· 2 min read

I have a dream. I dream that zero carbon Green Hydrogen will become the primary power source in my country. Not only that, I want the Oil & Gas industry to pay for it. Is that too much to ask?

Not really. A term I have been hearing more of recently is the Transition Premium? I expect you will be hearing a lot more of it soon because it will impact your energy bill for the foreseeable future. You think that energy is becoming more expensive? You are right. It is. That’s the transition premium and that is exactly how we are going to pay for Green Hydrogen.

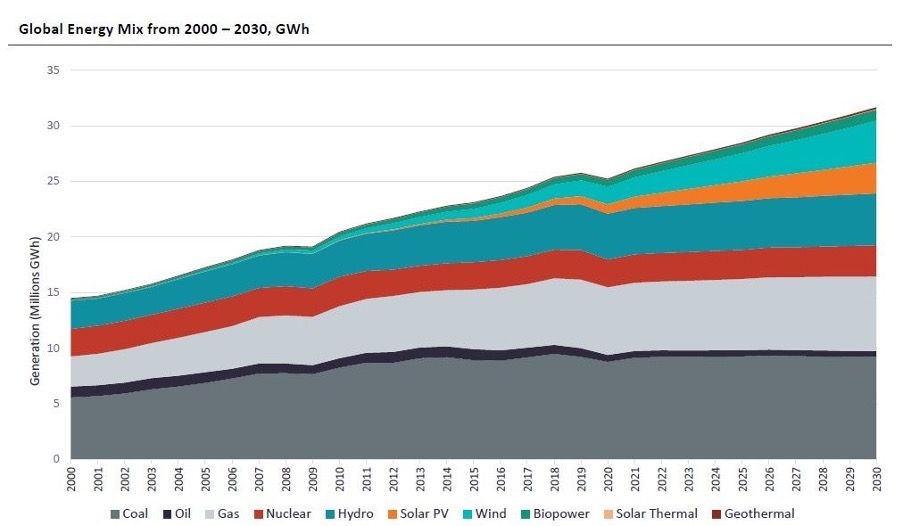

Let us not be in any doubt, hydrocarbons are here for the foreseeable future. If you look at the global Power mix out to 2030 then you get the distinct impression that the extractive industries will still be in rude health for a few years yet. Do you think that crude oil production is declining in the UK North Sea? No sir. There will in all likelihood be a slight increase over the next five years based on 2020 production.

Earnings for ExxonMobil in Q1 were $2.7 billion and for Q2 $4.7 billion. To put those numbers into context that comes after 4 straight quarter losses. What might those profits look like when Brent hits $100, or $120? If you are looking at historical trends to guide you all price corrections have seen a sustained period of growth in the subsequent years. Plenty of miles in the tank yet in more ways than one.

So back to Green Hydrogen. The energy transition has been estimated to cost $73 trillion out to 2050. That’s a whole lot of dollars. If it is going to be paid for by major oil then they will need the Brent price to keep on rising. If that is the case, then how long before the oil price hits $200? We will be looking back at 2021 as the good old days of cheap fuel. As COP 26 motors on and we decide who is going to find all those trillions maybe we should reflect on the fact that perhaps the answer really is to plant more trees.

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.