· 3 min read

Investment strategies to address NET zero and innovative solutions are moving toward the 8 pillars of climate tech investments, specifically:

- Mobility and transport;

- Energy

- Food, agriculture and land use;

- Industry, manufacturing and resource management;

- Built environment;

- Financial services;

- GHG capture, removal and storage;

- Climate change management and reporting

Important and relevant challenges that have a common variable: a smaller percentage of all the earth, soil (29%).

In these strategies, one color must become more part of the lexicon of climate tech investments: BLUE!

79% of the planet is covered by seas and oceans, which produce about 50% of the planet’s oxygen and stores 90% of our carbon.

This means for us to give more emphasis to funds that either vertically, or within wider investment strategies, invest in the blue economy with the aim of finding the right strategies to mitigate the impact of climate change.

However, the amount of money focused on ocean-related solutions is not enough.

The warning dictated by scientists is very simple in this regard: “The ocean and the atmosphere are one big fluid mass. Completely connected,” said Aulani Wilhelm, deputy director for ocean conservation, climate and equity at the Office of Science and Technology Policy, Executive Office of the President. “The ocean is what created all life on the planet and drives all living systems on Earth. When we think of climate, we often think of the atmosphere and the impacts that occur at the surface. But the impacts we are experiencing on land are actually due to the impacts that have already occurred and continue to occur in the oceans. Simply put, climate change is a change in the oceans.”

And it’s within this context that the best potential for investment comes in. Particularly if, within the investments verticals mentioned at the beginning, it is included also the ocean. The impact on the environment, on climate change (through action on all fronts regarding the earth), and, most importantly, on the potential return on investment, would be exponential.

The European Union is at the forefront with climate actions also for the ocean-related strategy, indeed, it has created “BlueInvest” the investment platform, launched by the European Commission in April 2019, with the aim of promoting investment, innovation and sustainable growth in the Blue Economy. It provides support to innovative SMEs and startups active in Blue Economy sectors through its online community, investment readiness assistance, matchmaking, research and investor engagement, its academy, project pipeline, and a BlueInvest fund.

What certainly deserves even more attention is that for once, maybe for the first time, Southern Europe may be the leader of a successful story.

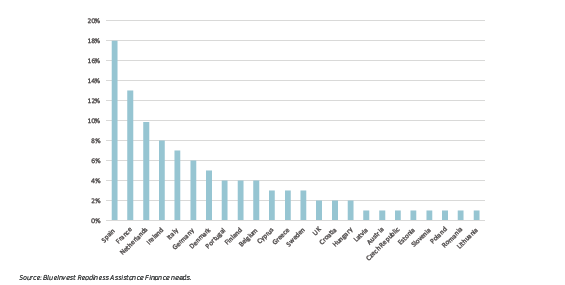

According to BlueInvest data, startups created in the Blue Economy (of which 21% of the total are Blue Energy solutions) are located merely in:

- Spain (18% of the total)

- France (13%)

- Italy (7%).

What is certainly interesting to note is that Mediterranean region will play a key role in the creation of Unicorns through Blue Climate solutions (a personal definition) and all of this happen into countries that have an historical track record concerning the energy sector.

For all this described, the potential for future returns could be secured, maybe for the first time in history, by an alignment of interests on each part of the economy, in particular:

- Lobbies

- Governments

- Activists

- Citizens

- Finance

All these actors converge in the need for an immediate paradigm shift. This means that the startups able to fully grasp all the opportunities arising from climate change would be real successful stories capable of impacting the GDP of each state.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.