’ve seen — we’ll see more in climate tech” stated by Yair Reem, General Partner of Extantia Capital.

The climate tech boom

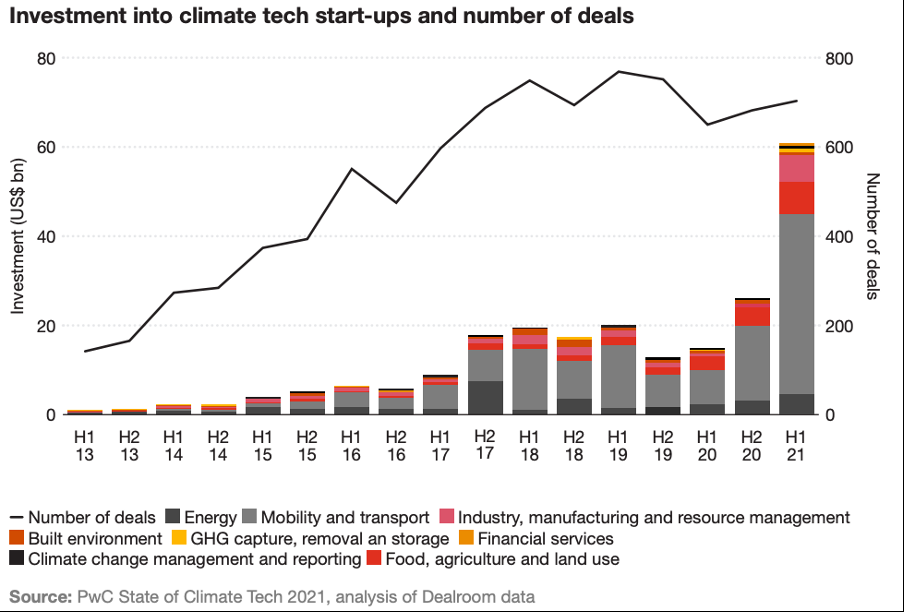

To advocate for the boom, climate tech investment has increased by 210% year on year.

In the first six months of 2021, climate tech set a record by attracting more than $60bn raised by more than 600 climate tech start-ups to account for 14 cents of every VC dollar going to climate tech.

The US remains the leading climate tech investor with the San Francisco Bay Area at the forefront, attracting nearly 65% of VC investment, $56.6bn from H2 2020 to H1 2021. Beyond San Francisco, the next most active climate tech investment hubs are London, Berlin, New York, and Boston.

Mobility and Transport is the most heavily invested challenge area, raising $58bn between H2 2020 and H1 2021 to represent 60% of the overall climate tech funding in the period.

Driven by the investor attraction to not only electric vehicles (EVs) but also electric mobility, battery technology and charging infrastructure, the EV ecosystem interest is validated by the megadeals of Lucid Motors raising $6.9bn, lithium-ion battery manufacturer Svot raised $1.6bn and Northvolt raised $2.8bn.

Northvolt’s raise enabled them to roll out Europe’s first lithium-ion battery ‘gigafactory-era’ in Sweden and challenge US rival Tesla with its own Berlin car and battery gigafactory plant to be running in 2022.

“We’ve seen the volume of investment in climate tech accelerate in 2020 and, this year (2021), it’s absolutely off the charts,” says Emily Reichert, Chief Executive of Greentown Labs — North America’s biggest climate tech start-up incubator. “We are seeing our start-ups be funded faster and in larger rounds than ever before.”

Heady climate tech valuations and investor FOMO (fear of missing out) coupled with the very real need to fund planetary-scale innovation have provided an enormous headwind for climate tech.

“I would expect valuations will continue being driven up,” said John Carrington, CEO of clean-energy storage firm Stem Inc.

Optimistic climate tech valuations are an implicit promise from founders to investors that their companies will grow to match expectations. For the climate’s sake, it is vital that a healthy number of highly valued climate tech startups succeed in that.

The bigger tickets

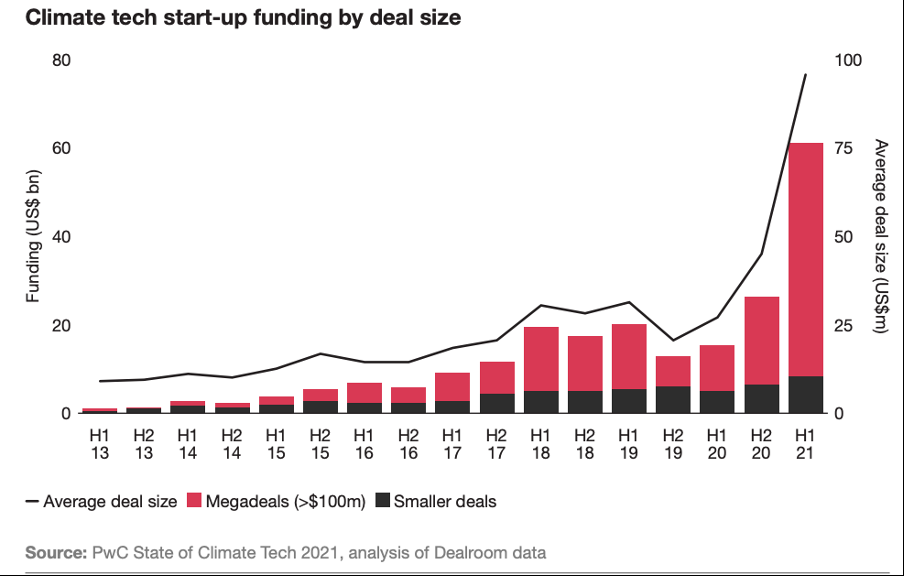

The average deal size nearly quadrupled in H1 2021 from one year prior, rising from $27m to $96m. Megadeals (ticket size of more than $100m) have driven much of the top-line growth in climate tech startup funding.

The average megadeal has risen in size from $130m in H1 2013 to over $430m in H1 2021 (and has correspondingly increased the average size of all deals to $96m), indicating that investment growth is being powered by a cohort of high-potential start-ups raising increasingly large amounts.

Untapped potential

Although capital is pouring into climate tech and the success of larger startups showcases climate tech as a growing mature asset class, the number of early VC, seed and Series A investments in climate tech has remained largely stagnant. Since 2018, there have been 260 and 320 deals in each of those half years.

VCs are focused on technologies that do little to reduce carbon emissions leaving those with greater potential starved for cash.

According to the PwC State of Climate Tech Report, of the 15 technology areas analysed, the top five that represent over 80% of future emissions reduction potential by 2050 received just 25% of recent climate tech investment between 2013 and H1 2021.

Alongside this, VCs remain deterred from taking on a higher risk profile when it comes to diversifying and taking on risk. Investors have been focused on startups with demonstrated success, late-stage funding pipelines and limited by geography/challenge areas.

Iterated earlier by the mobility and transport sector drawing in 60% of all climate tech investment between H2 2020 and H1 2021.

Hampus Jakkobson, General Partner of Pale Blue Dot states, ‘Climate change is a transboundary issue. Therefore, we can’t look at climate tech with traditional siloed geographical and sectoral lenses.’

Despite the signs of vast VC investment to fight climate, how can VCs overcome early-stage growth stagnation and avoid missing the opportunity to deploy capital to startups in line with the potential to decarbonise the planet and prevent the earth warming by more than 1.5°C?

Filling the gaps

To support investors, policies are needed to provide incentives and clear government action plans for investors. Furthermore, support of a consistent carbon price and R&D investment are needed to accelerate private-sector investment and technological innovation.

Investors willing to take on early-stage startup risks out of their ‘normal’ pipelines could be greatly rewarded by increasing funding activity with high-ERP challenge areas and less mature technologies.

“Hard-to-abate sectors with higher emissions often rely on climate technology solutions that are less proven or require yet-to-be implemented policy changes to become commercially viable,” Emma Cox of PwC said. “The investors that lean into that, and take the right risks, will create the next set of climate tech unicorns.”

The allocation of climate tech capital needs to be further defined. As 97% of funding is going towards technologies that mitigate climate change and only 1% going into adaptation.

If mitigation technologies are not accelerated, large-scale adaptation will be required to deal with the impacts of climate change in the short and longer-term. Hence, a deeper focus on adaptation technologies is dramatically needed.

More patient capital from VC’s is needed to fund innovation in capital-intensive technology areas that can also deliver the necessary financial returns, alongside outsized environmental and social impact.

Vinod Khosla, the founder of Khosla Ventures, states, ‘Matching the time horizons of climate tech start-ups with investors is a key challenge. Patient capital is needed, which is why Breakthrough Energy Ventures has set up a 20-year fund, rather than demanding returns within the traditional ten years.’

The challenge lies in convincing investors beyond only the ‘impact-first’ tribe to operate in this way and unlock the hundreds of billions of dollars of capital that is available.

Surfing the wave

The wave of climate tech financing shows no sign of slowing down. With their pockets full, VCs are uniquely placed to achieve a double bottom line of high financial returns and high climate impact. But to realise it, they must examine climate tech more holistically and uncover with a deeper focus on cross-sectoral decarbonisation opportunities that could flourish into future gigacorns.

This includes realigning their willingness to risk, looking beyond the low-hanging fruit to scale underfunded technologies across all challenging areas and the deployment of more patient capital.

For as long as capital continues to flow into climate tech solutions, new instruments and funds will emerge ranging from SPACS to sector/challenge specific micro funds.

Climate tech investing is not only influenced by VCs but also public opinion, related industries, and government’s incentivised to prolong the party to ultimately have a shot at tackling one of the biggest challenges of our times, climate change.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.