The “Conviction & Narrative” checklist: 10 questions to ask the manager of an ESG fund

· 7 min read

I can’t tell you how often I’ve been asked: “How can I tell genuine ESG funds from the … well, not quite so genuine?” As with pretty much everything in ESG, there are no simple answers. Different people look for different things in ESG: values-alignment, financial performance, saving the planet. Think about it.

No, but really: think about it!

…Yes, exactly – these are radically different things: (1) Some people want to avoid association with what they consider unethical or immoral activities, like tobacco or weapons, through their investments. (2) Some people believe that companies that perform well on environmental, social or governance aspects will also perform well financially. (3) Some people want to direct investments to certain companies or projects that will contribute to solving societal problems like climate change or poverty, and that will make a better world.

With these different motivations, how likely is it that you’ll hit on an investment strategy that satisfies these different objectives, and that actually works? ‘Works’, in the sense that it avoids the exact categories of investments that large numbers of clients want to avoid; manages to select – based on ESG factors that are material, or financially relevant – companies that outperform the market financially; and then provides the financing that allows the development of technologies or solutions that make our world a better place. I would say that the likelihood of this combination is close to zero.

In other words, ‘genuineness’ in ESG funds is in the eye of the beholder. It all depends on what the beholder, or client, is looking for.

And then, even if there’s clarity on the goals, or motivations, there are still lots of different ways to build investment strategies around these motivations, some more credible than others.To sum up the problem with ESG funds: you might be tempted to think “all roads lead to Rome”, as the familiar saying goes, but sadly this doesn’t fly in ESG. Because, in ESG, not everyone wants to go to Rome, some want to go to Tokyo, some to Rio.

So I think it’s good people are coming round to the view that it’s pointless to try to agree on what constitutes a genuine “sustainable fund”.

This is also because all the ways we’ve tried to classify ESG so far have pretty much failed. A quick classification of the classifications:

SFDR article 8 & 9: these are the two articles of the EU Sustainable Finance Disclosure Regulation that attempt to define ESG funds. However, the criteria for article 8 (the fund needs to “promote ESG characteristics”) are so laughably lenient that almost any fund can be classified here. And the criteria for article 9 are muddled and internally inconsistent, so clients looking for some guidance as to what’s “ESG” about the fund are none the wiser.

Labels: there’s a whole plethora of ESG labels out there but they’re not much help either – they do not clearly distinguish between the different things that different ESG funds are trying to enable, so it’s not clear to clients exactly what the label signifies.

Morningstar Globes: like a host of other ESG scores and indicators, the Morningstar Globes are an indication of how ‘sustainable’ a particular fund is. But, first, the assessment is just a subjective view of one data provider (in this case, Sustainalytics) on what ‘good ESG’ looks like. And, second, the assumption is that clients looking for ESG investing aim to invest in a portfolio of companies that are already sustainable, as compared to – for example – investing in companies that need to be helped on their sustainability transition, or companies that have some kind of societal impact.

These experiments also suggest that it is unlikely that we’ll come up with an objective and universal measure or label of ‘genuineness’. So the least I can do is give people some tools to deal with the complexity. In other words, this was ideal content for one of my “capture ESG complexity in one slide” Powerpoints.

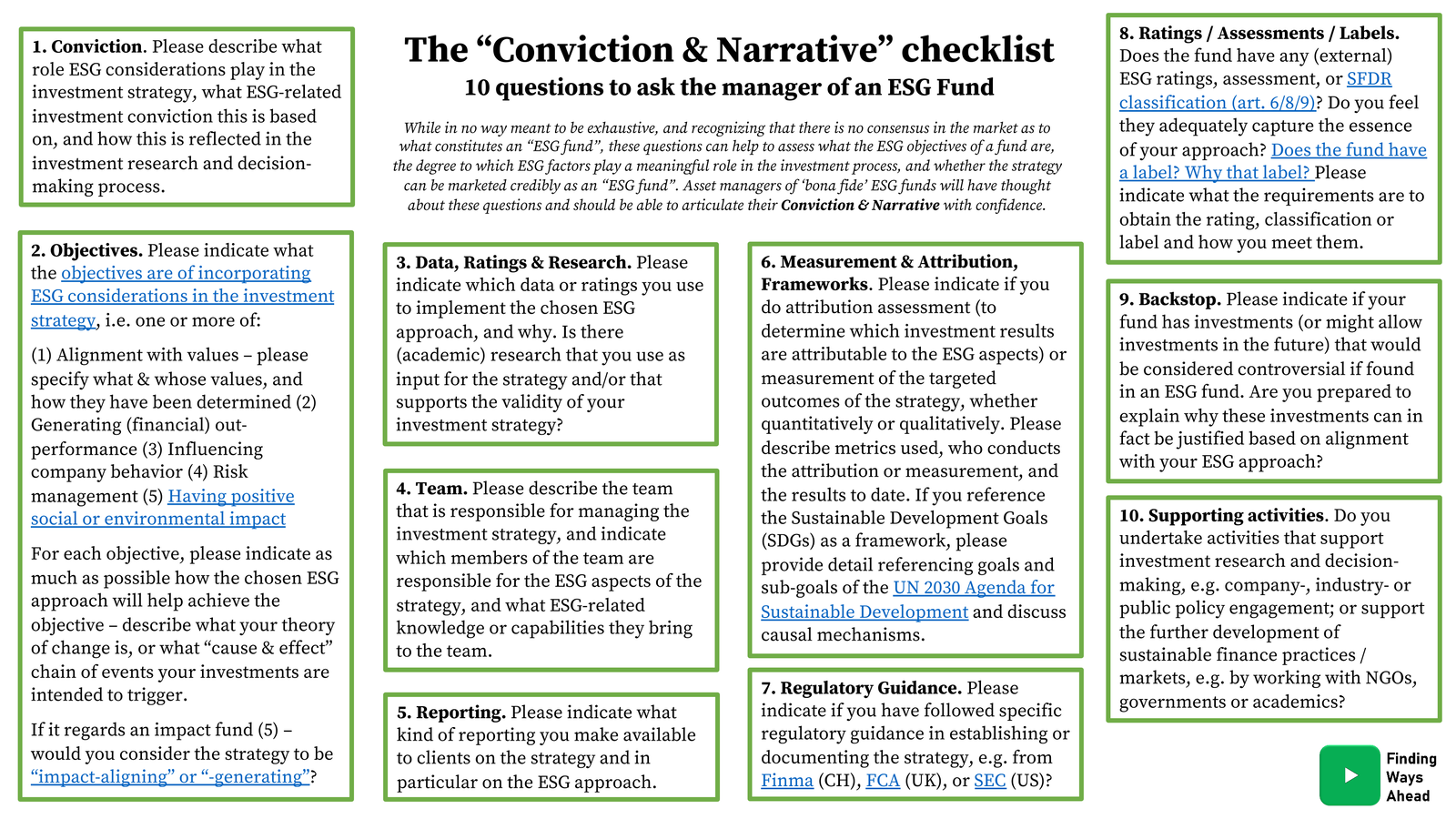

A couple of years ago, to help people with the question above, I developed the Conviction & Narrative checklist: 10 questions to ask the manager of an ESG fund, to determine if it is in fact 'genuine'.

And, building on the reasoning above, the idea is not to have one monolithic, objective set of criteria that will lead to an unassailable assessment that the fund “is ESG”, but rather a set of questions that will lead to a thoughtful and productive conversation allowing the asset manager to explain “what’s ESG about the fund”, and enabling the prospective client to see if this is where (s)he wants to go, and if this sounds like a credible way to get there.

In short, these questions should tease out the “conviction” that underpins the strategy, and elicit a solid “narrative” about how that conviction drives the investment decision-making and how it is expected to lead to the desired outcomes.

But obviously this set of questions can also be used by asset managers who came up with an ESG strategy and want to generate some inflows. What questions should you be prepared for? What should you cover in your documentation? What’s the latest in terms of market standards, regulation or regulatory guidance that you should be aware of?

The slide also has a couple of links to accessible and helpful reports, papers and articles that provide further background and detail.

So, I present to you: Finding ESG Authenticity in 10 Simple Questions! “A child can do the laundry,” as we like to say here in the Netherlands: it’s easy to do. Still, should you get lost on your way to Rome, Tokyo or wherever you want to go, you know where to find me.

Please describe what role ESG considerations play in the investment strategy, what ESG-related investment conviction this is based on, and how this is reflected in the investment research and decision-making process.

Please indicate what the objectives are of incorporating ESG considerations in the investment strategy, i.e. one or more of:

(1) Alignment with values – please specify what & whose values, and how they have been determined (2) Generating (financial) out- performance (3) Influencing company behavior (4)Risk management (5) Having positive social or environmental impact

For each objective, please indicate as much as possible how the chosen ESG approach will help achieve the objective – describe what your theory of change is, or what “cause & effect” chain of events your investments are intended to trigger.

If it regards an impact fund (5) – would you consider the strategy to be “impact-aligning” or “-generating”?

Please indicate which data or ratings you use to implement the chosen ESG approach, and why. Is there (academic) research that you use as input for the strategy and/or that supports the validity of your investment strategy?

Please describe the team that is responsible for managing the investment strategy, and indicate which members of the team are responsible for the ESG aspects of the strategy, and what ESG-related knowledge or capabilities they bring to the team.

Please indicate what kind of reporting you make available to clients on the strategy and in particular on the ESG approach.

Please indicate if you do attribution assessment (to determine which investment results are attributable to the ESG aspects) or measurement of the targeted outcomes of the strategy, whether quantitatively or qualitatively. Please describe metrics used, who conducts the attribution or measurement, and the results to date. If you reference the Sustainable Development Goals (SDGs) as a framework, please provide detail referencing goals and sub-goals of the UN 2030 Agenda for Sustainable Development and discuss causal mechanisms.

Please indicate if you have followed specific regulatory guidance in establishing or documenting the strategy, e.g. from Finma (CH), FCA (UK), or SEC (US)?

Does the fund have any (external) ESG ratings, assessment, or SFDR classification (art. 6/8/9)? Do you feel they adequately capture the essence of your approach? Does the fund have a label? Why that label? Please indicate what the requirements are to obtain the rating, classification or label and how you meet them.

Please indicate if your fund has investments (or might allow investments in the future) that would be considered controversial if found in an ESG fund. Are you prepared to explain why these investments can in fact be justified based on alignment with your ESG approach?

Do you undertake activities that support investment research and decision-making, e.g. company-, industry- or public policy engagement; or support the further development of sustainable finance practices/markets, e.g. by working with NGOs, governments or academics?

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change